Equiti 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive Equiti review evaluates one of the forex industry's established brokers. The company was originally founded as Divisa Capital in 2008 and rebranded as Equiti in 2017. Based on user feedback and available company information, Equiti has earned a reputation as a trustworthy forex broker with a user rating of 9 out of 10. The broker stands out through competitive low spreads and a diverse range of trading instruments spanning forex, indices, stocks, commodities, cryptocurrency CFDs, and ETFs.

Equiti operates as an execution-only broker. It focuses on market execution and liquidity provision rather than investment advisory or managed services. The platform caters primarily to intermediate and advanced traders who seek diversified asset exposure and appreciate user-friendly trading environments. With 24/6 customer support and regulatory oversight from the Seychelles Financial Services Authority, Equiti positions itself as a reliable choice for traders seeking multi-asset portfolio opportunities with competitive trading conditions.

Important Disclaimer

Due to varying regulatory requirements across different jurisdictions, Equiti's services and terms may differ between regions. The broker operates under different regulatory frameworks depending on the client's location, which can affect available features, protection levels, and trading conditions. This review is based on user feedback, publicly available company information, and regulatory filings, designed to provide prospective clients with comprehensive reference material.

Potential traders should verify specific terms and conditions applicable to their jurisdiction before opening an account. Regional variations in services, minimum deposits, leverage ratios, and available instruments may apply.

Rating Framework

Broker Overview

Company Background and Evolution

Established in 2008 under the name Divisa Capital, the company underwent significant transformation before emerging as Equiti in 2017. This rebranding marked a strategic shift toward becoming a specialized execution-only broker. The company deliberately focuses on market execution and liquidity provision rather than expanding into investment advisory or portfolio management services. The company's evolution reflects a commitment to core brokerage services, emphasizing technological infrastructure and trading execution quality over ancillary financial services.

Equiti's business model centers on providing direct market access through competitive pricing structures and efficient order execution. As an execution-only broker, the company maintains clear boundaries regarding its service scope. This ensures clients understand that trading decisions and strategies remain entirely within their control. This approach appeals to self-directed traders who prefer independent decision-making supported by robust execution capabilities.

The broker operates through user-friendly trading platforms designed to accommodate both novice and experienced traders. However, specific platform names and technical specifications require further verification. Equiti review data indicates strong user satisfaction with platform stability and interface design. The comprehensive asset coverage includes major forex pairs, global indices, individual stocks, commodities, cryptocurrency CFDs, and exchange-traded funds (ETFs). This provides traders with extensive diversification opportunities across traditional and digital asset classes.

Regulatory oversight comes from the Seychelles Financial Services Authority (FSA), providing a framework for client protection and operational standards. While this regulatory structure offers certain safeguards, traders should understand the specific protections and limitations associated with Seychelles-based regulation compared to other jurisdictions.

Regulatory Jurisdiction: Equiti operates under Seychelles Financial Services Authority regulation, providing baseline client protections within this offshore regulatory framework. Traders should verify specific regulatory numbers and protections applicable to their account type.

Deposit and Withdrawal Methods: Specific information regarding available deposit and withdrawal methods was not detailed in available sources. This requires direct verification with the broker for current options and processing times.

Minimum Deposit Requirements: Minimum deposit thresholds are not specified in available documentation. This represents a transparency gap that potential clients should clarify during account opening procedures.

Promotional Offers: Current bonus and promotional structures are not detailed in available sources. This suggests either limited promotional activity or the need for direct inquiry regarding available incentives.

Tradeable Assets: The broker provides access to foreign exchange markets, stock indices, individual equities, commodity markets, cryptocurrency contracts for difference, and exchange-traded funds. This supports comprehensive portfolio diversification strategies.

Cost Structure: Equiti offers competitive low spreads combined with industry-average commission structures. However, specific numerical values require verification through current rate sheets and trading conditions.

Leverage Ratios: Available leverage ratios are not specified in current documentation. This requires direct confirmation of maximum leverage levels available to different account types and jurisdictions.

Platform Options: User-friendly trading platforms are available. However, specific platform names, features, and compatibility details need verification through direct broker contact or demo account testing.

Geographic Restrictions: Specific country restrictions and availability limitations are not detailed in available sources. This requires verification based on individual trader locations.

Customer Support Languages: While 24/6 support is confirmed, specific language availability requires direct verification with the broker's support team.

This Equiti review highlights the importance of direct broker communication to clarify specific terms and conditions not detailed in publicly available sources.

Detailed Rating Analysis

Account Conditions Analysis (6/10)

Equiti's account conditions present a mixed picture that impacts the overall user experience. The lack of transparent information regarding minimum deposit requirements creates uncertainty for potential clients trying to assess accessibility and initial investment thresholds. This information gap particularly affects new traders who need clear guidance on entry-level requirements and account tier structures.

