Regarding the legitimacy of CENTRAL BULLION LIMITED forex brokers, it provides HKGX and WikiBit, (also has a graphic survey regarding security).

Is CENTRAL BULLION LIMITED safe?

Software Index

Risk Control

Is CENTRAL BULLION LIMITED markets regulated?

The regulatory license is the strongest proof.

HKGX Precious Metals Trading (AGN)

Hong Kong Gold Exchange

Hong Kong Gold Exchange

Current Status:

RegulatedLicense Type:

Precious Metals Trading (AGN)

Licensed Entity:

中融金業有限公司

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

https://www.zrgold202.com/Expiration Time:

--Address of Licensed Institution:

香港永吉街8號誠利商業大廈11樓F室Phone Number of Licensed Institution:

54651369Licensed Institution Certified Documents:

Is Central Bullion Safe or Scam?

Introduction

Central Bullion is a forex and precious metals trading platform that has positioned itself as a significant player in the online trading market. With a focus on providing access to trading in London gold and silver, this broker has attracted a diverse clientele. However, as the online trading landscape becomes increasingly crowded, traders must exercise caution when selecting a broker. The potential for scams and unreliable platforms is ever-present, making it crucial for traders to assess the legitimacy and safety of their chosen broker. This article aims to provide a comprehensive evaluation of Central Bullion, analyzing its regulatory status, company background, trading conditions, customer experiences, and overall safety. Our investigation draws upon various sources, including user reviews, regulatory filings, and expert analyses, to deliver an unbiased assessment of whether Central Bullion is safe or a potential scam.

Regulation and Legitimacy

The regulatory framework surrounding a broker is a critical factor in determining its legitimacy. Central Bullion operates under the auspices of the Chinese Gold & Silver Exchange Society (CGSE) in Hong Kong, holding a Type AA license. This regulatory oversight is essential as it aims to protect traders and ensure fair trading practices. However, the regulatory environment in Hong Kong has faced scrutiny, leading some to question the effectiveness of oversight in safeguarding traders' interests.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Chinese Gold & Silver Exchange Society | 202 | Hong Kong | Verified |

Despite being regulated, user complaints have surfaced regarding withdrawal issues and unauthorized trading actions. These concerns highlight the importance of understanding not only the regulatory status but also the broker's historical compliance record. While Central Bullion is legally registered, the reported issues may indicate potential risks for traders. Therefore, it is essential to consider both the regulatory framework and the broker's operational history when assessing its safety.

Company Background Investigation

Central Bullion was founded in 2018, with its headquarters located in Hong Kong. The company has focused on trading precious metals and has established itself as a regional player in this niche market. However, the ownership structure and management team behind Central Bullion remain somewhat opaque, with limited publicly available information. This lack of transparency can be a red flag for potential investors.

The management teams professional background plays a crucial role in the operational integrity of a broker. Unfortunately, detailed information about the leadership at Central Bullion is scant, which may raise concerns regarding their expertise and commitment to ethical trading practices. Transparency in operations and clear communication with clients are vital for building trust, and the absence of such information could lead to skepticism among potential users.

Trading Conditions Analysis

When evaluating whether Central Bullion is safe, understanding its trading conditions is paramount. The broker employs a straightforward fee structure, charging a flat commission of $7.50 per transaction, with no spreads on trades. This fee model can be attractive for frequent traders who prefer a transparent cost structure. However, it is essential to compare these fees against industry averages to determine their competitiveness.

| Fee Type | Central Bullion | Industry Average |

|---|---|---|

| Major Currency Pair Spread | No Spread | Varies (1-3 pips) |

| Commission Model | $7.50 per trade | $5 - $10 per trade |

| Overnight Interest Range | Not specified | Varies (0.5% - 2%) |

While the commission structure may appear reasonable, the lack of clarity regarding overnight interest rates could pose risks for traders using leveraged positions. Additionally, the absence of a demo account limits new traders' ability to familiarize themselves with the platform before committing real funds. Therefore, potential clients should weigh these factors carefully when considering whether Central Bullion is safe for their trading needs.

Client Fund Security

The security of client funds is a critical aspect of any trading platform. Central Bullion claims to implement various measures to protect client deposits, including segregated accounts for client funds. This practice is essential as it ensures that client money is kept separate from the broker's operational funds, providing an additional layer of security.

