Gildencrest Capital Review 9

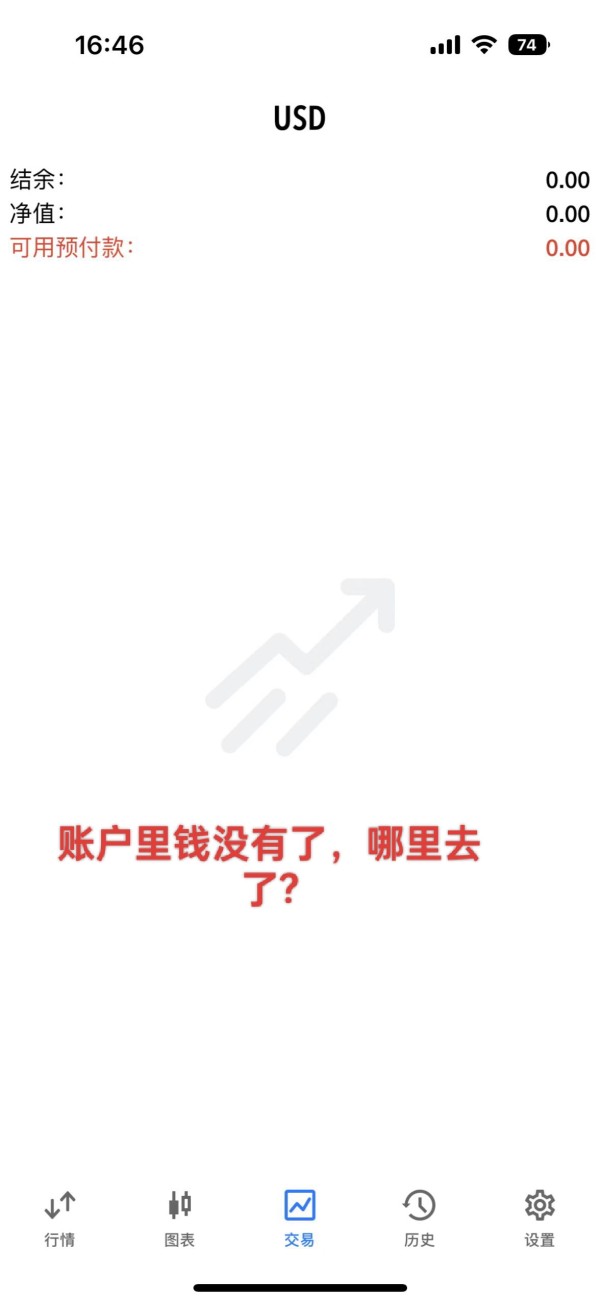

The account cannot be logged in, unable to withdraw funds, and it shows that there is no account. Where is my money?

Who else is in Lao Mo's group, please do not add any more funds, there is no return, and you will definitely not be able to withdraw. Most of the people in this group are scammers, and some are victims. They should have stolen and copied this platform, deceiving many victims. They constantly induce you to add positions. In the end, you cannot withdraw any funds. Legitimate platforms have a prepayment ratio of less than 30, and all positions can be closed. They manipulate the backend to close the positions. It's a scam, everyone please do not deposit any more funds. You definitely won't be able to withdraw.

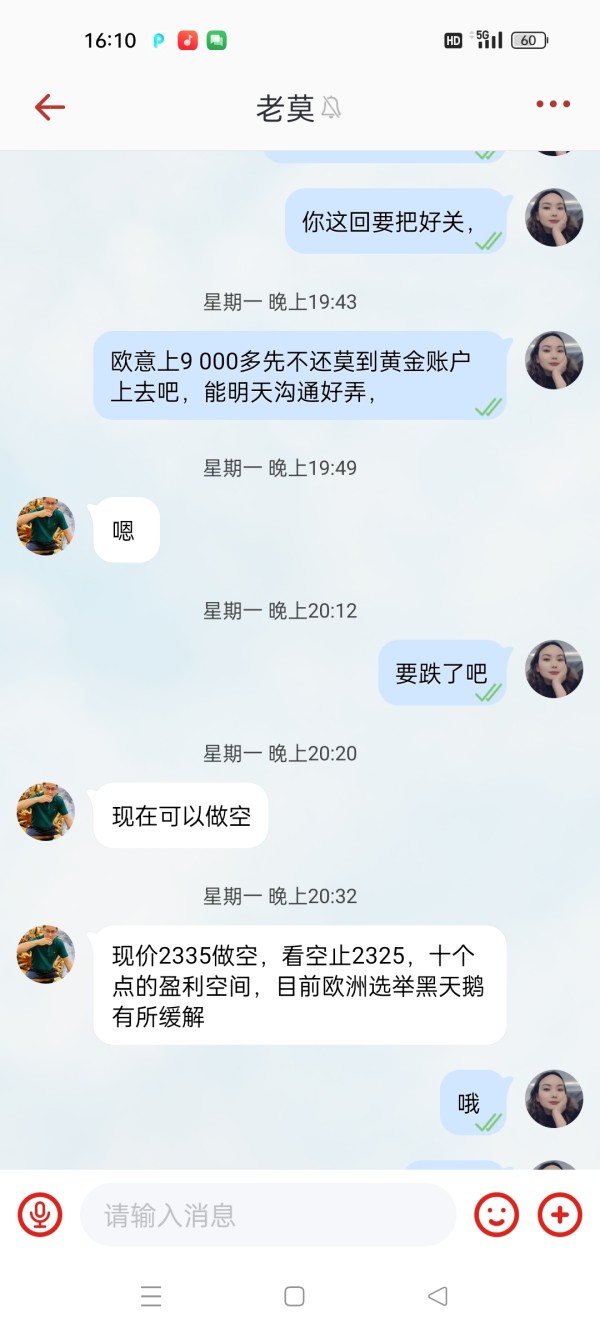

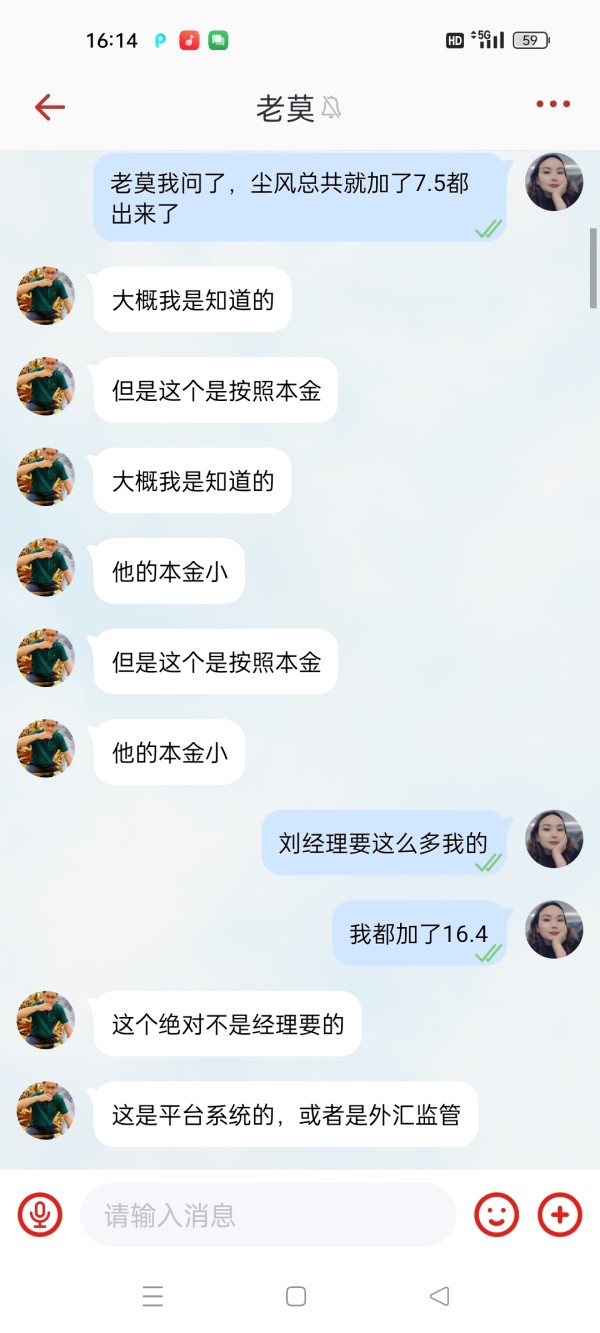

Someone asked me to download Pokochat and added me into a "Lao Mo Market Discussion Group". Later, when stocks weren't doing well, they started talking about gold and said they made a lot of money. Later, Manager Liu joined the group and asked us to open an account for trading. My capital was small and did not meet the requirements of Lao Mo's team, so I was not taken in. After that, I could not withdraw money.

This is a broker not many talk about, I think this is because of their limited availability, but overall they are decent, never really had any major issue, except for their slow customer service.

