Regarding the legitimacy of FXCC forex brokers, it provides CYSEC and WikiBit, (also has a graphic survey regarding security).

Is FXCC safe?

Pros

Cons

Is FXCC markets regulated?

The regulatory license is the strongest proof.

CYSEC Forex Execution License (STP) 22

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Forex Execution License (STP)

Licensed Entity:

FX Central Clearing Ltd

Effective Date:

2010-09-03Email Address of Licensed Institution:

corporate@fxcc.comSharing Status:

No SharingWebsite of Licensed Institution:

www.fxcc.eu/Expiration Time:

--Address of Licensed Institution:

2, Samou Street, Amorosa Centre, 2nd Floor, Germasogeia, CY-4043 LimassolPhone Number of Licensed Institution:

+357 25 870 750Licensed Institution Certified Documents:

Is FXCC A Scam?

Introduction

FXCC, or Forex Central Clearing, is a Cyprus-based forex broker established in 2010. It positions itself as a provider of trading services for both retail and professional traders, offering access to various financial instruments, including currencies, cryptocurrencies, indices, and commodities. Given the complexities and risks associated with forex trading, it is crucial for traders to evaluate the legitimacy and reliability of brokers like FXCC carefully. With numerous reports of scams and fraudulent activities in the forex market, understanding a broker's regulatory status, trading conditions, and customer experiences is essential for making informed trading decisions. This article aims to provide an objective analysis of FXCC, utilizing a structured framework that encompasses regulatory compliance, company background, trading conditions, customer fund safety, user experiences, platform performance, risk assessment, and final recommendations.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical factors in determining its legitimacy. FXCC is regulated by the Cyprus Securities and Exchange Commission (CySEC), which is a reputable regulatory authority in the European Union. This regulation ensures that FXCC adheres to strict financial standards and provides a level of protection for traders. Below is a summary of FXCC's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Cyprus Securities and Exchange Commission (CySEC) | 121/10 | Cyprus | Verified |

| Vanuatu Financial Services Commission (VFSC) | 14576 | Vanuatu | Verified |

The significance of regulation cannot be overstated. Being regulated by CySEC means that FXCC must comply with the Markets in Financial Instruments Directive (MiFID), which provides a framework for investor protection and operational transparency. Moreover, FXCC is a member of the Investor Compensation Fund (ICF), which protects clients' claims in case of insolvency. However, it is worth noting that FXCC also operates under offshore regulations in Vanuatu, where regulatory standards are less stringent. This dual regulatory framework raises concerns about the level of protection available to international clients, particularly those trading under the Vanuatu entity.

Company Background Investigation

FXCC was founded in 2010 by a group of foreign exchange professionals who sought to create a broker that prioritizes customer-centric services. Over the years, FXCC has expanded its operations and established a reputation for providing competitive pricing and transparent trading conditions. The company's ownership structure is not publicly disclosed, which may hinder full transparency. However, the management team comprises individuals with extensive experience in the financial markets, contributing to the broker's operational integrity.

In terms of transparency, FXCC provides a wealth of information on its website, including trading conditions, fees, and educational resources. However, the lack of detailed information regarding the ownership and management team may raise questions about the broker's accountability. Overall, while FXCC has made strides in establishing itself as a reliable broker, the opacity surrounding its ownership structure could be a concern for potential clients.

Trading Conditions Analysis

FXCC offers competitive trading conditions, primarily through its ECN XL account, which features tight spreads and no commissions. The broker operates on a spread-only model, which is appealing to cost-conscious traders. Below is a comparison of FXCC's core trading costs:

| Fee Type | FXCC | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.8 pips | 1.2 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Varies | Varies |

FXCC's spreads start as low as 0.1 pips for major currency pairs, which is competitive compared to industry averages. The absence of a commission on trades further enhances its appeal. However, FXCC does impose an inactivity fee of $5 per month after three months of no trading activity. This fee structure is relatively standard in the industry, but traders should be aware of it, especially if they plan to trade infrequently.

Despite these advantages, some users have reported hidden fees and unclear pricing structures, which can lead to confusion. Therefore, potential clients should carefully review all terms and conditions before opening an account.

Customer Fund Safety

The safety of customer funds is paramount in the financial services industry. FXCC implements several measures to ensure the security of client investments. Client funds are held in segregated accounts at tier-1 banks, which provides an additional layer of protection. Furthermore, FXCC offers negative balance protection, ensuring that clients cannot lose more than their account balance.

The broker's membership in the Investor Compensation Fund (ICF) adds an extra layer of security, as it compensates clients in the event of insolvency. However, historical issues related to fund safety have not been reported, which is a positive sign. Overall, FXCC appears to maintain a strong commitment to safeguarding client funds, but potential clients should remain vigilant and conduct thorough due diligence.

