Rallyville Markets 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive Rallyville Markets review examines a relatively young but established forex broker that has been serving global clients since 2015. Rallyville Markets Limited operates from Australia and follows rules set by the Vanuatu Financial Services Commission (VFSC). The company calls itself a leading provider and innovator of CFD trading services. The broker gives traders access to many different types of investments including forex, commodities, bonds, metals, energies, stocks, and indices through the popular MT4 trading platform.

Key highlights of this broker include leverage up to 1:400 and a minimum deposit requirement of $200 USD. This makes it easy for both new and experienced traders to start trading. The platform serves clients around the world who want different trading opportunities in forex and CFD markets. Based on available sources, Rallyville Markets has kept a stable trading environment with mostly positive user feedback. However, specific performance numbers and detailed user satisfaction scores change across different review platforms.

The broker's business plan focuses on giving competitive trading conditions while following regulatory rules under VFSC oversight. Traders should know that leverage ratios may change based on where clients live. The broker's offshore regulatory status needs careful thought when looking at overall trustworthiness and fund security measures.

Important Disclaimers

Jurisdictional Variations: Rallyville Markets operates under different regulatory frameworks depending on client location. Based on available information, leverage ratios and trading conditions may change a lot depending on where the client lives. The broker does not always tie leverage offerings directly to local requirements. This may create different experiences for different client groups.

Review Methodology: This evaluation uses publicly available information, regulatory filings, and user feedback collected from multiple independent sources including WikiBit, various forex review platforms, and regulatory databases. Specific performance data and user experience numbers reflect information available as of 2024-2025. Trading conditions may change over time.

Rating Framework

Broker Overview

Company Background and Establishment

Rallyville Markets Limited was established in 2015 as an Australian-headquartered forex and CFD broker. The company focuses on providing complete trading services to clients around the world. According to multiple sources, the company has positioned itself as "a leading provider and innovator of CFD trading, constantly pushing the boundaries through cutting-edge research and development." The broker operates mainly from Australia while following rules through the Vanuatu Financial Services Commission.

The company's business model centers on offering diverse trading opportunities across multiple asset classes. It targets both retail and institutional clients worldwide. Rallyville Markets has built its reputation on providing access to international markets through a single trading platform. The company emphasizes technological innovation and competitive trading conditions. The broker's operational structure allows it to serve clients from various locations while adapting leverage and trading terms based on local regulatory requirements.

