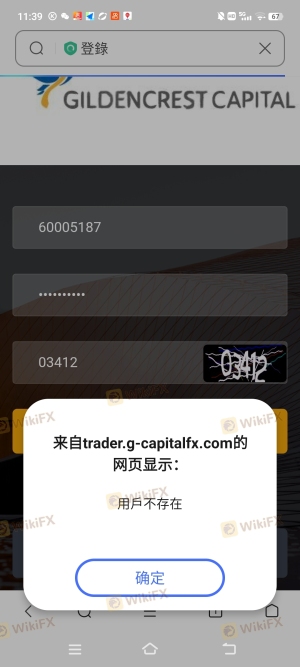

Regarding the legitimacy of Gildencrest Capital forex brokers, it provides FCA and WikiBit, (also has a graphic survey regarding security).

Is Gildencrest Capital safe?

Software Index

Risk Control

Is Gildencrest Capital markets regulated?

The regulatory license is the strongest proof.

FCA Forex Execution License (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Forex Execution License (STP)

Licensed Entity:

Gildencrest Capital Limited

Effective Date:

2012-05-30Email Address of Licensed Institution:

compliance@gildencrest.co.ukSharing Status:

No SharingWebsite of Licensed Institution:

www.gildencrestcapital.co.ukExpiration Time:

--Address of Licensed Institution:

Studio 11, 7th Floor One Canada Square Canary Wharf London E14 5AA UNITED KINGDOMPhone Number of Licensed Institution:

+44 2030484764Licensed Institution Certified Documents:

Is Gildencrest Capital Safe or a Scam?

Introduction

Gildencrest Capital is a financial brokerage firm based in London, primarily operating in the forex and CFD markets. Formerly known as Tera FX, the company rebranded in 2024 to reflect its commitment to regulatory compliance and enhanced service offerings. As the forex market continues to attract traders globally, it has also become a breeding ground for scams and fraudulent activities. Therefore, traders must exercise caution and conduct thorough evaluations before engaging with any brokerage. This article investigates the safety and legitimacy of Gildencrest Capital by examining its regulatory status, company background, trading conditions, client experiences, and risk factors.

Regulatory and Legitimacy

The regulatory status of a brokerage is a critical factor in determining its legitimacy and safety. Gildencrest Capital operates under the regulation of the Financial Conduct Authority (FCA) in the UK, which is considered a tier-1 regulatory body. The FCA's stringent requirements ensure that brokers adhere to high standards of conduct, thereby protecting investors. Below is a summary of the key regulatory information for Gildencrest Capital:

| Regulatory Authority | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| FCA | 564741 | United Kingdom | Verified |

The FCA mandates that brokers maintain client funds in segregated accounts, ensuring that clients money is protected even in the event of the broker's insolvency. Gildencrest Capital has been licensed since 2012, indicating a long history of compliance with regulatory standards. However, while the FCA's oversight is a positive sign, some reviews indicate mixed experiences from clients, raising questions about the firm's adherence to its regulatory obligations.

Company Background Investigation

Gildencrest Capital has a relatively recent history, having undergone a rebranding from Tera FX in 2024. The firm is a subsidiary of Tera Financial Holdings Ltd, which is controlled by Turkish businessman Oğuz Tezmen. The management team includes experienced professionals from various financial sectors, enhancing the firm's credibility. The company operates from a well-known financial district in London, which adds to its legitimacy.

Despite its FCA regulation, there have been concerns regarding the transparency of the firm. Some clients have reported difficulties in accessing information about the companys operations and financial health. This lack of transparency can be a red flag for potential investors. Therefore, while Gildencrest Capital is regulated, the overall transparency and communication from the management team warrant further scrutiny.

Trading Conditions Analysis

When assessing whether Gildencrest Capital is safe, it is essential to consider its trading conditions and fee structures. The broker offers various account types, including starter, premium, ECN, and pro accounts. Each account type has different trading fees and conditions, which can significantly impact a trader's experience.

| Fee Type | Gildencrest Capital | Industry Average |

|---|---|---|

| Spread on Major Pairs | From 1.6 pips | 1-2 pips |

| Commission Structure | Commission-free (varies by account type) | Varies widely |

| Overnight Interest Range | Standard Rates | Varies widely |

Gildencrest Capital's spreads start at 1.6 pips, which can be considered higher than the industry average. This may affect the profitability of trades, especially for high-frequency traders. Additionally, while the broker claims to have a transparent fee structure, some users have reported unexpected fees, raising concerns about the overall trading environment.

