Regarding the legitimacy of PRIMETIME GLOBAL MARKETS forex brokers, it provides ASIC, FSCA, FSA and WikiBit, (also has a graphic survey regarding security).

Is PRIMETIME GLOBAL MARKETS safe?

Software Index

Risk Control

Is PRIMETIME GLOBAL MARKETS markets regulated?

The regulatory license is the strongest proof.

ASIC Inst Forex Execution (STP)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Inst Forex Execution (STP)

Licensed Entity:

PRIMETIME GLOBAL MARKETS PTY LTD

Effective Date: Change Record

2015-03-02Email Address of Licensed Institution:

compliance@katgroup.netSharing Status:

No SharingWebsite of Licensed Institution:

https://www.pgmfx.comExpiration Time:

--Address of Licensed Institution:

SE103 566 ST KILDA RD MELBOURNE VIC 3004Phone Number of Licensed Institution:

+84 982950549Licensed Institution Certified Documents:

FSCA Forex Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

PRIMETIME GLOBAL MARKETS (PTY) LTD

Effective Date:

2024-09-02Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

41 LANSDOWNE CRESCENT DURBAN NORTH 4051Phone Number of Licensed Institution:

084 842 0626Licensed Institution Certified Documents:

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Primetime Global Markets Limited

Effective Date:

--Email Address of Licensed Institution:

officemanager@archipelcorporateservices.scSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Office 7, 1st Floor, Vairams Building, Zone 6, Providence, Mahe, SeychellesPhone Number of Licensed Institution:

4372722Licensed Institution Certified Documents:

Is PGM Safe or a Scam?

Introduction

PGM, or Paragon Global Markets, is a forex broker that positions itself in the competitive landscape of foreign exchange and futures trading. Established in the United States, PGM has been in operation for approximately 5 to 10 years, focusing primarily on serving institutional clients. As the forex market continues to grow, it becomes increasingly essential for traders to exercise caution when selecting a broker. The potential for scams and unregulated entities poses significant risks to investors' capital. This article aims to provide a comprehensive evaluation of PGM by analyzing its regulatory status, company background, trading conditions, customer safety measures, and user experiences. The investigation is based on a review of multiple credible sources, including user feedback, regulatory disclosures, and industry analyses.

Regulation and Legitimacy

Regulation is a critical aspect of any financial institution, particularly in the forex sector, where the lack of oversight can lead to numerous risks for traders. PGM currently operates without any formal regulatory oversight, which raises significant concerns about its legitimacy and the safety of client funds. The absence of regulation means that PGM does not adhere to the stringent financial standards and compliance measures imposed by recognized regulatory bodies. This lack of oversight can lead to potential fraud and mismanagement of client funds.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Regulated |

The lack of a regulatory framework is alarming, as it implies that PGM is not subject to any financial audits or consumer protection measures. Traders are advised to be cautious, as the absence of regulation can increase the risk of encountering unethical practices or outright scams. Furthermore, the historical compliance records of unregulated brokers often reveal a pattern of issues related to fund management and client grievances. In this context, the absence of regulatory oversight for PGM is a significant red flag.

Company Background Investigation

PGM, or Paragon Global Markets, is incorporated in the United States, with its headquarters located at 233 Broadway, Suite 1700, New York, NY 10279. The company has been operational for about 5 to 10 years, primarily focusing on forex and futures trading. However, its lack of established regulatory status raises questions about its operational integrity.

The management team at PGM comprises seasoned professionals with extensive experience in financial markets. However, the lack of transparency regarding the ownership structure and detailed backgrounds of the management team is concerning. It is essential for traders to be aware of who is managing their investments and their track record in the industry. Transparency is a key factor in establishing trust, and PGM's limited disclosure on these matters may deter potential clients.

The company's overall transparency regarding its operations, trading conditions, and management practices is inadequate. Prospective clients should be wary of brokers that do not provide clear information about their ownership and operational history, as this lack of clarity can often be indicative of larger issues.

Trading Conditions Analysis

When evaluating a forex broker, it is crucial to consider the trading conditions they offer, including fees, spreads, and commissions. PGM's trading conditions appear to lack transparency, as there is limited publicly available information regarding their overall fee structure. The absence of clear details about spreads, commissions, and leverage can be a significant drawback for potential clients.

| Fee Type | PGM | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not Disclosed | 1-2 pips |

| Commission Model | Not Disclosed | Varies |

| Overnight Interest Range | Not Disclosed | Varies |

The lack of information about trading costs can lead to unexpected expenses for traders, which is particularly concerning for those who rely on accurate cost assessments to make informed trading decisions. Moreover, if the fees are not competitive or if there are hidden charges, traders may find themselves at a disadvantage compared to other brokers in the market.

In conclusion, the lack of transparency in PGM's trading conditions raises questions about its reliability as a broker. Traders should be cautious and seek brokers that provide clear and detailed information about their fee structures to avoid potential pitfalls.

