Regarding the legitimacy of PU Prime forex brokers, it provides ASIC, FSA and WikiBit, .

Is PU Prime safe?

Pros

Cons

Is PU Prime markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

PU PRIME TRADING PTY LTD

Effective Date: Change Record

2012-01-19Email Address of Licensed Institution:

cristian.moreno@puprime.auSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

L 10 17 CASTLEREAGH ST SYDNEY NSW 2000Phone Number of Licensed Institution:

+61 8 6616 0661Licensed Institution Certified Documents:

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

PU Prime Limited

Effective Date:

--Email Address of Licensed Institution:

info@puprime.comSharing Status:

No SharingWebsite of Licensed Institution:

https://www.puprime.comExpiration Time:

--Address of Licensed Institution:

CT House, Office 1A, Providence, Mahe, SeychellesPhone Number of Licensed Institution:

+248 4373668Licensed Institution Certified Documents:

Is PU Prime A Scam?

Introduction

PU Prime is a forex and CFD broker that has been operating since 2015, offering a platform for trading a wide range of financial instruments, including forex, commodities, indices, shares, and cryptocurrencies. As the online trading landscape becomes increasingly crowded, it is essential for traders to exercise caution and thoroughly evaluate the brokers they choose to work with. This is particularly true in the forex market, where the potential for scams and fraudulent activities can be high. Traders must assess not only the regulatory compliance of a broker but also its operational history, customer feedback, and overall service quality. In this article, we will investigate PU Prime's legitimacy by examining its regulatory status, company background, trading conditions, customer fund security, user experience, and potential risks. Our findings are based on a comprehensive review of various online resources and user testimonials.

Regulation and Legitimacy

The regulatory environment in which a broker operates is critical to its credibility and the safety of its clients' funds. PU Prime is regulated by the Financial Services Authority (FSA) of Seychelles and the Financial Sector Conduct Authority (FSCA) of South Africa. While these licenses indicate some level of oversight, it is essential to recognize that regulations in offshore jurisdictions, such as Seychelles, can be less stringent than those imposed by top-tier regulators like the FCA (UK) or ASIC (Australia).

Here is a summary of PU Prime's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSA | SD 050 | Seychelles | Verified |

| FSCA | 52218 | South Africa | Verified |

The FSA in Seychelles is often viewed as a lower-tier regulator, which raises concerns regarding the level of investor protection offered. The FSCA, while more reputable, also has its limitations. Traders should be aware that regulatory oversight does not guarantee the absence of issues but can provide a framework for accountability. PU Prime's historical compliance and regulatory standing further need to be scrutinized, as the absence of any significant infractions can enhance a broker's reputation.

Company Background Investigation

PU Prime was established in 2015 and has since expanded its services to over 120 countries, claiming to serve more than 200,000 clients. The company operates under a multi-entity structure, with its headquarters in Mauritius and additional offices in Seychelles and South Africa. This geographical diversity allows PU Prime to cater to a global clientele while adhering to local regulatory requirements.

Understanding the management team behind a broker can provide insights into its operational integrity. PU Prime's leadership team consists of professionals with backgrounds in finance and technology, which is a positive indicator of the company's commitment to providing a robust trading environment. However, the level of transparency regarding the company's ownership structure and management team is crucial; a lack of information can lead to skepticism about a broker's motives and reliability.

PU Prime has made efforts to maintain transparency by providing information about its services and operations on its website. However, the effectiveness of this transparency in building trust among traders remains to be seen.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is paramount. PU Prime offers competitive trading fees, but it is essential to assess whether these fees are transparent and fair. The broker provides various account types, including standard, prime, and cent accounts, with differing minimum deposit requirements and fee structures.

Heres a comparison of core trading costs:

| Fee Type | PU Prime | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 1.3 pips | 0.6 - 1.0 pips |

| Commission Model | $0 (Standard) / $3.50 (Prime) | $0 to $6 |

| Overnight Interest Range | Varies by asset | Varies widely |

While PU Prime's spreads are competitive, they may not always align with industry standards, particularly for entry-level accounts. Moreover, the commission structure can be a point of confusion for traders. The lack of clarity regarding additional fees, such as withdrawal charges and overnight interest costs, may contribute to a perception of hidden costs, which can affect traders' overall profitability.

Customer Fund Security

The safety of customer funds is a primary concern for any trader. PU Prime claims to implement robust security measures, including segregated accounts that separate client funds from company operating capital. This practice is crucial in ensuring that clients' funds are protected in case of the broker's insolvency. Additionally, PU Prime offers negative balance protection, which ensures that clients cannot lose more than their initial investment.

