Amana 2025 Review: Everything You Need to Know

Executive Summary

This amana review gives you a complete look at Amana Capital, a financial brokerage firm that works in the forex trading market. The company shows mixed results with some good points and some areas that need work, based on data from multiple sources.

Amana Capital works as a regulated forex broker under the Securities and Commodities Authority (SCA). This gives traders the regulatory safety they want when picking a broker. The broker has a user rating of 4.3 out of 5 on BestCompany.com, which shows customers are generally happy with the service. But KitchenReviews.com says only 20% of customers actually recommend Amana services.

The broker focuses on small to medium-sized traders and investors who have some market experience. They offer services for both retail traders and semi-professional trading groups. The regulatory framework gives important protection, but there isn't much detailed information about trading conditions and platform features. This makes it hard for potential clients to fully evaluate the broker.

Key strengths include regulatory compliance and decent user satisfaction ratings. Areas of concern include transparency about trading conditions and the low customer recommendation rate. This amana review helps traders get the essential information they need to make smart decisions about this brokerage option.

Important Notice

When you look at Amana Capital, you should know that different regional entities may work under different regulatory frameworks and service conditions.

The regulatory requirements and protection levels can be very different between jurisdictions. This might affect the trading environment, available instruments, and client protections offered. This evaluation uses publicly available information and user feedback from various sources including review platforms and regulatory databases.

The assessment relies mainly on data from the Securities and Commodities Authority (SCA) regulatory information and customer feedback platforms. Traders should do their own research and check current terms and conditions directly with the broker before making any trading decisions. Market conditions and broker policies can change quickly, and information in this review shows the status at the time we put it together.

Prospective clients should confirm all details directly with Amana Capital representatives.

Rating Framework

Based on available information and industry standards, here are the ratings for Amana Capital across six key dimensions:

Rating Methodology: The trust and regulation score of 7/10 comes from SCA regulatory oversight and the 4.3 user rating from BestCompany.com.

Other dimensions stay unrated because we don't have enough specific information in available sources.

Broker Overview

Amana Capital works as a financial brokerage institution that specializes in forex trading services. While we don't know the exact founding year from available documentation, the company has made itself known as a regulated entity in the competitive forex brokerage landscape.

The firm positions itself to serve traders who want regulatory compliance and structured trading environments. The company's business model centers on providing forex trading services through a traditional brokerage framework. Amana Capital focuses on giving trading access to currency markets while keeping regulatory compliance standards.

The broker's approach seems to target traders who put regulatory oversight and established operational frameworks first over cutting-edge features or highly competitive pricing structures.

Operating under Securities and Commodities Authority (SCA) regulation, Amana Capital gets oversight from a recognized financial regulatory body. This regulatory framework gives essential client protections and operational standards that many traders think are fundamental when selecting a forex broker. The SCA regulation makes sure the company follows specific operational and financial requirements that protect client interests.

The broker's target market includes small to medium-sized traders and investors with some market experience. This positioning suggests that Amana Capital aims to serve traders who understand basic market principles but may not need the most sophisticated institutional-level tools.

This amana review shows that the broker focuses on providing reliable access to forex markets rather than creating innovative trading solutions.

Regulatory Jurisdiction: Amana Capital operates under the regulation of the Securities and Commodities Authority (SCA), providing clients with regulatory protection and oversight.

This regulatory framework makes sure the company follows established financial service standards and client protection protocols. Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods is not detailed in the available source materials.

Potential clients should check available payment options directly with the broker. Minimum Deposit Requirements: The minimum deposit requirements for various account types are not specified in the current information sources.

This information gap requires direct inquiry with Amana Capital representatives. Bonus and Promotional Offers: Details about current bonus structures or promotional campaigns are not available in the reviewed materials.