Platform and Asset Coverage

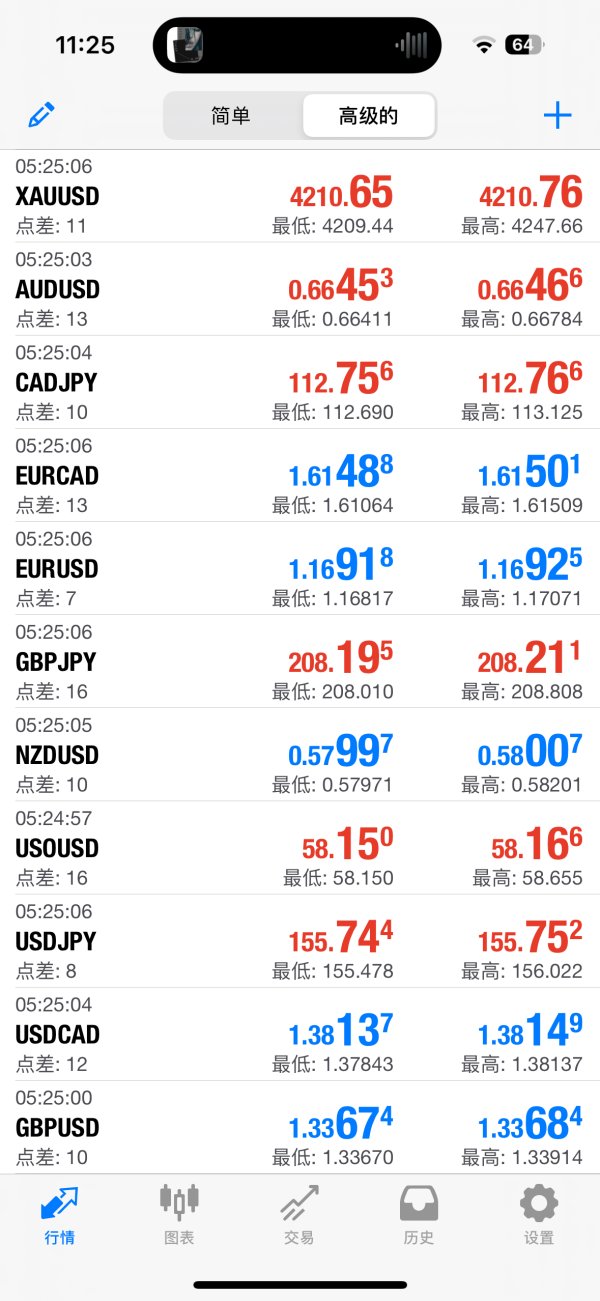

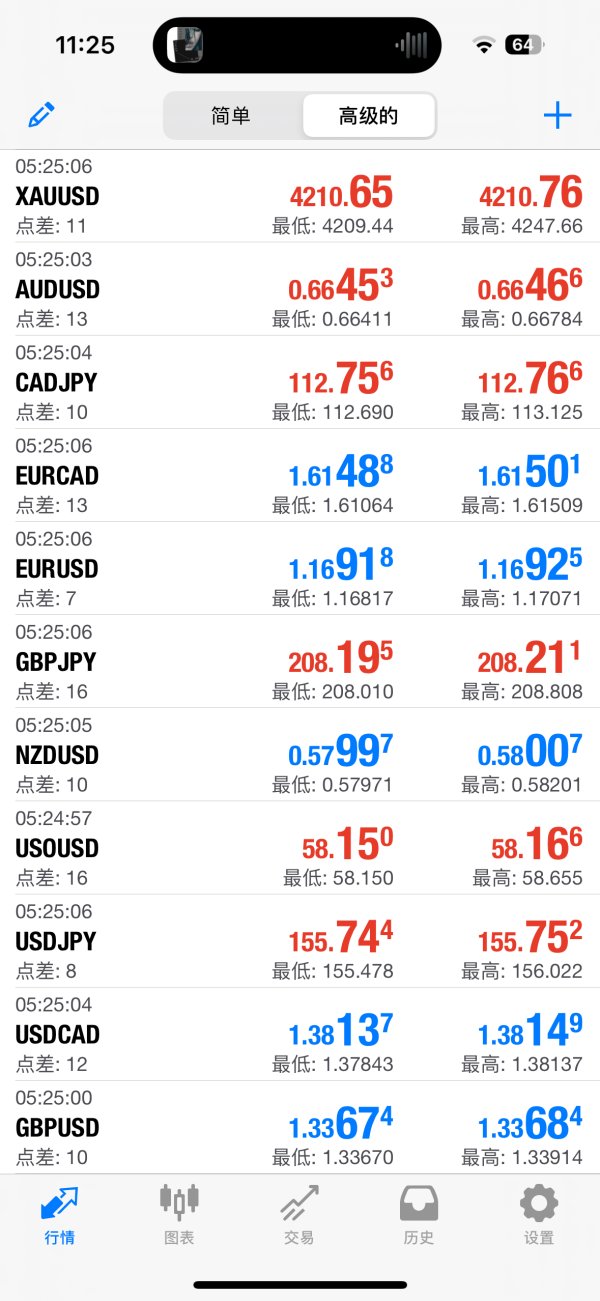

Rallyville Markets operates exclusively through the MetaTrader 4 (MT4) platform. This gives clients access to forex, commodities, bonds, metals, energies, stocks, and indices. The broker's asset coverage includes major and minor currency pairs, precious metals including gold and silver, energy commodities such as crude oil, and a variety of stock market indices from global exchanges. This Rallyville Markets review confirms that the platform supports automated trading through Expert Advisors (EAs) and provides signal services for algorithmic trading strategies.