Client Funds Safety

Safety of client funds is a paramount concern for any trader. Gildencrest Capital claims to follow strict protocols for fund protection, including keeping client funds in segregated accounts and adhering to the Financial Services Compensation Scheme (FSCS), which protects clients up to £85,000 in the event of financial failure.

However, there have been historical issues with fund withdrawals and account access, as reported by some clients. These incidents raise questions about the effectiveness of the firms fund protection measures. Therefore, while Gildencrest Capital implements some safety features, the mixed reviews regarding fund access and withdrawal processes indicate that traders should remain cautious.

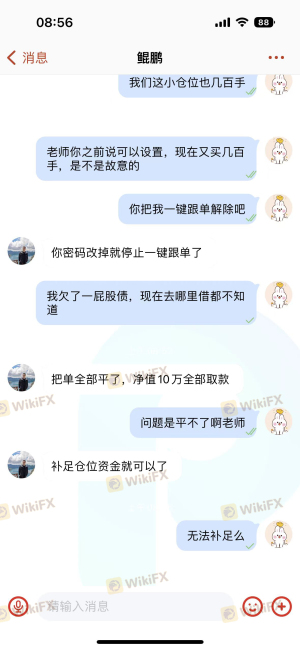

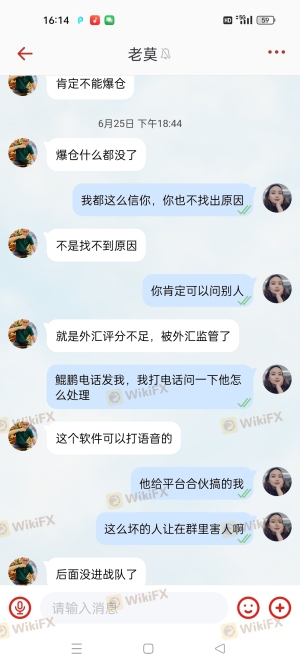

Customer Experience and Complaints

Customer feedback is a crucial indicator of a broker's reliability and service quality. Many traders have reported positive experiences with Gildencrest Capital, particularly in terms of customer support and trading platform functionality. However, a significant number of complaints revolve around withdrawal issues and unexpected fees.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Unexpected Fees | Medium | Unclear response |

Several users have expressed frustration over their inability to withdraw funds promptly, with some claiming their accounts were frozen without proper explanation. These concerns highlight potential operational flaws within the brokerage that could impact the overall trading experience. While Gildencrest Capital has a responsive customer service team, the frequency and severity of these complaints cannot be overlooked.

Platform and Execution

The trading platforms offered by Gildencrest Capital include the widely-used MetaTrader 4 and MetaTrader 5, which provide a robust trading environment for both novice and experienced traders. Users generally report a satisfactory experience with platform stability and execution speed. However, there are occasional reports of slippage and order rejections, which can be detrimental to trading outcomes.

The quality of order execution is critical in determining a broker's reliability. While Gildencrest Capital does not appear to manipulate trades, the presence of slippage and rejections can affect traders' experiences, particularly in volatile market conditions.

Risk Assessment

Using Gildencrest Capital involves several risks that traders should be aware of. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Medium | FCA regulated, but mixed reviews on compliance. |

| Fund Security | High | Reports of withdrawal issues raise concerns. |

| Trading Conditions | Medium | Higher than average spreads may affect profitability. |

| Customer Support | Medium | Generally responsive but issues with withdrawals reported. |

To mitigate these risks, traders should conduct thorough research, start with a demo account, and only invest what they can afford to lose.

Conclusion and Recommendations

In conclusion, while Gildencrest Capital is regulated by the FCA and offers a range of trading services, potential investors should proceed with caution. The mixed reviews regarding client experiences, especially concerning fund withdrawals and transparency, suggest that there are areas of concern.

For traders seeking reliable brokers, it may be prudent to consider alternatives with a stronger reputation for customer service and fund security. Brokers like IG, OANDA, or CMC Markets, which have established track records and robust regulatory oversight, could be more suitable options for those looking for a safer trading environment.

Ultimately, the question "Is Gildencrest Capital safe?" remains nuanced. While it is regulated, the presence of complaints and operational challenges indicates that traders should approach with caution and conduct their due diligence before committing funds.

Is Gildencrest Capital a scam, or is it legit?

The latest exposure and evaluation content of Gildencrest Capital brokers.

Gildencrest Capital Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Gildencrest Capital latest industry rating score is 5.80, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 5.80 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.