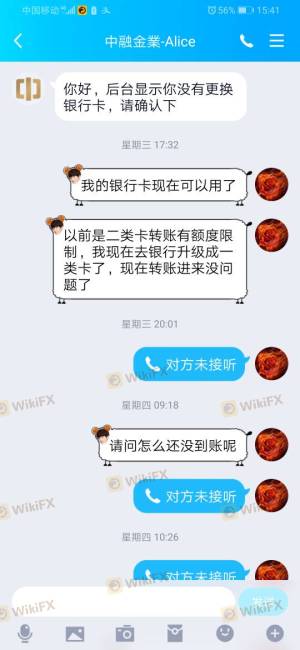

However, user reports have indicated issues with withdrawals and unauthorized trading activities, raising concerns about the overall safety of client funds. Historical incidents of fund mismanagement or disputes can significantly impact a broker's reputation, and Central Bullion is not immune to such scrutiny. Traders must remain vigilant and conduct thorough due diligence before entrusting their capital to any broker.

Customer Experience and Complaints

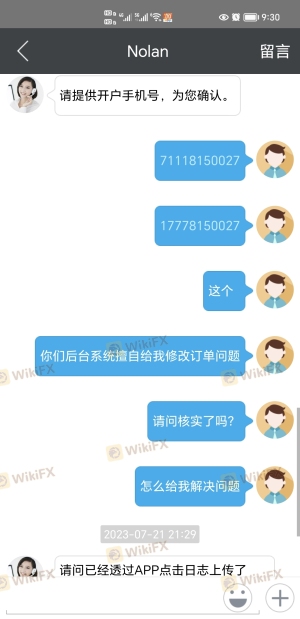

Customer feedback is a valuable indicator of a broker's reliability and responsiveness. Reviews for Central Bullion are mixed, with some users praising the platform's transparency and trading conditions, while others have reported significant issues. Common complaints include difficulties in withdrawing funds and unauthorized modifications to trades, which can be alarming for potential clients.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Unauthorized Trade Modifications | High | No resolution |

| Customer Service Availability | Medium | Limited support |

Two notable cases highlight these issues: one user reported a withdrawal of $2,000 being ignored, while another claimed that their trades were tampered with, resulting in significant losses. These accounts underscore the importance of assessing customer experiences when determining whether Central Bullion is safe.

Platform and Trade Execution

The trading platform offered by Central Bullion utilizes the widely recognized MetaTrader 4 (MT4) interface, which is known for its user-friendly design and robust trading features. However, the performance of the platform, including order execution speed and slippage, is critical for traders, particularly in volatile markets.

User reports suggest that while the platform is generally stable, there have been instances of slippage and order rejections, which can be detrimental to trading performance. The lack of evidence supporting claims of platform manipulation is reassuring, but the reported issues still warrant caution.

Risk Assessment

Using Central Bullion comes with inherent risks that potential traders should consider. The combination of regulatory oversight, customer feedback, and trading conditions contributes to an overall risk profile that could be classified as moderate to high.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Compliance | Medium | Regulated, but with reported issues |

| Fund Security | High | Withdrawal issues and complaints |

| Trading Conditions | Medium | Transparent fees, but unclear policies |

To mitigate these risks, traders should consider starting with a smaller investment and remain vigilant regarding their trading activities. Additionally, keeping abreast of user feedback and regulatory updates can help protect against potential pitfalls.

Conclusion and Recommendations

In conclusion, the assessment of Central Bullion reveals a mixed picture regarding its safety and reliability. While the broker is regulated and offers a transparent fee structure, significant concerns about customer service, fund withdrawals, and unauthorized trading actions cannot be overlooked. Therefore, it is essential for potential traders to exercise caution and conduct thorough research before committing to this broker.

For traders seeking alternatives, consider exploring brokers with a proven track record of customer satisfaction, robust regulatory frameworks, and transparent trading conditions. Some reputable options include brokers regulated by top-tier authorities, which offer comprehensive investor protection measures. Ultimately, the decision to engage with Central Bullion should be made with a clear understanding of the associated risks and the broker's operational history.

Is CENTRAL BULLION LIMITED a scam, or is it legit?

The latest exposure and evaluation content of CENTRAL BULLION LIMITED brokers.

CENTRAL BULLION LIMITED Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CENTRAL BULLION LIMITED latest industry rating score is 6.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.