Is CBF safe?

Pros

Cons

Is CBF Safe or a Scam?

Introduction

CBF is a forex broker that has emerged in the financial trading landscape since its establishment in 2017. Positioned in the United Kingdom, CBF aims to provide traders with access to various financial instruments using the widely recognized MetaTrader 4 platform. However, as the forex market is rife with potential scams and unregulated brokers, it is crucial for traders to conduct thorough evaluations before engaging with any trading platform. This article will delve into the safety and legitimacy of CBF, employing a structured framework that includes regulatory status, company background, trading conditions, client fund security, customer experience, platform performance, and overall risk assessment.

Regulatory and Legitimacy

The regulatory environment is a critical factor in determining the safety of a forex broker. CBF claims to operate under the oversight of the Financial Conduct Authority (FCA) in the UK. However, there are significant concerns regarding its actual regulatory status.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 466201 | United Kingdom | Not Verified |

While the FCA is known for its stringent regulatory standards, CBF has received a low score of 1.99 from WikiFX, indicating potential issues with compliance and operational transparency. The lack of a verified regulatory status raises questions about the broker's legitimacy and the level of protection afforded to traders. Furthermore, the absence of negative regulatory disclosures during the evaluation period does not necessarily imply that CBF is entirely safe. Traders should be cautious and consider the implications of engaging with a broker that may not be fully compliant with regulatory requirements.

Company Background Investigation

CBF was founded in 2017, aiming to cater to both novice and experienced traders. However, the limited information available about its ownership structure and management team raises concerns about transparency. A thorough background check reveals that the broker operates without a clearly defined history or a well-documented track record.

The management team's credentials are crucial in assessing the broker's reliability. Unfortunately, there is little information regarding their professional experience or qualifications, which can further complicate the evaluation process. A lack of transparency in company operations, including the absence of clear information on business practices, can be a red flag for potential investors. Therefore, traders must be vigilant and conduct their own due diligence before engaging with CBF.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its overall attractiveness. CBF provides a range of trading instruments, but the associated costs can be a determining factor for many traders. The broker utilizes a commission structure along with spreads, which can vary based on account types.

| Cost Type | CBF | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.8 pips | 1.0 - 2.0 pips |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | 0.5% - 3% | 0.5% - 2% |

The spread on major currency pairs is relatively high compared to industry standards, which may impact trading profitability. Additionally, the variable commission structure can lead to unexpected costs for traders. It is crucial for potential clients to carefully assess these costs and understand how they compare to other brokers in the market. Unusual or opaque fee structures can indicate potential issues with the broker's practices, making it essential for traders to remain cautious when considering CBF.

Client Fund Security

The safety of client funds is paramount when evaluating a forex broker. CBF claims to implement various security measures, including segregated accounts and third-party insurance protection. However, the effectiveness of these measures remains uncertain.

The absence of robust investor protection mechanisms, such as negative balance protection, raises concerns about the potential risks associated with trading through CBF. Additionally, historical incidents involving fund security issues or disputes can further complicate the broker's credibility. Traders must weigh these factors carefully and consider the implications of entrusting their capital to a broker with an unclear track record regarding client fund safety.

Customer Experience and Complaints

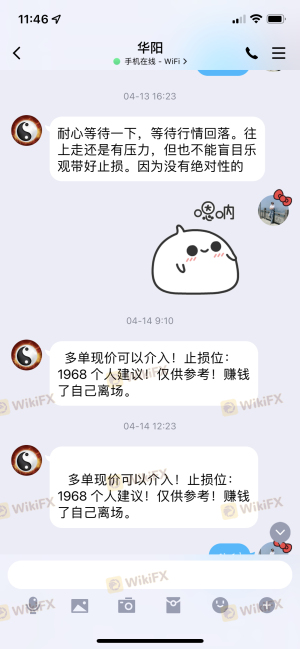

Customer feedback is an invaluable resource for assessing the reliability of a broker. Reviews and testimonials from existing users can provide insights into the overall client experience with CBF. However, there are notable patterns of complaints that warrant attention.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow Response |

| Poor Customer Support | Medium | Long Wait Times |

| Misleading Information | High | Unresolved Issues |

Common complaints include withdrawal delays, poor customer support, and instances of misleading information regarding trading conditions. These issues can significantly impact a trader's experience and raise concerns about the broker's operational integrity. It is essential for traders to be aware of these complaints and consider the company's response quality when evaluating CBF's overall reliability.

Platform and Trade Execution

The trading platform provided by CBF is a critical aspect of the trading experience. CBF utilizes the MetaTrader 4 platform, which is known for its user-friendly interface and robust functionality. However, the platform's performance, stability, and execution quality must be thoroughly assessed.

Traders have reported mixed experiences with order execution, including instances of slippage and rejected orders. These issues can severely affect trading outcomes and raise concerns about the broker's operational practices. Moreover, any signs of potential platform manipulation should be taken seriously, as they can indicate deeper issues with the broker's integrity.

Risk Assessment

Using CBF for trading presents various risks that traders must consider. The lack of regulation, combined with the broker's questionable practices, contributes to an overall high-risk profile.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unverified regulatory status |

| Financial Risk | Medium | High spreads and variable commissions |

| Operational Risk | High | Complaints regarding execution and support |

To mitigate these risks, traders are advised to conduct thorough research, maintain realistic expectations, and consider diversifying their trading activities across multiple platforms. Engaging with well-regulated brokers can also provide additional layers of protection.

Conclusion and Recommendations

In conclusion, the investigation into CBF raises significant concerns regarding its safety and legitimacy. The broker's low regulatory score, lack of transparency, and patterns of customer complaints indicate potential issues that traders should be wary of. While CBF may offer certain trading opportunities, the risks associated with using this broker are substantial.

For traders seeking a safer trading environment, it is advisable to consider alternative brokers that offer robust regulatory oversight, transparent fee structures, and positive customer feedback. Ultimately, ensuring the safety of your investments should be the top priority when navigating the forex market. Therefore, before engaging with CBF, traders should carefully reflect on the risks and consider more reliable options to safeguard their capital.

Is CBF a scam, or is it legit?

The latest exposure and evaluation content of CBF brokers.

CBF Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CBF latest industry rating score is 2.18, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.18 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.