Regarding the legitimacy of CICC Futures forex brokers, it provides CFFEX and WikiBit, .

Is CICC Futures safe?

Risk Control

Software Index

Is CICC Futures markets regulated?

The regulatory license is the strongest proof.

CFFEX Derivatives Trading License (AGN)

China Financial Futures Exchange

China Financial Futures Exchange

Current Status:

RegulatedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

中金期货有限公司

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is CICC Futures Safe or Scam?

Introduction

CICC Futures, a prominent player in the forex market, has garnered attention for its range of trading services and its association with the China International Capital Corporation (CICC). Established in 2004, CICC Futures operates under the regulatory oversight of the China Financial Futures Exchange (CFFEX), positioning itself as a legitimate broker in the competitive landscape of forex trading. However, the increasing number of unregulated brokers has made it imperative for traders to exercise caution and thoroughly evaluate any trading platform before committing their funds. This article aims to provide a comprehensive analysis of CICC Futures to determine whether it is a safe trading option or a potential scam.

To assess the safety and reliability of CICC Futures, we conducted an extensive review of available information from reputable sources, including regulatory filings, customer reviews, and industry analyses. Our evaluation framework includes examining the broker's regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and overall risk assessment.

Regulatory and Legitimacy

The regulatory environment in which a broker operates is crucial for ensuring the safety of traders' funds and the integrity of the trading process. CICC Futures is regulated by the China Financial Futures Exchange (CFFEX), which is a recognized authority responsible for overseeing futures trading in China. This regulatory framework is designed to protect investors by enforcing compliance with industry standards and safeguarding client funds.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CFFEX | 0172 | China | Verified |

The importance of regulation cannot be overstated; it provides a level of assurance that the broker adheres to stringent operational guidelines. CICC Futures has maintained a positive regulatory history, with no reported violations or significant compliance issues. However, it is essential to note that while CFFEX is a legitimate regulatory body, the strictness of oversight may not be as rigorous as that of other global regulators. Therefore, while CICC Futures is regulated, potential investors should remain vigilant and conduct their own due diligence.

Company Background Investigation

CICC Futures has a solid foundation, being a subsidiary of the well-established China International Capital Corporation, which has been a key player in the financial services industry since its inception in 1995. The company's ownership structure is robust, providing a level of credibility that many newer brokers lack. The management team at CICC Futures is composed of experienced professionals with extensive backgrounds in finance and investment, which further enhances the broker's reputation.

Transparency is a critical factor in assessing a broker's trustworthiness. CICC Futures offers detailed information about its operations, services, and regulatory compliance on its official website. However, some users have expressed concerns regarding the availability of comprehensive details on fees and trading conditions, which could impact the overall perception of transparency.

Trading Conditions Analysis

Understanding the trading conditions offered by CICC Futures is vital for evaluating its appeal to potential traders. The broker's fee structure is an essential aspect of this analysis, as it directly affects trading profitability. CICC Futures has a competitive pricing model, but it is crucial to scrutinize the specifics of its fee structure to identify any hidden costs.

| Fee Type | CICC Futures | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 2.0 pips |

| Commission Model | Varies | $5 - $10 per lot |

| Overnight Interest Range | Low | 3% - 5% |

CICC Futures offers variable spreads on major currency pairs, which can be competitive compared to industry averages. However, traders should be cautious of any unusual or unclear fee policies that could lead to unexpected expenses. Additionally, the broker does not provide a fixed commission structure, which may lead to confusion among traders regarding their total trading costs.

Client Fund Security

The security of client funds is paramount when evaluating a broker's safety. CICC Futures implements several measures to ensure the protection of its clients' assets. The broker maintains segregated accounts for client funds, which means that traders' money is held separately from the company's operational funds. This practice is crucial in the event of financial difficulties faced by the broker, as it helps safeguard clients' investments.

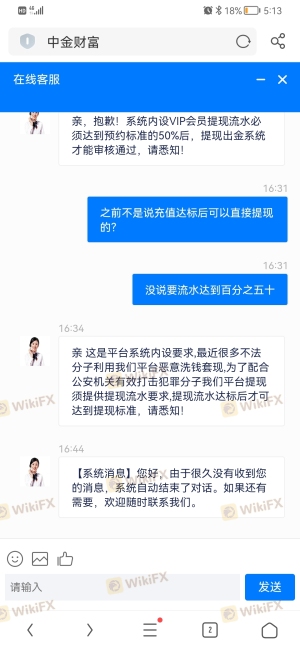

Moreover, CICC Futures adheres to investor protection policies, which can provide additional peace of mind for traders. However, historical concerns regarding fund security have been raised, with some clients reporting difficulties in withdrawing their funds. Such incidents can significantly impact the perceived safety of a broker, leading to skepticism about their reliability.

Customer Experience and Complaints

Customer feedback plays a vital role in assessing the overall experience with a broker. CICC Futures has received mixed reviews from clients. While some users commend the broker for its user-friendly platform and responsive customer service, others have reported issues related to withdrawals and communication.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Service Delay | Medium | Moderate |

Common complaints include difficulties in processing withdrawals, with some clients alleging that their requests were delayed or denied. These issues can raise red flags for potential investors, as they suggest a lack of operational transparency and responsiveness. Analyzing specific case studies of clients who faced withdrawal challenges can provide further insights into the broker's reliability.

Platform and Trade Execution

The performance of a trading platform is crucial for a seamless trading experience. CICC Futures offers a range of trading platforms that are designed to cater to different trading styles. Users have reported that the platforms are generally stable, with a good range of features and tools available for analysis.

However, concerns have been raised regarding order execution quality. Instances of slippage and rejected orders have been reported, which can negatively impact trading outcomes. Traders should be aware of these potential issues when considering CICC Futures as their trading partner.

Risk Assessment

Engaging with any broker carries inherent risks, and CICC Futures is no exception. Evaluating the overall risk profile of this broker is essential for informed decision-making.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Compliance with CFFEX but less stringent than global standards. |

| Operational Risk | High | Reports of withdrawal issues and customer service delays. |

| Market Risk | High | Volatility in forex markets can lead to significant losses. |

Given the mixed reviews and reported operational challenges, potential traders should exercise caution. It is advisable to start with a demo account to assess the platform's functionality and customer service responsiveness before committing significant capital.

Conclusion and Recommendations

In conclusion, while CICC Futures is regulated by the CFFEX and has a solid organizational backing, potential traders should approach with caution. The mixed customer feedback, particularly concerning withdrawal issues and operational transparency, raises questions about the broker's overall reliability.

For traders considering CICC Futures, it is crucial to conduct thorough research and possibly start with smaller investments to gauge the broker's performance. If you seek alternatives, consider brokers with a stronger regulatory presence and more favorable customer reviews to ensure a safer trading experience.

Ultimately, the question of is CICC Futures safe hinges on individual risk tolerance and investment strategies. By weighing the evidence presented in this analysis, traders can make informed decisions about whether to engage with CICC Futures or seek other options in the market.

Is CICC Futures a scam, or is it legit?

The latest exposure and evaluation content of CICC Futures brokers.

CICC Futures Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CICC Futures latest industry rating score is 7.81, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.81 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.