However, it is essential to assess whether these security measures have been effective historically. There have been no significant reports of fund mismanagement or security breaches at PU Prime, but any broker operating under lower-tier regulations should be scrutinized carefully. Traders should also consider the implications of the broker's regulatory status on the level of investor protection available in the event of disputes or other issues.

Customer Experience and Complaints

Analyzing customer feedback is vital in assessing a broker's reliability. PU Prime has received mixed reviews from users, with some praising its trading platform and customer service, while others have raised concerns about withdrawal delays and customer support responsiveness.

Common complaint patterns include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

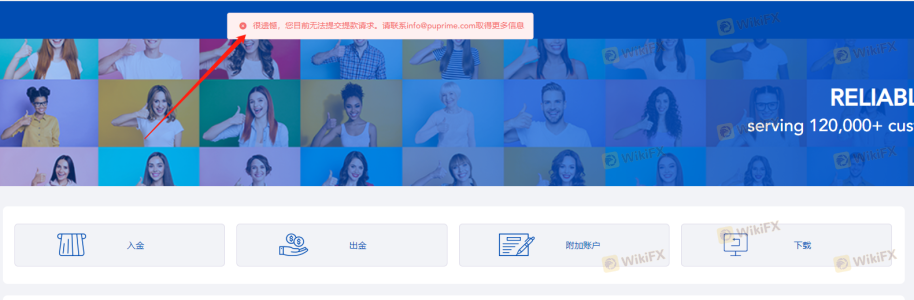

| Withdrawal Delays | High | Mixed responses |

| Customer Support Issues | Medium | Generally responsive |

| Fee Transparency | Medium | Limited clarity |

For instance, some users have reported difficulties in withdrawing their funds promptly, which is a common issue among brokers with less stringent regulatory oversight. In contrast, others have highlighted the helpfulness of customer support when addressing issues. The mixed feedback indicates that while PU Prime may have strengths, there are areas requiring improvement to enhance the overall customer experience.

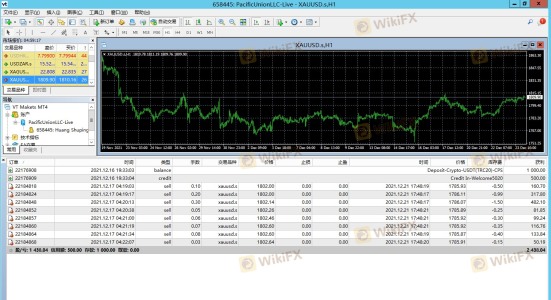

Platform and Execution

The performance of a trading platform is critical for traders, as it directly impacts execution quality and user experience. PU Prime offers the widely-used MetaTrader 4 and MetaTrader 5 platforms, which are known for their reliability and advanced trading features. However, some users have reported slower execution speeds and instances of slippage, particularly during volatile market conditions.

The average execution speed reported for PU Prime is around 120 milliseconds, which is slower than the industry average. This can be a disadvantage for traders who rely on quick execution for their strategies. Additionally, the absence of virtual private server (VPS) hosting options may hinder the performance of automated trading strategies.

Risk Assessment

When considering whether to trade with PU Prime, it is essential to evaluate the overall risk involved. The following risk assessment summarizes key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Operates under lower-tier regulations. |

| Fund Security | Medium | Segregated accounts and negative balance protection are in place, but regulatory oversight is limited. |

| Customer Service | Medium | Mixed feedback on responsiveness and issue resolution. |

| Execution Quality | High | Slower execution speeds and occasional slippage reported. |

To mitigate these risks, traders should conduct thorough research, utilize demo accounts to test the platform, and only invest funds they can afford to lose.

Conclusion and Recommendations

In conclusion, while PU Prime has established itself as a broker with a diverse range of trading instruments and competitive fees, there are several areas of concern that potential traders should be aware of. The lack of robust regulatory oversight, mixed customer feedback, and reported issues with withdrawal processes suggest that caution is warranted.

Traders considering PU Prime should weigh these factors carefully and may want to explore alternative brokers that offer stronger regulatory protections and better customer experiences. Recommended alternatives include brokers regulated by top-tier authorities like the FCA or ASIC, which tend to provide greater security and transparency.

Overall, while PU Prime is not definitively a scam, it is crucial for traders to approach it with due diligence and awareness of the associated risks.

Is PU Prime a scam, or is it legit?

The latest exposure and evaluation content of PU Prime brokers.

PU Prime Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

PU Prime latest industry rating score is 8.46, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 8.46 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.