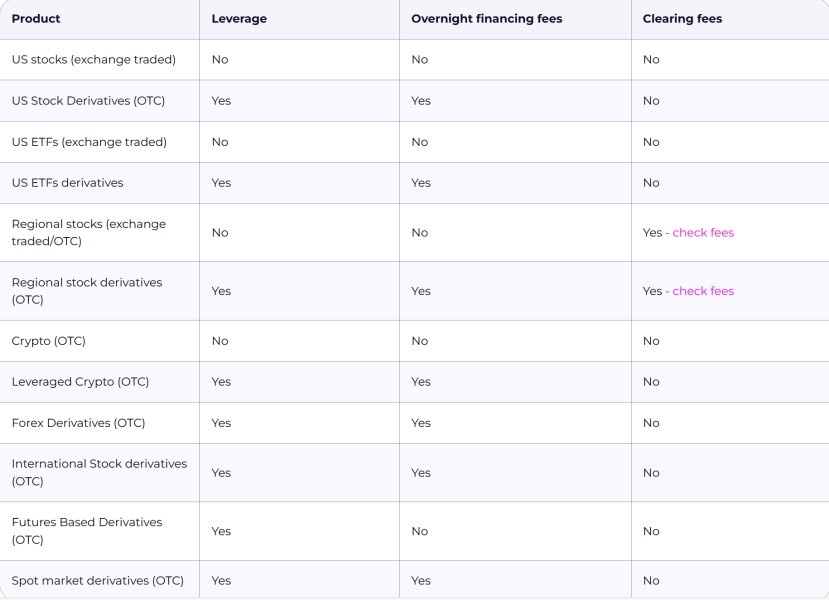

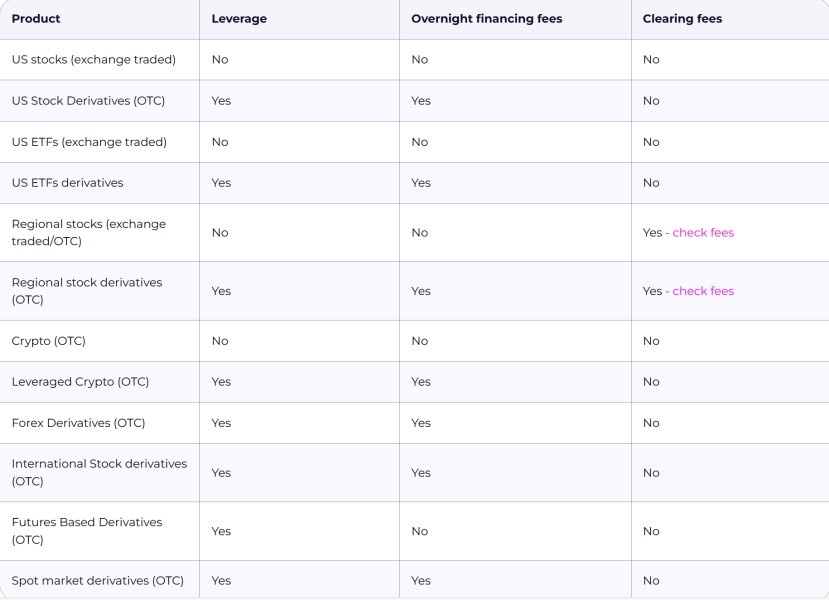

Traders interested in promotional offers should contact the broker directly for current opportunities. Tradeable Assets: The specific range of tradeable instruments and asset classes offered by Amana Capital is not detailed in the available documentation.

While the broker focuses on forex trading, the complete instrument list requires verification. Cost Structure: Information about spreads, commissions, and other trading costs is not provided in the source materials.

The fee structure represents a significant information gap that potential clients must address through direct broker contact. Leverage Options: Leverage ratios and margin requirements are not specified in the available information.

These critical trading parameters require clarification from the broker. Platform Options: Specific trading platform offerings and their features are not detailed in the current source materials.

Geographic Restrictions: Information about service availability in different regions is not specified in the reviewed materials. Customer Service Languages: Available customer support languages are not mentioned in the source documentation.

This amana review shows the need for direct broker contact to get comprehensive trading condition details.

Detailed Rating Analysis

Account Conditions Analysis (Rating: Not Available)

The evaluation of Amana Capital's account conditions faces significant limitations because there isn't enough publicly available information.

Standard account condition assessments typically look at account type variety, minimum deposit requirements, account opening procedures, and specialized features such as Islamic accounts for Sharia-compliant trading. Without specific details about account tiers, deposit requirements, or special account features, it becomes impossible to provide a meaningful comparative analysis.

Industry-standard evaluations require information about demo account availability, account maintenance fees, inactivity charges, and minimum trading volumes. The absence of this information in available sources prevents a comprehensive account conditions assessment.

Professional traders typically evaluate account conditions based on flexibility, accessibility, and alignment with their trading strategies. The lack of clear information about these fundamental aspects raises questions about the broker's commitment to information transparency.

Potential clients seeking specific account features or having particular deposit constraints cannot make informed decisions without this essential information. The account opening process complexity, required documentation, and verification timeframes also remain unclear.

These operational aspects significantly impact the user experience and trader satisfaction levels. This amana review emphasizes the importance of getting detailed account condition information directly from the broker before making any commitments.

The assessment of Amana Capital's trading tools and educational resources cannot be completed because there isn't enough information in available sources.

Comprehensive broker evaluations typically examine charting capabilities, technical analysis tools, market research provision, economic calendars, and automated trading support. Modern forex brokers are expected to provide sophisticated analytical tools, real-time market data, and comprehensive educational materials.

The absence of specific information about these resources prevents evaluation of the broker's competitive positioning in terms of trader support and platform capabilities. Educational resources play a crucial role in trader development and retention.

