Regarding the legitimacy of amana forex brokers, it provides CYSEC, DFSA, CMA, FCA and WikiBit, (also has a graphic survey regarding security).

Is amana safe?

Pros

Cons

Is amana markets regulated?

The regulatory license is the strongest proof.

CYSEC Market Making License (MM) 20

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Amana Capital Ltd

Effective Date:

2011-10-21Email Address of Licensed Institution:

nas.velianis@amanacapital.comSharing Status:

No SharingWebsite of Licensed Institution:

www.amanacapital.com.cyExpiration Time:

--Address of Licensed Institution:

12, Archiepiskopou Makariou III, KrisTelina House - 3rd Floor - OFFice 302, Mesa GeiTonia, CY-4000 LiMassolPhone Number of Licensed Institution:

+357 25 257 999Licensed Institution Certified Documents:

DFSA Derivatives Trading License (MM)

Dubai Financial Services Authority

Dubai Financial Services Authority

Current Status:

RegulatedLicense Type:

Derivatives Trading License (MM)

Licensed Entity:

Amana Financial Services (Dubai) Limited

Effective Date:

2016-04-11Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Unit N307, Level 3, Emirates Financial Towers, DIFC, PO Box 506931, Dubai, UAEPhone Number of Licensed Institution:

971 4 276 9525Licensed Institution Certified Documents:

CMA Derivatives Trading License (MM)

Capital Markets Authority LEBANON

Capital Markets Authority LEBANON

Current Status:

RegulatedLicense Type:

Derivatives Trading License (MM)

Licensed Entity:

Amana Capital SAL

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

FCA Forex Execution License (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

UnverifiedLicense Type:

Forex Execution License (STP)

Licensed Entity:

Amana Financial Services UK Limited

Effective Date:

2014-04-01Email Address of Licensed Institution:

richard.craddock@amanafs.co.uk, support@amanafs.co.ukSharing Status:

No SharingWebsite of Licensed Institution:

http://www.amanafs.co.uk/Expiration Time:

--Address of Licensed Institution:

Office 961 9 Appold St London EC2A 2AP UNITED KINGDOMPhone Number of Licensed Institution:

+4402072486494Licensed Institution Certified Documents:

Is Amana Capital A Scam?

Introduction

Amana Capital, established in 2010, has positioned itself as a prominent player in the forex and CFD trading market, particularly within the MENA (Middle East and North Africa) region. The broker offers a diverse range of financial instruments, including forex, stocks, commodities, and cryptocurrencies, catering to both retail and institutional clients. With the rise of online trading, it has become increasingly important for traders to assess the legitimacy and reliability of their chosen brokers. This evaluation is crucial as the forex market is rife with potential scams and unregulated entities that can jeopardize traders' investments.

This article aims to provide a comprehensive analysis of Amana Capital, examining its regulatory status, company background, trading conditions, customer safety measures, user experiences, and overall risk profile. The investigation is based on various reputable sources, including regulatory bodies, financial reviews, and user testimonials, ensuring an objective and thorough assessment.

Regulation and Legitimacy

The regulatory landscape is a fundamental aspect of any brokerage's credibility. Amana Capital is regulated by multiple authorities across different jurisdictions, which is a positive indicator of its legitimacy. Below is a summary of its regulatory status:

| Regulatory Authority | License Number | Jurisdiction | Verification Status |

|---|---|---|---|

| FCA | 605070 | United Kingdom | Verified |

| DFSA | F003269 | Dubai, UAE | Verified |

| CySEC | 155/11 | Cyprus | Verified |

| CMA | 26 | Lebanon | Verified |

| LFSA | MB/18/0025 | Labuan, Malaysia | Verified |

| FSC | C118023192 | Mauritius | Verified |

The presence of these regulatory licenses, particularly from the UK's FCA and Dubai's DFSA, suggests that Amana Capital adheres to strict financial standards and operational guidelines. The FCA, in particular, is known for its rigorous oversight, providing a level of investor protection that is generally considered robust.

However, the broker has faced scrutiny regarding its compliance history, with some reports indicating irregularities in customer fund management and withdrawal processes. Despite these concerns, the overall regulatory framework surrounding Amana Capital appears to support its legitimacy as a trading entity.

Company Background Investigation

Amana Capital was founded in 2010 in Beirut, Lebanon, and has since expanded its operations to multiple countries, including the UAE, Cyprus, and the UK. The company operates under several entities, each regulated by the respective financial authorities in their jurisdictions. This multi-entity structure allows Amana Capital to cater to a broader client base while adhering to local regulations.

The management team comprises professionals with extensive experience in finance and trading, which enhances the broker's credibility. However, the company's transparency regarding its ownership structure and operational practices has been questioned. While it claims to prioritize transparency, the level of information disclosed to the public is sometimes limited, which can lead to skepticism among potential clients.

Overall, Amana Capital's background indicates a broker with a solid foundation and a commitment to compliance, but the lack of comprehensive transparency may raise concerns for some traders.