The absence of detailed leverage information in available sources further complicates account condition evaluation. Leverage ratios significantly impact trading strategies and risk management approaches, making this information crucial for informed decision-making. While the broker likely offers competitive leverage options given its market positioning, the lack of readily available specifications reduces transparency scores.

Account opening procedures and verification requirements are not thoroughly documented in available sources. However, user feedback suggests reasonable processing times. The broker's focus on execution-only services may streamline account structures, but this simplification should not come at the expense of clear communication regarding account features and limitations.

Special account features such as Islamic accounts, professional trader classifications, or institutional account options require direct verification. This Equiti review emphasizes the need for improved transparency in account condition communication to better serve potential clients' evaluation processes.

Equiti demonstrates strength in providing diverse trading instruments that support sophisticated portfolio construction and risk management strategies. The comprehensive asset coverage spanning traditional forex markets, equity indices, individual stocks, commodities, and emerging cryptocurrency CFDs positions the broker favorably for traders seeking multi-asset exposure through a single platform.

The variety of available instruments suggests robust backend infrastructure capable of handling different asset classes with appropriate pricing feeds and execution protocols. This diversity particularly benefits traders employing correlation strategies, hedging techniques, or seeking exposure to different economic sectors and geographic regions.

However, specific details regarding research and analysis resources are not thoroughly documented in available sources. Modern traders increasingly value integrated market analysis, economic calendars, technical analysis tools, and educational resources as part of their broker relationship. The absence of detailed information about these supplementary tools represents a potential area for improvement.

Automated trading support capabilities, including expert advisor compatibility, API access, and algorithmic trading infrastructure, require verification through direct broker contact. These features increasingly influence broker selection among technically sophisticated traders who rely on systematic trading approaches.

Customer Service and Support Analysis (7/10)

Equiti's customer support framework centers on 24/6 availability, providing coverage during most global trading sessions while allowing for weekend maintenance periods. This schedule accommodates the majority of forex market hours and supports traders across different time zones. However, the specific coverage hours and regional support centers require clarification.

User feedback indicates generally positive experiences with support quality, suggesting competent staff capable of addressing common trading queries and technical issues. The responsiveness and problem-resolution capabilities appear adequate based on available user testimonials. However, specific response time metrics and escalation procedures are not detailed in current sources.

The range of available support channels鈥攚hether including live chat, phone support, email ticketing, or social media engagement鈥攔equires verification through direct contact. Modern traders expect multiple communication options and prefer channels that match their urgency levels and communication preferences.

Multilingual support capabilities are particularly important for an international broker, yet specific language availability and regional support expertise are not thoroughly documented. This represents a potential service gap for non-English speaking clients who require native language assistance for complex trading or account issues.