Quality brokers typically offer webinars, tutorials, market analysis, and trading guides. Without information about Amana Capital's educational offerings, potential clients cannot assess the broker's commitment to trader development and ongoing support.

Research and analysis capabilities are fundamental for informed trading decisions. Professional-grade brokers provide market commentary, technical analysis, fundamental analysis, and trading signals.

The lack of detailed information about these services limits the ability to evaluate the broker's analytical support quality.

Customer Service and Support Analysis (Rating: Not Available)

Customer service evaluation requires specific information about support channels, response times, service quality, and availability that is not present in the current source materials.

Professional forex brokers typically offer multiple contact methods including live chat, email, phone support, and sometimes social media channels. Response time benchmarks vary across the industry, but quality brokers generally provide rapid responses during market hours and reasonable response times during off-hours.

The availability of 24/5 support during forex market hours is considered standard for serious forex brokers. Multilingual support capabilities are increasingly important in the global forex market.

Brokers serving international clients typically provide support in major languages including English, Arabic, Spanish, and other regional languages depending on their target markets. Problem resolution effectiveness and customer satisfaction with support interactions are critical metrics that remain unmeasurable without specific user feedback and service quality data.

The absence of detailed customer service information prevents meaningful evaluation of this crucial broker dimension.

Trading Experience Analysis (Rating: Not Available)

Platform stability, execution speed, and overall trading environment assessment cannot be completed because there isn't enough technical information in available sources.

Trading experience evaluation typically includes platform reliability, order execution quality, slippage analysis, and mobile trading capabilities. Modern traders expect fast, reliable order execution with minimal slippage and rejection rates.

Platform stability during high-volatility periods and major news events is crucial for serious trading operations. Without specific performance data or user experience reports, these critical aspects remain unevaluated.

Mobile trading capabilities have become essential for contemporary forex trading. The quality of mobile applications, feature parity with desktop platforms, and mobile-specific functionality significantly impact the overall trading experience.

Information about mobile trading options is not available in current sources. Trading environment factors such as available order types, one-click trading, partial fills handling, and advanced order management features require detailed platform analysis that cannot be conducted without specific platform information.

This amana review cannot provide meaningful trading experience assessment without these fundamental details.

Trust and Regulation Analysis (Rating: 7/10)

Amana Capital's regulatory status under the Securities and Commodities Authority (SCA) provides a solid foundation for trust and credibility.

The SCA operates as a recognized financial regulatory body that enforces compliance standards and client protection measures. This regulatory oversight ensures that the broker must maintain specific operational standards and financial requirements.

Regulatory compliance represents one of the most critical factors in broker selection, as it provides legal recourse and protection for client funds. The SCA regulation shows that Amana Capital operates within an established regulatory framework that monitors broker activities and enforces industry standards.

However, the trust rating is limited by the lack of detailed information about additional safety measures such as segregated client funds, deposit insurance coverage, and transparency in financial reporting. While regulatory oversight provides basic protection, comprehensive trust evaluation requires information about the broker's financial stability and risk management practices.

The 4.3 user rating from BestCompany.com supports the positive regulatory foundation but is somewhat offset by the low 20% customer recommendation rate reported by KitchenReviews.com. This difference suggests that while users find the service acceptable, they may not be enthusiastic advocates for the broker.

User Experience Analysis (Rating: Not Available)

User experience evaluation relies heavily on the 4.3 rating from BestCompany.com, which shows generally positive user satisfaction.

However, this single data point provides limited insight into specific user experience aspects such as platform usability, account management efficiency, and overall service satisfaction. The 20% customer recommendation rate from KitchenReviews.com presents a concerning contrast to the 4.3 rating.

This low recommendation rate suggests that while users may not be dissatisfied enough to provide negative ratings, they lack sufficient enthusiasm to actively recommend the service to others. Interface design, ease of use, and platform navigation are crucial components of user experience that remain unevaluated due to insufficient information.

Modern traders expect intuitive platforms with efficient workflows and minimal learning curves for basic operations. Registration and verification processes significantly impact initial user experience.

Complex, time-consuming onboarding procedures can deter potential clients, while streamlined processes enhance user satisfaction. Without specific information about these procedures, user experience assessment remains incomplete.

