Is HengXing safe?

Pros

Cons

Is Hengxing Safe or a Scam?

Introduction

Hengxing, a forex broker registered in China, has garnered attention in the trading community for its offerings in the forex market. As with any broker, it is crucial for traders to assess the safety and legitimacy of Hengxing before committing their funds. The forex market is known for its high volatility and potential risks, making it imperative for traders to exercise caution and conduct thorough research on their brokers. This article aims to provide an objective analysis of whether Hengxing is a safe trading option or a potential scam. The evaluation will be based on an extensive review of regulatory status, company background, trading conditions, customer experiences, and risk assessments.

Regulation and Legitimacy

A broker's regulatory status is a key factor in determining its legitimacy. Regulatory bodies enforce rules and standards to protect traders from fraud and malpractice. Unfortunately, Hengxing lacks clear regulatory oversight, which raises red flags regarding its operations.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Regulated |

The absence of regulation implies that Hengxing is not bound by any financial authority's standards, which is a significant concern for traders. Regulatory quality is essential as it ensures that brokers adhere to ethical practices, maintain transparency, and provide a level of investor protection. Given that Hengxing does not provide any details about its regulatory compliance, it raises questions about its operational integrity and the safety of clients' funds.

Company Background Investigation

Hengxing Assets Limited, operating under the name Hengxing, lacks comprehensive information regarding its history and ownership structure. The broker does not disclose its physical address or provide information about its management team, which further obscures its transparency.

The lack of a well-defined company history often correlates with potential scams. Traders have reported issues such as difficulty in withdrawing funds and changes in trading policies that seem to benefit the broker rather than the clients. The absence of transparency and information about the company's founders or management team raises concerns about the broker's credibility and reliability in the market.

Trading Conditions Analysis

Understanding the trading conditions offered by Hengxing is essential for evaluating its trustworthiness. This includes examining the fee structure, spreads, and any unusual policies that may indicate potential scams.

| Fee Type | Hengxing | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-3 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

Reports indicate that Hengxing has a non-transparent fee structure, which can lead to unexpected costs for traders. The lack of clarity regarding spreads and commissions is a common tactic among scam brokers to exploit traders financially. Moreover, traders have alleged that they were asked to pay additional fees for withdrawals, a tactic often employed by fraudulent brokers to retain clients' funds. This ambiguity in trading conditions raises serious concerns about whether Hengxing is safe for trading.

Customer Funds Safety

The safety of customer funds is paramount in evaluating any broker. Hengxing's lack of regulatory oversight means that it is not required to segregate client funds from its operational funds, which could put traders' investments at risk.

Furthermore, there are no indications that Hengxing offers investor protection measures, such as negative balance protection or compensation schemes in the case of broker insolvency. Reports from users suggest that there have been instances where clients were unable to withdraw their funds, indicating potential mishandling of client money. The absence of robust safety measures for customer funds is a significant warning sign for prospective traders considering Hengxing.

Customer Experience and Complaints

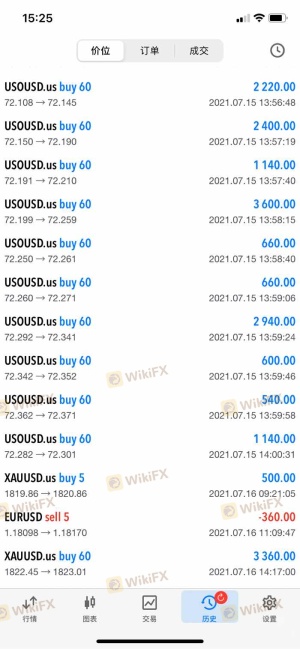

Customer feedback is a vital aspect of assessing a broker's reliability. Numerous complaints have been lodged against Hengxing, primarily concerning withdrawal issues and aggressive sales tactics.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Misleading Information | Medium | Inconsistent |

| Customer Support Quality | High | Poor |

Common complaints include clients being unable to withdraw their funds and being pressured to deposit more money to access their existing funds. The company's response to these issues has been largely inadequate, with many clients reporting a lack of communication and assistance. This pattern of complaints suggests that Hengxing may not prioritize customer satisfaction, raising further questions about its legitimacy and safety.

Platform and Trade Execution

The trading platform provided by Hengxing is another essential factor in evaluating its safety. Users have reported mixed experiences regarding platform performance, stability, and execution quality.

Concerns have been raised about potential slippage, order rejections, and even suspected manipulation of trading conditions. Such issues can significantly impact a trader's experience and profitability. A reliable broker should offer a stable platform with transparent execution practices, which appears to be lacking in Hengxing's case.

Risk Assessment

Assessing the risks associated with trading through Hengxing is crucial for potential clients.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Lack of transparency in fees |

| Operational Risk | Medium | Platform performance issues |

The overall risk profile for Hengxing indicates a high level of concern for potential traders. The absence of regulation, coupled with reported issues regarding fund withdrawals and platform reliability, suggests that trading with Hengxing could lead to significant financial losses.

Conclusion and Recommendations

In conclusion, the evidence suggests that Hengxing is not a safe trading option for forex traders. The lack of regulatory oversight, transparency issues, and numerous customer complaints point to a high likelihood of it being a scam. Traders should exercise extreme caution and consider alternative options that are regulated and have a proven track record of reliability.

For those seeking safe trading environments, it is advisable to explore brokers that are regulated by reputable financial authorities, such as the FCA, ASIC, or SEC. These brokers typically offer better protection for client funds and have transparent operating practices. In light of the information presented, it is clear that Hengxing is not safe, and potential traders should avoid engaging with this broker.

Is HengXing a scam, or is it legit?

The latest exposure and evaluation content of HengXing brokers.

HengXing Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

HengXing latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.