Is KangDa safe?

Pros

Cons

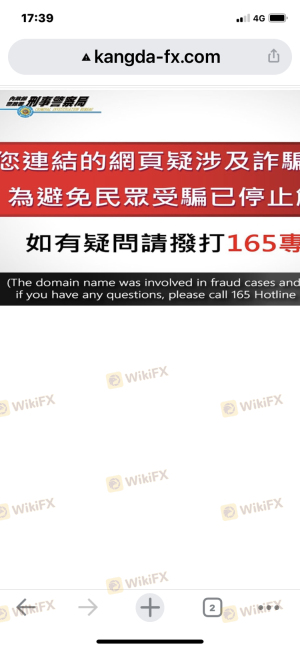

Is Kangda Safe or a Scam?

Introduction

Kangda is a forex broker that has emerged in the online trading landscape, claiming to provide a wide range of trading services. As with any broker, it is essential for traders to conduct thorough due diligence before committing their funds. The forex market is notorious for its lack of regulation and the presence of unscrupulous entities, making it crucial for traders to assess the legitimacy and safety of brokers like Kangda. This article aims to provide an objective analysis of Kangda's operations, regulatory status, company background, trading conditions, client experiences, and overall risk assessment, ultimately answering the question: Is Kangda safe?

Regulation and Legitimacy

One of the primary indicators of a broker's reliability is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to certain standards and practices. In the case of Kangda, the broker claims to operate under the auspices of Kangda Global Limited, yet there are significant concerns regarding its regulatory compliance.

Regulatory Information Table

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | 0544123 | USA | Unauthorized |

Despite claiming to be licensed by the National Futures Association (NFA) in the USA, it has been confirmed that Kangda is not a member of the NFA, which raises serious red flags regarding its operational legitimacy. Furthermore, the lack of valid regulatory oversight means that traders' funds are not protected by any legal framework, making it a high-risk choice for potential investors. Thus, the evidence leans heavily towards the conclusion that Kangda is not safe.

Company Background Investigation

Kangda's operational history is marked by a lack of transparency. The company claims to have a well-structured management team and a robust operational framework. However, upon closer inspection, the credibility of these claims appears questionable.

The management team's backgrounds lack verifiable credentials, and many of the profiles presented on their website are either generic or sourced from stock images. This raises concerns about the authenticity of the information provided. Furthermore, the company's ownership structure is not clearly defined, contributing to the overall opacity surrounding its operations. A lack of transparency often correlates with fraudulent practices, leading to the question: Is Kangda safe? Given these factors, potential traders should exercise extreme caution.

Trading Conditions Analysis

Kangda offers a variety of trading instruments, including forex, commodities, and indices. However, the overall fee structure and trading conditions warrant scrutiny.

Trading Costs Comparison Table

| Cost Type | Kangda | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not Disclosed | 1-2 pips |

| Commission Model | Not Disclosed | Varies |

| Overnight Interest Range | Not Disclosed | 0.5% - 2% |

The absence of clear information regarding spreads, commissions, and overnight interest rates is concerning. Traders typically expect transparency in these areas, and the lack thereof could indicate hidden fees or unfavorable trading conditions. The uncertainty surrounding these costs further affirms the notion that Kangda may not be safe for trading.

Client Fund Safety

The safety of client funds is paramount when choosing a broker. Kangda claims to implement various security measures, yet the absence of regulatory oversight raises serious questions about the effectiveness of these measures.

Kangda does not provide clear information regarding fund segregation, which is crucial for ensuring that client funds are kept separate from the company's operational funds. Furthermore, there is no mention of investor protection schemes or negative balance protection policies. These omissions are significant, as they expose traders to the risk of losing their entire investment without any recourse. Consequently, the safety of funds with Kangda is highly questionable, reinforcing the concern: Is Kangda safe?

