Regarding the legitimacy of ActivTrades forex brokers, it provides FCA, SCB and WikiBit, (also has a graphic survey regarding security).

Is ActivTrades safe?

Pros

Cons

Is ActivTrades markets regulated?

The regulatory license is the strongest proof.

FCA Market Making License (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Activtrades Plc

Effective Date:

2005-10-27Email Address of Licensed Institution:

compliance@activtrades.comSharing Status:

No SharingWebsite of Licensed Institution:

www.activtrades.co.ukExpiration Time:

--Address of Licensed Institution:

ActivTrades Plc The Loom, Office 2.6 14 Gowers Walk London Tower Hamlets E1 8PY UNITED KINGDOMPhone Number of Licensed Institution:

+4402076500500Licensed Institution Certified Documents:

SCB Derivatives Trading License (MM)

The Securities Commission of The Bahamas

The Securities Commission of The Bahamas

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (MM)

Licensed Entity:

ActivTrades Corp

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

209/210 Church Street, Sandyport Plaza, Nassau, BahamasPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is ActivTrades A Scam?

Introduction

ActivTrades is a UK-based brokerage firm that specializes in forex and contracts for difference (CFD) trading. Founded in 2001, it has established itself as a prominent player in the retail trading sector, offering a range of financial instruments including forex, commodities, indices, and cryptocurrencies. As the financial markets continue to grow and evolve, traders must exercise caution and diligence when selecting a brokerage. A thorough evaluation of a broker's regulatory standing, trading conditions, and customer experiences is essential to ensure a safe trading environment. This article aims to provide an objective analysis of ActivTrades, utilizing data from various credible sources to assess its legitimacy and safety.

Regulation and Legitimacy

Regulation is a crucial aspect of any brokerage, as it provides a framework for ensuring compliance with financial laws and protecting clients' interests. ActivTrades is regulated by several reputable authorities, including the UK's Financial Conduct Authority (FCA), which is known for its stringent regulatory requirements. Below is a summary of ActivTrades' regulatory information:

| Regulatory Authority | License Number | Regulated Region | Verification Status |

|---|---|---|---|

| FCA | 434413 | UK | Verified |

| SCB | 199667 | Bahamas | Verified |

| CMVM | 433 | Portugal | Verified |

| BACEN | 43.050.917/0001-03 | Brazil | Verified |

| CONSOB | 5257 | Italy | Verified |

The FCA's oversight is particularly significant, as it ensures that ActivTrades adheres to high standards of transparency and client protection. Additionally, the broker provides negative balance protection, which prevents clients from losing more than their deposited funds. Despite its solid regulatory framework, ActivTrades also operates through its Bahamian entity, which may raise concerns regarding the level of investor protection compared to stricter jurisdictions like the FCA. Nevertheless, the overall regulatory status of ActivTrades indicates that it is a legitimate broker, as it has consistently complied with the requirements set forth by the regulatory bodies.

Company Background Investigation

ActivTrades was established in Switzerland in 2001 and later relocated its headquarters to London in 2005. Over the years, the firm has expanded its operations and now serves clients in over 140 countries. The company was founded by Alex Pusco, who continues to lead the organization today. Under his leadership, ActivTrades has grown significantly, developing a reputation for providing high-quality trading services and innovative solutions.

The management team at ActivTrades consists of experienced professionals from various backgrounds in finance and technology, contributing to the firm's robust operational framework. The company maintains a high level of transparency, regularly publishing financial reports and updates regarding its services. ActivTrades has also received numerous awards for its customer service and trading conditions, further solidifying its reputation in the industry. Overall, the company's long history, experienced management team, and commitment to transparency suggest that it is a trustworthy broker.

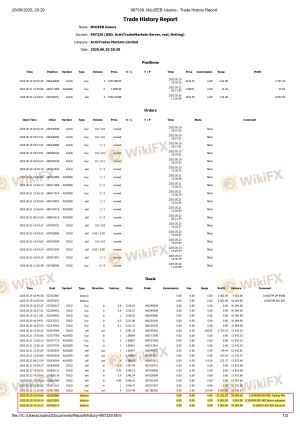

Trading Conditions Analysis

ActivTrades offers a competitive trading environment with a focus on transparency and low trading costs. The broker primarily operates on a spread-only model, meaning that traders do not incur additional commissions for most trades. Below is a comparison of ActivTrades' core trading costs with industry averages:

| Fee Type | ActivTrades | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.5 pips | 1.2 pips |

| Commission Model | None (spread only) | Varies |

| Overnight Interest Range | Varies by position | Varies |

The average spread for major currency pairs starts at 0.5 pips, which is highly competitive compared to the industry average of 1.2 pips. This low-cost structure makes ActivTrades an attractive option for traders who are cost-conscious. However, the broker does charge a monthly inactivity fee of €10 after one year of account inactivity, which could be a drawback for traders who do not trade frequently.

While the overall fee structure appears favorable, traders should be aware of potential costs associated with currency conversions and withdrawal fees for certain payment methods. For example, ActivTrades imposes a 0.5% currency conversion fee for deposits and withdrawals made in a currency different from the account's base currency. Overall, ActivTrades offers a transparent and competitive trading environment, but traders should carefully review the fee structure to avoid unexpected costs.

