Regarding the legitimacy of RALLYVILLE MARKETS forex brokers, it provides ASIC, VFSC and WikiBit, (also has a graphic survey regarding security).

Is RALLYVILLE MARKETS safe?

Pros

Cons

Is RALLYVILLE MARKETS markets regulated?

The regulatory license is the strongest proof.

ASIC Forex Execution License (STP)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Forex Execution License (STP)

Licensed Entity:

RALLYVILLE FINANCIAL GROUP PTY LTD

Effective Date: Change Record

2010-01-15Email Address of Licensed Institution:

compliance@tickrs.com.auSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

SWA - CATALYST PRIVATE WEALTH PTY LTD SE 1204 219-227 ELIZABETH ST SYDNEY NSW 2000Phone Number of Licensed Institution:

0292233461Licensed Institution Certified Documents:

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

Offshore RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

RALLYVILLE MARKETS LIMITED

Effective Date:

2023-08-22Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Rallyville Markets A Scam?

Introduction

Rallyville Markets is a relatively new player in the forex trading arena, positioning itself as a provider of forex and CFD trading services. Established in 2021, the broker claims to offer a wide range of trading instruments, including currencies, commodities, and indices. However, the influx of online brokers in recent years has made it essential for traders to exercise caution and thoroughly evaluate the legitimacy and reliability of these platforms. The potential for scams in the forex market is significant, with many brokers lacking regulatory oversight and transparency.

This article aims to provide an objective analysis of Rallyville Markets, focusing on its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and associated risks. The evaluation is based on a review of multiple credible sources, including user reviews, regulatory filings, and expert assessments, to present a comprehensive view of whether Rallyville Markets is a trustworthy broker or a potential scam.

Regulation and Legitimacy

The regulatory landscape is crucial for any broker as it provides a framework for operational integrity and client protection. Rallyville Markets claims to be regulated by multiple authorities, including the Vanuatu Financial Services Commission (VFSC), the Australian Securities and Investments Commission (ASIC), and the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC). However, the quality and rigor of these regulations vary significantly, with offshore regulators like the VFSC often providing minimal oversight.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| VFSC | 41698 | Vanuatu | Registered |

| ASIC | 342771 | Australia | Registered |

| FINTRAC | M23092517 | Canada | Registered |

Despite being regulated, the VFSC is considered a tier-3 regulatory body, which does not impose stringent requirements on brokers. This raises concerns regarding the level of investor protection offered to clients. Additionally, there are discrepancies in the claims regarding the broker's operational headquarters, with some sources indicating that it operates from Vanuatu while others suggest offices in Australia and Hong Kong. The lack of transparency about its regulatory status and the absence of tier-1 regulatory oversight should be a red flag for potential investors.

Company Background Investigation

Rallyville Markets is owned by Rallyville Markets Limited, which is registered in Vanuatu. The broker's establishment in 2021 means it is relatively new in the forex market, which may pose risks for traders seeking stability and a proven track record. The management team behind Rallyville Markets has not been prominently featured in available documentation, raising questions about their experience and expertise in the financial sector.

The company's transparency is further called into question due to the vague information regarding its ownership structure and the lack of comprehensive disclosures about its operational history. A broker with a clear and transparent background is often more trustworthy, as it indicates a commitment to ethical practices and compliance with industry standards. In this case, the limited information available about Rallyville Markets may lead potential clients to be cautious.

Trading Conditions Analysis

Rallyville Markets advertises competitive trading conditions, including a minimum deposit requirement of $100 and leverage of up to 1:400. However, the broker's fee structure has raised concerns among users. The absence of detailed information regarding commissions and spreads may lead to unexpected costs for traders.

| Fee Type | Rallyville Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.4 - 0.8 pips | 0.2 - 0.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Not Specified | Varies |

While the spreads appear competitive, there are reports from users indicating hidden fees and other costs that are not clearly communicated. This lack of transparency can lead to dissatisfaction among traders who may feel misled by the broker's marketing.