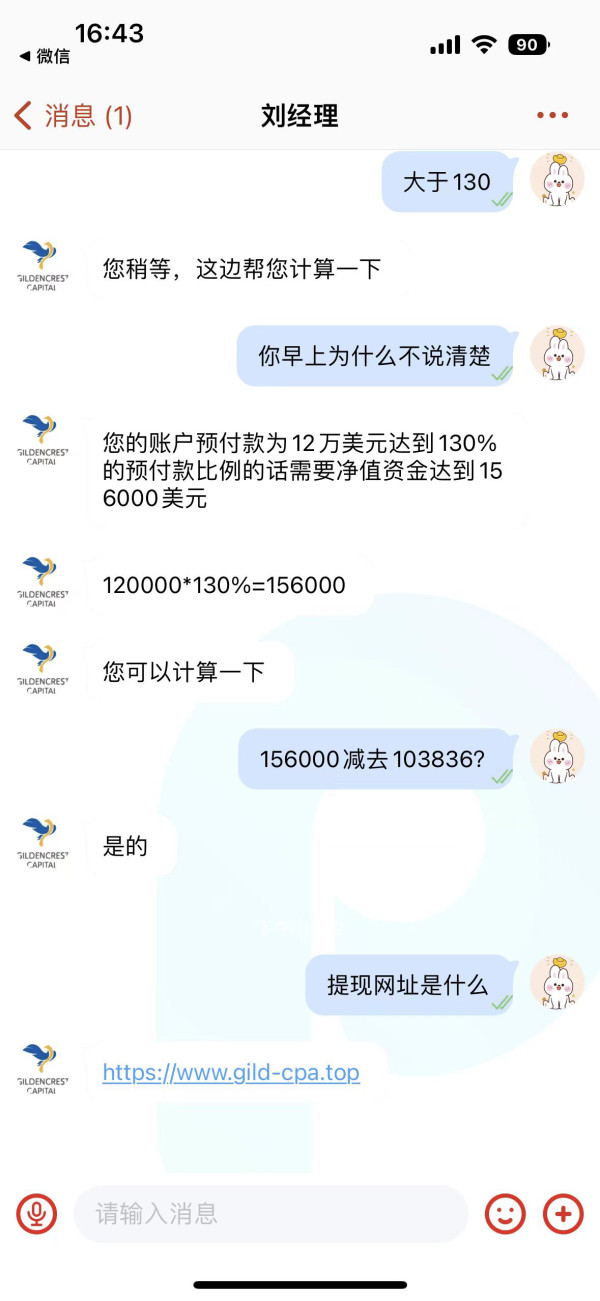

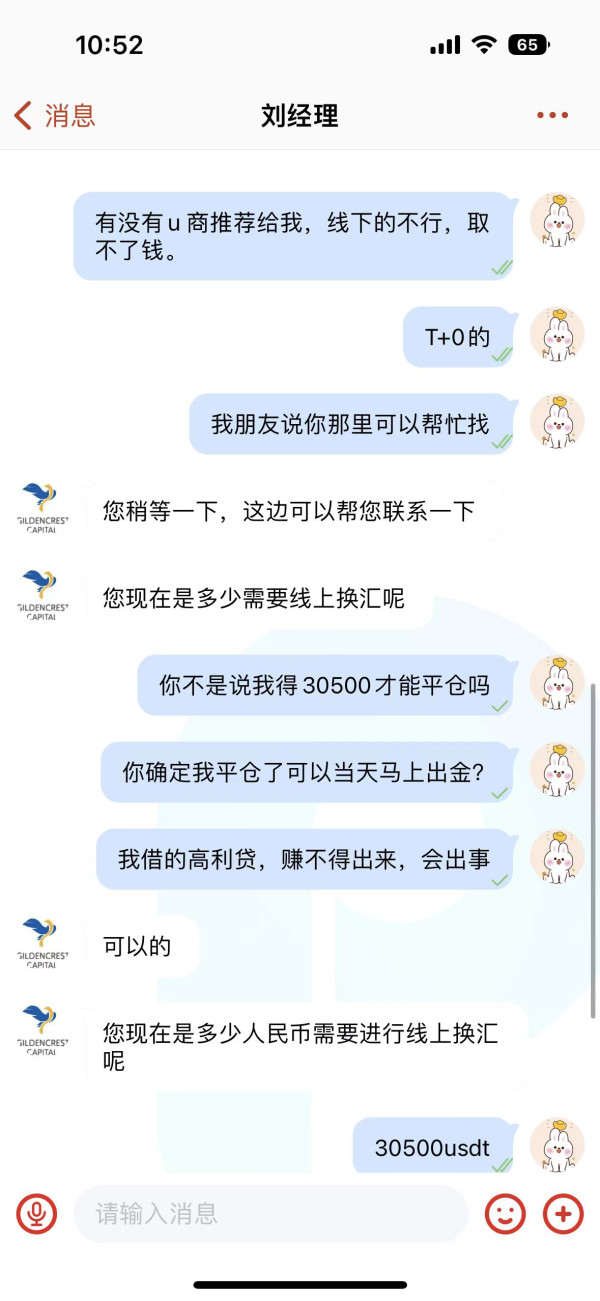

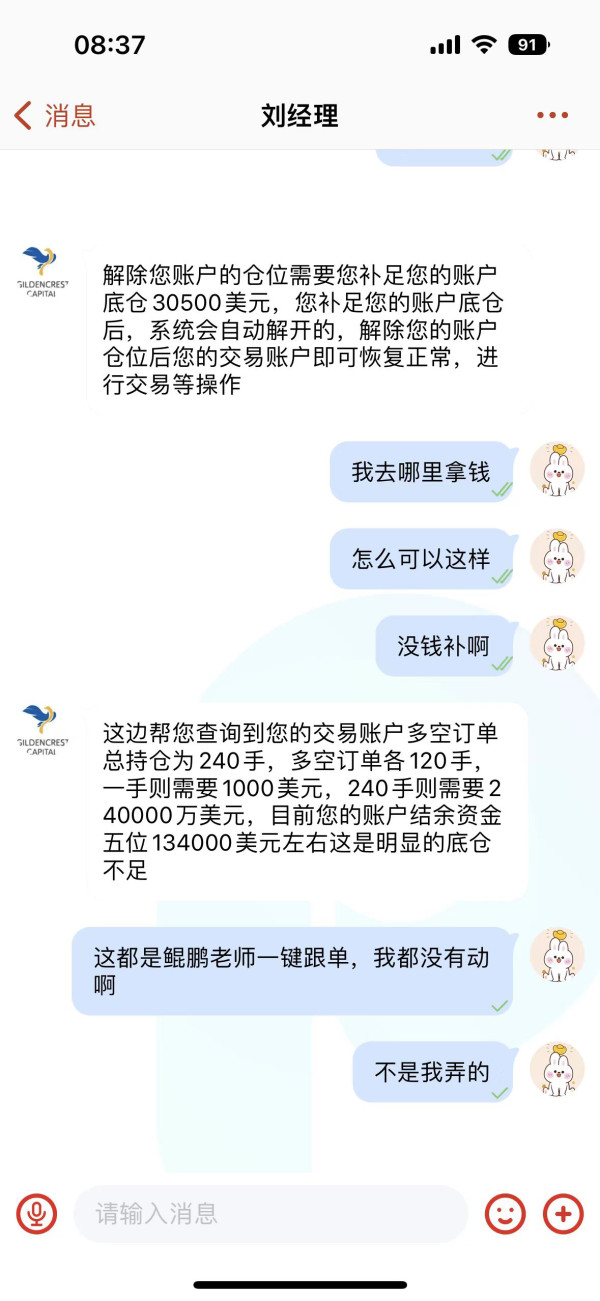

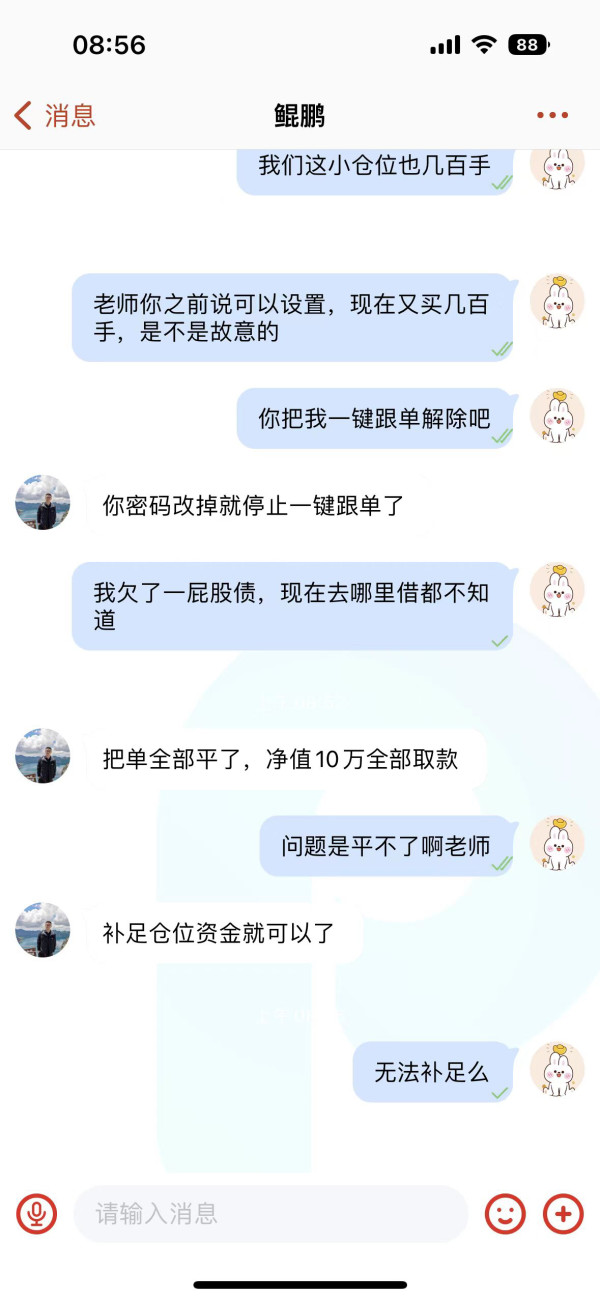

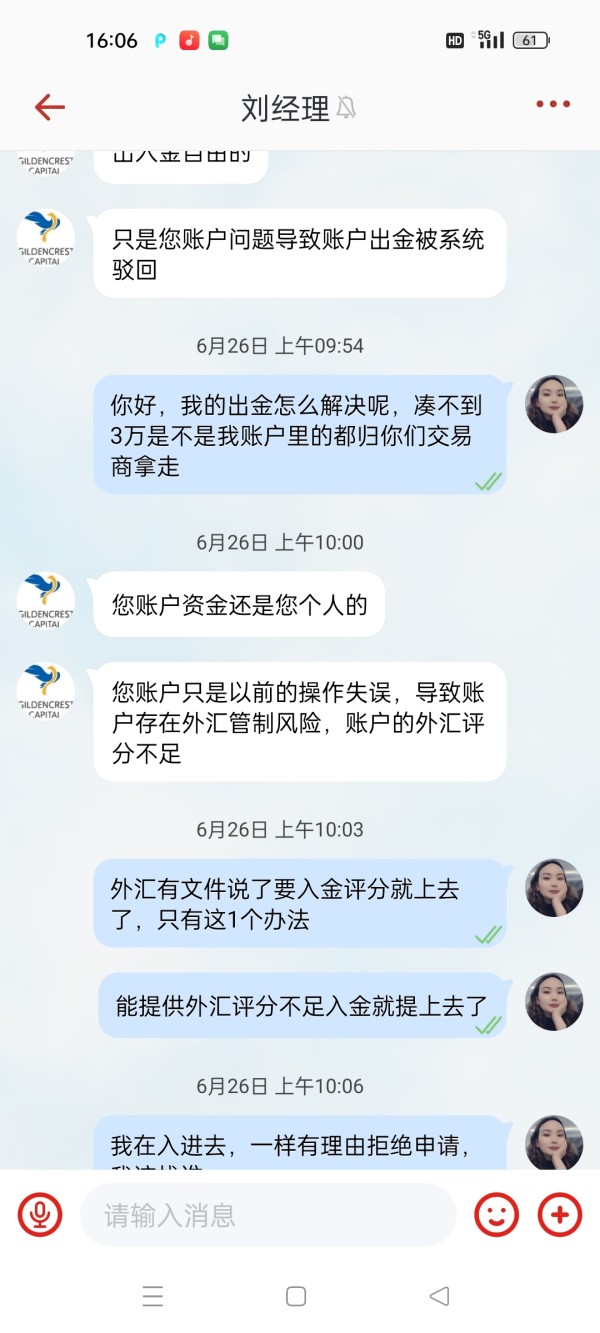

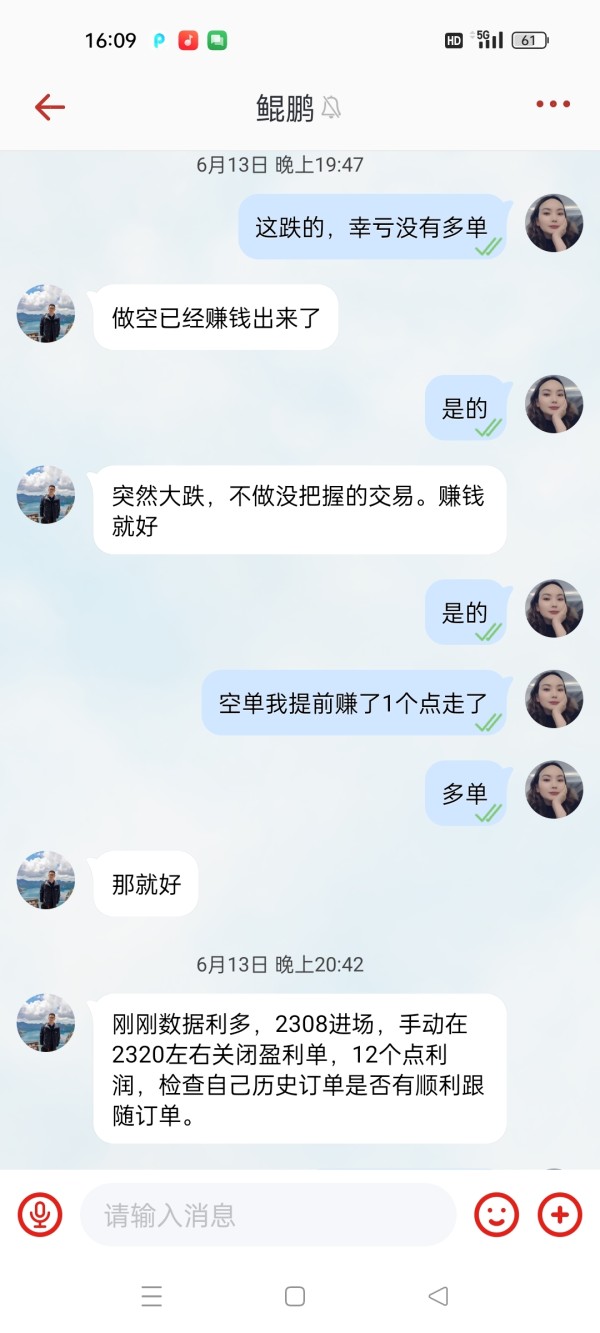

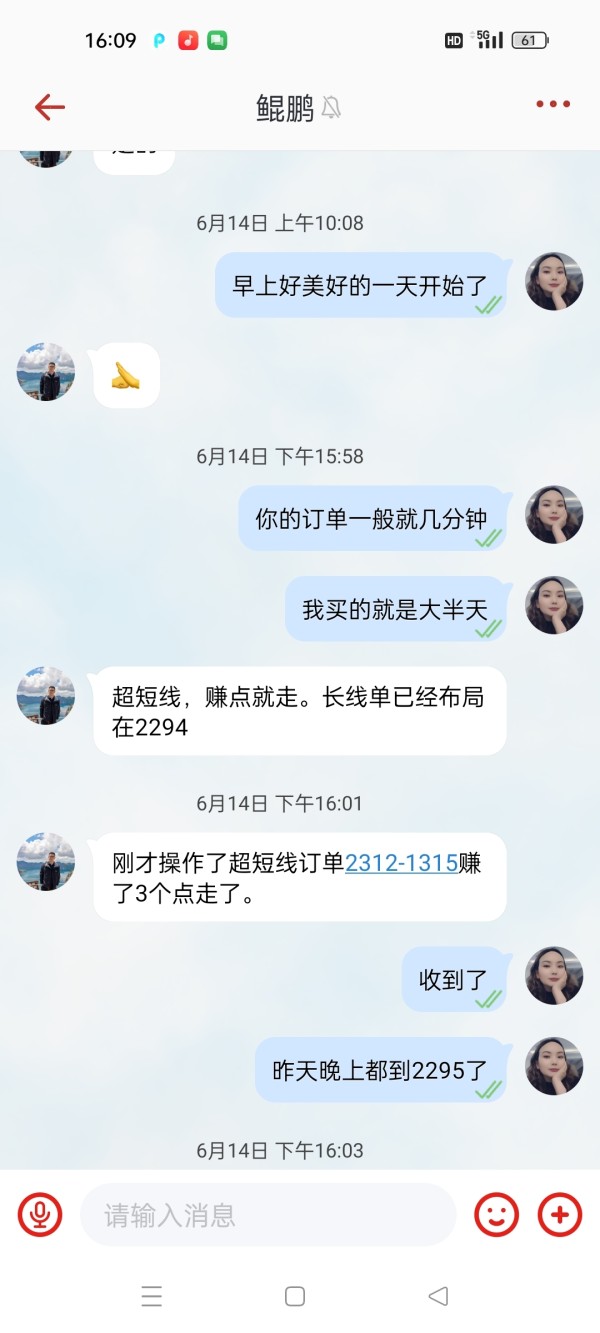

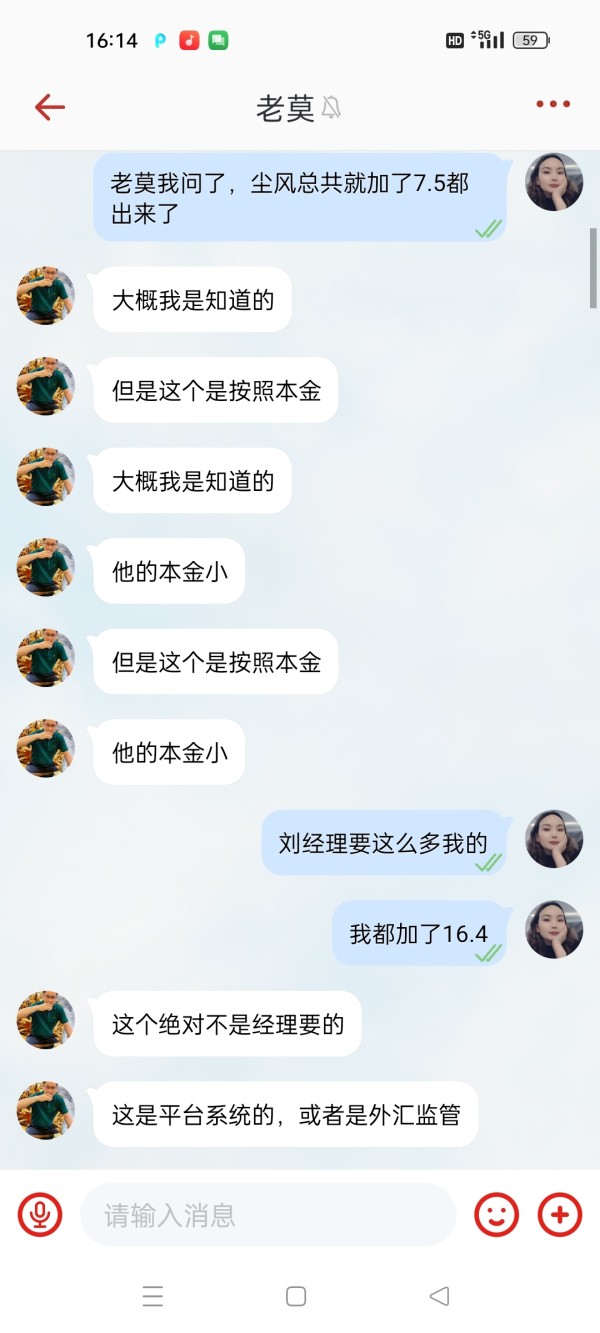

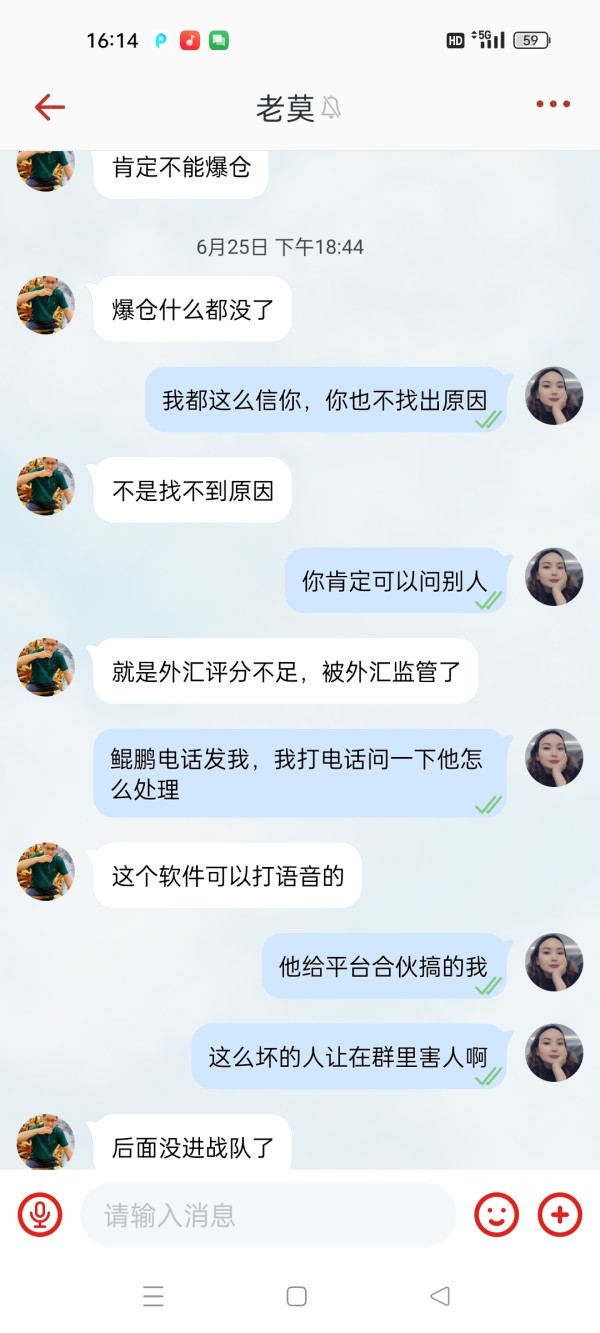

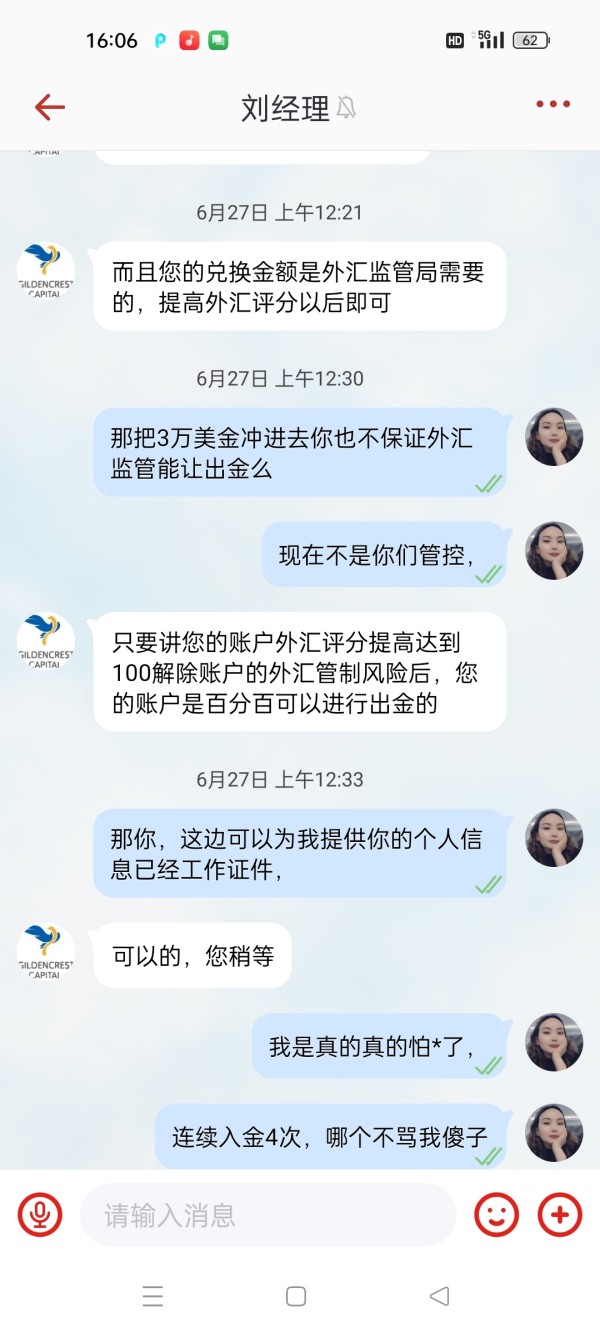