The broker's regulatory status under the Vanuatu Financial Services Commission provides a framework for operations. However, specific license numbers and detailed regulatory compliance measures are not clearly shown in available public documentation. This regulatory arrangement allows the broker to offer higher leverage ratios while maintaining operational flexibility across different market jurisdictions.

Regulatory Framework and Compliance

Rallyville Markets operates under the regulatory oversight of the Vanuatu Financial Services Commission (VFSC). This classifies it as an offshore regulatory arrangement. This regulatory status provides certain operational advantages, including the ability to offer higher leverage ratios and serve international clients. However, it may raise considerations regarding investor protection standards compared to tier-one regulatory jurisdictions.

Minimum Deposit and Account Requirements

The broker maintains a minimum deposit requirement of $200 USD. This positions it as accessible to entry-level traders while remaining competitive within the industry standard range. This relatively low barrier to entry makes the platform suitable for new traders testing strategies or experienced traders seeking additional trading accounts.

Available Trading Assets

Rallyville Markets provides comprehensive asset coverage including spot forex pairs, CFDs on commodities, bonds, precious metals, energy markets, individual stocks, and major market indices. The diversity of available instruments allows traders to implement cross-market strategies and portfolio diversification approaches through a single trading platform.

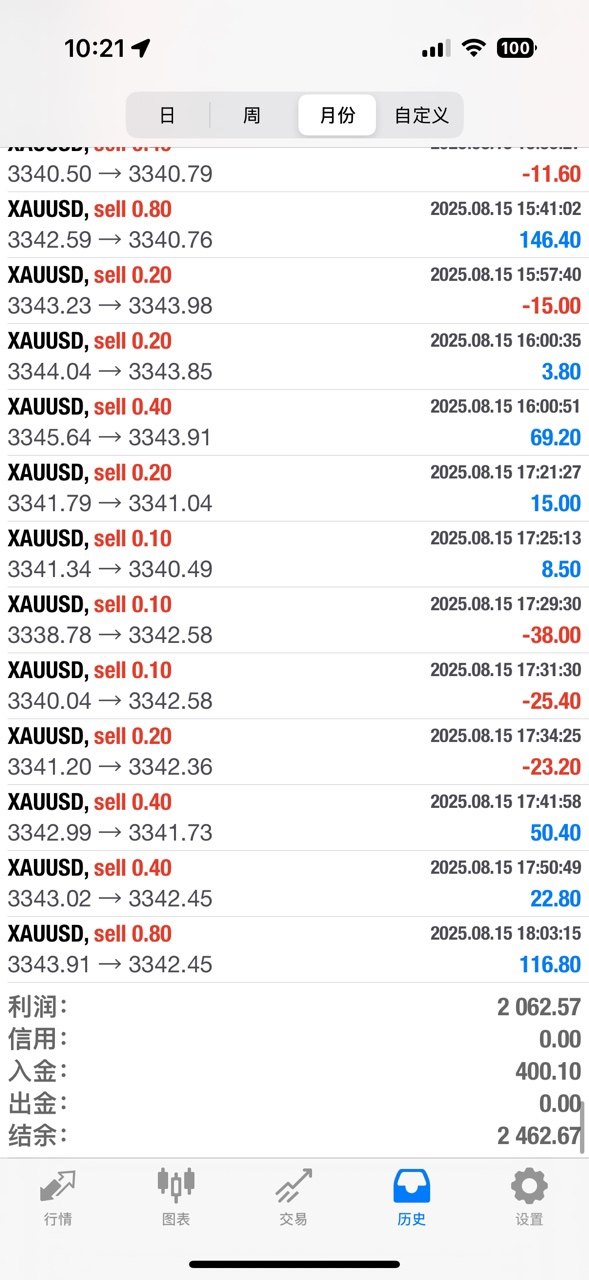

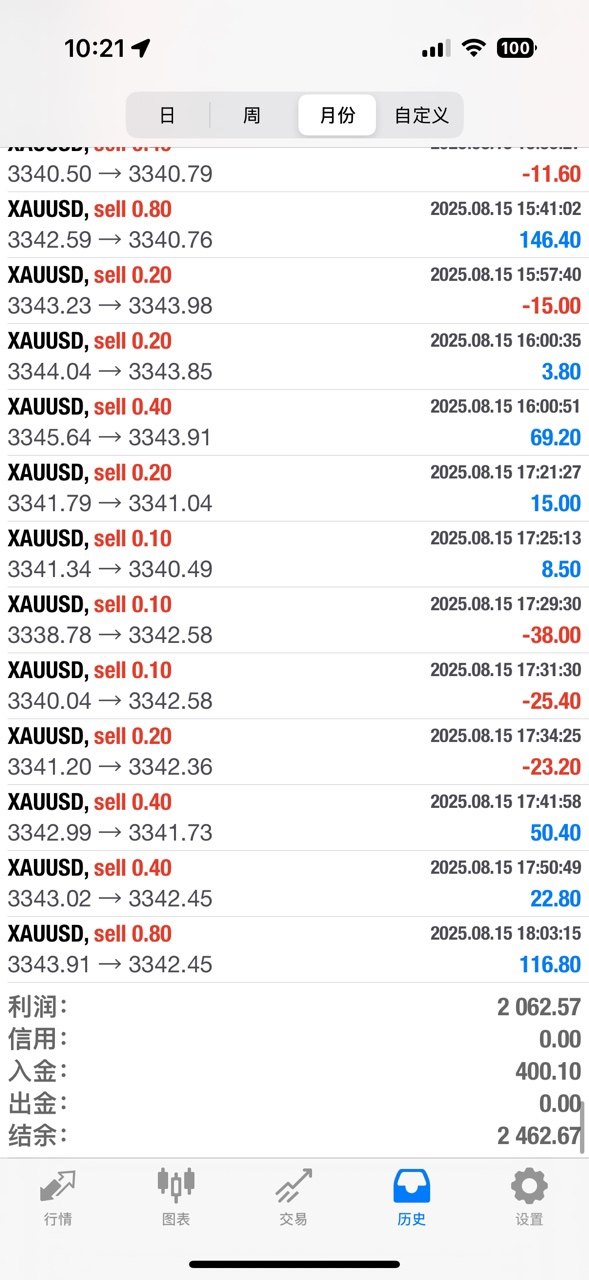

Cost Structure and Fees