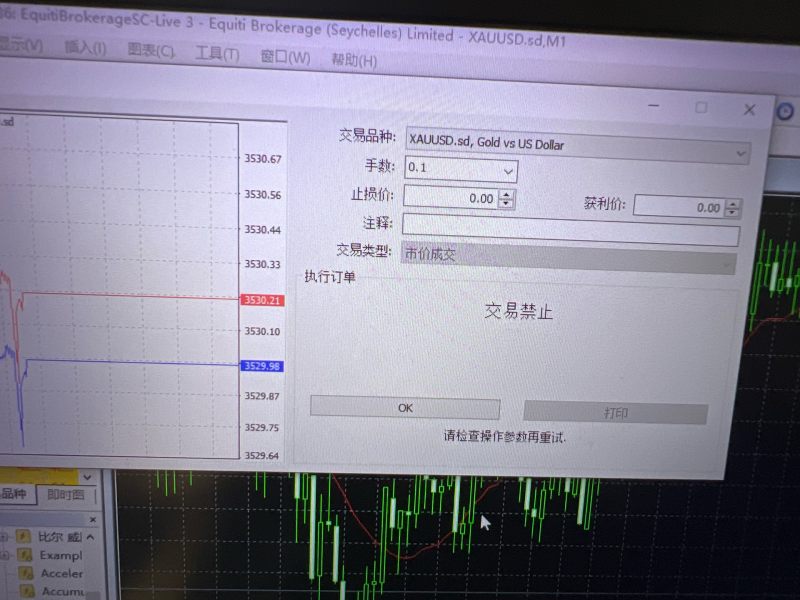

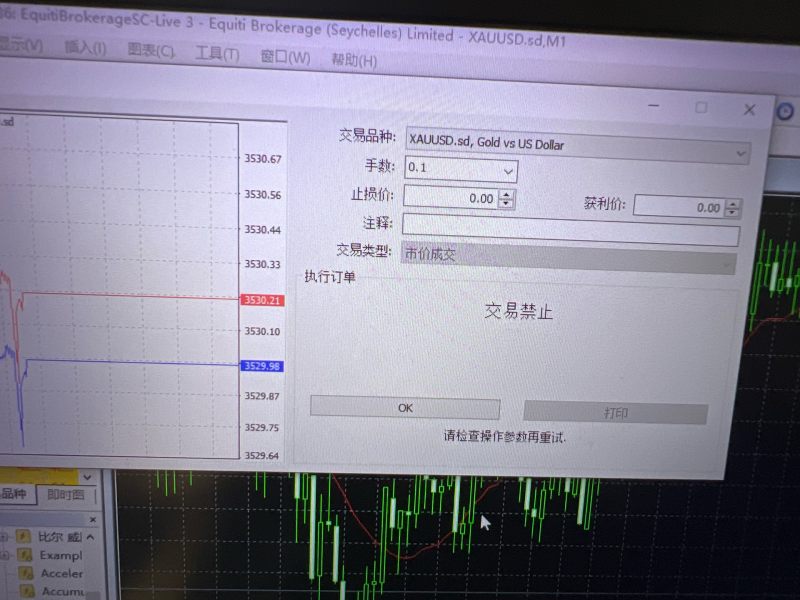

Trading Experience Analysis (8/10)

The trading experience evaluation reveals several positive aspects that contribute to user satisfaction ratings. Platform stability appears strong based on user feedback, with minimal reports of connectivity issues or system downtime during critical trading periods. This reliability is essential for traders who require consistent market access and dependable order execution.

Order execution quality receives positive user assessment, though specific metrics regarding slippage rates, requote frequency, and fill ratios are not detailed in available sources. The competitive spread environment suggests efficient pricing mechanisms and adequate liquidity provision across major trading instruments.

Platform functionality and user interface design receive favorable reviews, with users appreciating the user-friendly approach to navigation and order management. However, specific feature sets, charting capabilities, technical analysis tools, and customization options require verification through platform demonstration or trial usage.

Mobile trading experience details are not thoroughly covered in available sources, representing a significant evaluation gap given the importance of mobile platforms for modern traders. The quality of mobile applications, feature parity with desktop platforms, and mobile-specific functionality increasingly influence broker selection decisions.

This Equiti review notes that while overall trading experience feedback is positive, more detailed performance metrics would strengthen the evaluation framework and provide clearer guidance for potential users.

Trust and Safety Analysis (7/10)

Equiti's regulatory standing under the Seychelles Financial Services Authority provides a foundational level of oversight and client protection. However, the specific regulatory license number and compliance details require verification through official regulatory databases. Seychelles regulation offers certain protections while operating within an offshore regulatory framework that differs from major financial centers.

Fund security measures and client money protection protocols are not detailed in available sources, representing a significant information gap for safety-conscious traders. Modern brokers typically implement segregated account structures, insurance coverage, and other safeguards that should be clearly communicated to potential clients.

Company transparency regarding financial reporting, management structure, and operational procedures requires improvement based on available public information. While user feedback suggests trustworthy operations, formal transparency measures such as audited financial statements and regulatory reporting enhance credibility.

Industry reputation appears positive based on user ratings and feedback. However, specific recognition from industry publications, regulatory commendations, or professional certifications are not documented in current sources. The broker's handling of any historical regulatory issues or client complaints requires verification through regulatory records and industry databases.

User Experience Analysis (9/10)

User satisfaction metrics show strong performance with a 9/10 rating reflecting positive overall experiences across multiple aspects of the broker relationship. This high satisfaction level suggests effective integration of platform functionality, customer service, and trading conditions that meet user expectations and requirements.

Interface design and usability receive particular praise, with users appreciating the user-friendly approach to platform navigation and trade execution. The balance between comprehensive functionality and accessible design appears well-executed, accommodating both novice and experienced traders within the same platform environment.

Registration and account verification processes, while not detailed in available sources, appear to function smoothly based on user feedback patterns. Efficient onboarding procedures contribute significantly to initial user impressions and long-term satisfaction levels.

Fund management operations and withdrawal processing experiences are not thoroughly documented. However, the absence of significant user complaints suggests reasonable performance in these critical areas. Specific processing times, fee structures, and operational procedures would strengthen the evaluation framework.

The target user profile of intermediate and advanced traders seeking diversified asset exposure appears well-matched to the broker's service delivery model. This alignment between service design and user needs contributes to the high satisfaction ratings and positive user experience feedback patterns.

Conclusion

This comprehensive Equiti review reveals a broker with solid fundamentals and strong user satisfaction, earning recognition as a trustworthy forex broker suitable for diversified trading requirements. The combination of competitive spreads, user-friendly platform design, and comprehensive asset coverage creates a compelling offering for intermediate and advanced traders seeking multi-asset exposure through a single provider.

The broker's strengths lie in execution quality, platform usability, and customer satisfaction, supported by regulatory oversight and 24/6 customer support availability. However, transparency improvements regarding account conditions, fund security measures, and detailed service specifications would enhance the overall client experience and evaluation process.

Equiti appears best suited for self-directed traders who value platform stability, competitive pricing, and asset diversity over extensive research resources or advisory services. The execution-only model aligns well with experienced traders who prefer independent decision-making supported by reliable infrastructure and efficient order processing.