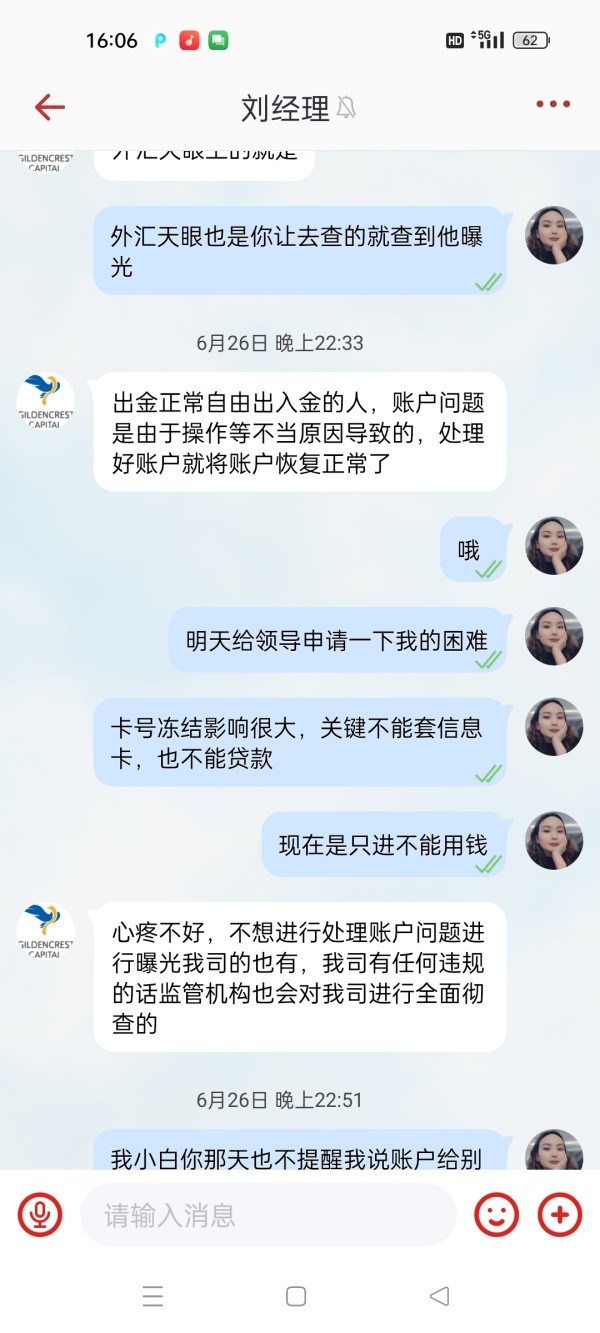

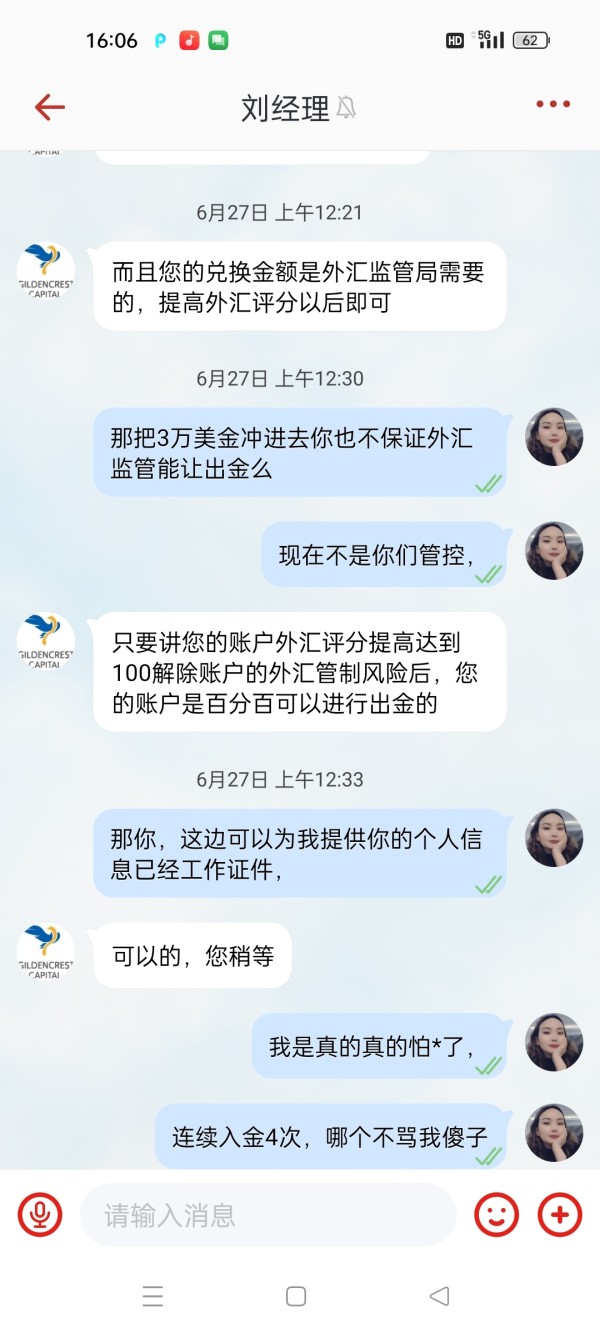

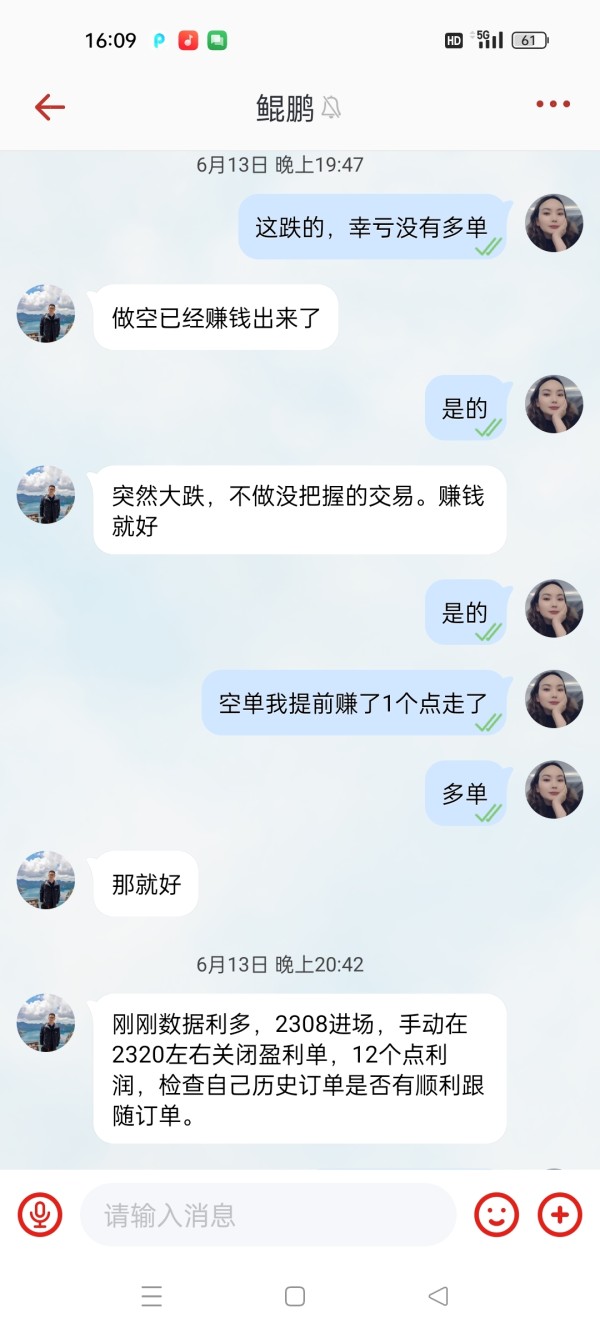

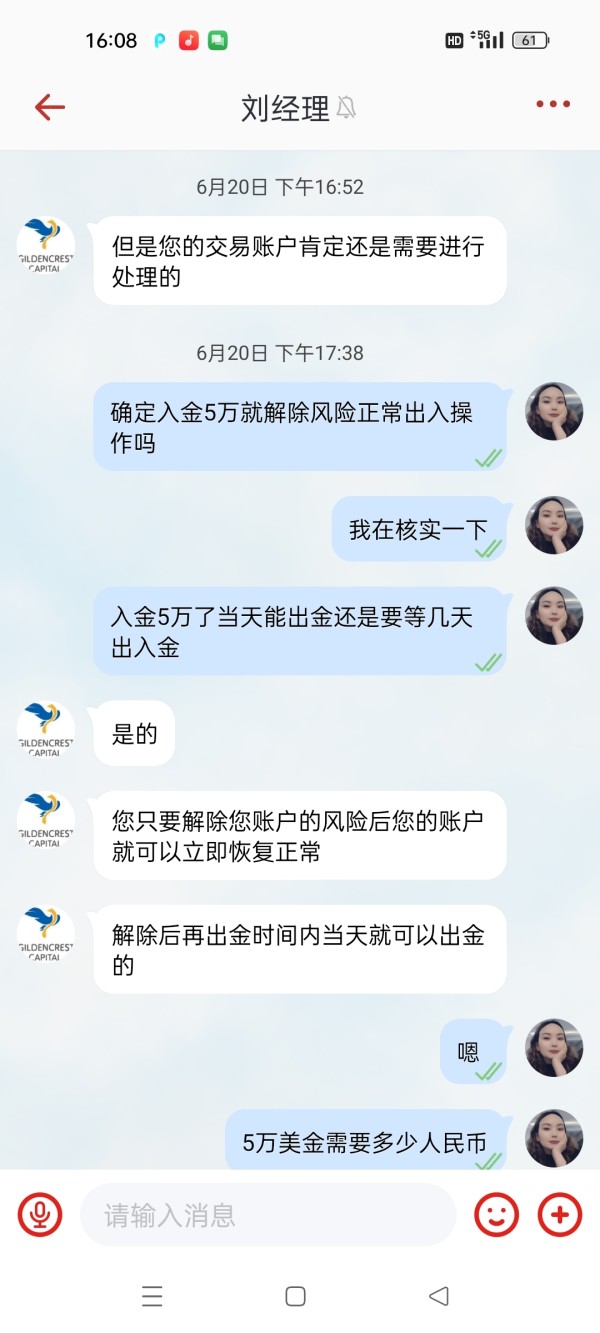

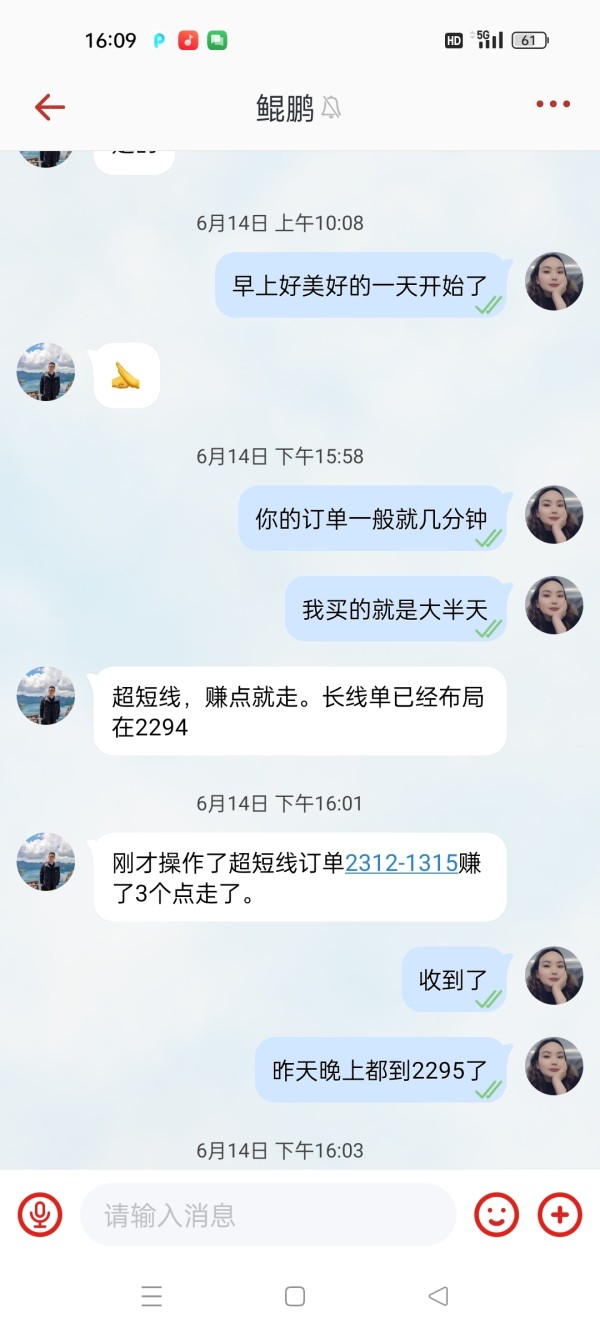

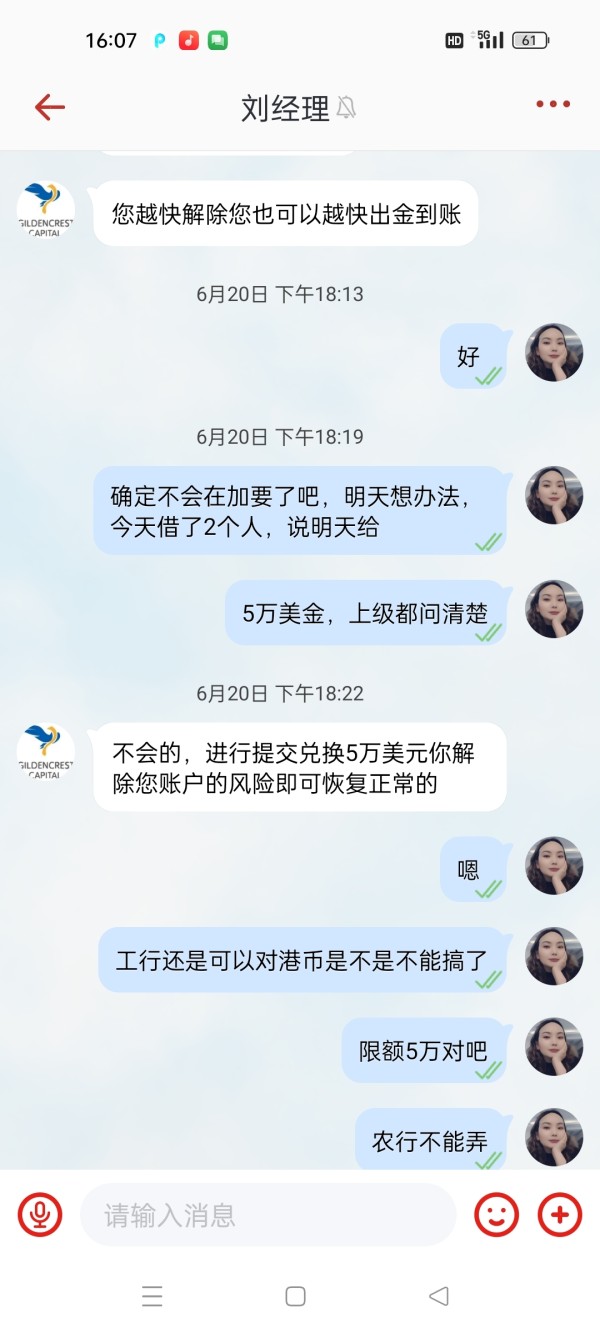

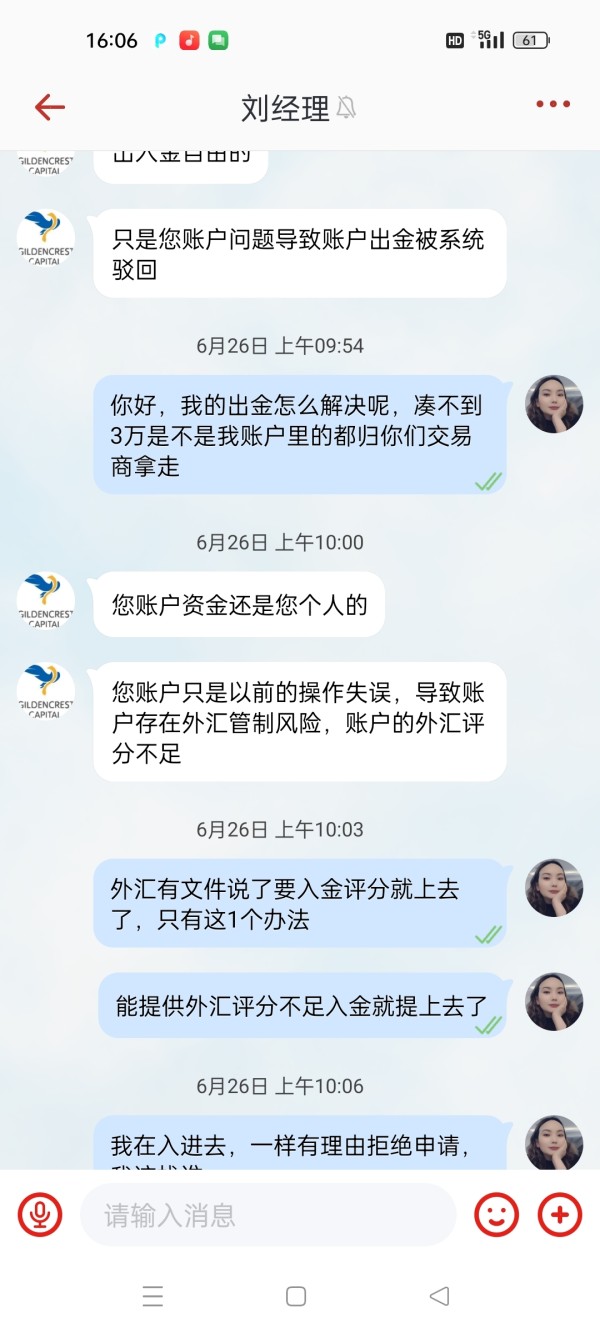

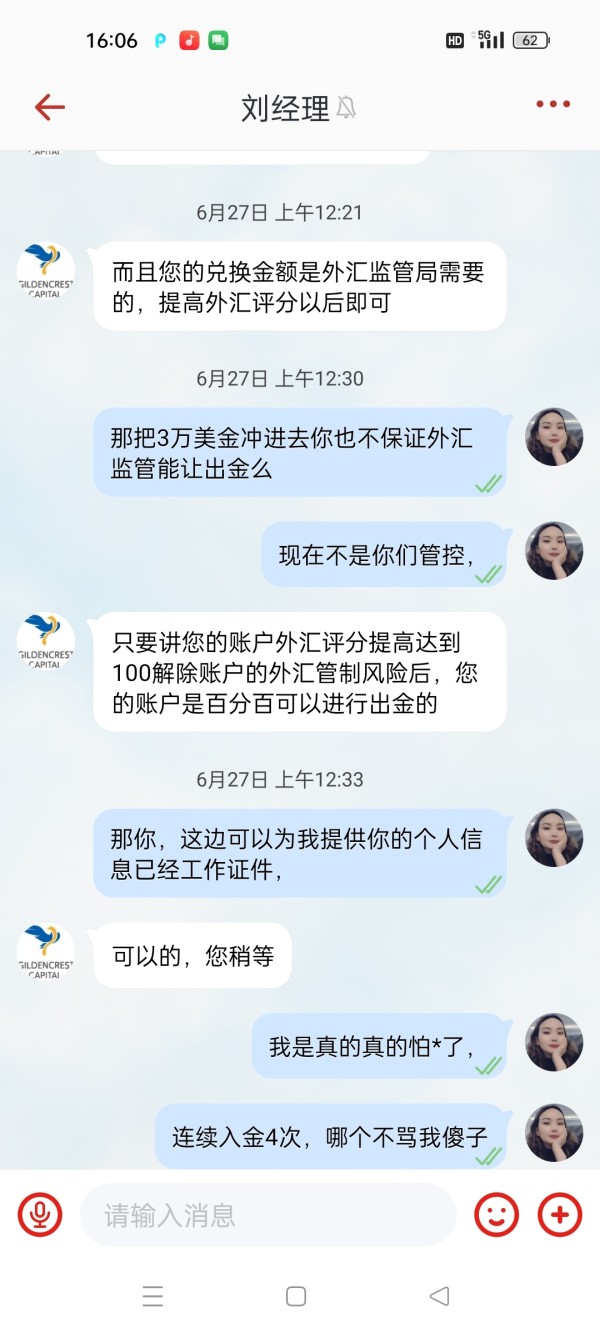

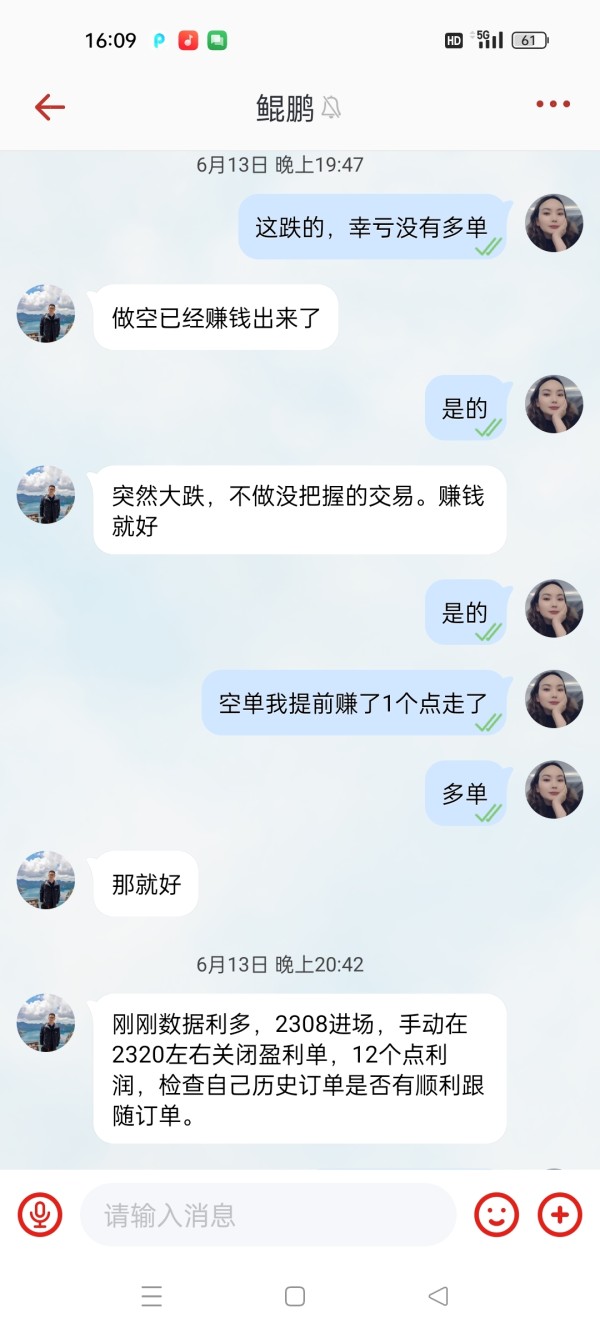

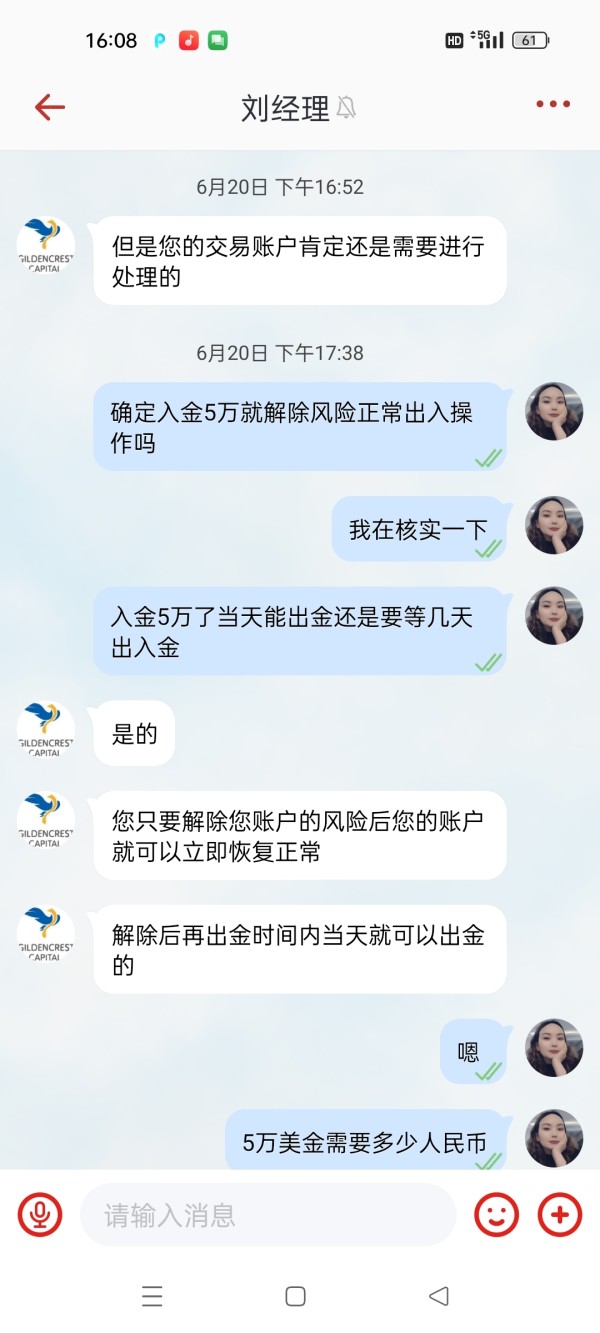