Based on available information, the broker's commission structure receives a moderate rating (6/10). This suggests average pricing compared to industry standards. However, specific spread information, overnight financing costs, and detailed fee schedules are not fully detailed in available public sources. This requires direct broker consultation for complete cost analysis.

Leverage and Margin Requirements

The platform offers leverage up to 1:400. This represents the higher end of industry offerings and appeals to traders seeking maximum capital efficiency. As noted in multiple sources, leverage ratios vary based on client location. The broker maintains flexibility in applying leverage limits based on regulatory requirements and risk management policies.

Trading Platform Features

The exclusive use of MT4 provides clients with a proven, stable trading environment supporting multiple order types, technical analysis tools, and automated trading capabilities. The platform's widespread adoption and familiar interface reduce the learning curve for traders moving from other brokers.

Geographic and Language Considerations

While specific geographic restrictions are not detailed in available sources, the broker's Australian base and VFSC regulation suggest broad international accessibility. Customer service language options and specific regional support capabilities require direct verification with the broker.

Detailed Rating Analysis

Account Conditions Analysis (Score: 6/10)

The account conditions offered by Rallyville Markets present a mixed picture that merits a moderate rating. The $200 minimum deposit requirement positions the broker well for accessibility. This is especially true when compared to premium brokers requiring $1,000 or more for account opening. This low entry threshold makes the platform suitable for traders testing new strategies or those with limited initial capital.