Client Fund Security

The safety of client funds is paramount when selecting a forex broker. PGM's lack of regulatory oversight raises significant concerns regarding its client fund security measures. A regulated broker is typically required to implement stringent security protocols, including fund segregation, investor protection schemes, and negative balance protection policies. However, PGM does not provide any information regarding such measures, which could leave clients vulnerable to potential losses.

Clients should be particularly wary of brokers that do not have clear policies regarding the segregation of funds. Without proper fund segregation, a broker can use client funds for its operational expenses, putting investors' capital at risk. Moreover, the absence of investor protection schemes means that clients have no recourse in the event of a broker's insolvency or fraudulent activities.

Historically, unregulated brokers have faced numerous issues related to fund mismanagement and client complaints. PGM's lack of transparency regarding its security measures is a significant concern, as it indicates a potential risk to client funds. Traders are advised to prioritize brokers that provide clear information about their fund security measures and adhere to regulatory standards.

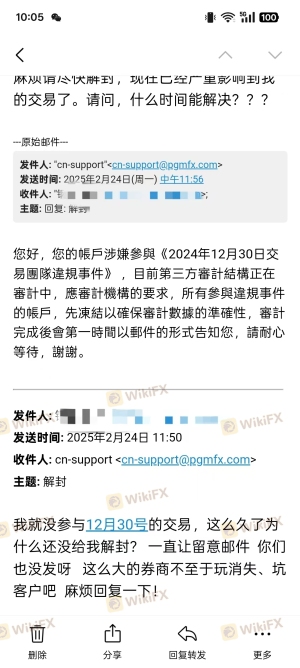

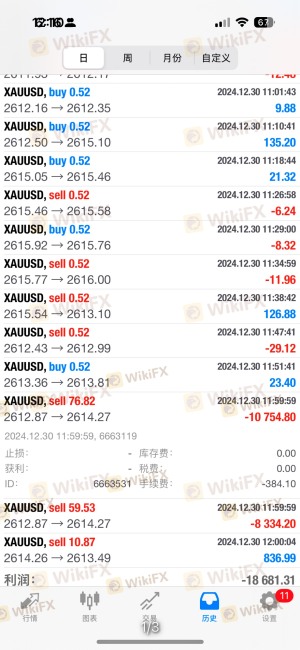

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability and service quality. PGM has received mixed reviews from users, with some praising its trading execution speed and customer service, while others have reported significant issues, including account freezes and withdrawal difficulties.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Account Freezes | High | Poor |

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Fair |

One notable complaint involved a user who reported that their account was frozen without explanation, leaving them unable to access their funds. This incident raises serious concerns about the broker's operational practices and responsiveness to client issues. Furthermore, the overall response quality from PGM appears to be lacking, as many users have expressed frustration with the company's customer service.

In conclusion, the mixed customer feedback regarding PGM highlights potential issues with its operational integrity and responsiveness. Traders should carefully consider these factors when deciding whether to engage with this broker.

Platform and Execution

The performance of a trading platform is crucial for a successful trading experience. PGM offers multiple trading platforms, but user feedback suggests that there may be issues related to stability and execution quality. Traders have reported instances of slippage and order rejections, which can significantly impact trading outcomes.

The execution quality is particularly concerning, as traders rely on timely order execution to capitalize on market movements. If a broker experiences frequent slippage or rejects orders, it can lead to substantial financial losses. Moreover, any signs of potential platform manipulation, such as frequent disconnections or unexplained delays, could indicate deeper issues within the broker's operations.

Risk Assessment

Using PGM as a forex broker carries several risks that traders should be aware of. The lack of regulation, transparency, and customer feedback all contribute to a higher risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Security Risk | High | Lack of fund segregation |

| Customer Service Risk | Medium | Poor response to complaints |

To mitigate these risks, traders are advised to conduct thorough research before engaging with any broker. It is crucial to prioritize brokers that are well-regulated, transparent about their operations, and responsive to customer inquiries.

Conclusion and Recommendations

In summary, PGM presents several red flags that warrant caution. The absence of regulatory oversight, lack of transparency regarding trading conditions, and mixed customer feedback raise significant concerns about the broker's legitimacy and reliability. While some users report satisfactory experiences, the potential risks associated with trading through PGM are considerable.

For traders seeking a reliable forex broker, it is advisable to consider alternatives that are well-regulated and have a proven track record of customer satisfaction. Brokers such as OANDA, IG, or Forex.com offer robust regulatory frameworks, transparent trading conditions, and positive user experiences. Ultimately, traders should prioritize safety and transparency when selecting a broker to protect their investments.

Is PRIMETIME GLOBAL MARKETS a scam, or is it legit?

The latest exposure and evaluation content of PRIMETIME GLOBAL MARKETS brokers.

PRIMETIME GLOBAL MARKETS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

PRIMETIME GLOBAL MARKETS latest industry rating score is 5.87, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 5.87 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.