Is eFX markets safe?

Business

License

Is EFX Markets Safe or a Scam?

Introduction

EFX Markets positions itself as a forex broker offering a variety of trading instruments, including currencies, commodities, and indices. Established in a highly competitive landscape, the broker aims to attract traders with promises of high leverage and a user-friendly trading platform. However, the importance of thoroughly evaluating forex brokers cannot be overstated, as the financial trading industry is rife with scams and unregulated entities. Traders must exercise caution and conduct comprehensive research before committing funds to any platform. This article investigates the legitimacy of EFX Markets, focusing on its regulatory status, company background, trading conditions, customer safety measures, user experiences, and overall risk assessment.

Regulation and Legitimacy

The regulatory framework under which a forex broker operates is crucial for ensuring the safety of traders' funds. EFX Markets claims to be registered in the British Virgin Islands, but it lacks any valid regulatory license from recognized financial authorities. The absence of regulation raises significant concerns about the broker's legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The lack of oversight means that EFX Markets is not subject to the stringent compliance requirements that regulated brokers must adhere to. This absence of regulatory protection can expose traders to potential fraud and financial losses. Furthermore, historical compliance records indicate that unregulated brokers often have a higher incidence of customer complaints and withdrawal issues. As such, the question arises: Is EFX Markets safe? Given its unregulated status, potential clients should approach with caution.

Company Background Investigation

EFX Markets, operating under the name EFX CPI LLC, has a somewhat opaque history. The company claims to have been established to provide retail traders with access to global financial markets, yet details about its ownership structure and management team remain unclear. Transparency is vital in building trust, and EFX Markets appears to fall short in this regard.

The management team's qualifications and experience are crucial indicators of a broker's reliability. However, the lack of publicly available information about the team's expertise raises red flags. In a well-regulated environment, brokers are typically required to disclose information about their management and operational practices, which fosters accountability. The absence of such disclosures further complicates the assessment of whether EFX Markets is safe for trading.

Trading Conditions Analysis

Understanding a broker's trading conditions, including fees and spreads, is essential for traders. EFX Markets offers various account types with differing spreads and leverage options. However, the overall fee structure remains somewhat ambiguous, with reports of hidden fees and unclear commission policies.

| Fee Type | EFX Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.0 pips |

| Commission Structure | Unclear | $3 - $7 per lot |

| Overnight Interest Range | Not disclosed | Varies |

The spreads offered by EFX Markets are higher than the industry average, which could erode potential profits for traders. Moreover, the lack of transparency surrounding commission structures raises concerns about possible hidden costs. Traders should be wary of brokers with unclear fee policies, as they may lead to unexpected costs that impact overall trading performance. Hence, the question remains: Is EFX Markets safe when it comes to trading costs?

Customer Funds Safety

The safety of customer funds is paramount in the forex trading environment. EFX Markets claims to implement various measures to protect clients' investments. However, the absence of regulatory oversight means that there are no guarantees regarding fund segregation or investor protection.

Typically, regulated brokers are required to maintain client funds in segregated accounts, ensuring that traders' money is kept separate from the broker's operational funds. This practice safeguards against potential misappropriation or insolvency issues. Unfortunately, EFX Markets lacks such assurances, raising significant concerns about whether client funds are genuinely secure. Moreover, any historical issues related to fund safety could further jeopardize traders' financial well-being. Thus, potential clients must consider whether EFX Markets is safe in terms of customer fund protection.

Customer Experience and Complaints

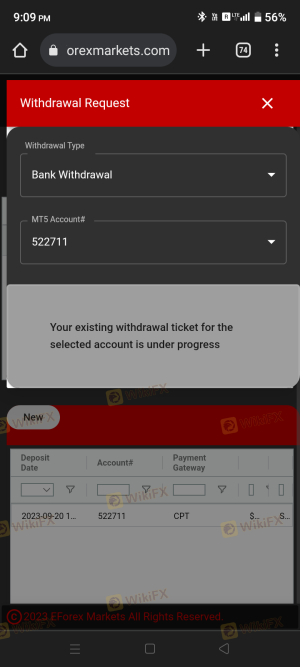

User feedback provides invaluable insights into a broker's reliability and service quality. Reports from EFX Markets customers indicate a range of experiences, with many expressing dissatisfaction regarding withdrawal processes and customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Lack of Customer Support | Medium | Limited availability |

| Transparency Concerns | High | Unclear policies |

Common complaints include difficulties in withdrawing funds, with some users reporting that their accounts were blocked or that they faced unreasonable conditions for withdrawals. These issues suggest a pattern of problematic customer service that could deter potential traders. Furthermore, the company's slow response to complaints raises additional concerns about its overall reliability. Given these factors, traders should carefully consider whether EFX Markets is safe based on user experiences.

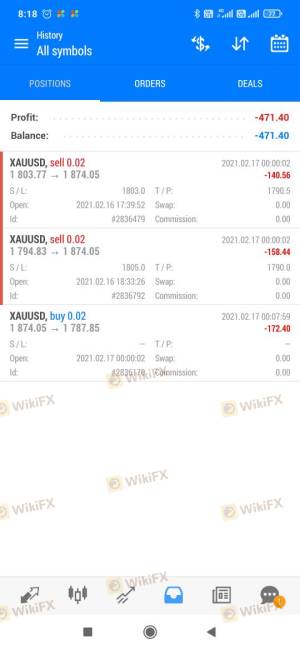

Platform and Trade Execution

The trading platform's performance is critical for successful trading. EFX Markets offers the popular MetaTrader 4 platform, known for its user-friendly interface and advanced trading capabilities. However, the quality of order execution, slippage rates, and potential signs of platform manipulation are essential considerations for traders.

Reports of slippage and rejected orders can significantly impact trading outcomes. If traders frequently experience execution issues, it raises questions about the broker's reliability. While EFX Markets claims to provide a seamless trading experience, any discrepancies in execution quality could lead to frustrations and financial losses. As such, potential clients must assess whether EFX Markets is safe regarding platform performance.

Risk Assessment

Using EFX Markets involves various risks that traders should be aware of. The absence of regulation, unclear fee structures, and reports of withdrawal issues contribute to a higher risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | Medium | Potential hidden fees |

| Operational Risk | High | Reports of withdrawal issues |

To mitigate these risks, traders should consider diversifying their investments and avoiding placing large sums with unregulated brokers. Additionally, opting for brokers with strong regulatory frameworks can provide greater security and peace of mind.

Conclusion and Recommendations

In conclusion, the investigation into EFX Markets raises significant concerns regarding its safety and legitimacy. The lack of regulation, coupled with reports of withdrawal issues and unclear fee structures, paints a troubling picture. While EFX Markets may offer some attractive features, the potential risks associated with trading on an unregulated platform cannot be ignored.

For traders seeking a reliable and secure trading environment, it is advisable to consider alternative brokers that are regulated by reputable financial authorities. These brokers typically offer stronger protections for client funds and clearer trading conditions. Ultimately, the question of whether EFX Markets is safe remains unanswered for many, and caution is strongly recommended for potential clients.

Is eFX markets a scam, or is it legit?

The latest exposure and evaluation content of eFX markets brokers.

eFX markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

eFX markets latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.