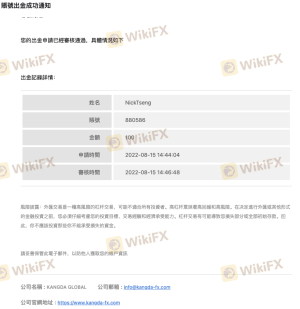

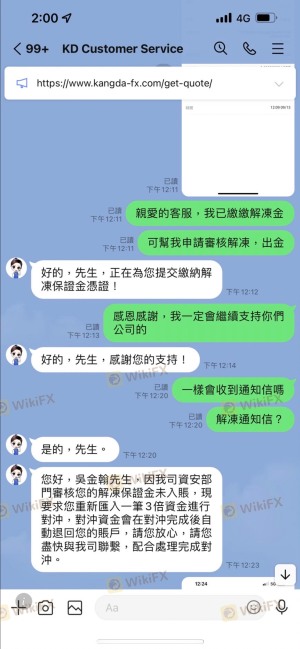

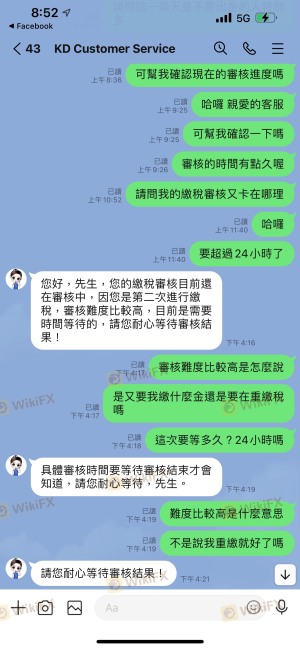

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing a broker's reliability. In the case of Kangda, numerous complaints have surfaced regarding its services.

Complaint Types and Severity Assessment Table

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Unauthorized Trades | High | Unresolved |

| Poor Customer Service | Medium | Slow Response |

Many users have reported difficulties in withdrawing their funds, with some alleging that their accounts were manipulated without consent. The company's response to these complaints has been largely inadequate, with many users describing customer support as unresponsive. This pattern of complaints raises significant concerns about the broker's operational integrity and whether it can be trusted. Thus, it is reasonable to conclude that Kangda may not be safe for trading.

Platform and Execution

The trading platform offered by Kangda is another critical aspect to consider. While it claims to utilize the popular MetaTrader 5 (MT5) platform, concerns about the platform's performance and reliability have been raised.

Users have reported issues with order execution, including slippage and rejected orders, which can severely impact trading outcomes. Additionally, there are allegations of potential platform manipulation, further complicating the trustworthiness of the broker. Given these factors, traders must question: Is Kangda safe? The signs suggest that it may not be a reliable trading venue.

Risk Assessment

Using Kangda as a trading platform comes with inherent risks that must be carefully evaluated.

Risk Assessment Summary Table

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of oversight |

| Fund Safety Risk | High | No protection schemes |

| Execution Risk | Medium | Reports of slippage and rejected orders |

The combination of high regulatory risk, inadequate fund safety measures, and execution issues creates an environment fraught with potential pitfalls for traders. To mitigate these risks, it is advisable for traders to consider alternative, well-regulated brokers that prioritize transparency and client protection.

Conclusion and Recommendations

In light of the evidence presented, it is clear that Kangda raises significant concerns regarding its safety and legitimacy. The lack of regulatory oversight, transparency issues, and numerous client complaints suggest that traders should exercise extreme caution when considering this broker.

For those seeking to engage in forex trading, it is advisable to explore alternative brokers that are well-regulated and have a proven track record of reliability. Brokers such as OANDA, IG, and Forex.com are known for their robust regulatory frameworks and commitment to client safety. Ultimately, the question remains: Is Kangda safe? The overwhelming evidence points to a resounding no, urging traders to prioritize their financial security by choosing reputable brokers.

Is KangDa a scam, or is it legit?

The latest exposure and evaluation content of KangDa brokers.

KangDa Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

KangDa latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.