However, the commission structure, rated at 6/10 based on available information, suggests pricing that falls within industry averages rather than offering competitive advantages. The lack of detailed information about different account tiers, if any exist, limits the ability to fully assess the value proposition across different trader segments. According to user feedback referenced in various sources, the overall account experience receives generally positive ratings. However, specific features like account upgrade processes or premium account benefits are not well documented.

The account opening process and verification requirements are not extensively detailed in available sources. The generally positive user feedback suggests a reasonably straightforward onboarding experience. This Rallyville Markets review notes that traders seeking transparent, competitive account conditions may need to request detailed fee schedules directly from the broker to make fully informed decisions.

Rallyville Markets demonstrates solid performance in the tools and resources category. It earns a 7/10 rating based on its comprehensive asset coverage and platform capabilities. The broker provides access to a diverse range of trading instruments including forex pairs, commodities, bonds, metals, energies, stocks, and indices. This offers traders significant opportunities for portfolio diversification and cross-market strategy implementation.

The exclusive use of the MT4 platform provides a robust foundation for trading activities. It supports advanced charting capabilities, technical analysis tools, and automated trading through Expert Advisors. The platform's proven stability and extensive third-party support ecosystem enhance its value proposition for both manual and algorithmic traders.

However, the evaluation is limited by the lack of detailed information about proprietary research resources, educational materials, or market analysis tools that the broker may provide beyond the standard MT4 offerings. According to available sources, while the trading experience receives positive feedback for stability and reliability, specific details about additional research tools, economic calendars, or educational resources are not prominently featured in public documentation.

The broker's emphasis on being "a leading provider and innovator of CFD trading" suggests ongoing platform development. However, specific innovative features or proprietary tools are not detailed in accessible sources. Traders seeking comprehensive research and educational support may need to evaluate these resources directly through account opening or demo access.

Customer Service and Support Analysis (Not Rated)

The customer service dimension cannot be adequately rated due to insufficient detailed information in available sources. While basic contact information indicates support availability through email (support@rallyvilleglobal.com), comprehensive data about response times, service quality, available communication channels, and multilingual support capabilities is not readily available in public documentation.

The general user feedback suggesting "stable trading experience" and "overall good evaluation" provides some indication that customer support issues may not be significant pain points for users. Major service problems typically generate notable negative feedback. However, without specific data about support response times, resolution effectiveness, or service availability hours, a meaningful quantitative assessment cannot be provided.

Customer service quality represents a critical factor in broker evaluation, particularly for traders requiring technical support or assistance with account issues. The absence of detailed customer service information in this Rallyville Markets review highlights the need for prospective clients to directly test support responsiveness and quality through initial inquiries before committing to account opening.

Traders prioritizing responsive customer support should consider requesting specific information about support channels, response time commitments, and available service hours during their evaluation process.

Trading Experience Analysis (Score: 7/10)

The trading experience dimension receives a solid 7/10 rating based on generally positive user feedback and the broker's stable operational track record. Multiple sources indicate that users report a "stable trading experience" and "overall good evaluation." This suggests that the fundamental trading infrastructure meets user expectations for reliability and performance.

The MT4 platform foundation contributes significantly to the positive trading experience. It provides traders with a familiar, well-tested environment for order execution and market analysis. The platform's stability and widespread adoption reduce technical learning curves and compatibility issues that can impact trading effectiveness.

However, the evaluation is constrained by the absence of specific performance metrics such as execution speeds, slippage rates, or server uptime statistics. While user feedback suggests satisfactory performance, quantitative data about order execution quality, platform responsiveness during high-volatility periods, or mobile trading experience is not available in accessible sources.

The broker's leverage offering up to 1:400 enhances the trading experience for users seeking maximum capital efficiency. However, this also requires careful risk management consideration. The diverse asset coverage allows for comprehensive trading strategies, contributing positively to the overall trading environment.

Traders requiring detailed performance metrics or specific execution quality guarantees should seek this information directly from the broker. This Rallyville Markets review cannot provide quantitative performance benchmarks based on available public information.

