FXCC Review 29

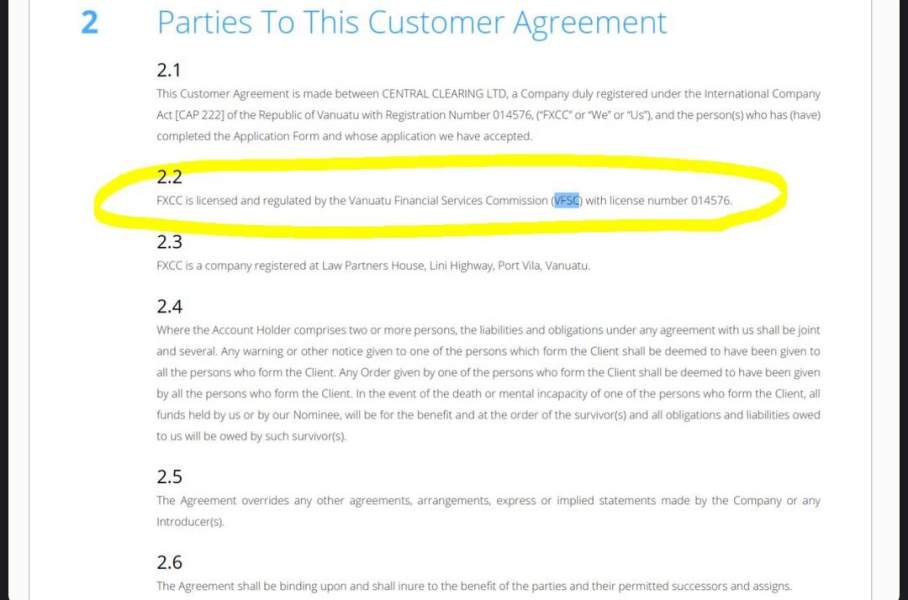

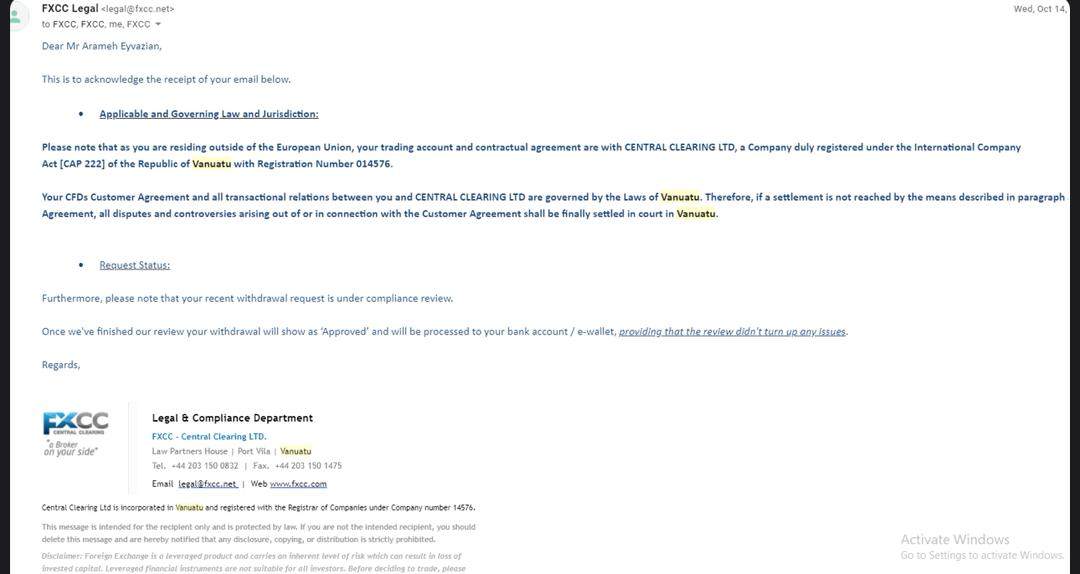

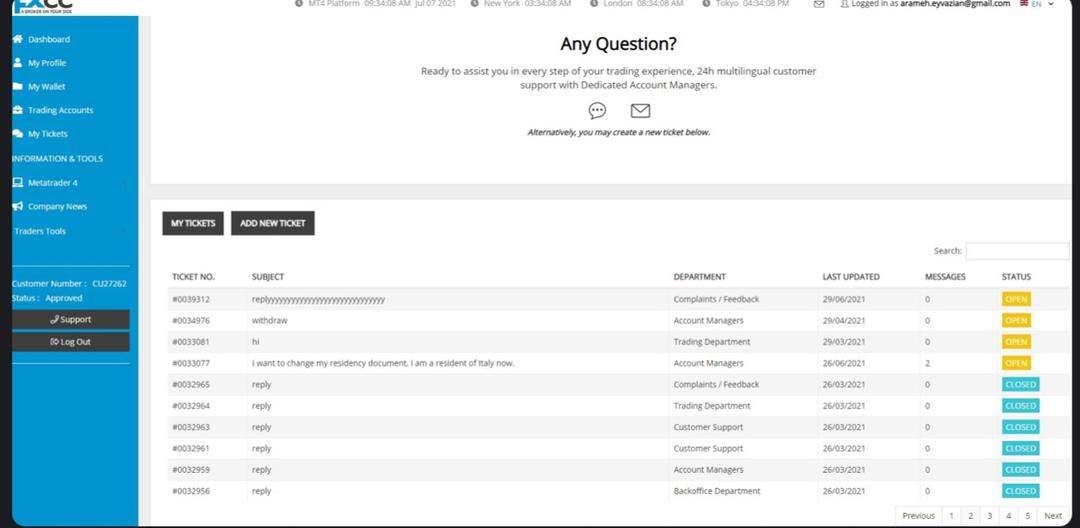

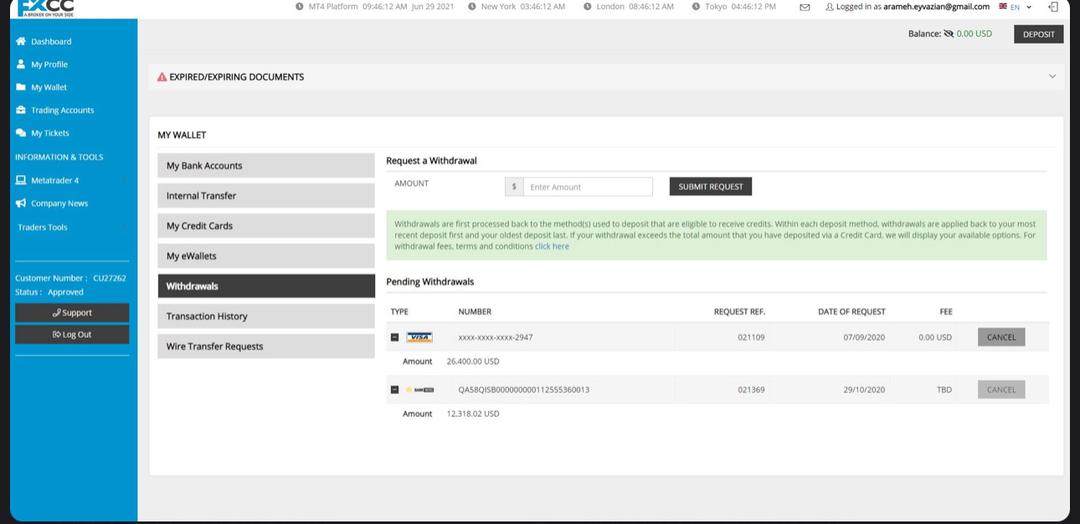

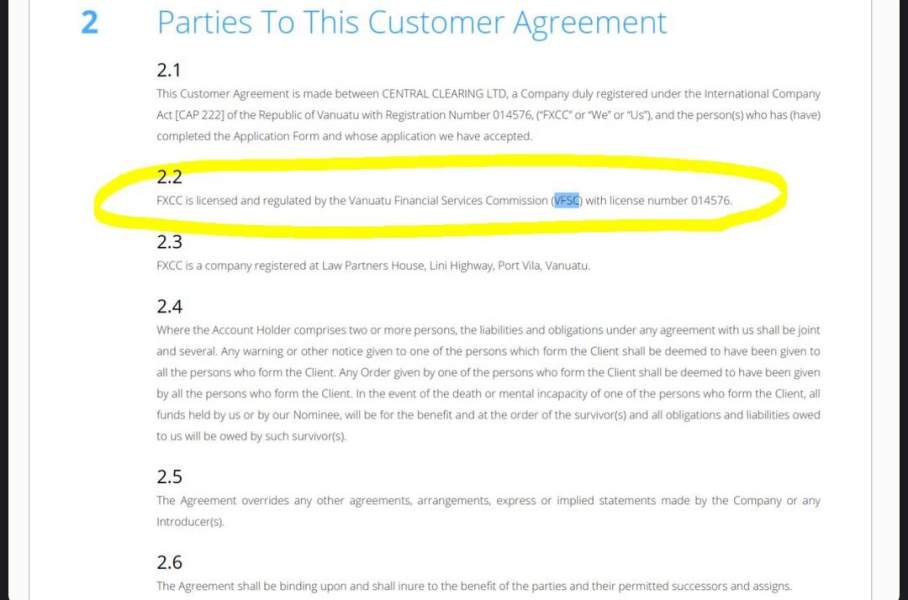

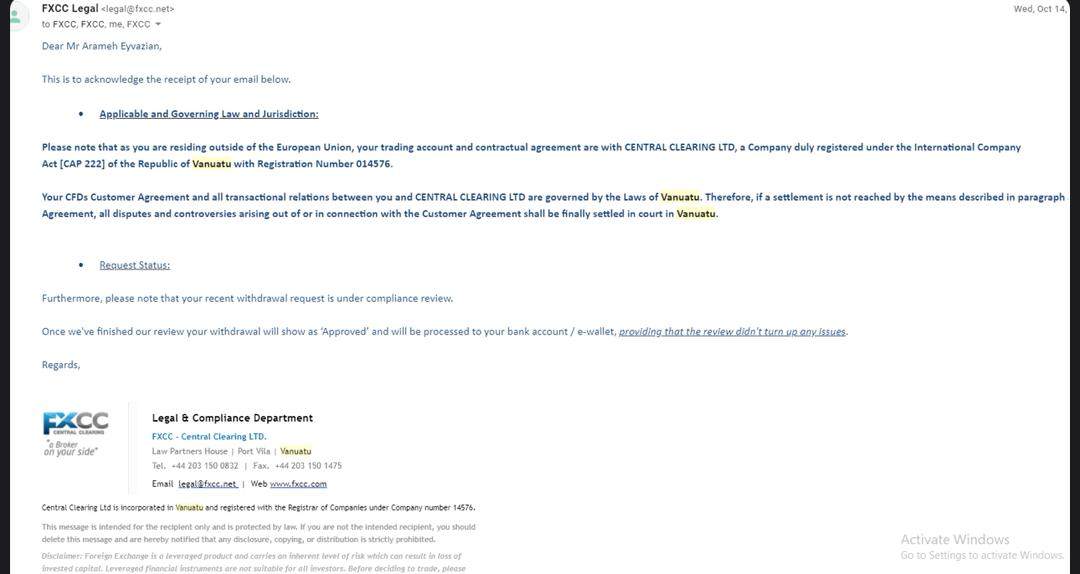