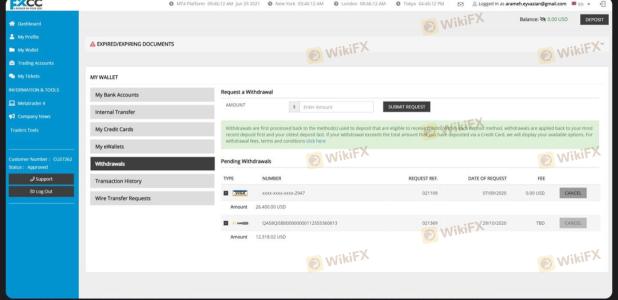

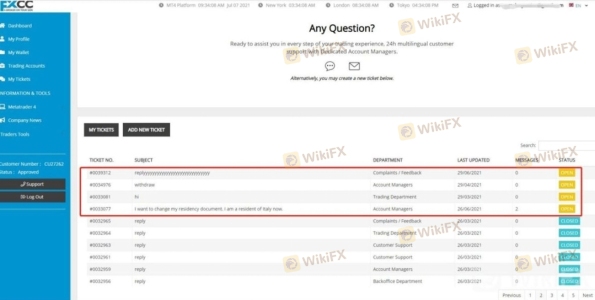

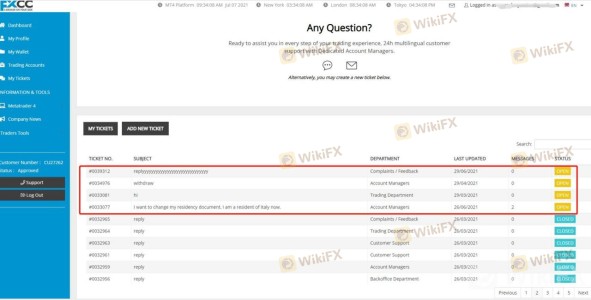

Customer Experience and Complaints

Customer feedback is a vital aspect of assessing a broker's reliability. Reviews of FXCC vary, with some users praising its trading conditions and customer support, while others express dissatisfaction with withdrawal processes and customer service responsiveness. Below is a summary of common complaints:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Mixed |

| Poor Customer Support | Medium | Improving |

| Hidden Fees | Medium | Addressing |

A few users have reported difficulties withdrawing funds, citing delays and requests for additional documentation. While FXCC's customer support operates 24/5, the lack of 24/7 availability has been a point of contention. In some cases, clients have noted that their inquiries took longer than expected to resolve.

For instance, one user reported a delayed withdrawal request that took several days to process, leading to frustration. However, other clients have praised the broker's support team for their helpfulness and responsiveness in addressing issues.

Platform and Trade Execution

FXCC primarily utilizes the MetaTrader 4 (MT4) trading platform, which is well-regarded for its reliability and advanced trading features. Users generally report a positive experience with the platform, noting its ease of use and comprehensive analytical tools. However, the absence of a web-based trading platform may inconvenience some traders.

In terms of order execution, FXCC employs an ECN model, ensuring that trades are executed at the best available prices without dealer intervention. Users have reported minimal slippage and a low rate of re-quotes, which is a significant advantage for active traders. Nonetheless, there have been occasional reports of execution delays during high volatility periods, which traders should be aware of.

Risk Assessment

Trading with FXCC involves certain risks, as with any forex broker. Below is a summary of the key risk areas associated with FXCC:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Dual regulation may lead to confusion regarding the level of investor protection. |

| Fund Safety Risk | Low | Segregated accounts and ICF membership enhance fund security. |

| Customer Service Risk | Medium | Reports of delayed responses and withdrawal issues may impact user experience. |

To mitigate these risks, it is advisable for traders to conduct thorough research, maintain clear communication with the broker, and be aware of the terms and conditions associated with their accounts.

Conclusion and Recommendations

In conclusion, FXCC is not a scam; it operates as a regulated broker under CySEC and offers competitive trading conditions. However, potential clients should exercise caution due to its dual regulatory structure, which may complicate the level of protection available for international traders. While FXCC provides a solid trading environment, the mixed customer feedback regarding support and withdrawal processes highlights the need for improvement.

For beginner traders, FXCC may be a suitable option due to its no minimum deposit requirement and user-friendly trading platform. However, those seeking a broader range of investment options or more comprehensive educational resources may want to consider alternative brokers.

If you're looking for reliable alternatives, brokers like IC Markets and Pepperstone offer a wider selection of trading instruments and robust educational resources. Ultimately, conducting thorough research and understanding the risks involved is essential for successful trading in the forex market.

Is FXCC a scam, or is it legit?

The latest exposure and evaluation content of FXCC brokers.

FXCC Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FXCC latest industry rating score is 4.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 4.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.