FPR 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive fpr review examines a broker that presents significant transparency challenges for potential traders. Based on available information, FPR lacks clear regulatory disclosure and detailed trading condition specifications, which results in a neutral overall assessment. While some positive employee culture feedback exists from workplace review platforms, the absence of crucial trading-related information raises concerns for prospective clients.

The broker appears to target individual investors interested in forex market participation. However, specific user demographics remain unclear due to limited publicly available data. Without clear regulatory oversight information or detailed service specifications, traders should exercise considerable caution when considering FPR as their trading partner.

Key areas requiring attention include regulatory compliance transparency, trading condition disclosure, and comprehensive service documentation. The limited available information suggests potential clients should seek additional verification before committing to this platform.

Important Notice

Due to insufficient regulatory information in available sources, users should exercise heightened caution when evaluating FPR across different jurisdictions. Regulatory frameworks vary significantly between regions. The absence of clear licensing information makes it difficult to assess compliance standards.

This review is based on available information summaries and limited user feedback data. Potential clients are strongly advised to conduct independent verification of all claims and seek additional regulatory confirmation before engaging with this broker.

Rating Framework

Broker Overview

FPR presents a complex profile in the online trading landscape. It shows limited transparency regarding its operational framework and regulatory status. The available information suggests the entity operates in the financial services sector, though specific establishment dates and comprehensive company background details are not disclosed in accessible sources.

The broker's business model and operational structure remain unclear based on available documentation. Without detailed information about trading platforms, asset offerings, or client service frameworks, potential users face significant uncertainty about the broker's actual capabilities and service quality.

This fpr review highlights the importance of comprehensive due diligence when evaluating brokers with limited public information. The absence of clear regulatory oversight details, trading platform specifications, and asset class offerings creates challenges for informed decision-making by potential clients seeking reliable trading services.

Regulatory Framework

Available sources do not provide specific information about FPR's regulatory status or licensing jurisdictions. This absence of regulatory transparency represents a significant concern for potential clients seeking compliant trading services.

Deposit and Withdrawal Methods

Funding options and withdrawal procedures are not detailed in available source materials. This leaves potential clients without crucial information about financial transaction processes.

Minimum Deposit Requirements

Specific minimum deposit amounts and account funding requirements are not disclosed in accessible documentation.

Current bonus structures and promotional campaigns are not mentioned in available sources. This provides no insight into potential incentive programs.

Available Assets

The range of tradeable instruments and asset classes remains unspecified in source materials. This limits understanding of investment opportunities.

Cost Structure

Commission rates, spread information, and fee schedules are not detailed in this fpr review due to lack of available data in source materials.

Leverage Options

Maximum leverage ratios and margin requirements are not specified in accessible documentation.

Trading platform options and software specifications are not detailed in available sources.

Geographic Restrictions

Regional availability and service limitations are not mentioned in source materials.

Customer Support Languages

Multilingual support options are not specified in available documentation.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of FPR's account conditions faces significant limitations due to the absence of detailed information in available sources. Standard account types, their respective features, and associated benefits remain unspecified. This makes it impossible to assess the broker's offerings against industry standards.

Minimum deposit requirements, which typically serve as a key differentiator among brokers, are not disclosed in accessible documentation. This lack of transparency prevents potential clients from understanding entry barriers and planning their investment approach accordingly.

Account opening procedures and verification processes are not detailed in available sources. This leaves questions about user onboarding experiences and compliance requirements. The absence of information about specialized account types, such as Islamic accounts for Sharia-compliant trading, further limits understanding of the broker's service diversity.

Without user feedback specifically addressing account conditions, this fpr review cannot provide insights into client satisfaction with account management features or related services.

The assessment of FPR's trading tools and educational resources encounters substantial information gaps in available sources. Technical analysis tools, charting capabilities, and market research provisions are not detailed. This prevents evaluation of the platform's analytical capabilities.

Educational resources, which are crucial for trader development and success, are not mentioned in accessible documentation. The absence of information about webinars, tutorials, market analysis, or trading guides suggests limited support for trader education and skill development.