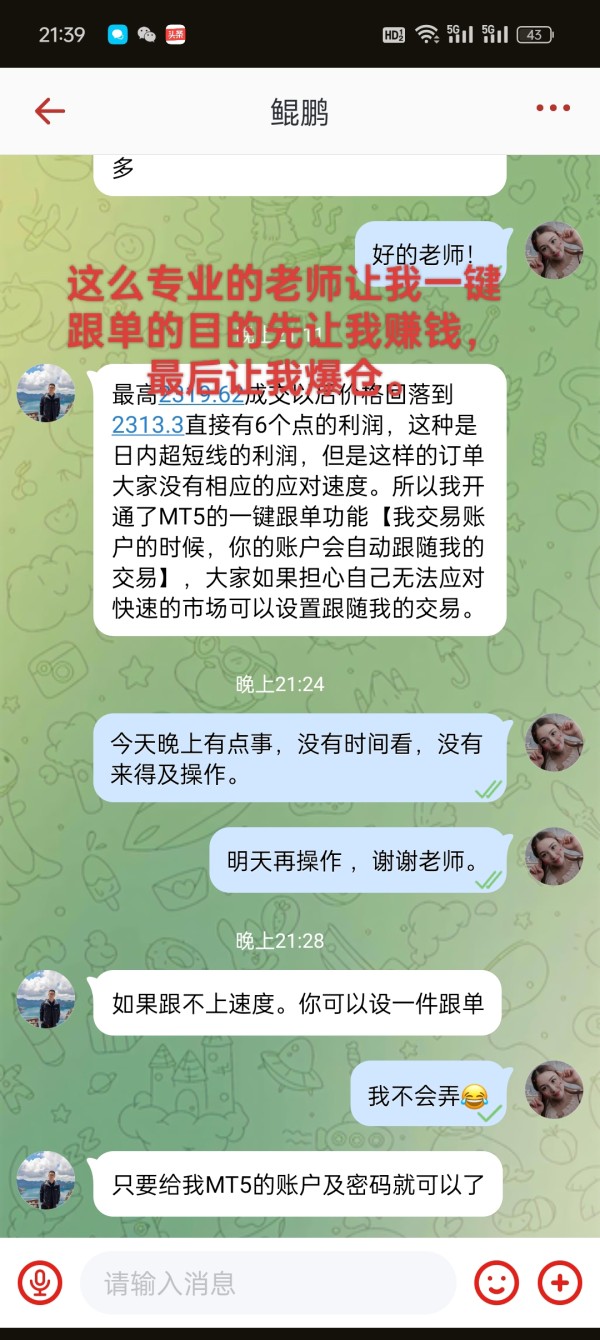

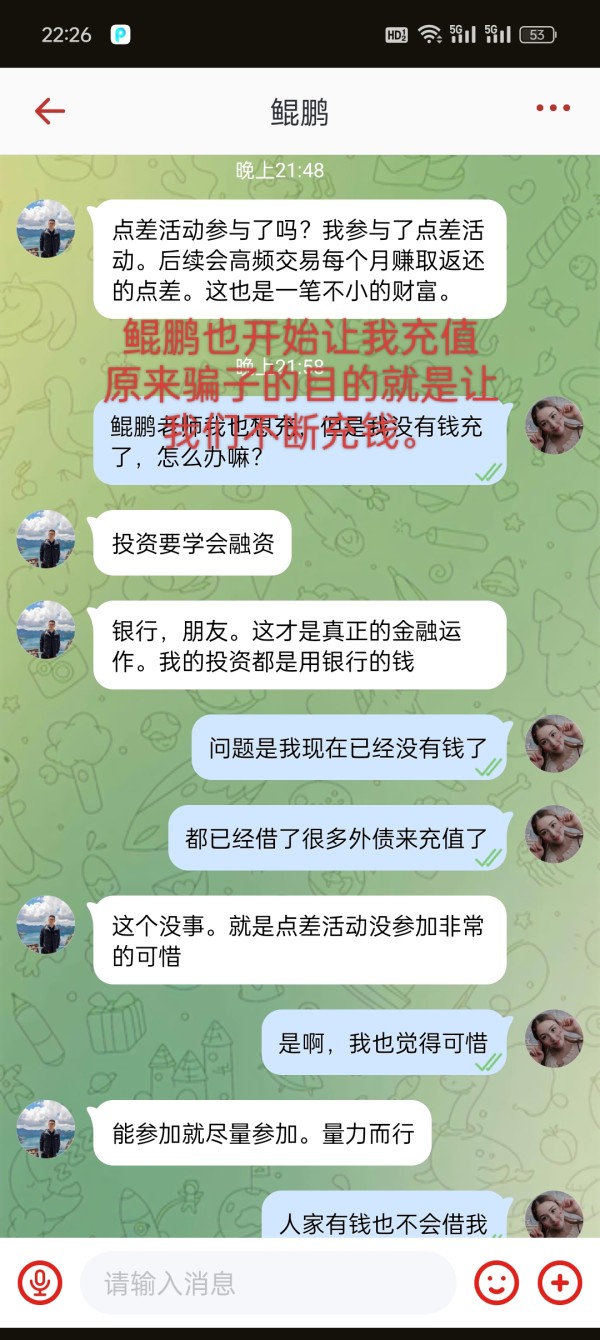

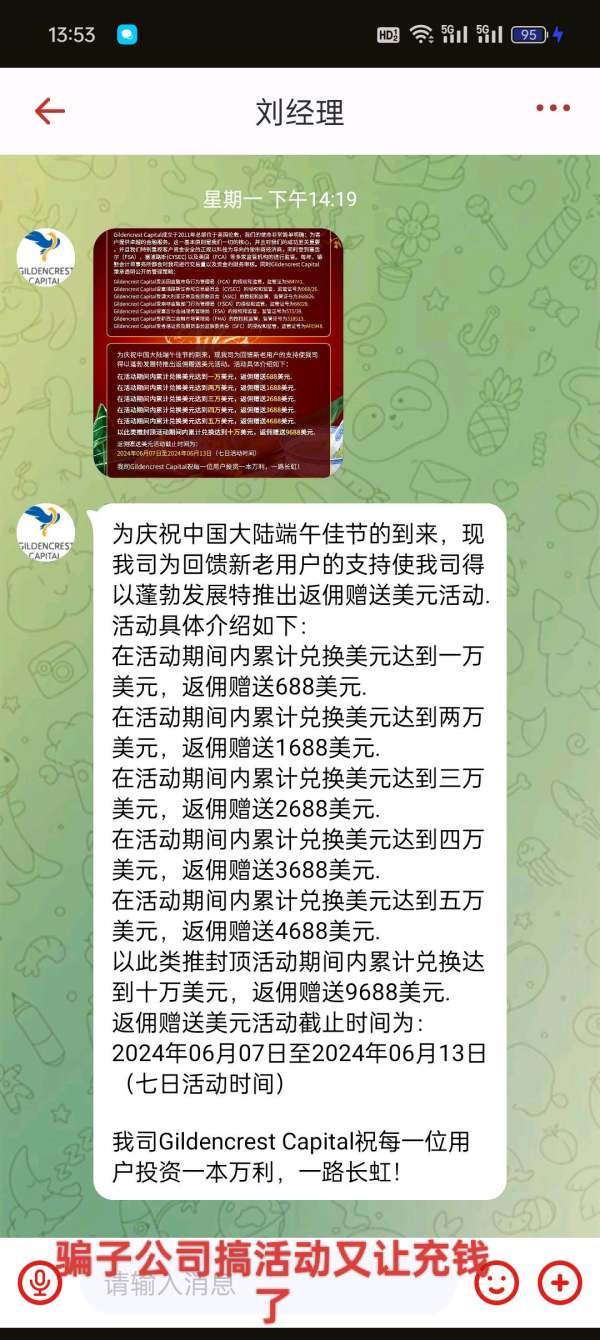

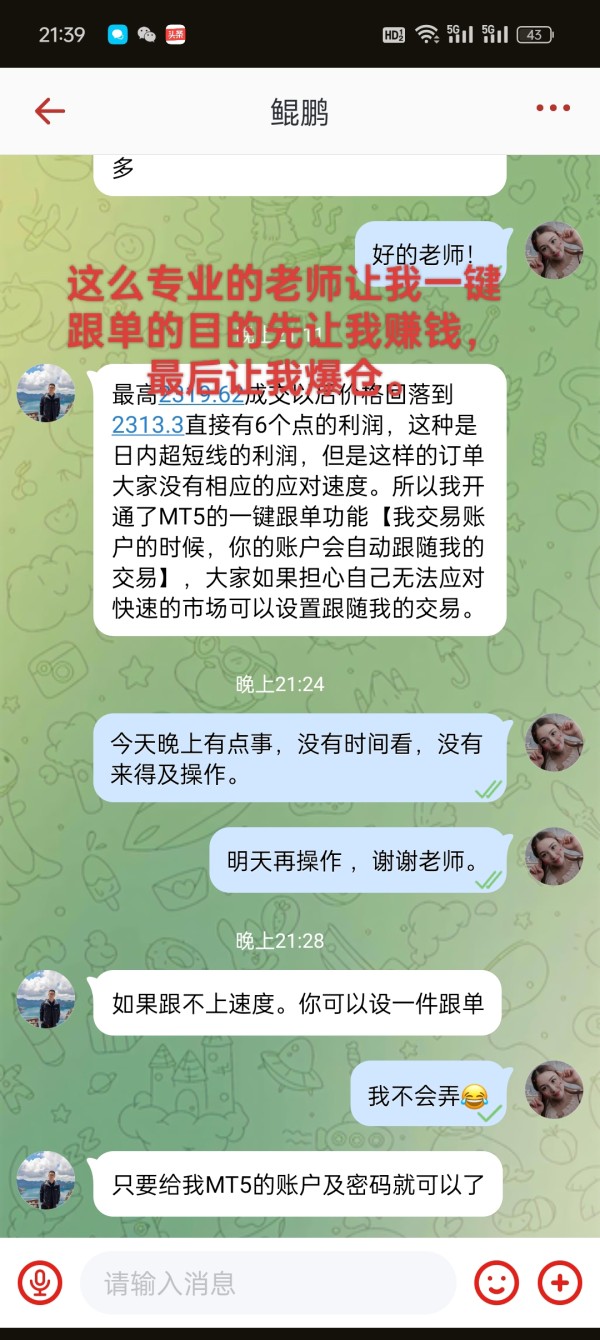

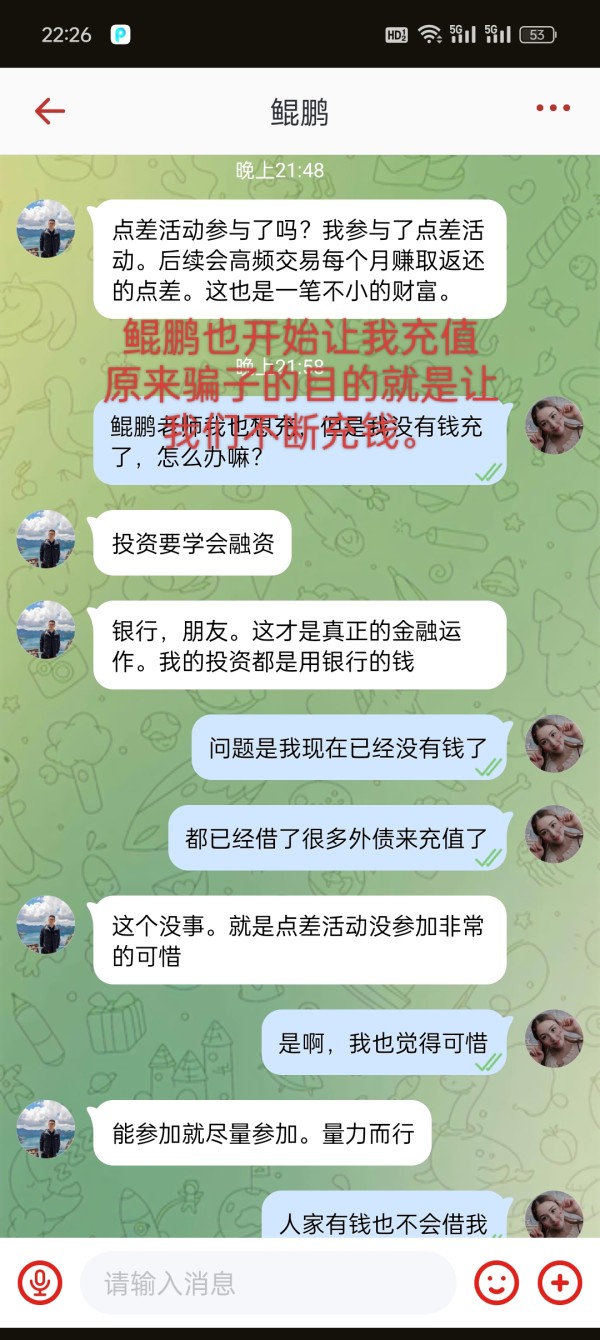

I was added to a stock group by a promoter, and then the group owner recommended us to invest in gold, saying it was profitable. At first, I didn't invest, but they shared how to make money in the group every day and even sent red pockets. They wanted everyone to invest in the gold he bought. Some people doubled their money in just one week. I opened an account and made a deposit, and I also made some profits. There was a man named Kunpeng in the group who claims there is an app for copying trades with just one click, saying that it could make money quickly. I hesitated, so I asked the promoter who brought me into the group. He said that Kunpeng's trades were safe and could earn more money. I was foolish enough to let Kunpeng trade for me. At first, I made some profits for a few days. On the evening of June 18th, I bought a heavy position. But the next day, I found that I couldn't close the position due to hedging. Then, the platform manager, Liu, kept asking me to make more deposits to avoid losses. To close the position, I kept raising money and depositing it. I deposited more than $70,000 that I was able to close the position. But then, I couldn't withdraw any funds. Liu, the manager, asked for an additional $50,000 to remove the risk of being hacked from multiple locations before I could withdraw. I had already invested so much capital and had no choice but to make another deposit. In the end, I still couldn't withdraw any funds. This scam platform has deceived many people that day.

