Regarding the legitimacy of FXlift forex brokers, it provides CYSEC and WikiBit, (also has a graphic survey regarding security).

Is FXlift safe?

Pros

Cons

Is FXlift markets regulated?

The regulatory license is the strongest proof.

CYSEC Market Making License (MM) 20

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Notesco Financial Services Ltd

Effective Date:

2010-11-16Email Address of Licensed Institution:

compliance@notesco.comSharing Status:

Website of Licensed Institution:

www.ironfx.eu, www.fxlift.euExpiration Time:

--Address of Licensed Institution:

2, Iapetou Street, Agios Athanasios, CY-4101 LimassolPhone Number of Licensed Institution:

+357 25 027 000Licensed Institution Certified Documents:

Is FXLift A Scam?

Introduction

FXLift is a forex and CFD broker that positions itself as a competitive player in the financial markets, offering a wide range of trading instruments and services. As traders increasingly seek opportunities in the volatile world of forex, it becomes imperative to carefully evaluate the legitimacy and reliability of brokers like FXLift. This article aims to provide an objective analysis of FXLift, assessing its safety and trustworthiness for potential investors. The evaluation is based on a comprehensive review of regulatory compliance, company background, trading conditions, customer feedback, and security measures.

Regulation and Legitimacy

Understanding the regulatory environment in which a broker operates is crucial for assessing its legitimacy. FXLift claims to be regulated by the Cyprus Securities and Exchange Commission (CySEC), which is a reputable regulatory body in the European Union. The significance of regulation lies in the protection it offers to traders, ensuring that brokers adhere to strict operational standards and maintain transparency.

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| CySEC | 125/10 | Cyprus | Verified |

Despite its regulatory status, concerns have been raised about FXLift's offshore operations. The broker operates under Notesco Financial Services Ltd, which has an offshore registration in Bermuda. This dual structure can lead to ambiguity regarding the level of protection afforded to clients, especially those trading through the offshore entity. While CySEC regulation provides a safety net, the existence of an unregulated offshore branch raises questions about the broker's operational integrity and compliance history.

Company Background Investigation

FXLift has been in operation since 2010, and it is owned by Notesco Financial Services Ltd, a company registered in Bermuda. The management team comprises professionals with backgrounds in finance and trading, which theoretically enhances the broker's credibility. However, the lack of detailed information regarding the management's experience and the company's operational history can be concerning for potential clients.

Transparency is a vital aspect of any financial institution. FXLift provides some information about its services on its website; however, the overall disclosure level is limited. This lack of comprehensive information can lead to skepticism among traders regarding the broker's intentions and operational practices.

Trading Conditions Analysis

FXLift presents a competitive trading environment, offering various account types and trading instruments. However, the overall fee structure requires careful scrutiny. The absence of clear information regarding minimum deposits for different account types can also be a red flag.

| Fee Type | FXLift | Industry Average |

|---|---|---|

| Spread on Major Pairs | 1.5 - 2.1 pips | 1.0 - 1.5 pips |

| Commission Structure | None | Varies |

| Overnight Interest Range | Varies | Varies |

FXLift claims to have no commissions on trades, which is an attractive feature. However, the spreads offered, particularly for the standard account, are on the higher side compared to industry averages. Additionally, traders should be cautious of any hidden fees that may not be explicitly stated, as these can significantly impact profitability.

Customer Funds Security

The safety of customer funds is a paramount concern for any trader. FXLift claims to implement several security measures, including segregated accounts and investor compensation funds. Segregation of funds is a crucial practice that ensures client deposits are held separately from the broker's operational funds, providing an additional layer of security.

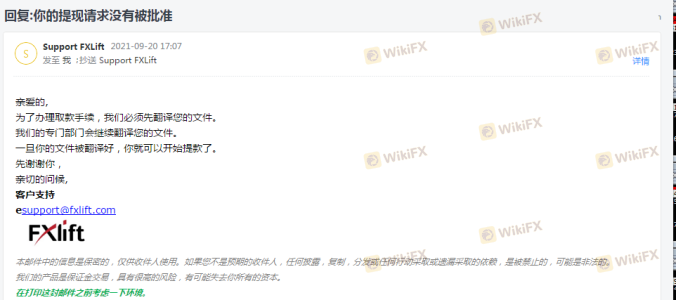

However, the effectiveness of these measures can be called into question, especially given the offshore entity's lack of regulation. Historical issues related to fund security have been reported by users, with some clients alleging difficulties in withdrawing their funds. Such incidents can severely undermine the trustworthiness of a broker and raise concerns about the safety of client investments.

Customer Experience and Complaints

Analyzing customer feedback is essential to gauge the reliability of a broker. Reviews of FXLift present a mixed picture, with some users praising its trading conditions while others report significant issues, particularly regarding withdrawal processes.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Account Suspension | Medium | Unresolved |

Common complaints include difficulties in withdrawing funds and account suspensions without clear explanations. These issues can indicate potential operational problems or a lack of transparency in the broker's practices. A couple of users have reported being unable to access their accounts for extended periods, raising alarm bells about the broker's reliability.

Platform and Execution

FXLift utilizes the widely recognized MetaTrader 4 (MT4) platform, which is favored for its user-friendly interface and robust features. However, the platform's performance can vary based on execution quality. Reports of slippage and order rejections have surfaced, which can be detrimental to trading success.

The execution quality is critical for traders, especially in a fast-paced market. Any signs of manipulation or poor execution can significantly impact a trader's experience and profitability. Thus, it is essential for potential clients to consider these factors before committing to FXLift.

Risk Assessment

Using FXLift entails various risks that traders must be aware of. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Medium | Mixed regulatory status raises concerns. |

| Fund Safety | High | Reports of withdrawal issues and unregulated entity. |

| Execution Quality | Medium | Potential slippage and order rejection issues. |

To mitigate these risks, traders should conduct thorough research, utilize risk management strategies, and consider starting with a demo account before investing real capital.

Conclusion and Recommendations

In conclusion, while FXLift presents itself as a legitimate broker with several attractive features, significant concerns regarding its regulatory status, fund safety, and customer feedback cannot be overlooked. The mixed reviews, coupled with the existence of an unregulated offshore entity, suggest that traders should exercise caution when considering this broker.

For traders seeking reliable options, it may be wise to explore alternatives that have a more robust regulatory framework and a proven track record of positive customer experiences. Brokers such as eToro or IG, which offer comprehensive services and strong regulatory oversight, could provide safer trading environments.

In summary, while FXLift may not be outright classified as a scam, the potential risks associated with trading through this broker warrant careful consideration and due diligence.

Is FXlift a scam, or is it legit?

The latest exposure and evaluation content of FXlift brokers.

FXlift Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FXlift latest industry rating score is 4.62, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 4.62 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.