Regarding the legitimacy of HSB forex brokers, it provides BAPPEBTI, ICDX and WikiBit, (also has a graphic survey regarding security).

Is HSB safe?

Pros

Cons

Is HSB markets regulated?

The regulatory license is the strongest proof.

BAPPEBTI Forex Trading License (EP)

Badan Pengawas Perdagangan Berjangka Komoditi Kementerian Perdagangan

Badan Pengawas Perdagangan Berjangka Komoditi Kementerian Perdagangan

Current Status:

RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

PT. HANDAL SEMESTA BERJANGKA

Effective Date:

--Email Address of Licensed Institution:

pthandalsemestaberjangka@gmail.comSharing Status:

No SharingWebsite of Licensed Institution:

www.hsb.co.idExpiration Time:

--Address of Licensed Institution:

MAYAPADA TOWER 2 LT 14 JL. JEND. SUDIRMAN KAV. 27 JakartaPhone Number of Licensed Institution:

(021) 501-22288Licensed Institution Certified Documents:

ICDX Derivatives Trading License (EP)

Indonesia Commodity and Derivatives Exchange

Indonesia Commodity and Derivatives Exchange

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Handal Semesta Berjangka, PT

Effective Date:

--Email Address of Licensed Institution:

info@hsb.co.idSharing Status:

No SharingWebsite of Licensed Institution:

http://www.hsb.co.id/Expiration Time:

--Address of Licensed Institution:

Mayapada Tower 2 Lantai 14, Jalan Jenderal Sudirman Kavling 27, Jakarta Selatan 12920Phone Number of Licensed Institution:

(021)50595588Licensed Institution Certified Documents:

Is HSB A Scam?

Introduction

HSB, operating under the name HSB Investasi, is a forex broker based in Indonesia that has been active in the market since 2018. It offers a range of trading products including forex, commodities, indices, and stocks. Given the volatile nature of the forex market and the numerous scams that have plagued it, traders must exercise caution and conduct thorough research before engaging with any broker. Evaluating a broker's legitimacy is crucial for protecting ones investment and ensuring a safe trading environment. This article aims to provide an objective analysis of HSB by examining its regulatory status, company background, trading conditions, customer fund safety, client experiences, platform performance, and associated risks.

Regulation and Legitimacy

One of the primary indicators of a broker's reliability is its regulatory status. HSB is regulated by the Indonesian Commodity Futures Trading Regulatory Agency (Bappebti) and is a member of the Indonesia Commodity and Derivatives Exchange (ICDX). Regulation serves as a safeguard for traders, ensuring that brokers adhere to industry standards and maintain transparency in their operations.

| Regulatory Agency | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Bappebti | 001/Bappebti/si/5/2018 | Indonesia | Verified |

| ICDX | 197/sp kb/icdx/dir/vi/2020 | Indonesia | Verified |

The presence of Bappebti as a regulatory body is significant, as it imposes strict guidelines on brokers concerning client fund management and operational transparency. However, it is essential to note that while Bappebti provides a level of oversight, it is not on par with top-tier regulatory bodies such as the FCA (UK) or ASIC (Australia), which are known for their rigorous compliance requirements. HSB has not had any major compliance issues reported, which adds to its credibility. However, traders should remain vigilant and consider the overall regulatory environment when assessing the safety of their funds.

Company Background Investigation

HSB Investasi is operated by PT Handal Semesta Berjangka, which has been in the forex trading industry since its establishment in 2018. The company is headquartered in Jakarta, Indonesia, and has positioned itself as a player in the burgeoning Indonesian forex market. The management team comprises professionals with backgrounds in finance and trading, although specific details regarding their experience and qualifications are limited.

Transparency is a critical factor when assessing a broker's legitimacy. HSB's website provides basic information about its services, but it lacks comprehensive disclosures regarding its management team and operational history. This lack of information can raise red flags for potential clients. While the company is regulated, the extent of its transparency and the quality of its information disclosure remain areas of concern for prospective traders.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is essential. HSB offers competitive trading conditions, but potential traders should be aware of the overall fee structure and any unusual policies that might affect their trading experience. The broker provides a demo account for practice, which is beneficial for new traders.

| Fee Type | HSB | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 1.1 pips | 1.0 pips |

| Commission Model | $2 per lot (for $100 deposit) | $1 per lot |

| Overnight Interest Range | Varies per position | Varies widely |

HSB's spread on major currency pairs starts from 1.1 pips, which is slightly above the industry average. Additionally, the commission structure can be seen as a potential drawback, particularly for traders who plan to execute high-volume trades. Traders should also be cautious about any hidden fees that may not be clearly outlined on the broker's website, as transparency in fee structures is crucial for maintaining trust.