I was added into a stock group by someone, and then they said stocks were not profitable and started persuading everyone to trade gold. They sent red pockets in the group every day, claiming to have made a lot of money from trading gold. At first, I deposited a small amount and made some profit. But later, they kept asking me to add more funds. There were two traders in the group, and even the worst one, Kunpeng. Suddenly, he said he could synchronize accounts to make more money. I asked the platform manager, and they confirmed it was possible. So I gave my account to the trader. At first, I made some profit. But one night, I found myself in a situation where I had a heavy position that I couldn't close. The platform manager kept urging me to add more US dollars, saying that if I didn't, I would lose tens of thousands every day. So I immediately borrowed money and added positions three times, each time adding 1 million. Finally, they said my forex rating was insufficient and asked me to add another 30,000. I realized that all the capital I had was borrowed, but I found a way to borrow another 30,000 US dollars to improve my rating. However, the manager and the group owner stopped responding to my messages. I hope the relevant department can take action against this platform.

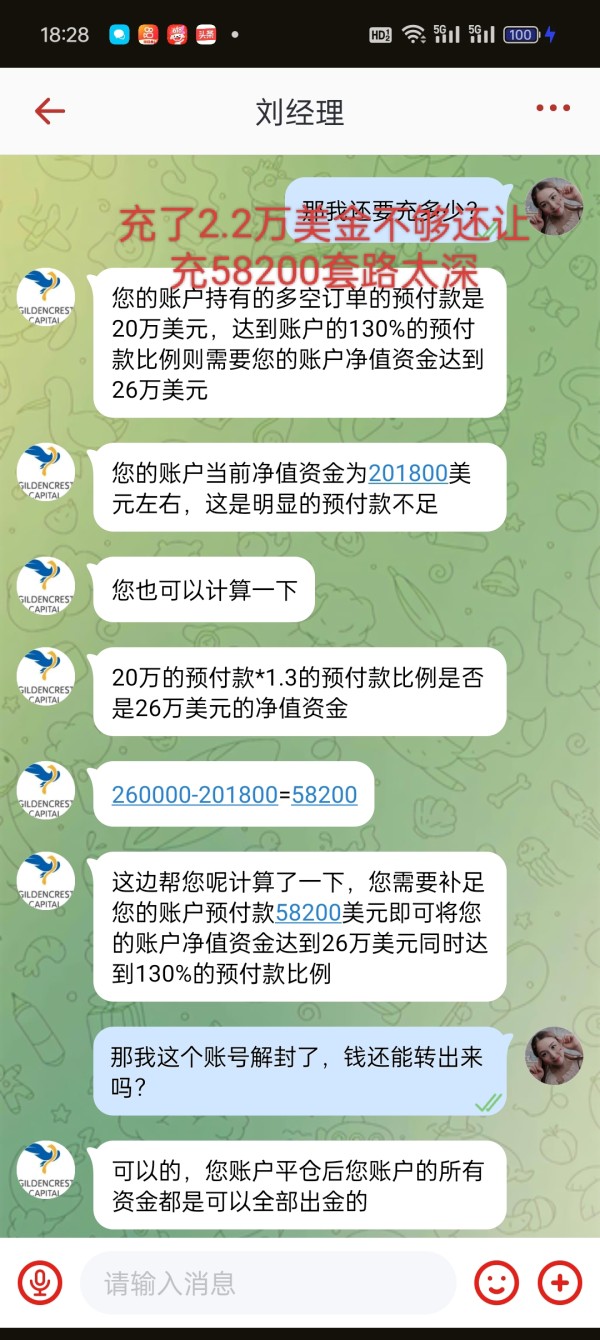

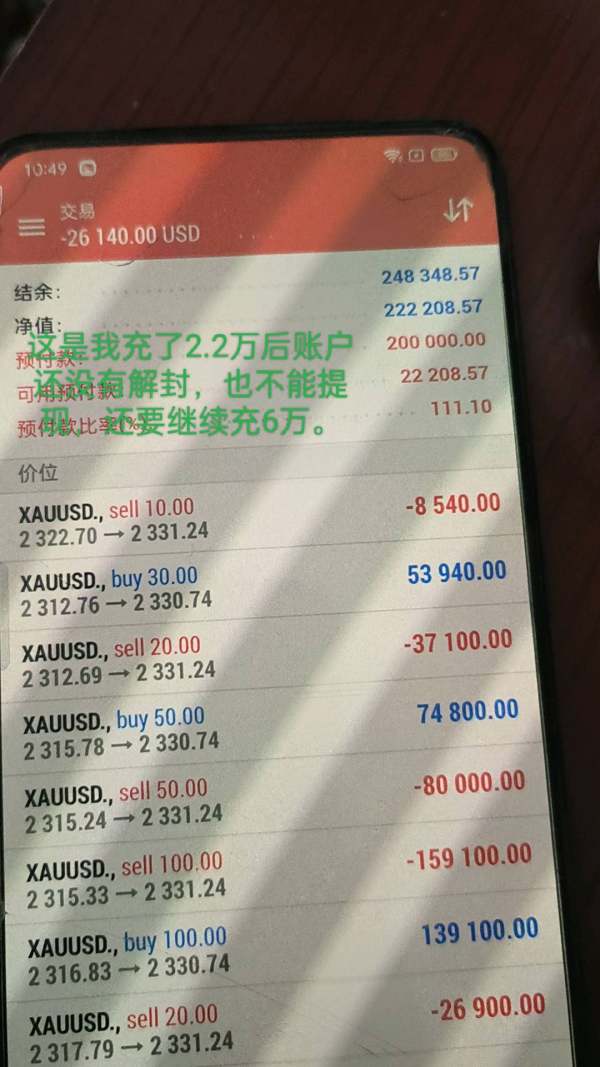

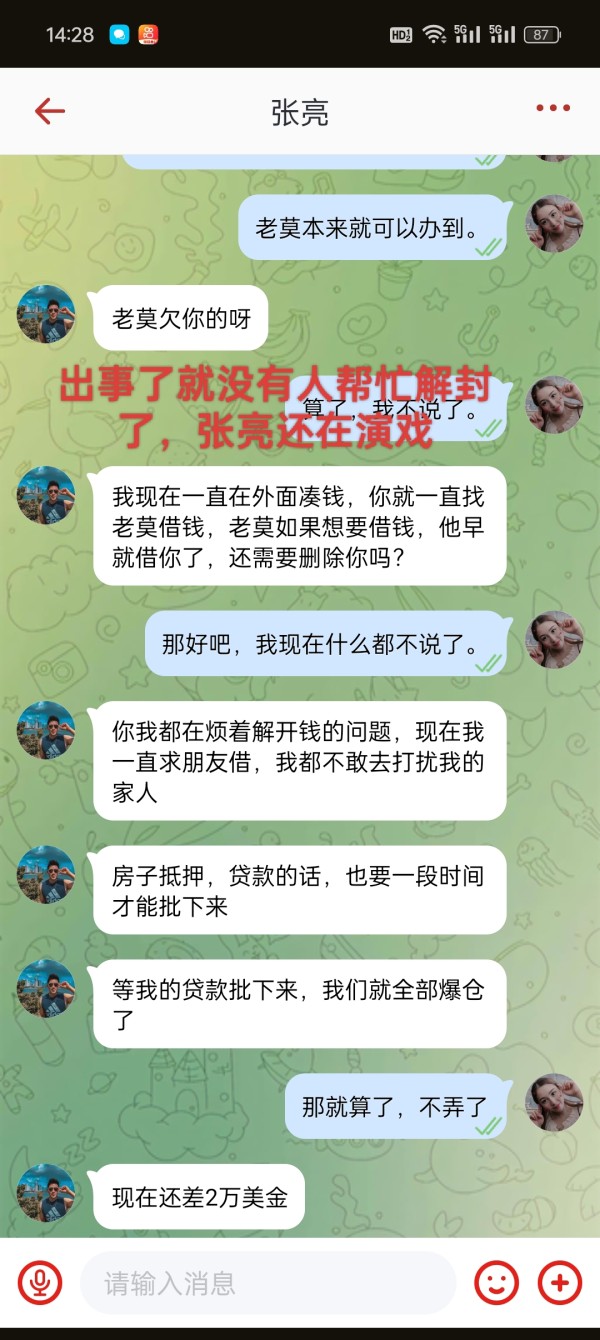

How could such a profitable platform take our money away? There were two seniors in the group. One was Lao Mo pretending to be a good guy, and the other was Kunpeng pretending to be a bad guy. Zhang Liang played the role of our good friend. Zhang Liang told me that Kunpeng said that Mt5 has a one-click follow-up function. As long as we tell him the account number and password, we will also make money when he places an order. Zhang Liang first sent me a screenshot and said how much money the senior helped him make today. I was a little tempted. So I told the senior my account number and password. My friend also followed the senior with me. My friend and I each recharged more than 60,000 US dollars, and the transaction doubled to more than 200,000 US dollars in five days. Zhang Liang recharged more than one million US dollars and turned it into 3.5 million US dollars. Just when we said we would withdraw the money the next day, we saw that the account was frozen in the morning. What was the reason? Kunpeng explained that the system triggered the protection mechanism. We are not fools, we can all see that this was intentional. He asked us to find Manager Liu. Manager Liu told me to deposit 22,000 US dollars before my account could be unblocked, and I could only withdraw the money after it was unblocked. I borrowed money from everywhere and collected 22,000. After depositing it, I still couldn't get my account unblocked. Manager Liu said it was not enough. I had to deposit another 60,000. At this time, the police station called me. They said my account was abnormal. They asked me why I had transferred so many money recently? They asked me to explain it immediately. I was not sober at the time. I was still thinking about how to raise money to unblock my account. The police told me not to be fooled again. They checked all the chat records on my phone and said I was cheated. This platform is a scam platform. I can't withdraw money even if I continue to deposit money. I realized it and quickly told the other two friends not to deposit money. I don't know if other people in the group are the same as us. I asked the two seniors to help us unblock our account. I would return it to them after I withdraw the money. They refused. They could do it, but they didn't help. It was obvious that they just wanted our money. They asked us to continue to deposit money, but they would not let us withdraw the money in the end. I went to Zhang Liang and he also lost money. I asked him, isn't this your uncle's friend? You can ask your uncle to help us. He said his uncle would not help. Let us not embarrass him. Then I understood. They are in the same group. One-click follow-up is a scam, and Zhang Liang's account may also be a demo account. Two or three days later, the seniors saw that we did not continue to recharge, so they found a reason to kick us out of the group. Now we can't even log in to the account of that software, nor the MT5 foreign exchange platform account. The goal was achieved, and Zhang Liang disappeared. My friend and I became penniless overnight. We owed a lot of debts to unblock the account.

I was scammed and can't withdraw money. The platform has run away. I have been scammed and there is nothing I can do.