Is FPR safe?

Pros

Cons

Is FPR Safe or Scam?

Introduction

FPR, a forex broker based in the United Kingdom, has positioned itself as a versatile trading platform catering to a diverse range of traders. With a variety of account types and a wide array of tradable assets, FPR attracts both novice and experienced traders alike. However, as the forex market continues to grow, so does the prevalence of scams and unregulated brokers. This necessitates a cautious approach when evaluating forex trading platforms. Traders must ensure that their chosen broker is legitimate and operates under proper regulatory oversight to mitigate risks.

This article aims to assess whether FPR is a safe broker or a potential scam by examining its regulatory status, company background, trading conditions, customer fund safety, user experiences, platform performance, and overall risk profile. The evaluation will be grounded in data collected from reputable financial websites, user reviews, and regulatory bodies, providing a comprehensive overview of FPR's standing in the forex market.

Regulation and Legitimacy

The regulatory framework within which a broker operates is crucial for determining its legitimacy and safety. FPR claims to be regulated by the Financial Conduct Authority (FCA) in the UK, which is known for its stringent regulatory standards. This oversight is essential for ensuring that brokers adhere to practices that protect traders' interests.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | Not disclosed | United Kingdom | Verified |

The FCA's regulation is a positive indicator, as it mandates that brokers maintain certain capital requirements, segregate client funds, and provide transparency in their operations. However, FPR's claims of being regulated must be scrutinized further, as there are reports of customer complaints regarding withdrawal issues and lack of access to funds. These complaints raise questions about FPR's compliance with regulatory standards.

The quality of regulation is paramount in the forex industry. A well-regulated broker like FPR should ideally have a clean compliance record. However, the presence of complaints about withdrawal difficulties suggests that there may be underlying issues with its operational practices. This discrepancy prompts a closer examination of FPR's regulatory history and adherence to FCA guidelines.

Company Background Investigation

FPR was founded in 2008 and has since established itself as a trading platform offering various financial instruments, including forex, commodities, and cryptocurrencies. The company's ownership structure and management team play a significant role in its credibility. FPR is operated by FXPro Financial Services Limited, which is based in the UK.

The management team at FPR consists of experienced professionals in the financial sector, contributing to the company‘s overall reputation. However, transparency regarding the team’s qualifications and backgrounds is limited. A thorough investigation into the management's experience and the company's operational history is essential for assessing the broker's reliability.

In terms of information disclosure, FPR provides some educational resources, including webinars and eBooks. However, the lack of detailed information about the management team and their qualifications raises concerns about the company's commitment to transparency. A higher level of openness regarding its operations and management would enhance FPR's credibility and instill greater confidence among potential traders.

Trading Conditions Analysis

FPR offers a range of trading conditions, including various account types that cater to different trading styles. The fee structure is a critical aspect of any broker's offering, as it directly impacts traders' profitability. FPR's trading costs include spreads, commissions, and overnight interest rates.

| Fee Type | FPR | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.1 pips | 1.2 pips |

| Commission Model | $3.50 per lot (ECN) | $5.00 per lot |

| Overnight Interest Range | Varies | Varies |

The spreads offered by FPR are competitive, particularly for its ECN accounts. However, the commission structure may be higher than industry averages for certain account types. Traders should be aware of any hidden fees or unusual policies that could affect their trading experience.

Moreover, the overnight interest rates could vary significantly depending on the market conditions and the specific trading instruments. It is advisable for traders to carefully review the fee structure and ensure that they understand all associated costs before opening an account with FPR.

Client Fund Safety

The safety of client funds is paramount when evaluating a broker. FPR claims to implement measures to protect client funds, including segregating accounts and adhering to FCA regulations. This segregation of funds is crucial in ensuring that traders' money is not used for the broker's operational expenses.

However, the historical complaints regarding withdrawal issues raise concerns about the effectiveness of these safety measures. Traders must be vigilant and consider the brokers track record concerning fund safety. Any past incidents involving fund mismanagement or security breaches should be thoroughly investigated.

In addition, FPR's policies regarding negative balance protection are essential for safeguarding traders from incurring debts beyond their initial investments. A comprehensive review of these policies is necessary to assess the overall safety of client funds at FPR.

Customer Experience and Complaints

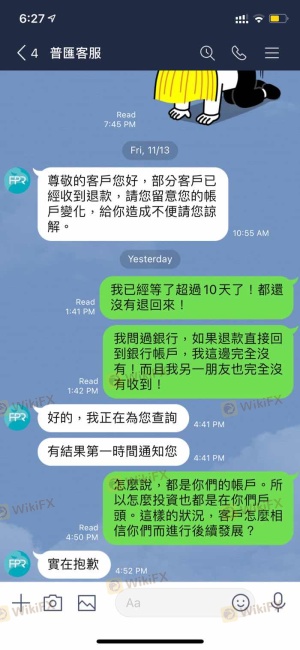

Customer feedback is a vital component of evaluating a broker's reliability. An analysis of user reviews reveals mixed experiences with FPR. While some users praise the platform for its range of services, others have reported significant issues, particularly regarding withdrawals and customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Customer Support | Medium | Inadequate |

Common complaints include difficulties in accessing funds and slow responses from customer service. These issues can severely impact traders' experiences and raise red flags regarding the broker's operational integrity.

A couple of notable cases involve users who claimed they were unable to withdraw funds after multiple requests, leading to frustration and distrust in the broker. Such patterns of complaints necessitate a cautious approach when considering FPR as a trading partner.

Platform and Execution

FPR provides access to multiple trading platforms, including MetaTrader 4 and 5, which are well-regarded in the trading community. The performance and stability of these platforms are crucial for traders, as they directly affect order execution and overall trading experience.

However, reports of slippage and order rejections have been noted by some users. These issues can lead to significant losses, especially for traders employing high-frequency strategies. It is essential to assess the platform's reliability and the broker's transparency regarding execution quality.

Additionally, any signs of platform manipulation should be carefully monitored. Traders should remain vigilant and report any suspicious activities to regulatory authorities to ensure their trading environment remains fair and transparent.

Risk Assessment

Using FPR involves several risks that traders should be aware of before committing their capital. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Compliance | Medium | Complaints about withdrawal issues exist. |

| Customer Support | High | Slow response times to user inquiries. |

| Fund Safety | Medium | Past issues with fund access reported. |

To mitigate these risks, traders are advised to conduct thorough research before engaging with FPR. This includes starting with a smaller investment to gauge the broker's reliability and responsiveness before increasing capital.

Conclusion and Recommendations

In conclusion, the evidence suggests that while FPR presents itself as a legitimate trading platform, there are significant concerns regarding its operational practices and customer experiences. The presence of complaints about withdrawal issues and inadequate customer support raises red flags about the broker's overall reliability.

For traders considering FPR, it is crucial to proceed with caution. Conduct thorough research, start with a small investment, and remain vigilant regarding any unusual activity. If concerns persist, it may be wise to explore alternative brokers with a stronger reputation for reliability and customer service.

Ultimately, while FPR may offer a range of trading options, the potential risks associated with its operations warrant careful consideration. Alternative brokers with proven track records of customer satisfaction and regulatory compliance may provide a safer trading environment for forex traders.

Is FPR a scam, or is it legit?

The latest exposure and evaluation content of FPR brokers.

FPR Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FPR latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.