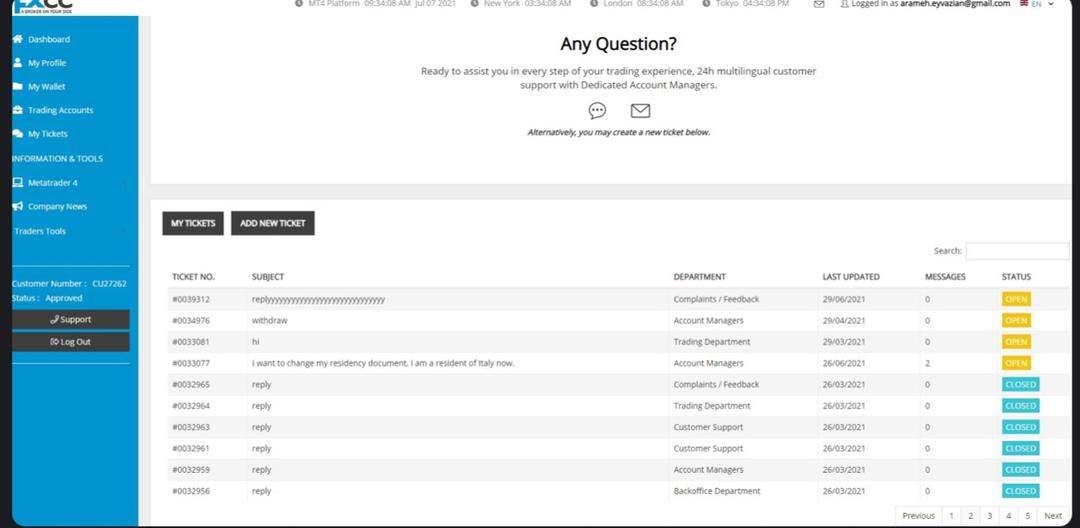

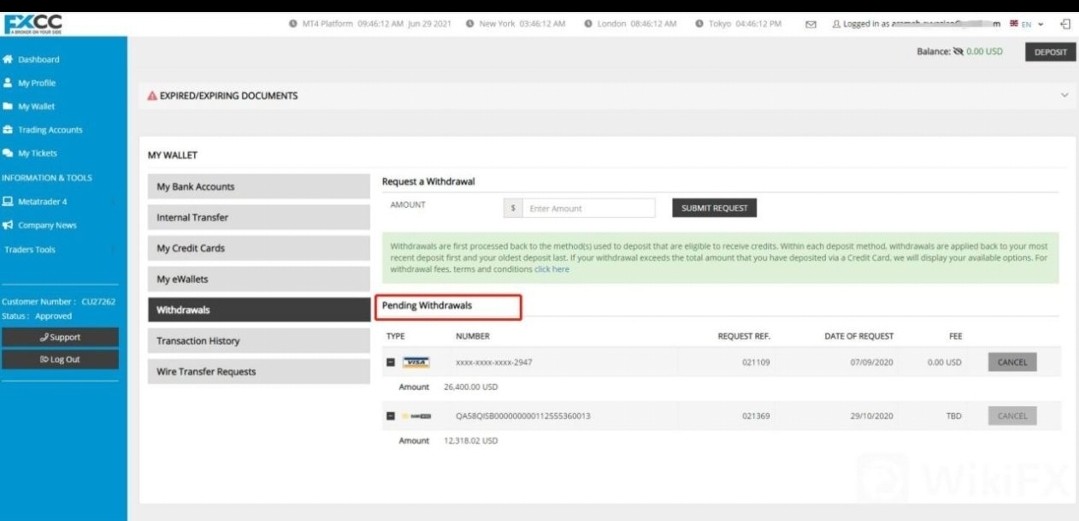

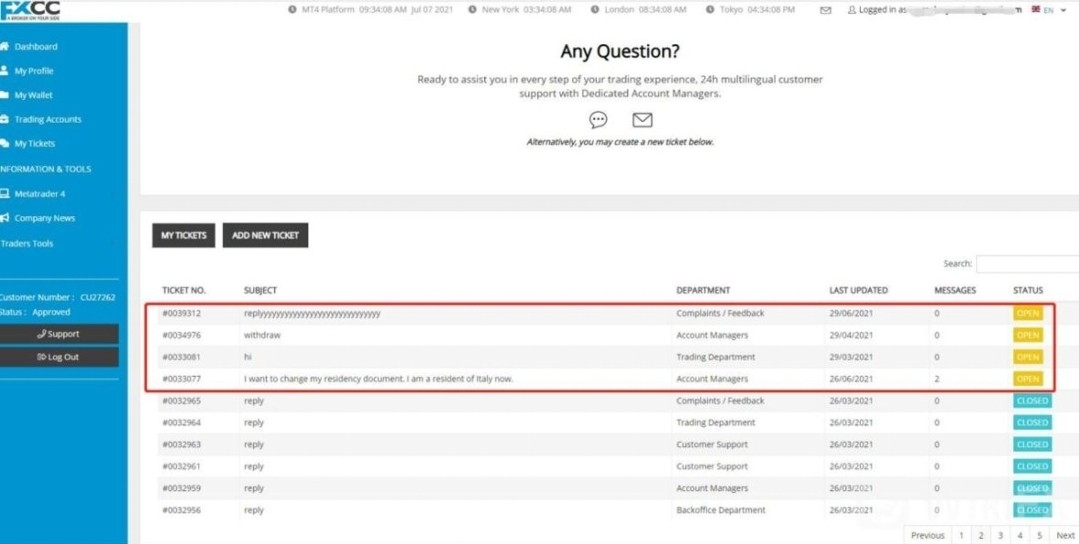

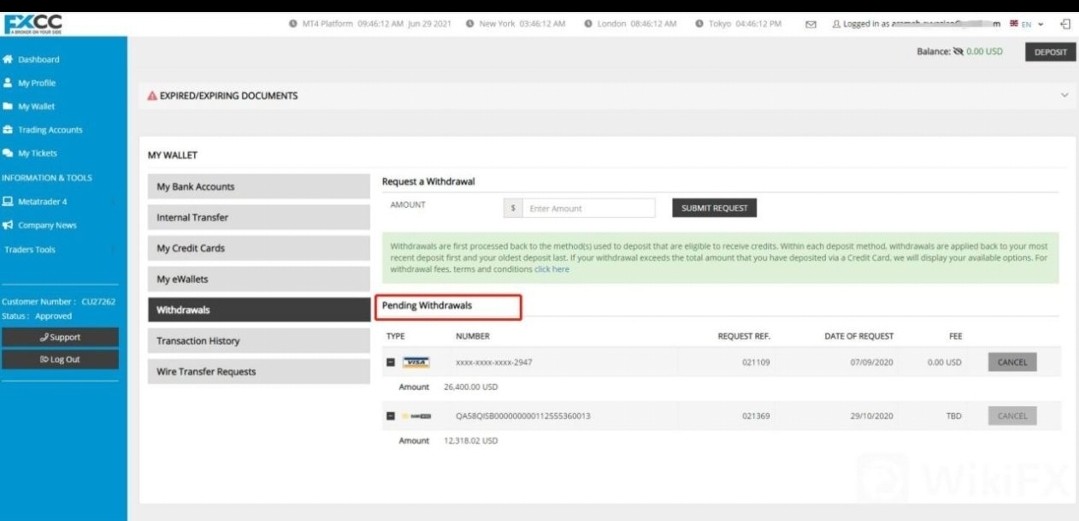

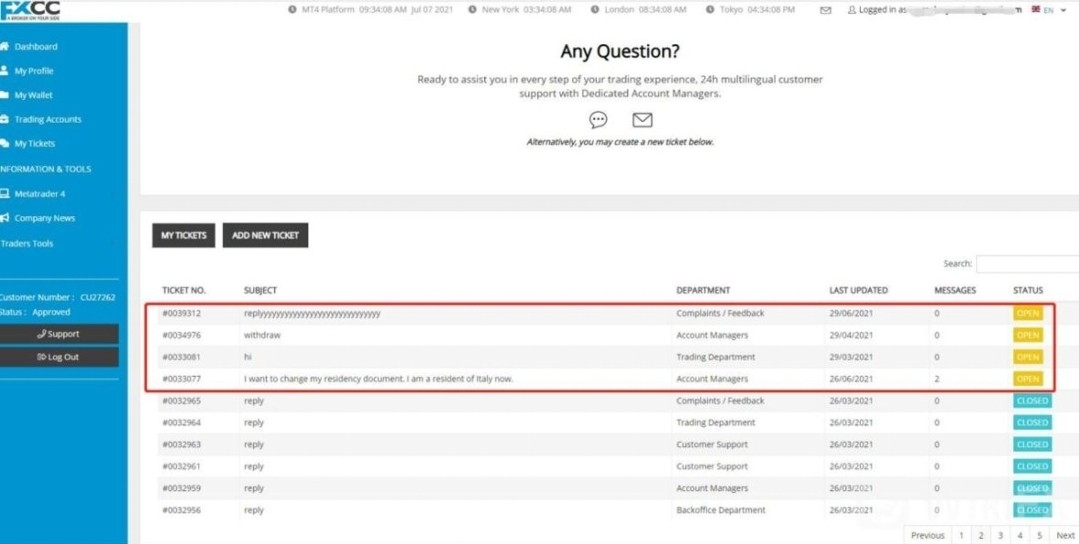

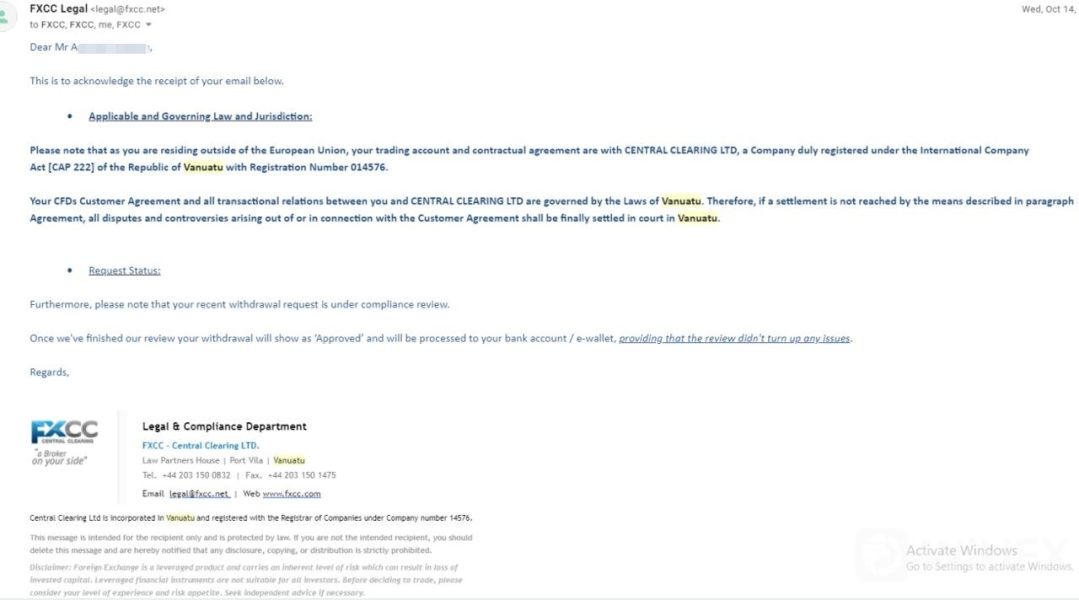

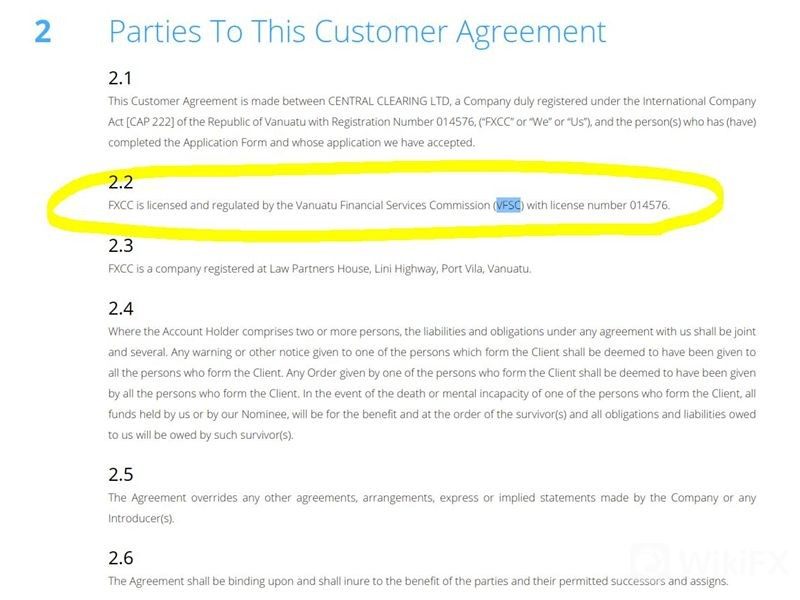

