Regarding the legitimacy of NAGA forex brokers, it provides CYSEC, FSA and WikiBit, (also has a graphic survey regarding security).

Is NAGA safe?

Software Index

Risk Control

Is NAGA markets regulated?

The regulatory license is the strongest proof.

CYSEC Market Making License (MM) 20

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Naga Markets Europe Ltd

Effective Date:

2013-06-20Email Address of Licensed Institution:

regulatory@nagamarkets.comSharing Status:

Website of Licensed Institution:

www.nagamarkets.com, Naga.com/eu, Naga.com/de, Naga.com/it, Naga.com/es, Naga.com/pl, Naga.com/cz, Naga.com/nl, Naga.com/ro, Naga.com/ntExpiration Time:

--Address of Licensed Institution:

Agias Zonis 11, 3027, Limassol, CyprusPhone Number of Licensed Institution:

+357 25 041 410Licensed Institution Certified Documents:

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

NAGA Capital Ltd

Effective Date:

--Email Address of Licensed Institution:

compliance@naga.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

T53, Third Floor, Espace, Victoria, Mahe, SeychellesPhone Number of Licensed Institution:

+248 4373121Licensed Institution Certified Documents:

Is NAGA Safe or a Scam?

Introduction

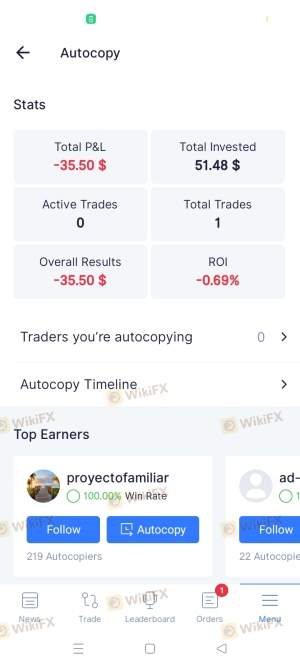

NAGA, a multi-asset trading platform founded in 2015, has carved a niche for itself in the forex market by focusing on social trading and innovative financial technology. As a broker that allows users to trade a variety of instruments, including forex, stocks, and cryptocurrencies, NAGA has attracted a significant user base, boasting over one million registered accounts. However, as with any financial service, it is crucial for traders to exercise caution and thoroughly evaluate the credibility of the broker they choose. The integrity of a trading platform can significantly impact a trader's financial security and overall trading experience.

In this article, we will conduct a comprehensive analysis of NAGA's operations, regulatory status, company background, trading conditions, and customer experiences. Our investigation is based on extensive research, including reviews from financial experts, user testimonials, and regulatory information. By presenting a balanced view, we aim to determine whether NAGA is a safe trading option or if there are potential red flags that traders should be aware of.

Regulation and Legitimacy

The regulatory framework surrounding a broker is one of the most critical factors in assessing its legitimacy. NAGA operates under the regulation of the Cyprus Securities and Exchange Commission (CySEC), which is known for its stringent compliance standards. This regulatory oversight ensures that the broker adheres to specific operational guidelines, safeguarding traders' interests.

Here is a summary of NAGA's regulatory information:

| Regulatory Authority | License Number | Regulated Region | Verification Status |

|---|---|---|---|

| CySEC | 204/13 | Cyprus | Verified |

CySEC's regulation is significant because it mandates that client funds be held in segregated accounts, ensuring that they are not used for the broker's operational expenses. Additionally, NAGA is a publicly traded company on the Frankfurt Stock Exchange, which adds an extra layer of transparency and accountability. However, it is important to note that NAGA's regulation is limited to CySEC, and it does not hold licenses from other top-tier regulatory bodies. This could potentially expose traders to risks, especially those outside the European Union, where different regulatory standards apply.

Company Background Investigation

NAGA was founded by Benjamin Bilski and Yogev Baraki in Germany, initially under the name Hanseatic Brokerhouse Global Markets. The company quickly gained recognition for its innovative approach to trading, particularly with the introduction of its copy trading feature. Over the years, NAGA has expanded its offerings to include a wide range of financial instruments and has secured significant funding, including partnerships with major financial institutions.

The management team at NAGA has a solid background in finance and technology, which is crucial for navigating the complex world of online trading. Transparency is a cornerstone of NAGA's operations; the company publishes its financial statements, allowing users to monitor its performance. However, some users have reported concerns regarding the clarity of information provided, particularly in distinguishing between different account types and their associated fees.