Client Fund Security

The security of client funds is paramount in the trading industry. Rallyville Markets claims to keep client funds in segregated accounts, which is a standard practice to protect investors' capital. However, the broker's offshore regulatory status raises concerns about the effectiveness of these protections.

The absence of negative balance protection further complicates the situation, as traders could potentially lose more than their initial investment. Historical complaints and issues related to fund withdrawals also cast a shadow over the broker's commitment to safeguarding client funds. Traders should be aware of these risks and consider the implications of trading with a broker that operates under such regulatory conditions.

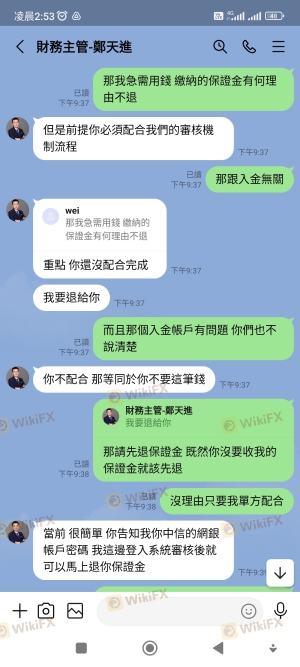

Customer Experience and Complaints

User feedback is a critical component in assessing the reliability of a broker. Reviews of Rallyville Markets reveal a mixed bag of experiences, with some traders praising the platform's functionality while others report significant issues. Common complaints include difficulties with fund withdrawals, lack of responsive customer support, and issues with order execution.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Customer Support | Medium | Inconsistent |

| Order Execution | High | Unresolved |

For instance, some users have reported delays in processing withdrawals, claiming that the broker often provides vague explanations for these delays. This lack of responsiveness can lead to frustration and distrust among clients, making it essential for potential traders to weigh these experiences against the broker's advertised benefits.

Platform and Trade Execution

Rallyville Markets utilizes the widely recognized MetaTrader 4 (MT4) platform, which is known for its robustness and user-friendly interface. However, there are concerns regarding order execution quality, including reports of slippage and rejected orders. These issues can significantly impact trading outcomes, particularly for those employing high-frequency or scalping strategies.

The platform's performance is generally satisfactory, but the potential for manipulation remains a concern, especially given the broker's offshore status. Traders should remain vigilant and consider the implications of executing trades on a platform that may not be fully transparent.

Risk Assessment

Engaging with Rallyville Markets presents several risks that potential traders should consider. The lack of tier-1 regulation, potential issues with fund withdrawals, and reports of order execution problems contribute to a high-risk environment for investors.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Offshore regulation offers minimal protection. |

| Fund Security Risk | High | Lack of negative balance protection and transparency. |

| Execution Risk | Medium | Reports of slippage and rejected orders. |

To mitigate these risks, traders should conduct thorough research and consider diversifying their investments across multiple brokers. Additionally, employing risk management strategies, such as setting stop-loss orders, can help protect capital in volatile market conditions.

Conclusion and Recommendations

In conclusion, while Rallyville Markets presents itself as a legitimate forex broker, the evidence suggests that potential traders should approach with caution. The broker's offshore regulatory status, mixed customer feedback, and concerns regarding fund security raise significant red flags.

It is advisable for traders to consider alternative brokers with stronger regulatory oversight and a proven track record of client satisfaction. Some reputable alternatives include brokers regulated by tier-1 authorities like the FCA or ASIC, which offer enhanced protections and a more transparent trading environment.

Ultimately, the decision to trade with Rallyville Markets should be made with careful consideration of the associated risks and a thorough understanding of the broker's operational practices.

Is RALLYVILLE MARKETS a scam, or is it legit?

The latest exposure and evaluation content of RALLYVILLE MARKETS brokers.

RALLYVILLE MARKETS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

RALLYVILLE MARKETS latest industry rating score is 5.10, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 5.10 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.