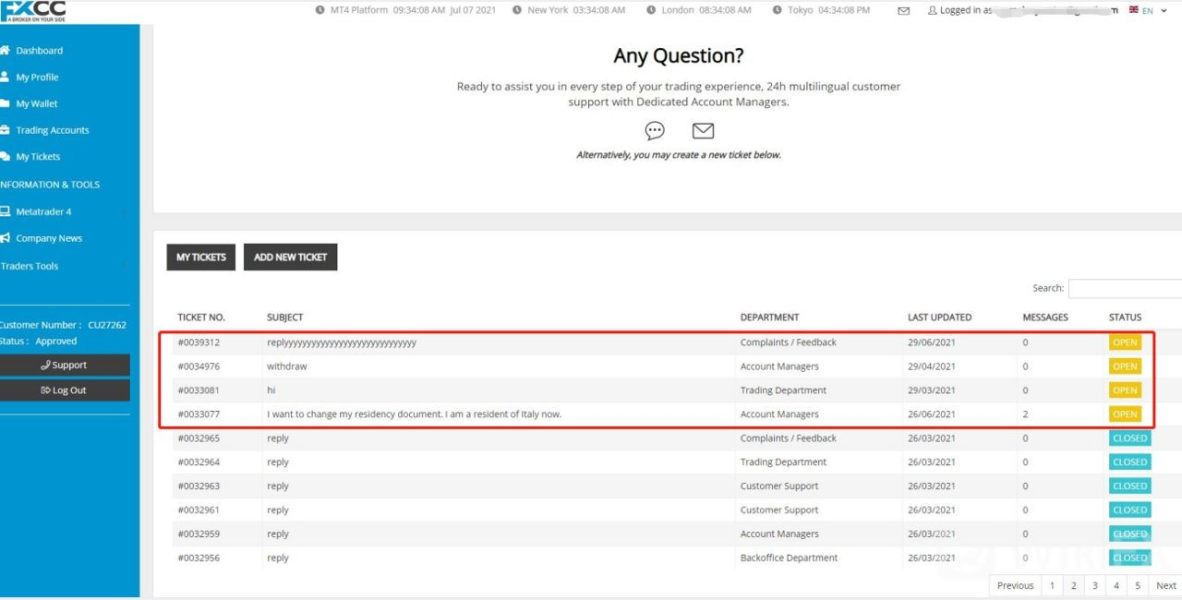

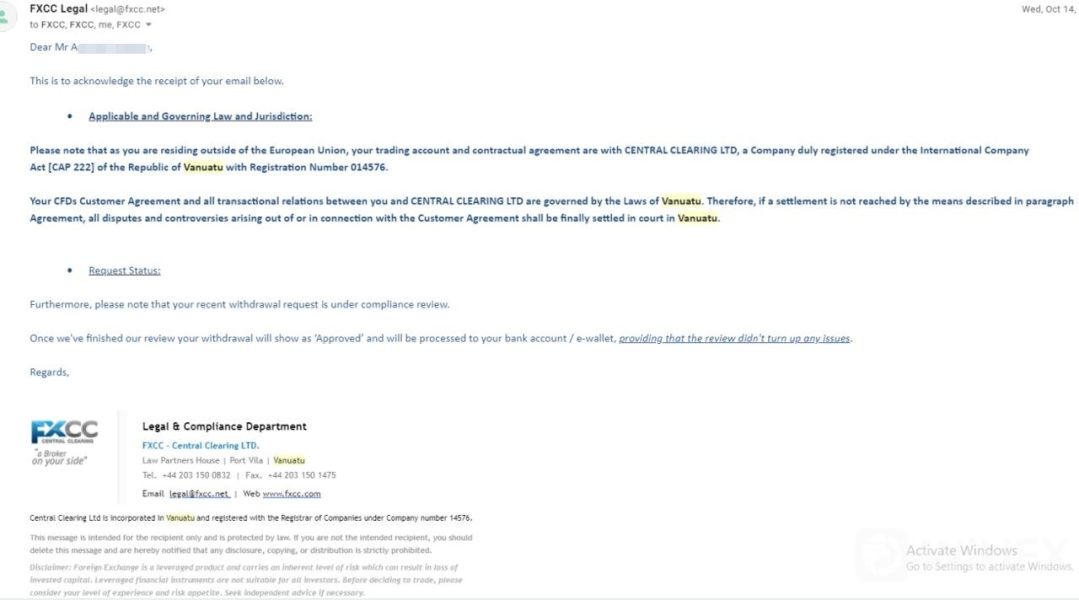

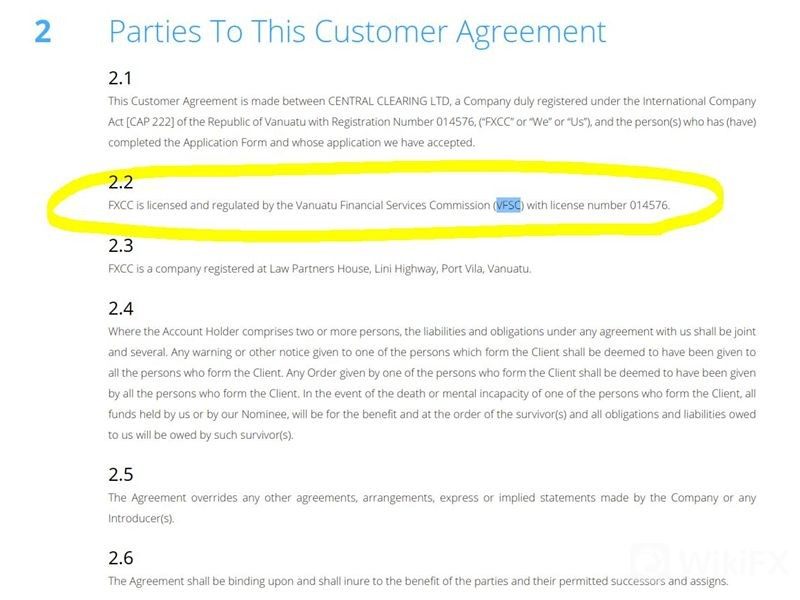

FXCC broker did not process my withdrawal request for more than 11 months The amount is 38718 USD. I have tried to contact them many times but they do not reply to my emails or messages in the past 6 months (a screenshot of the opened ticket is attached). I strongly believe they do some fraud or scam business. I tried to explain to them that I will take legal action and complaint against them but they answer me my account is with the Vanuatu Island branch (email attached). This was a total surprise for me as I understand that they transfer my agreement and my account in HIDDEN WAY (without my permission) to Vanuatu Island (as I am not a resident of the EU). Worthy to mention that they do not have an active licence in Vanuatu to give forex services (email from VFSC is attached). however, they lie in their agreement that they have the licence number 014576 (clause of 2.2 in agreement) I have attached the agreement and the screenshot of that false information to decide customer.