Trust and Safety Analysis (Score: 5/10)

The trust and safety dimension receives a moderate 5/10 rating. This reflects the mixed implications of the broker's regulatory and operational structure. Rallyville Markets operates under Vanuatu Financial Services Commission (VFSC) regulation, which provides a legal framework for operations but represents an offshore regulatory arrangement with potentially limited investor protection compared to tier-one jurisdictions.

The VFSC regulatory status allows the broker to offer higher leverage ratios and serve international clients with operational flexibility. However, it may raise considerations about fund security measures, dispute resolution mechanisms, and regulatory oversight intensity. While no specific negative incidents or regulatory actions are mentioned in available sources, the offshore regulatory structure inherently carries different risk profiles compared to brokers regulated by authorities like the FCA, ASIC, or CySEC.

The company's establishment in 2015 provides several years of operational history, which contributes positively to credibility assessment. However, detailed information about client fund segregation, insurance coverage, or specific fund protection measures is not prominently available in public documentation.

The absence of detailed transparency measures, such as regular financial reporting or third-party audits, limits the ability to fully assess the broker's financial stability and operational integrity. Traders prioritizing maximum fund security may prefer brokers with tier-one regulatory oversight and comprehensive transparency measures.

This trust assessment reflects the need for traders to carefully consider their risk tolerance and regulatory preferences when evaluating offshore-regulated brokers. This applies regardless of operational quality indicators.

User Experience Analysis (Not Rated)

The user experience dimension cannot be comprehensively rated due to limited specific user satisfaction data in available sources. While general feedback indicates "overall good evaluation" and "stable trading experience," detailed information about interface design, registration processes, verification procedures, and fund operation experiences is not sufficiently documented for quantitative assessment.

The general positive feedback suggests that major user experience issues are not prevalent. Significant usability problems typically generate notable negative reviews. The use of the widely-adopted MT4 platform contributes positively to user experience through its familiar interface and extensive functionality. This reduces learning curves for traders moving from other brokers.

However, critical user experience elements such as account opening efficiency, document verification timelines, deposit and withdrawal processing speeds, and mobile platform functionality are not detailed in accessible sources. The broker's target market appears to include traders with higher risk tolerance given the 1:400 leverage offering. However, specific user demographic information or satisfaction surveys are not available.

The lack of detailed user experience data in this Rallyville Markets review emphasizes the importance of prospective clients conducting direct evaluation through demo accounts or initial small deposits. This helps assess personal compatibility with the broker's systems and processes.

Traders prioritizing seamless user experience should consider testing key processes including account registration, platform navigation, and customer service responsiveness before making significant commitments.

Conclusion

This comprehensive Rallyville Markets review reveals a broker that offers solid trading fundamentals with both strengths and limitations that traders should carefully consider. The platform demonstrates particular value for traders seeking high leverage opportunities (up to 1:400) and diverse asset access through the reliable MT4 platform. A reasonable $200 minimum deposit makes it accessible to various trader segments.

Primary Strengths: The broker excels in providing comprehensive asset coverage across forex, commodities, metals, energies, and indices. This is supported by a stable trading environment that receives generally positive user feedback. The high leverage availability appeals to experienced traders seeking maximum capital efficiency. The low minimum deposit accommodates entry-level traders.

Key Limitations: The offshore VFSC regulatory status, while operationally functional, may not provide the same level of investor protection as tier-one jurisdictions. Limited transparency regarding detailed fee structures, customer service capabilities, and fund protection measures creates information gaps that require direct broker consultation.

Recommended User Profile: Rallyville Markets appears most suitable for experienced traders comfortable with offshore regulation who prioritize high leverage access and asset diversity. It also works for new traders seeking affordable entry points to test trading strategies. The platform may be less appropriate for traders prioritizing maximum regulatory protection or requiring extensive educational and research resources.

Prospective clients should conduct thorough due diligence, including direct communication with the broker to clarify fee structures, fund protection measures, and customer service capabilities before making trading commitments.