Is EBI safe?

Pros

Cons

Is EBI Safe or a Scam?

Introduction

EBI, a forex broker established in 2017 and based in the United Kingdom, has garnered attention in the trading community. Positioned as a platform for forex trading, EBI claims to offer a range of services tailored to both novice and experienced traders. However, the growing number of complaints and concerns surrounding its legitimacy raises a crucial question: Is EBI safe? This article aims to provide a thorough evaluation of EBI's credibility by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. The analysis is based on data collected from various sources, including user reviews, regulatory databases, and expert opinions.

Regulation and Legitimacy

The regulatory status of a forex broker is paramount in assessing its safety and reliability. EBI's operations are purportedly regulated by the Financial Conduct Authority (FCA), a reputable regulatory body in the UK. However, concerns have been raised regarding EBI's compliance and the legitimacy of its operations, with some sources labeling it as a "suspicious clone."

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 581079 | United Kingdom | Suspicious Clone |

The FCA is known for its stringent regulations and commitment to protecting investors. However, the designation of EBI as a "suspicious clone" raises alarms about its operational integrity. While no negative regulatory disclosures have been found during the evaluation period, the lack of clarity regarding EBI's compliance history necessitates caution. Traders should be aware that a broker's regulatory status can significantly impact their investment safety.

Company Background Investigation

EBI's history and ownership structure play a critical role in determining its trustworthiness. Founded in 2017, EBI claims to offer a transparent trading environment, yet details about its management team and ownership remain vague. A lack of transparency can be a red flag for potential investors.

The company appears to have limited information available regarding its founders and key personnel, which raises concerns about its operational stability and the experience of its management team. A well-established company typically provides detailed biographies of its executives, showcasing their expertise in the financial sector. EBI's failure to do so may indicate a lack of accountability or experience in handling investor funds.

Moreover, the absence of clear information about the company's financial health and operational practices further complicates the assessment of its legitimacy. Traders should always seek brokers that provide comprehensive information about their operations and management to ensure a safe trading environment.

Trading Conditions Analysis

Understanding the trading conditions offered by EBI is essential for evaluating its overall value proposition. The broker utilizes the widely recognized MetaTrader 4 (MT4) platform, which is known for its user-friendly interface and advanced trading features. However, the overall cost structure and fee policies warrant scrutiny.

| Fee Type | EBI | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | TBD | TBD |

| Commission Model | TBD | TBD |

| Overnight Interest Range | TBD | TBD |

While EBI claims to offer competitive spreads, the lack of specific information on its website regarding fees and commissions leaves potential clients in the dark. Traders should be wary of brokers that do not clearly disclose their fee structures, as hidden costs can significantly impact profitability.

Additionally, any unusual fees or policies should be carefully evaluated. For instance, if the broker imposes excessive withdrawal fees or has a complex commission structure, it could be a sign of potential exploitation of traders. Always compare the broker's fees with industry averages to ensure a fair trading environment.

Customer Funds Security

The safety of customer funds is a primary concern for any trader. EBI claims to implement several measures to protect client funds, including segregating client accounts from operational funds. However, the specifics of these measures are not clearly outlined.

Traders should inquire about the following aspects to assess EBI's commitment to fund security:

- Client Fund Segregation: Are client funds held in separate accounts to prevent misuse?

- Investor Protection: Does EBI provide any form of insurance or compensation in case of insolvency?

- Negative Balance Protection: If a trader's account goes negative, does EBI cover the losses?

The lack of detailed information regarding these security measures raises concerns about the potential risks involved in trading with EBI. Historical instances of fund mismanagement or disputes can further exacerbate these concerns, emphasizing the need for thorough due diligence before investing.

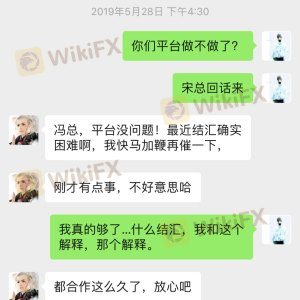

Customer Experience and Complaints

Analyzing customer feedback is crucial for understanding the overall experience with EBI. Numerous reviews indicate a mixed bag of experiences, with several clients reporting issues related to account management and withdrawal processes.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Account Bans | High | Poor |

| Withdrawal Issues | High | Poor |

| Misleading Information | Medium | Average |

Common complaints include allegations of account bans without proper justification and difficulties in withdrawing funds. Such patterns can indicate systemic issues within the broker's operations. For instance, one user reported that after a significant profit, their account was banned, leading to a loss of funds. The company's failure to address these complaints adequately raises questions about its customer service and operational integrity.

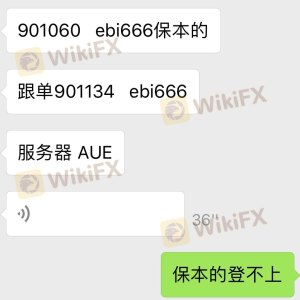

Platform and Trade Execution

The performance and reliability of the trading platform are critical for a seamless trading experience. EBI utilizes the MT4 platform, known for its stability and extensive features. However, users have raised concerns about order execution quality, including instances of slippage and rejected orders.

A thorough assessment of the platform's performance is essential to determine if there are any signs of manipulation or inefficiencies. Traders should monitor their order execution closely and report any discrepancies to ensure they are receiving fair treatment.

Risk Assessment

Using EBI for trading presents several risks that potential clients should consider.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Suspicious clone status raises concerns |

| Fund Security | High | Lack of transparency regarding fund protection |

| Customer Service Quality | Medium | Poor response to complaints reported |

To mitigate these risks, traders should conduct thorough research, monitor their accounts closely, and consider diversifying their trading activities across multiple platforms. Engaging with reputable brokers that have a proven track record of reliability can also help reduce exposure to potential scams.

Conclusion and Recommendations

In conclusion, the question remains: Is EBI safe? While EBI presents itself as a legitimate forex broker, several red flags warrant caution. The lack of transparency regarding its regulatory status, company background, and customer service responses raises significant concerns. Traders should be wary of potential scams and carefully evaluate their options before investing.

For those seeking safer alternatives, it is advisable to consider brokers that are fully regulated by top-tier authorities, offer transparent fee structures, and have a proven track record of positive customer experiences. Always prioritize due diligence and take the time to research thoroughly before engaging with any broker, especially one with questionable credibility like EBI.

Is EBI a scam, or is it legit?

The latest exposure and evaluation content of EBI brokers.

EBI Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

EBI latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.