Regarding the legitimacy of ForexClub forex brokers, it provides NBRB and WikiBit, (also has a graphic survey regarding security).

Is ForexClub safe?

Software Index

Risk Control

Is ForexClub markets regulated?

The regulatory license is the strongest proof.

NBRB Forex Trading License (EP)

National Bank of the Republic of Belarus

National Bank of the Republic of Belarus

Current Status:

RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

Forex Club

Effective Date:

2016-04-19Email Address of Licensed Institution:

info@fxclub.bySharing Status:

No SharingWebsite of Licensed Institution:

www.fxclub.by, investing.by, http://www.forexclub.by/, http://www.forex.by/, http://www.libertex.by/Expiration Time:

--Address of Licensed Institution:

220030, Minsk, Myasnikova Stг. 70, office 4Phone Number of Licensed Institution:

+375339052220Licensed Institution Certified Documents:

Is Forex Club A Scam?

Introduction

Forex Club is a well-known online forex broker that has been operating in the trading industry since 1997. With its headquarters in Saint Vincent and the Grenadines, Forex Club primarily caters to retail traders, offering a variety of trading instruments including forex, commodities, indices, and cryptocurrencies. Given the complexity and risks associated with forex trading, it is crucial for traders to carefully evaluate the legitimacy and reliability of brokers like Forex Club before committing their funds.

The forex market is rife with both reputable and questionable brokers, making it essential for traders to conduct thorough due diligence. This article aims to provide an objective analysis of Forex Club, focusing on its regulatory status, company background, trading conditions, customer safety, client experiences, platform performance, risk assessment, and ultimately, whether it presents a scam risk to traders.

Regulation and Legitimacy

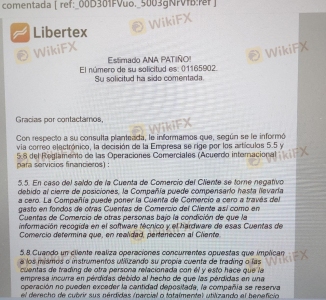

Forex Club operates under the regulation of various authorities, most notably the National Bank of the Republic of Belarus (NBRB) and the Cyprus Securities and Exchange Commission (CySEC). Regulatory oversight is a crucial factor in assessing a broker's legitimacy, as it ensures compliance with financial standards and provides a level of protection for clients.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NBRB | 192580558 | Belarus | Verified |

| CySEC | 164/12 | Cyprus | Verified |

The NBRB oversees Forex Club's operations in Belarus, ensuring that the broker adheres to strict financial regulations. However, it is important to note that the regulatory environment in Saint Vincent and the Grenadines, where Forex Club is also registered, is less stringent. This offshore registration raises concerns about the level of investor protection available to clients.

Historically, Forex Club has faced regulatory challenges, including compliance issues that led to its exit from the U.S. market. While the current regulatory status provides a degree of assurance, potential clients should remain cautious and consider the implications of the broker's offshore presence.

Company Background Investigation

Founded in 1997, Forex Club has established itself as a significant player in the forex trading market. Over the years, the company has expanded its operations globally, with a presence in multiple countries, including Belarus, Russia, and various regions in Asia and Latin America. The ownership structure of Forex Club is complex, involving multiple entities that operate under the Forex Club brand.

The management team consists of seasoned professionals with extensive experience in the financial markets. However, the company's transparency regarding its ownership and management structure has been called into question, as detailed information is not readily available to the public. This lack of transparency can be a red flag for potential investors.

Forex Club's commitment to transparency in its operations and information disclosure is critical for building trust with clients. While the company has made strides in improving its communication with traders, there are still areas where it could enhance its transparency, particularly concerning its ownership and management.

Trading Conditions Analysis

Forex Club offers a range of trading conditions, including competitive spreads and a low minimum deposit requirement. The broker's fee structure is designed to be accessible to both novice and experienced traders. However, it is essential to scrutinize the details of the fee structure to identify any potential pitfalls.

| Fee Type | Forex Club | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.2 pips | From 0.1 pips |

| Commission Model | From 0.03% | Varies |

| Overnight Interest Range | Varies | Varies |

While Forex Club advertises low spreads, traders should be aware that these can widen during periods of high volatility. Additionally, the commission structure may not be as straightforward as it appears, with various fees potentially impacting overall trading costs.