Customer Fund Safety

The safety of client funds is a top priority for ActivTrades. The broker employs several measures to ensure the security of its clients' assets. All client funds are held in segregated accounts, which means that they are kept separate from the company's operational funds. This practice protects clients in the event of financial difficulties faced by the broker.

Additionally, ActivTrades provides negative balance protection, ensuring that clients cannot lose more than their deposited funds. The broker also offers additional insurance coverage of up to $1 million, which further enhances the safety of client funds. Despite these robust safety measures, it is essential for traders to remain vigilant and aware of the potential risks associated with trading, particularly in volatile markets.

Historically, ActivTrades has maintained a good track record regarding fund safety and has not faced any significant controversies or issues related to client fund protection. The combination of regulatory oversight, segregated accounts, and insurance coverage positions ActivTrades as a safe choice for traders looking to protect their investments.

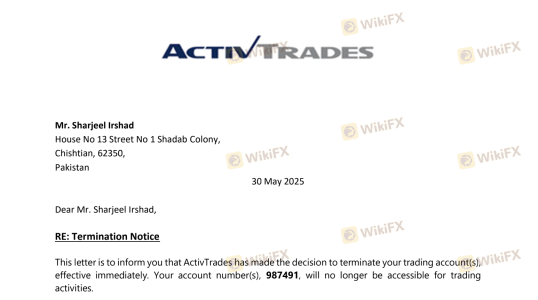

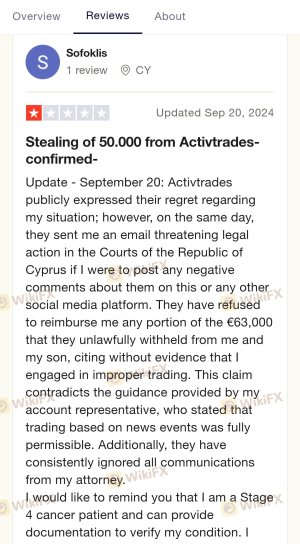

Customer Experience and Complaints

Customer feedback is a critical component of evaluating a broker's performance. ActivTrades has generally received positive reviews from clients, particularly regarding its responsive customer support and user-friendly trading platforms. However, like any broker, it has faced some common complaints. Below is a summary of the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | Moderate | Generally responsive |

| Platform Issues | Moderate | Addressed in updates |

| Inactivity Fees | Low | Clearly communicated |

One common complaint involves delays in processing withdrawals, which can be frustrating for traders needing timely access to their funds. While ActivTrades generally responds well to inquiries, some clients have reported longer wait times during peak periods. Another issue raised by users is related to occasional technical glitches on the trading platform, which can affect the trading experience.

For instance, one user reported experiencing slippage during a high-volatility trading session, leading to unexpected losses. However, the broker addressed the issue promptly, providing a clear explanation of the circumstances. Overall, while there are areas for improvement, ActivTrades has shown a commitment to addressing customer concerns and enhancing the overall trading experience.

Platform and Execution Quality

ActivTrades offers a range of trading platforms, including its proprietary ActivTrader platform, as well as the widely used MetaTrader 4 (MT4) and MetaTrader 5 (MT5). The performance and stability of these platforms are generally well-regarded, with users praising their ease of use and advanced features.

In terms of order execution, ActivTrades boasts an average execution time of under 0.004 seconds, which is competitive in the industry. The broker employs a market maker model, which allows for quick order processing without requotes. However, some users have reported occasional slippage during periods of high market volatility, which is a common occurrence across many brokers.

While there is no substantial evidence to suggest any manipulative practices on ActivTrades' platforms, traders should remain aware of the inherent risks associated with trading in volatile markets. The overall user experience on ActivTrades' platforms is positive, with many traders appreciating the range of tools and features available for technical analysis and risk management.

Risk Assessment

Using ActivTrades does come with certain risks, as is the case with any trading platform. Below is a summary of the key risk areas associated with trading through ActivTrades:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Low | Strongly regulated by reputable bodies |

| Market Risk | High | Volatility can lead to significant losses |

| Execution Risk | Medium | Occasional slippage in volatile markets |

| Withdrawal Risk | Medium | Delays in processing withdrawals |

To mitigate these risks, traders should ensure they fully understand the nature of the financial instruments they are trading, implement sound risk management strategies, and stay informed about market conditions. It is also advisable to maintain open communication with customer support in case of any issues.

Conclusion and Recommendations

In conclusion, ActivTrades is a legitimate broker with a solid regulatory framework and a commitment to client safety. The broker's long history, positive customer feedback, and competitive trading conditions suggest that it is a trustworthy choice for traders. However, potential clients should be aware of the occasional withdrawal delays and the fees associated with inactivity and currency conversions.

For traders looking for a reliable broker with strong regulatory oversight, ActivTrades is worth considering. However, those seeking a broader range of trading instruments or 24/7 customer support may want to explore alternative options. Other reputable brokers to consider include IG Group, OANDA, and CMC Markets, each offering diverse trading conditions and a wide array of financial instruments. Ultimately, traders should align their individual needs and trading strategies with the offerings of the broker they choose.

Is ActivTrades a scam, or is it legit?

The latest exposure and evaluation content of ActivTrades brokers.

ActivTrades Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ActivTrades latest industry rating score is 7.20, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.20 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.