Automated trading capabilities and algorithmic trading support are not specified in available sources. This leaves questions about platform sophistication and advanced trading features. Integration with third-party tools and services also remains unclear based on accessible information.

Without specific user feedback about tool effectiveness and resource quality, potential clients cannot assess whether FPR provides adequate support for their trading strategies and learning objectives.

Customer Service and Support Analysis

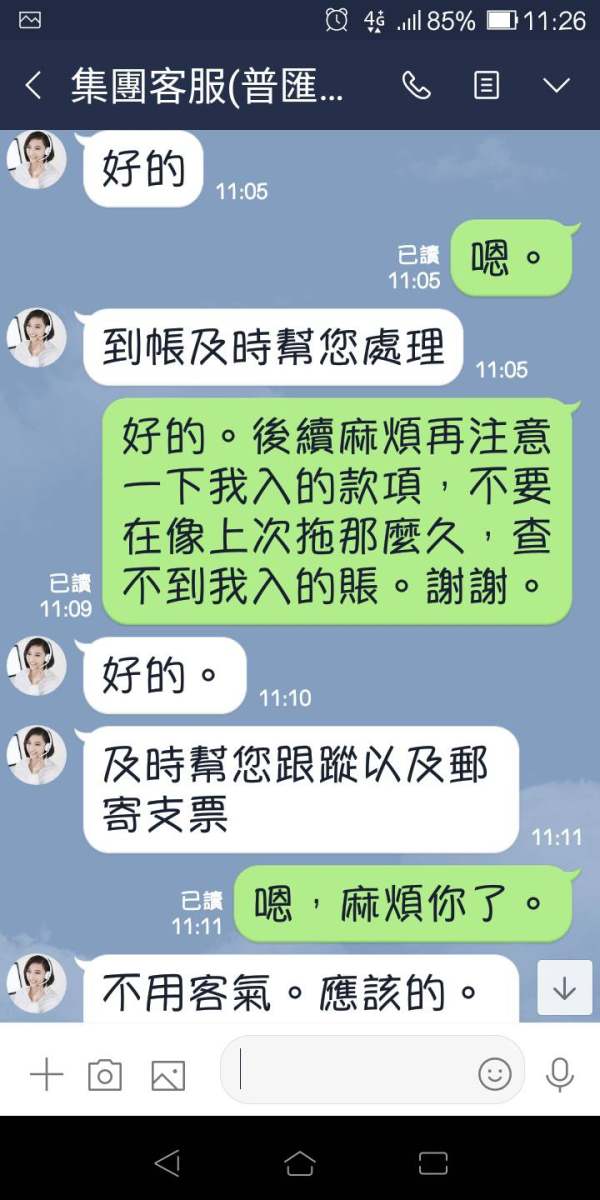

Customer service evaluation proves challenging due to the absence of detailed support information in available sources. Communication channels, such as live chat, email support, or telephone assistance, are not specified. This leaves questions about accessibility and convenience of customer interactions.

Response time standards and service level commitments are not disclosed in accessible documentation. This prevents assessment of support efficiency and reliability. The quality of problem resolution and technical assistance cannot be evaluated without specific user experiences or service descriptions.

Multilingual support capabilities remain unspecified, which is particularly important for international clients seeking assistance in their preferred languages. Operating hours and timezone coverage for customer service are also not detailed in available sources.

Without documented user experiences or service quality metrics, this evaluation cannot provide insights into actual customer satisfaction levels or support effectiveness.

Trading Experience Analysis

Platform stability and execution quality cannot be adequately assessed due to limited technical information in available sources. Order execution speeds, slippage rates, and system reliability metrics are not provided. This prevents evaluation of actual trading performance.

User interface design and functionality details are not described in accessible documentation. This leaves questions about platform usability and trader experience. Mobile trading capabilities and cross-platform synchronization features remain unspecified.

Trading environment characteristics, such as market depth information, price feed quality, and execution transparency, are not detailed in this fpr review due to insufficient source data. Advanced order types and risk management tools are also not described.