Traders should also be cautious of any hidden fees associated with deposits and withdrawals, as these can significantly affect profitability. A thorough understanding of the broker's fee structure is crucial for effective trading strategy development.

Customer Funds Safety

The safety of client funds is paramount when evaluating a forex broker. Forex Club claims to implement various security measures to protect customer funds, including segregated accounts and negative balance protection. However, the effectiveness of these measures is contingent upon the broker's regulatory status and operational practices.

Forex Club segregates client funds in top-tier banks, which adds a layer of security. However, the lack of robust regulatory oversight raises concerns about the adequacy of these protections. Additionally, while negative balance protection is a positive feature, it is essential to understand the conditions under which it applies.

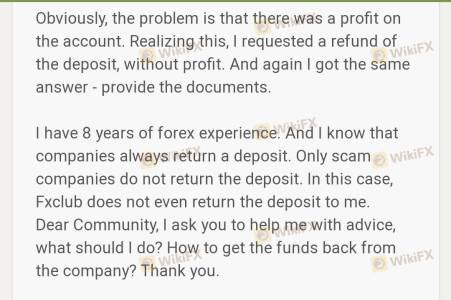

Historically, Forex Club has faced issues related to fund security, including complaints from clients about withdrawal difficulties and other financial disputes. These incidents highlight the importance of assessing the broker's track record in handling client funds and addressing security concerns.

Customer Experience and Complaints

Customer feedback is a vital aspect of evaluating a broker's reliability. Forex Club has received mixed reviews from clients, with some praising its user-friendly platforms and trading conditions, while others express dissatisfaction with customer service and withdrawal processes.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Mixed |

| Poor Customer Support | Medium | Slow |

Common complaints include slow response times from customer support and difficulties in withdrawing funds. While some users report satisfactory experiences, the frequency of negative feedback suggests that Forex Club may need to improve its customer service and responsiveness.

A few notable cases involve clients experiencing significant delays in fund withdrawals, leading to frustration and distrust. These issues underscore the importance of a reliable support system and prompt resolution of client concerns.

Platform and Execution

Forex Club offers multiple trading platforms, including its proprietary Libertex platform and the widely-used MetaTrader 4 (MT4) and MetaTrader 5 (MT5). The performance and reliability of these platforms are crucial for traders seeking a seamless trading experience.

The execution quality on Forex Club's platforms has been generally positive, with users reporting efficient order processing and low slippage. However, there are occasional reports of rejected orders, which can be frustrating for traders, particularly during volatile market conditions.

While the platforms are user-friendly and feature-rich, traders should remain vigilant for any signs of manipulation or unfair practices. Continuous monitoring of platform performance and execution quality is essential for maintaining a successful trading experience.

Risk Assessment

Engaging with Forex Club carries certain risks that traders should be aware of. The broker's regulatory challenges, mixed customer feedback, and potential issues with fund security contribute to an overall risk profile that requires careful consideration.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Offshore registration and compliance issues. |

| Customer Service Risk | Medium | Mixed reviews on support responsiveness. |

| Fund Safety Risk | Medium | Concerns about historical fund security issues. |

To mitigate these risks, traders should conduct thorough research, utilize demo accounts to familiarize themselves with the platform, and maintain realistic expectations regarding potential returns. Additionally, diversifying trading strategies and employing risk management techniques can help protect capital.

Conclusion and Recommendations

In conclusion, Forex Club presents a mixed picture regarding its legitimacy and reliability as a forex broker. While it is regulated by the NBRB and CySEC, the offshore registration and historical compliance issues raise concerns about investor protection. The broker offers competitive trading conditions and a range of platforms, but mixed customer feedback and potential fund security risks warrant caution.

For traders considering Forex Club, it is essential to weigh the benefits against the risks. Those new to trading or with limited capital may want to explore alternative brokers with stronger regulatory oversight and more transparent practices. Recommendations for reliable alternatives include brokers with tier-one regulation and a proven track record of customer satisfaction.

Ultimately, due diligence and a careful assessment of personal trading needs will guide traders in making informed decisions about whether to engage with Forex Club.

Is ForexClub a scam, or is it legit?

The latest exposure and evaluation content of ForexClub brokers.

ForexClub Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ForexClub latest industry rating score is 4.89, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 4.89 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.