Client Fund Security

Client fund safety is paramount when choosing a forex broker. HSB implements several measures to ensure the security of traders' funds. The broker maintains segregated accounts, meaning that client funds are kept separate from the companys operational funds. This practice is essential for protecting client investments in the event of financial difficulties faced by the broker.

Moreover, HSB is regulated by Bappebti, which mandates certain security protocols, including investor protection measures. However, it is important to note that the level of investor protection may not be as robust as that offered by brokers regulated by higher-tier authorities. HSB has not reported any significant issues related to fund safety in its operational history, which is a positive sign for potential clients.

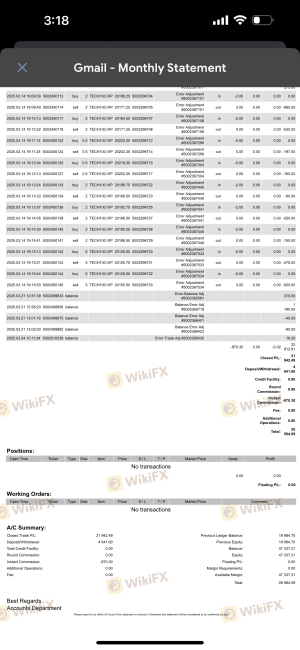

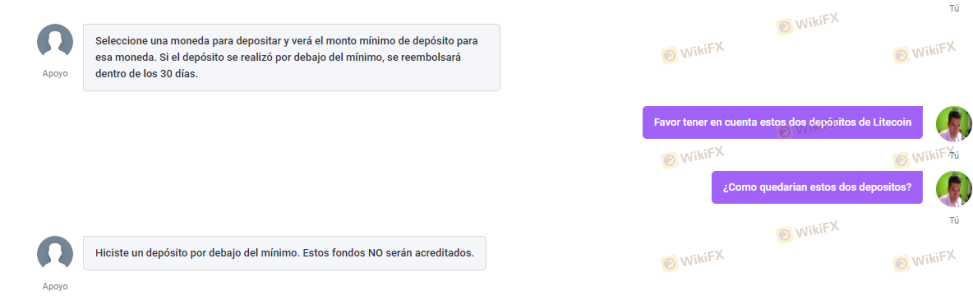

Customer Experience and Complaints

Analyzing customer feedback is crucial for understanding a broker's reputation. HSB has received mixed reviews from clients, with some praising its customer service and trading platform, while others have raised concerns over withdrawal processes and the responsiveness of support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response time |

| Account Blocking | Medium | Inconsistent communication |

| High Fees | Low | Addressed in FAQs |

Common complaints include delays in withdrawals and issues with account verification. Several users have reported that their accounts were blocked unexpectedly, leading to frustration and a lack of trust in the broker. While HSB has a customer support system in place, the response time can be slow, which is a significant concern for traders needing immediate assistance.

Platform and Trade Execution

The performance of the trading platform is a critical aspect for traders. HSB offers the widely used MetaTrader 5 platform, known for its advanced trading features and user-friendly interface. However, user experiences vary, with some traders reporting issues related to order execution quality, including slippage and rejections.

HSB's platform stability appears to be generally reliable, but traders should be cautious of any signs of manipulation or irregularities in order execution. High slippage rates can affect trading outcomes, particularly for scalpers or those executing high-frequency trades.

Risk Assessment

The overall risk associated with trading with HSB is moderate. While the broker is regulated, the lack of transparency and mixed reviews regarding customer experiences can raise concerns.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Regulated but under a less stringent authority |

| Fund Safety Risk | Low | Segregated accounts in place |

| Customer Service Risk | High | Mixed reviews on responsiveness |

To mitigate risks, traders are advised to conduct thorough research, start with a demo account, and only invest funds they can afford to lose. It is also recommended to stay informed about the broker's policies and any changes in regulatory status.

Conclusion and Recommendations

In conclusion, HSB is a regulated forex broker operating in Indonesia, but potential clients should approach with caution. While it has regulatory oversight from Bappebti, the level of protection may not be as strong as that offered by top-tier regulators. The broker's transparency regarding its management and operational history is limited, which could be a red flag for some traders.

Given the mixed feedback from clients, particularly concerning withdrawal processes and customer service, it is advisable for traders to carefully consider their options. For those seeking a more secure trading experience, alternative brokers regulated by higher-tier authorities, such as the FCA or ASIC, may be more suitable.

Ultimately, while HSB is not definitively a scam, it is essential for traders to remain vigilant and conduct their due diligence before engaging with this broker.

Is HSB a scam, or is it legit?

The latest exposure and evaluation content of HSB brokers.

HSB Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

HSB latest industry rating score is 5.77, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 5.77 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.