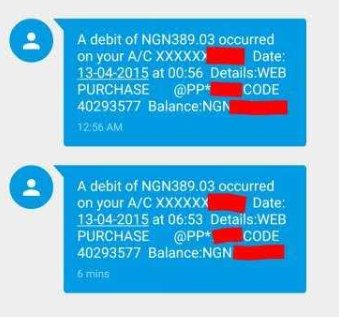

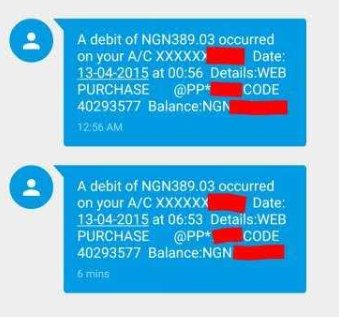

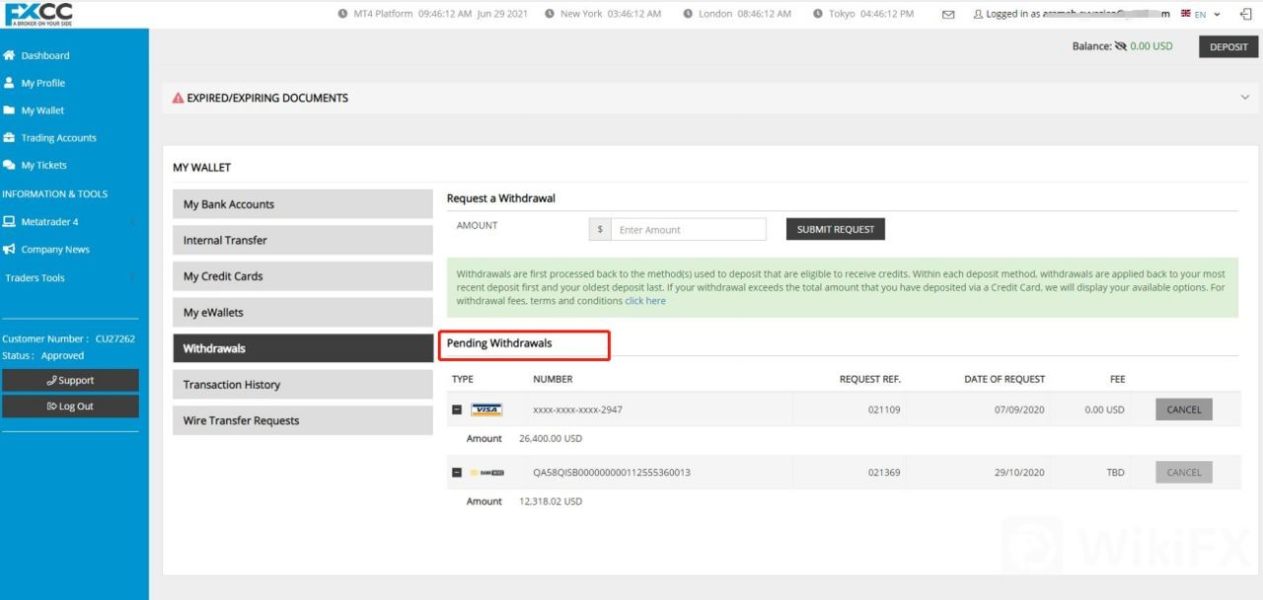

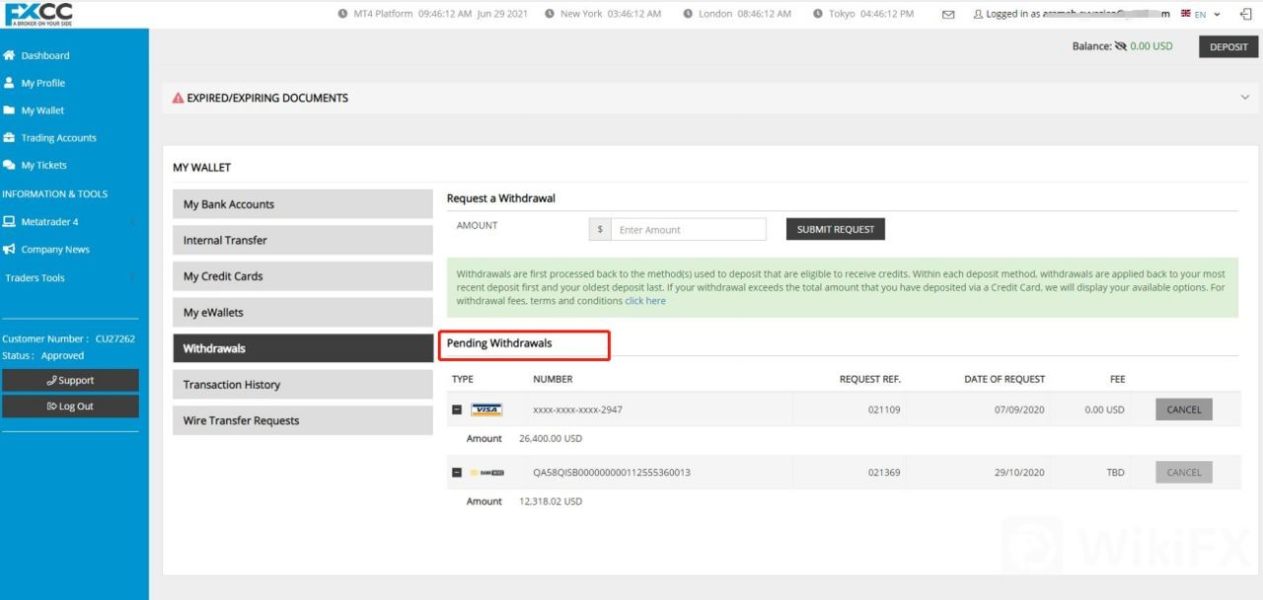

FXCC broker did not process my withdrawal request for more than 11 months (withdraw initiated in SEP2020). The amount is 38718 USD.(a screenshot of my withdrawal is attached ) I have tried to contact them many times but they do not reply to my emails or messages in the past 6 months (a screenshot of the opened ticket is attached). I strongly believe they do some fraud or scam business.

Hello! I traded in FXCC in the guidance of the programmer. Having made profits, I was to withdraw on 10th. But the platform refused on 11st, saying that my bank information was wrong, and asked for margin. I did so on 14th, while the customer service still refused, asking for bank bills. But why not tell me one time? The customer service declined my phone call. They claimed that I couldn’t contact the chairman since I wasn’t their VIP. I am suspected it is a scam. Hope you reply to me.

I used to use it before. Back then, it was rare to find a service with no fees up to $10,000 and swap-free, which made it very handy. However, recently, more brokers have started offering swap-free options, so I stopped using this broker since they don't have Japanese customer support.

FXCC is best broker I had ever used, and everything on this platform seems so perfect. It offers the best customer support, always fixing my problems patiently. I am so lucky to find this broker.

No deposit threshold and it is regulated and offers demo accounts on the MT4 platform. So who wouldn't love such a broker? Very nice! Anyway, pls be careful that many brokers will distort the facts and beautify everything to attract traders to invest. Everyone must polish their eyes before investing!

This broker is holding my withdrawal request for ridiculous reasons! At first they flagged my document aren't the same address. I emailed them but they barely respond to my report. I tried to fulfill all the things they requested to me in order to verify my authenticity. But now they sent me an email saying that my request is under compliance review. What is this nonsense? They don't want to pay my withdrawal!

after i deposit my money into platform my broker took all my money and no respond at all!!!when i want to withdrawal the broker just ignore my request and no reply!