Conclusion

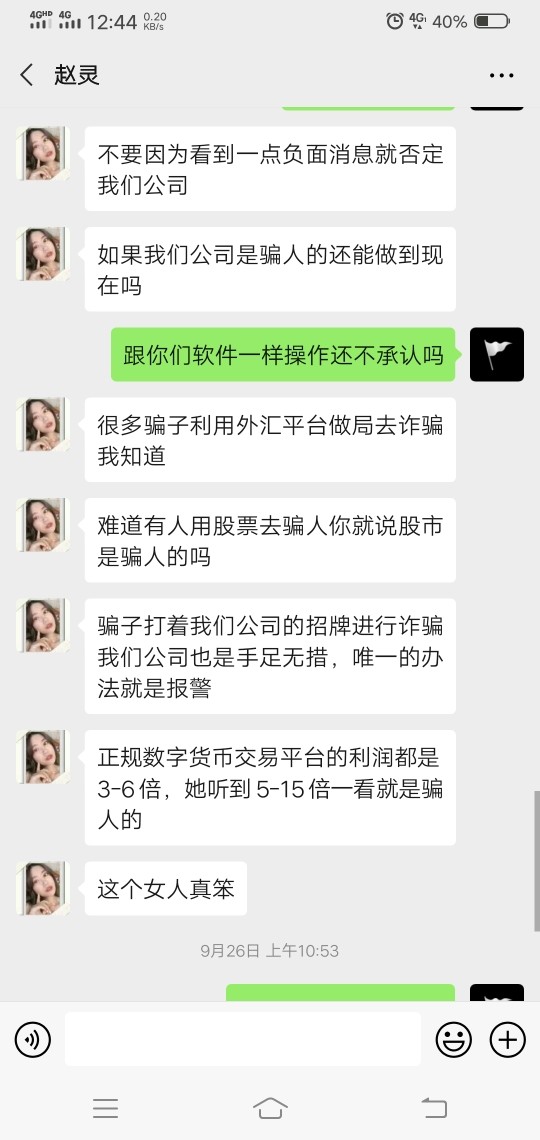

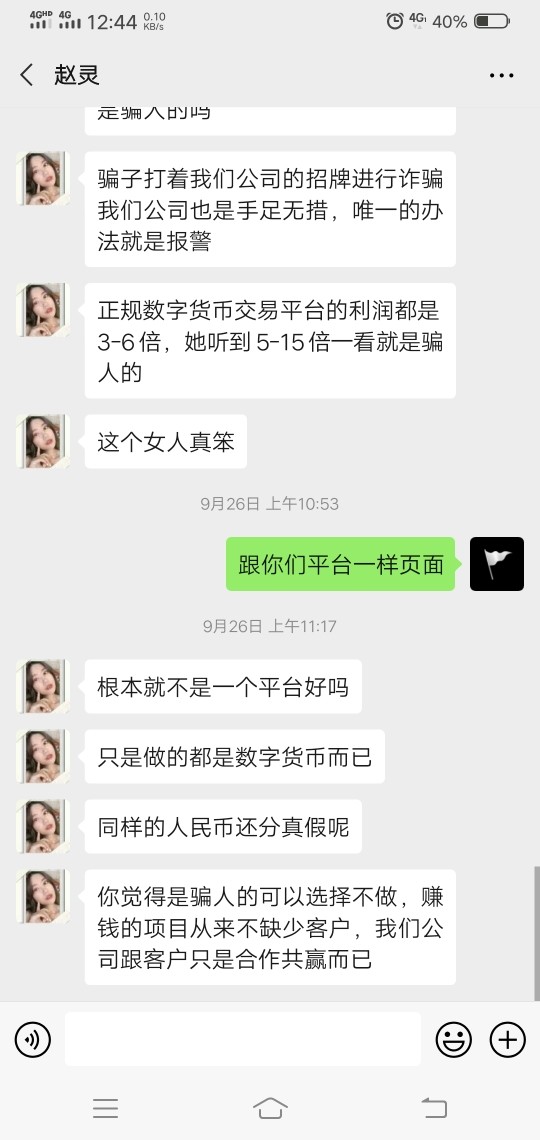

This amana review reveals a forex broker with a solid regulatory foundation but significant transparency limitations.

Amana Capital's regulation by the Securities and Commodities Authority (SCA) provides essential credibility and client protection, earning a trust rating of 7/10. The 4.3 user rating from BestCompany.com shows generally acceptable service levels.

However, the broker faces substantial challenges in information transparency. The absence of detailed information about trading conditions, platform features, costs, and customer service capabilities prevents comprehensive evaluation across most assessment dimensions.

The 20% customer recommendation rate suggests that while the service may be adequate, it lacks the compelling features or exceptional service quality that creates strong customer advocacy. Suitable User Types: Based on available information, Amana Capital appears most suitable for small to medium-sized traders and investors with some market experience who prioritize regulatory compliance over cutting-edge features or highly competitive conditions.

Key Advantages: SCA regulation provides regulatory protection, and the 4.3 user rating shows acceptable service levels for existing clients. Primary Limitations: Lack of transparency about trading conditions, platform features, and costs creates significant barriers for informed decision-making.

The low customer recommendation rate suggests limited competitive advantages in service quality or trading conditions. Potential clients should conduct thorough direct inquiries with Amana Capital to get the detailed information necessary for informed broker selection decisions.