Trading Conditions Analysis

Amana Capital offers a variety of trading accounts with different fee structures, catering to both novice and experienced traders. The broker's overall fee structure is considered competitive, but there are areas of concern that warrant attention. Below is a comparison of key trading costs:

| Fee Type | Amana Capital | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 1.4 pips | 1.0 pips |

| Commission Model | Spread-only | Varies |

| Overnight Interest Range | Varies | Varies |

The spread for major currency pairs, such as EUR/USD, starting at 1.4 pips is slightly higher than the industry average, which typically hovers around 1.0 pips. This could be a disadvantage for low-volume traders who may find better rates elsewhere. Additionally, while the broker does not charge commissions on forex trading, fees for CFDs and other instruments can apply, which may lead to unexpected costs for traders.

It is essential for traders to carefully review the fee structure associated with their chosen account type, as discrepancies can significantly impact trading profitability.

Customer Funds Safety

The safety of customer funds is paramount in the trading industry. Amana Capital employs several measures to protect client assets, including segregated accounts, which ensure that client funds are kept separate from the broker's operational funds. This practice is crucial in the event of insolvency, as it helps to safeguard investors' capital.

Furthermore, Amana Capital offers negative balance protection, which prevents traders from losing more than their account balance. This feature is particularly beneficial in volatile market conditions, where sudden price swings can lead to significant losses.

However, there have been historical concerns regarding the broker's handling of withdrawals and customer complaints about fund accessibility. Such issues can undermine confidence in the broker's commitment to safeguarding client assets.

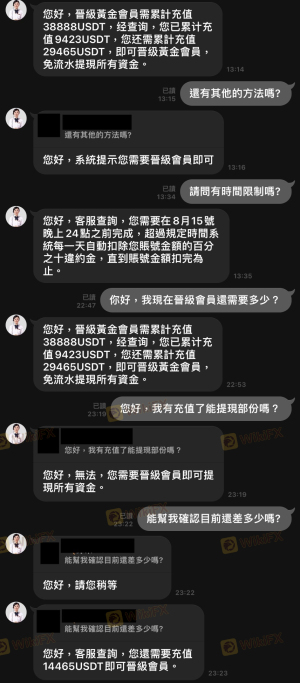

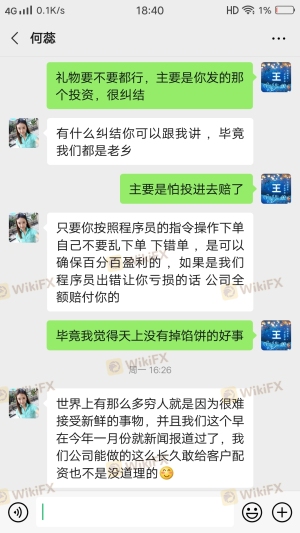

Customer Experience and Complaints

Customer feedback is a vital component in assessing a broker's reliability. While many users report positive experiences with Amana Capital, there are notable complaints regarding withdrawal processes and customer service responsiveness. Common complaint types include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Customer Support Availability | Medium | Limited Hours |

| Account Blocking | High | Inconsistent |

Several users have reported difficulties in withdrawing funds, sometimes leading to account blocks or requests for additional deposits before processing withdrawals. These issues have raised red flags among traders, prompting calls for greater transparency and improved customer support.

For instance, one user reported being unable to withdraw funds after multiple attempts, citing a lack of communication from customer service. Such experiences can significantly impact a trader's perception of the broker's integrity.

Platform and Execution

Amana Capital primarily utilizes the well-regarded MetaTrader 4 and MetaTrader 5 platforms, which are known for their robust features and user-friendly interfaces. The platforms provide traders with essential tools for market analysis and automated trading capabilities. However, there have been mixed reviews regarding the execution quality and stability of the platforms.

Traders have expressed concerns about slippage and order rejections during high-volatility periods, which can adversely affect trading outcomes. While the platforms are generally reliable, any signs of manipulation or execution issues should be closely monitored.

Risk Assessment

Engaging with Amana Capital carries certain risks that potential traders should be aware of. Below is a summary of the key risk areas associated with trading through this broker:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Potential compliance issues reported |

| Withdrawal Risk | High | Complaints regarding fund accessibility |

| Platform Stability Risk | Medium | Occasional execution issues reported |

To mitigate these risks, traders are advised to conduct thorough research and consider starting with a demo account to familiarize themselves with the platform and trading conditions before committing significant capital.

Conclusion and Recommendations

In conclusion, Amana Capital presents itself as a regulated broker with a solid operational framework. However, potential traders should remain vigilant due to reports of withdrawal issues and concerns regarding customer support. While the broker is not classified as a scam, the presence of complaints and the need for improved transparency suggest that caution is warranted.

For traders seeking reliable alternatives, it may be beneficial to explore brokers with a stronger reputation for customer service and fewer reported issues. Recommended alternatives include brokers like IG, OANDA, or Forex.com, known for their robust regulatory frameworks and positive user experiences. Ultimately, due diligence is key when selecting a forex broker to ensure a secure and satisfactory trading experience.

Is amana a scam, or is it legit?

The latest exposure and evaluation content of amana brokers.

amana Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

amana latest industry rating score is 6.66, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.66 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.