Regarding the legitimacy of NCM forex brokers, it provides FCA, CMA and WikiBit, (also has a graphic survey regarding security).

Is NCM safe?

Software Index

Risk Control

Is NCM markets regulated?

The regulatory license is the strongest proof.

FCA Inst Market Making (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Inst Market Making (MM)

Licensed Entity:

NCM FINANCIAL UK LTD

Effective Date:

2024-07-22Email Address of Licensed Institution:

info@ncm-uk.com, compliance@ncm-uk.comSharing Status:

No SharingWebsite of Licensed Institution:

www.ncm-uk.comExpiration Time:

--Address of Licensed Institution:

11 Burford Road Stratford London E15 2ST UNITED KINGDOMPhone Number of Licensed Institution:

+4402039300061Licensed Institution Certified Documents:

CMA Forex Trading License (EP)

Capital Market Authority

Capital Market Authority

Current Status:

RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

NCM FINANCIAL SERVICES L.L.C

Effective Date:

2023-07-19Email Address of Licensed Institution:

Sharif@ncminvest.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Al Wasl- Office No.3009- Al Skeikh Said Bin Maktoum Bin Rashid Al MaktoumPhone Number of Licensed Institution:

971-563872543Licensed Institution Certified Documents:

Is NCM Investment A Scam?

Introduction

NCM Investment, established in 2009 and headquartered in Kuwait, positions itself as a global forex and CFD broker catering primarily to traders in the Middle East and beyond. As a broker that offers a wide range of trading instruments, including forex pairs, commodities, and indices, NCM Investment has garnered attention from both novice and experienced traders. However, the forex market is notorious for its inherent risks, and traders must exercise caution when selecting a broker. Given the prevalence of scams and unregulated entities in the industry, it is crucial to conduct thorough due diligence before entrusting any broker with your funds. This article aims to evaluate the legitimacy of NCM Investment by examining its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and associated risks. The analysis is based on a review of multiple reputable sources, including regulatory databases, customer reviews, and industry expert evaluations.

Regulation and Legitimacy

The regulatory environment in which a broker operates plays a significant role in determining its credibility and the safety of client funds. NCM Investment claims to be regulated by several financial authorities, including the Capital Markets Authority (CMA) in Kuwait, the Labuan Financial Services Authority (LFSA) in Malaysia, the Securities and Commodities Authority (SCA) in the UAE, the Capital Markets Board (CMB) in Turkey, and the Jordan Securities Commission (JSC). Below is a summary of the key regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Capital Markets Authority (CMA) | AP/2017/0009, AP/2019/0003 | Kuwait | Verified |

| Labuan Financial Services Authority (LFSA) | MB/22/0092 | Malaysia | Verified |

| Securities and Commodities Authority (SCA) | 703036 | UAE | Verified |

| Capital Markets Board (CMB) | 022 | Turkey | Verified |

| Jordan Securities Commission (JSC) | 18/01533/1/3 | Jordan | Verified |

While the presence of multiple regulatory licenses can provide a sense of security, it is important to evaluate the quality of these regulations. The CMA is a recognized authority, but it does not possess the same stringent reputation as top-tier regulators like the FCA (UK) or ASIC (Australia). Furthermore, NCM Investment's operations in offshore jurisdictions, such as Labuan, raise concerns regarding regulatory oversight and investor protection. Historically, brokers operating under less stringent regulations have been associated with higher risks, including the potential for fraud or insolvency. Therefore, while NCM Investment is regulated, the quality and effectiveness of its regulatory framework warrant careful consideration.

Company Background Investigation

NCM Investment was founded in 2009 and has since established a presence in several countries, including Kuwait, Turkey, Jordan, the UAE, and Malaysia. The company's operational history spans over a decade, which is generally a positive indicator of stability in the forex industry. However, the ownership structure and management team are equally important in assessing the broker's reliability.

The management team at NCM Investment comprises individuals with varied backgrounds in finance, trading, and investment management. However, specific details about key personnel, such as their professional experience and qualifications, are not extensively disclosed, which can be a red flag for potential clients. Transparency regarding the management team and their qualifications is crucial for building trust among traders.

In terms of information disclosure, NCM Investment provides basic details about its operations and regulatory licenses on its official website. However, the lack of comprehensive information about its ownership structure and management team raises questions about the broker's commitment to transparency. A reputable broker typically provides detailed information about its founders, management team, and operational history to instill confidence in potential clients.

Trading Conditions Analysis

Understanding a broker's trading conditions is essential for evaluating its overall competitiveness and fairness. NCM Investment offers a minimum deposit requirement of $500, which is relatively high compared to many other brokers that allow lower initial deposits. The broker provides access to both fixed and variable spreads, but the specific spread rates can vary depending on market conditions and the trading account type.