Trading Conditions Analysis

NAGA's trading conditions are a vital aspect of its appeal. The broker offers a competitive fee structure, with spreads starting from 1.3 pips for major currency pairs. However, the overall cost of trading can vary significantly depending on the account type and the assets traded. Below is a comparison of NAGA's core trading costs:

| Fee Type | NAGA | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.3 pips | 1.0 - 1.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | 0.20% | 0.15% - 0.25% |

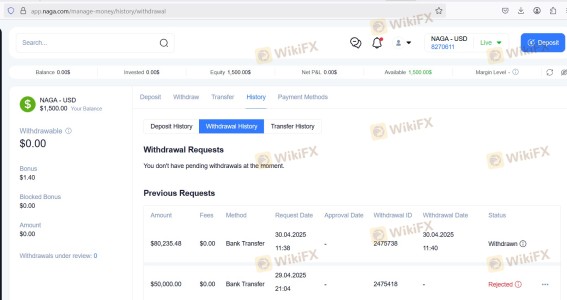

While NAGA does not charge deposit fees, withdrawal fees can range from $0 to $5, depending on the account type. This fee structure is relatively competitive; however, some users have expressed dissatisfaction with the withdrawal process, citing delays and lack of clarity on fees.

Customer Funds Security

Ensuring the safety of customer funds is paramount for any broker. NAGA has implemented several measures to protect client assets. Client funds are held in segregated accounts with tier-1 banks, which means that in the event of insolvency, traders' funds are not at risk. Additionally, NAGA offers negative balance protection, ensuring that traders cannot lose more than their initial investment.

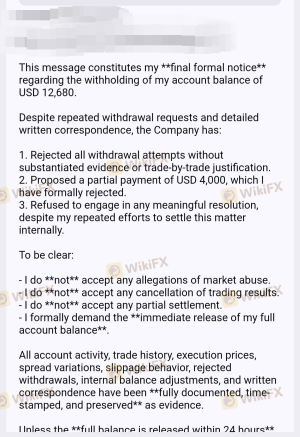

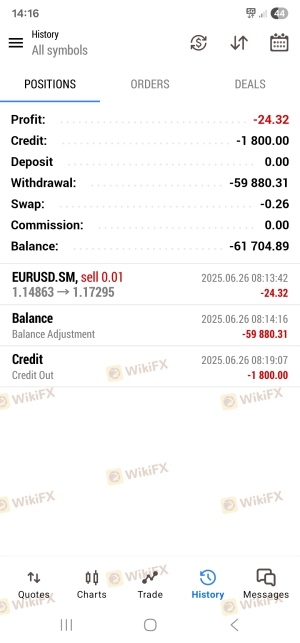

Despite these protective measures, there have been historical concerns regarding fund security and withdrawal issues. Some users have reported difficulties in accessing their funds promptly, raising questions about the efficiency of NAGA's withdrawal process. Overall, while NAGA has established a framework for fund security, it is essential for potential clients to be aware of these issues.

Customer Experience and Complaints

Customer feedback provides valuable insights into a broker's reliability. NAGA has received mixed reviews from users. Positive feedback often highlights the platform's user-friendly interface, extensive trading options, and effective customer support. However, common complaints include withdrawal delays and insufficient responsiveness from customer service.

Here is a summary of the main complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Average |

| Customer Support Issues | Medium | Below Average |

| Platform Performance | High | Average |

For instance, one user reported a frustrating experience when attempting to withdraw funds, leading to account restrictions without clear explanations. Such incidents can significantly impact a trader's confidence in the broker.

Platform and Trade Execution

The performance of a trading platform is crucial for a positive trading experience. NAGA offers multiple platforms, including MetaTrader 4, MetaTrader 5, and its proprietary web trader. Users generally report satisfactory performance, but there have been instances of slippage and order rejections during high volatility periods.

While the platform's design is user-friendly, some traders have noted concerns about potential manipulation, particularly regarding price quotes during critical trading times. Such issues can undermine trust in the broker's execution quality.

Risk Assessment

Using NAGA as a trading platform involves certain risks, as is the case with any broker. Below is a summary of the key risk areas associated with trading on NAGA:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Limited regulatory oversight outside CySEC. |

| Withdrawal Issues | High | Reports of delays and complications in accessing funds. |

| Platform Reliability | Medium | Occasional performance issues during high market volatility. |

To mitigate these risks, traders should conduct thorough research, maintain realistic expectations regarding trading outcomes, and consider using demo accounts to familiarize themselves with the platform.

Conclusion and Recommendations

In conclusion, NAGA is not a scam; it is a regulated broker with a solid reputation in the market. However, potential clients should be aware of certain risks and limitations associated with the platform. While NAGA offers competitive trading conditions and innovative features like social trading, there have been reported issues related to fund withdrawals and platform performance.

For traders seeking a reliable broker, NAGA can be a viable option, particularly for those interested in social trading. However, it is advisable to consider alternative brokers, such as Pepperstone or AvaTrade, which may offer more robust regulatory protections and better customer service experiences.

Ultimately, potential traders should weigh the pros and cons of using NAGA and ensure they are comfortable with the broker's offerings before committing their funds.

Is NAGA a scam, or is it legit?

The latest exposure and evaluation content of NAGA brokers.

NAGA Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

NAGA latest industry rating score is 6.09, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.09 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.