Without specific user testimonials about trading experiences or technical performance data, potential clients cannot assess whether the platform meets their trading requirements and expectations.

Trust and Security Analysis

Regulatory compliance assessment faces significant challenges due to the absence of licensing information in available sources. Without clear regulatory oversight details, evaluating the broker's adherence to financial services standards becomes impossible.

Fund safety measures and client protection protocols are not detailed in accessible documentation. This raises concerns about asset security and segregation practices. Insurance coverage and compensation schemes are also not specified.

Corporate transparency and financial reporting practices cannot be evaluated without additional company information. The absence of regulatory registration numbers or supervisory authority details prevents verification of legitimate operations.

Industry reputation and third-party assessments are not available in source materials. This limits understanding of the broker's standing within the financial services community.

User Experience Analysis

Overall user satisfaction cannot be comprehensively evaluated due to limited feedback information in available sources. Interface design quality and navigation ease are not described. This prevents assessment of platform usability for traders of different experience levels.

Registration and verification processes are not detailed in accessible documentation. This leaves questions about onboarding efficiency and compliance requirements. The user journey from account opening to active trading remains unclear.

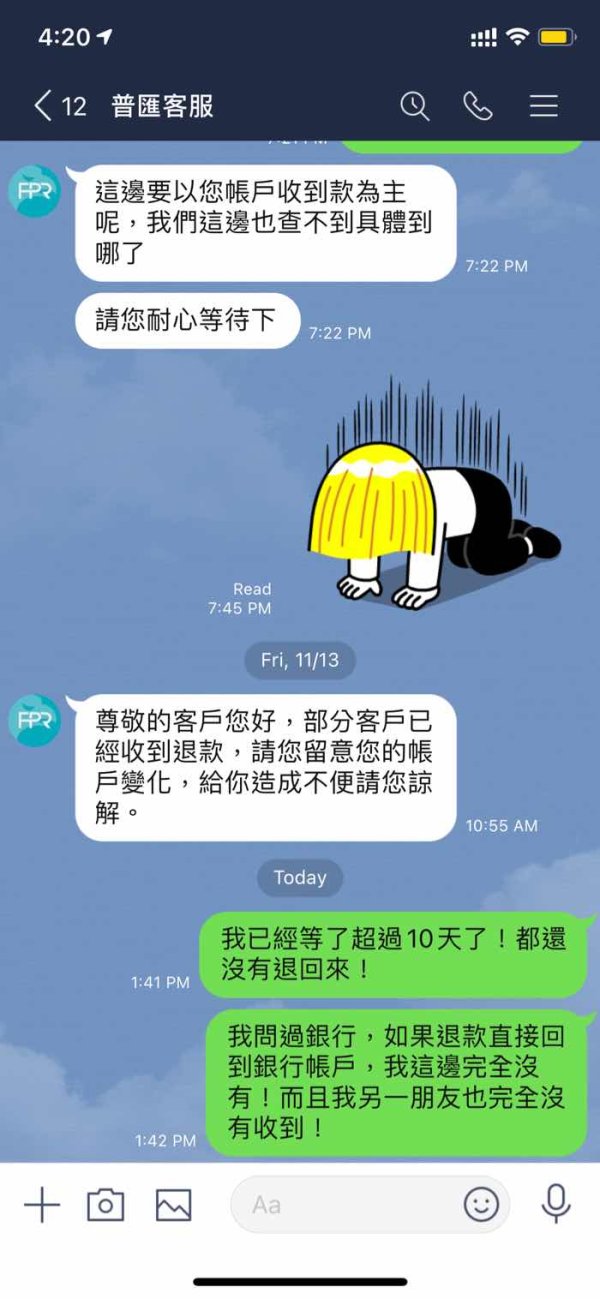

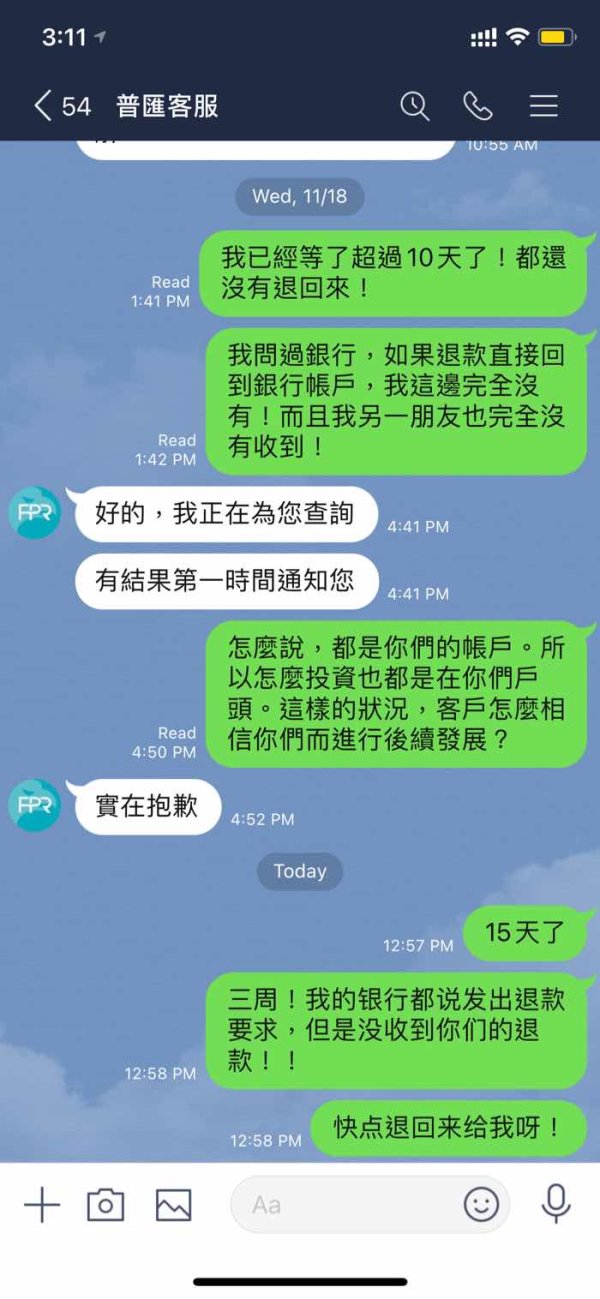

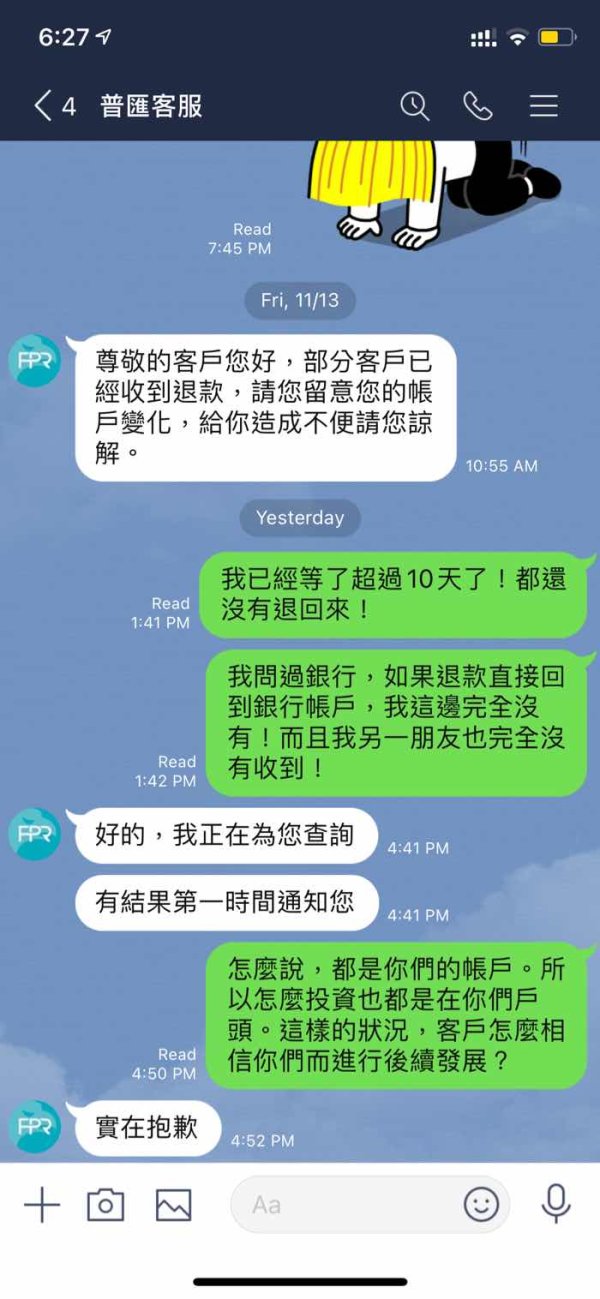

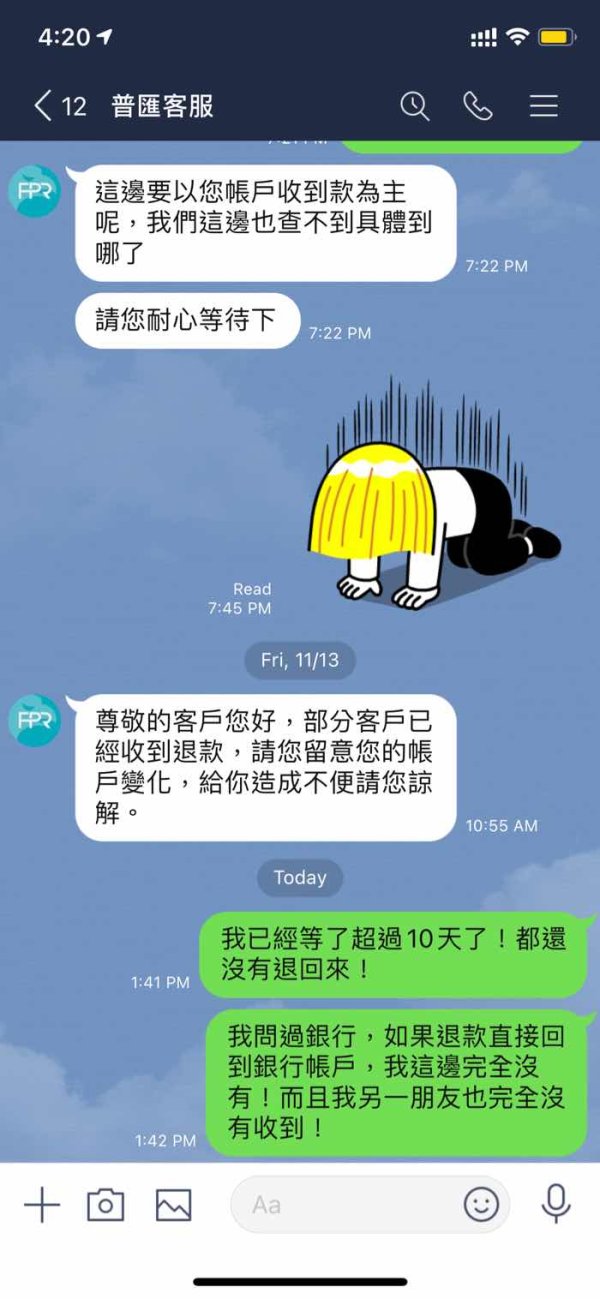

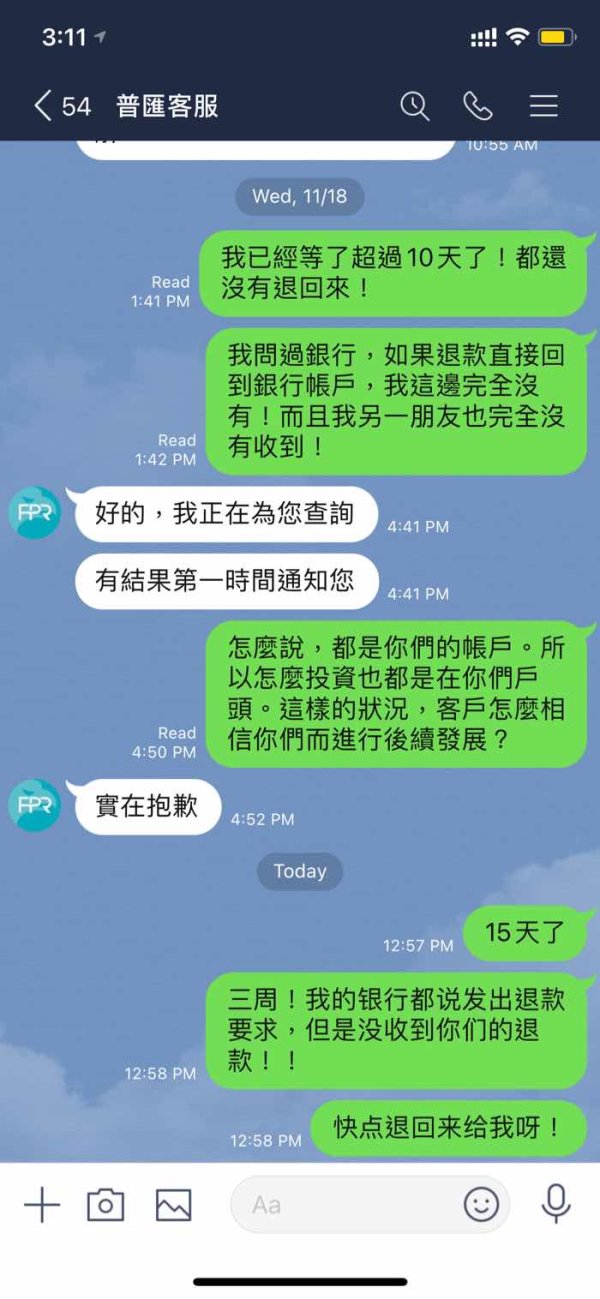

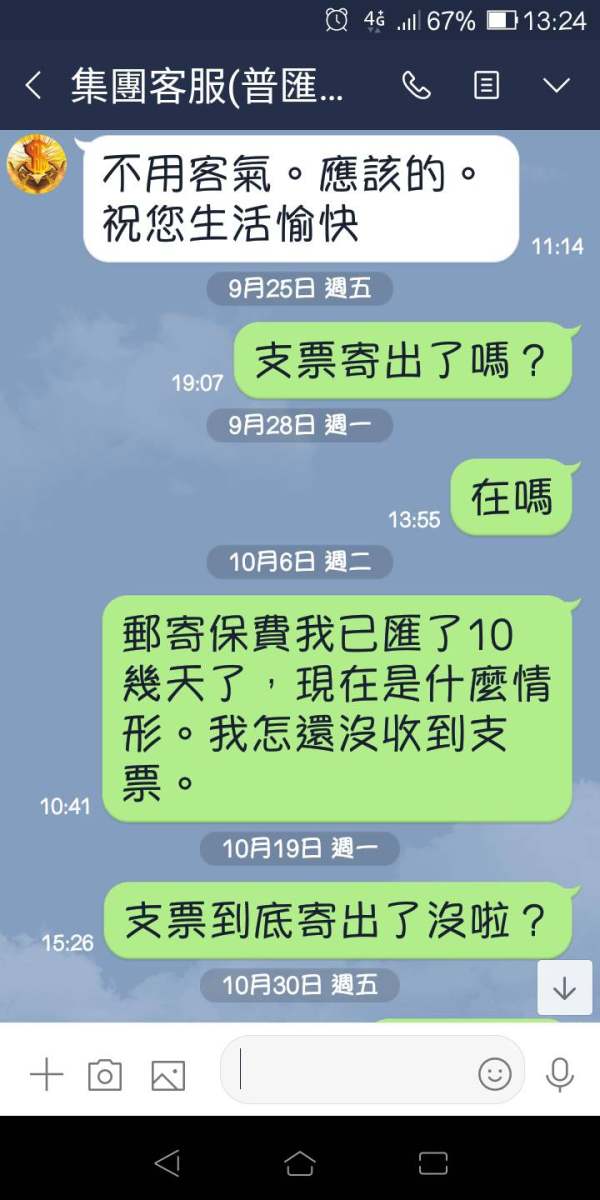

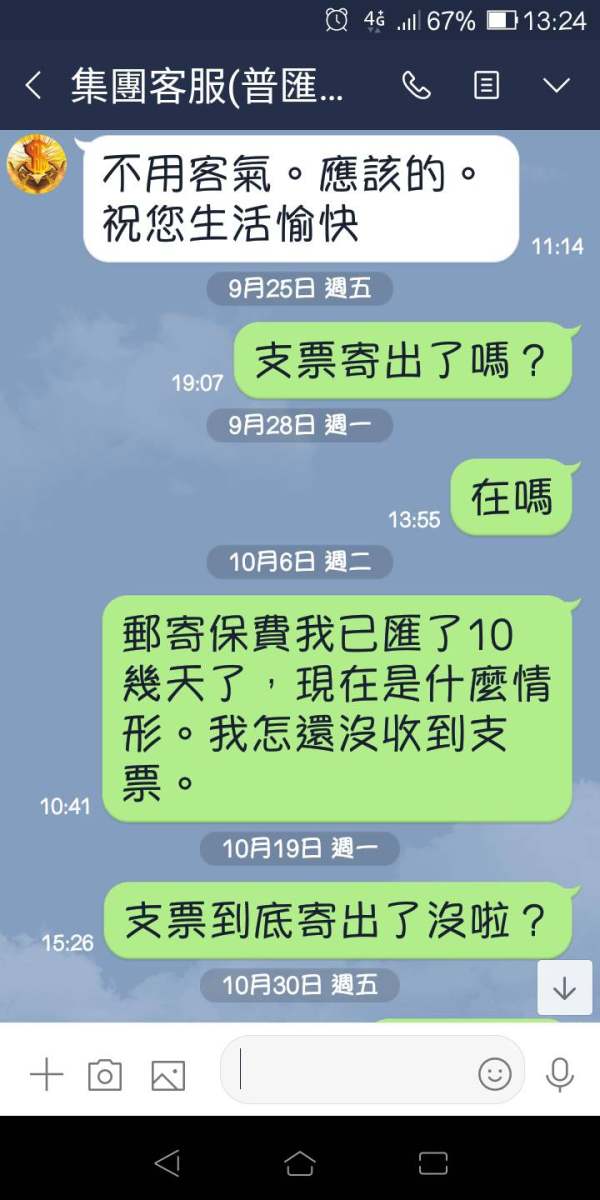

Funding and withdrawal experiences are not documented in available sources. This prevents evaluation of financial transaction convenience and processing times. Common user complaints or satisfaction areas cannot be identified without comprehensive feedback data.

Target user demographics and suitability for different trader types cannot be determined based on available information. This limits guidance for potential clients seeking appropriate trading partners.

Conclusion

This comprehensive fpr review reveals significant transparency challenges that potential traders should carefully consider. The absence of crucial information regarding regulatory status, trading conditions, and service specifications creates substantial uncertainty about the broker's capabilities and compliance standards.

While some positive workplace culture feedback exists, the lack of detailed trading-related information makes it difficult to recommend FPR to serious traders seeking reliable and transparent services. Potential clients should prioritize brokers with clear regulatory oversight and comprehensive service documentation.

The main advantages appear limited to positive employee culture feedback. However, significant disadvantages include the absence of regulatory transparency and detailed trading condition disclosure. Traders should exercise extreme caution and seek additional verification before considering this platform for their trading activities.