The overall fee structure at NCM Investment includes the following core trading costs:

| Fee Type | NCM Investment | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.4 - 2 pips | 0.2 - 1.5 pips |

| Commission Model | Variable (not explicitly stated) | Typically low to zero |

| Overnight Interest Range | Variable | Variable |

While NCM Investment does not charge deposit or withdrawal fees for most payment methods, the relatively high spreads, particularly for major currency pairs, may affect trading profitability. Additionally, the lack of clarity regarding commission structures raises concerns about potential hidden fees. Traders should always seek transparency in fee disclosures to avoid unexpected costs.

Client Fund Security

The safety of client funds is paramount when selecting a forex broker. NCM Investment claims to prioritize fund security by maintaining client funds in segregated accounts at reputable banks. This practice is essential for ensuring that client funds are not used for operational purposes, thereby reducing the risk of misappropriation.

However, NCM Investment does not provide negative balance protection, which means that clients could potentially lose more than their initial investment in volatile market conditions. Furthermore, the absence of a robust investor protection scheme raises concerns, especially for traders who may be vulnerable to significant losses.

Historically, there have been no reported incidents of fund misappropriation or major security breaches at NCM Investment, but the lack of a comprehensive investor protection framework remains a concern for potential clients.

Customer Experience and Complaints

Customer feedback is a critical factor in assessing a broker's reliability and service quality. Reviews of NCM Investment show a mixed bag of experiences. While some clients commend the broker for its user-friendly platforms and responsive customer support, others have reported issues related to withdrawal delays and lack of transparency regarding fees.

Common complaint types include:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response times reported |

| Fee Transparency | Medium | Inconsistent information provided |

| Platform Stability | Low | Generally positive feedback |

For instance, one trader reported experiencing delays in withdrawing funds, leading to frustration and concern about the broker's reliability. While NCM Investment's customer support team was responsive, the resolution of the issue took longer than expected, highlighting a potential area for improvement.

Platform and Trade Execution

The trading platform is a vital aspect of the trading experience. NCM Investment utilizes the widely recognized MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, which are known for their robust features and user-friendly interfaces. Traders can access a range of tools for market analysis, order execution, and trade management.

In terms of order execution quality, NCM Investment generally provides satisfactory performance. However, some traders have reported instances of slippage during high volatility periods, which can impact trading outcomes. While the broker claims to offer competitive execution speeds, the potential for slippage is a common risk in the forex market.

Moreover, there have been no significant indications of platform manipulation or unfair practices reported by users. However, the broker's overall platform performance should be continuously monitored by traders to ensure a smooth trading experience.

Risk Assessment

Engaging with any forex broker carries inherent risks, and NCM Investment is no exception. While the broker offers a range of trading opportunities, several key risk factors should be considered:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Operates under multiple jurisdictions but lacks top-tier regulation. |

| Fund Safety Risk | High | No negative balance protection and limited investor protection measures. |

| Fee Transparency Risk | Medium | Potential hidden fees and high spreads may affect profitability. |

| Customer Service Risk | Medium | Mixed feedback on response times and issue resolution. |

To mitigate these risks, traders are advised to conduct thorough research, maintain a diversified trading portfolio, and implement risk management strategies, such as setting stop-loss orders and limiting exposure to volatile instruments.

Conclusion and Recommendations

In conclusion, while NCM Investment operates under several regulatory licenses, its overall credibility remains a subject of scrutiny. The broker is not a scam per se, but potential clients should be wary of several factors, including the lack of top-tier regulation, the relatively high minimum deposit requirement, and the absence of negative balance protection.

For traders looking for reliable alternatives, consider brokers that are regulated by top-tier authorities such as the FCA or ASIC, which offer comprehensive investor protection and transparency. Brokers like AvaTrade or IG may provide more robust regulatory frameworks and lower entry barriers, making them suitable options for both novice and experienced traders.

Ultimately, conducting thorough due diligence and understanding the specific risks associated with NCM Investment will empower traders to make informed decisions that align with their trading goals and risk tolerance.

Is NCM a scam, or is it legit?

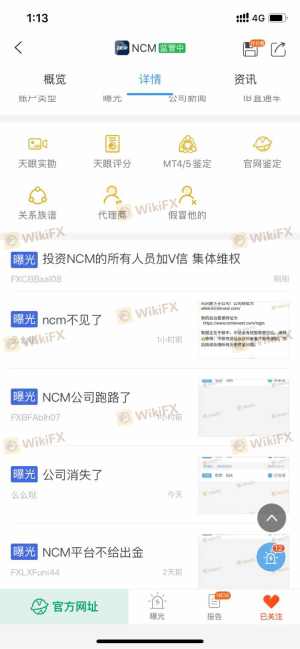

The latest exposure and evaluation content of NCM brokers.

NCM Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

NCM latest industry rating score is 6.29, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.29 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.