ActivTrades 2025 Review: Everything You Need to Know

Summary

ActivTrades is a well-regulated forex and CFD broker. The company has been serving traders since 2001, building a strong reputation over more than two decades. This activtrades review shows a broker that offers competitive trading conditions with ultra-tight spreads starting from 0 pips and fast execution speeds that have earned positive feedback across the industry. The UK-based broker operates under multiple regulatory frameworks including the FCA. It provides services to both retail and institutional clients across 170 jurisdictions worldwide.

The broker's standout features include access to over 1,000 trading instruments. These span forex, stocks, indices, commodities, bonds, and cryptocurrencies, all available through popular platforms including MT4, MT5, TradingView, and their proprietary ActivTrader platform. According to brokerchooser.com, ActivTrades has established itself as an award-winning CFD broker. The company particularly appeals to traders who prioritize execution quality and regulatory compliance.

ActivTrades targets a diverse clientele ranging from beginner retail traders to sophisticated institutional investors. The broker offers scalable solutions that accommodate varying trading volumes and strategies. The broker's commitment to transparency and regulatory adherence makes it particularly suitable for traders in Europe and other regulated markets who prioritize security and reliability in their trading operations.

Important Notice

ActivTrades operates through different regional entities to comply with local regulatory requirements. This may result in variations in services, products, and trading conditions depending on your jurisdiction. Clients should verify the specific offerings available in their region before opening an account.

This review is based on publicly available information, user feedback, and industry reports available as of 2024. The assessment aims to provide an objective evaluation of ActivTrades' services. However, individual trading experiences may vary based on personal trading styles, market conditions, and regional regulations.

Rating Framework

Broker Overview

Founded in 2001, ActivTrades has established itself as a prominent player in the online trading industry. The company is headquartered in the United Kingdom with a focus on delivering professional-grade forex and CFD trading services. According to comparebrokers.co, the broker has built its reputation on providing "one of the best trading conditions in the market" with particularly competitive spreads. These spreads appeal to both individual and institutional traders.

The company operates under a multi-jurisdictional regulatory framework. It holds licenses from respected financial authorities including the Financial Conduct Authority (FCA) in the UK, Comissão do Mercado de Valores Mobiliários (CMVM) in Portugal, the Financial Commission Bahamas (FCB), and the Financial Services Commission (FSC) in Seychelles. This comprehensive regulatory coverage enables ActivTrades to serve clients across 170 different jurisdictions while maintaining compliance with local financial regulations.

ActivTrades supports multiple trading platforms to accommodate diverse trader preferences and strategies. The broker offers access to the industry-standard MetaTrader 4 and MetaTrader 5 platforms, the increasingly popular TradingView platform, and their proprietary ActivTrader platform. This activtrades review found that the platform diversity allows traders to choose tools that best match their technical analysis needs and trading workflows. The options range from basic forex trading to advanced algorithmic strategies across multiple asset classes including stocks, indices, commodities, bonds, and cryptocurrencies.

Regulatory Coverage: ActivTrades maintains regulatory compliance across multiple jurisdictions through licenses from the FCA (UK), CMVM (Portugal), FCB (Bahamas), and FSC (Seychelles). This ensures client protection and operational transparency across different regions.

Deposit and Withdrawal Methods: Specific deposit and withdrawal options are not detailed in the available source materials. However, regulated brokers typically offer standard banking methods including wire transfers, credit cards, and electronic payment systems.

Minimum Deposit Requirements: The exact minimum deposit amounts are not specified in the available documentation. Potential clients need to contact the broker directly for current account opening requirements.

Bonus and Promotional Offers: Current promotional activities or bonus structures are not mentioned in the source materials reviewed for this evaluation.

Available Trading Assets: ActivTrades provides access to over 1,000 trading instruments. These cover major, minor, and exotic forex pairs, individual stocks, stock indices, commodities, government bonds, ETFs, and cryptocurrency CFDs, offering comprehensive market exposure.

Cost Structure: The broker advertises very tight spreads starting from 0 pips, positioning itself competitively in the market. However, specific commission structures and overnight financing rates are not detailed in the available materials.

Leverage Options: Specific leverage ratios available to different account types and regions are not mentioned in the source documentation. These likely vary based on regulatory requirements in different jurisdictions.

Platform Selection: Four main platforms are available: MetaTrader 4, MetaTrader 5, TradingView, and the proprietary ActivTrader platform. These cater to different trading styles from manual analysis to automated trading strategies.

Geographic Restrictions: Specific country restrictions are not detailed in the available materials. However, the broker's multiple regulatory licenses suggest broad international availability with standard exclusions for certain jurisdictions.

This activtrades review notes that while the broker provides substantial trading infrastructure, some specific details about costs and account requirements would benefit from direct broker consultation.

Account Conditions Analysis

ActivTrades' account structure reflects a professional approach to serving diverse trader segments. However, specific details about account tiers and requirements are not comprehensively outlined in available public materials. The broker's emphasis on competitive spreads starting from 0 pips suggests a focus on cost-effective trading conditions that can benefit both high-frequency traders and those with smaller trading volumes.

The absence of detailed minimum deposit information in public materials indicates that ActivTrades may offer flexible account opening requirements. It may also customize these based on individual trader needs and regional regulations. This approach is common among brokers serving multiple jurisdictions where regulatory requirements and market conditions vary significantly.

Account opening procedures are not specifically detailed in the reviewed materials. However, the broker's multiple regulatory licenses suggest standard KYC (Know Your Customer) and AML (Anti-Money Laundering) compliance procedures. The regulatory framework under FCA and other authorities typically requires identity verification, proof of residence, and financial suitability assessments.

Special account features such as Islamic accounts for Sharia-compliant trading are not mentioned in the available documentation. Given the broker's international reach across 170 jurisdictions, such offerings may be available but require direct inquiry with the broker to confirm availability and specific terms.

This activtrades review finds that while the broker appears to offer competitive basic conditions, potential clients would benefit from direct consultation. This would help them understand specific account features, requirements, and any special accommodations available for their trading needs and regulatory jurisdiction.

ActivTrades demonstrates exceptional strength in trading instrument diversity. The broker offers access to over 1,000 different trading opportunities across multiple asset classes. According to brokersway.com, this extensive selection includes major, minor, and exotic forex pairs, individual shares, stock indices, cryptocurrencies, ETFs, commodities, and government bonds. This provides traders with comprehensive market exposure from a single platform.

The broker's platform selection shows a commitment to meeting varied trader preferences and technical requirements. The availability of MetaTrader 4 and MetaTrader 5 ensures compatibility with popular expert advisors and custom indicators, while TradingView integration appeals to traders who prefer advanced charting and social trading features. The proprietary ActivTrader platform, as noted by topforexbrokers.com, provides additional functionality designed specifically for the broker's trading environment.

Research and analytical resources are not specifically detailed in the available source materials. This represents a potential area where prospective clients should inquire directly about market analysis, economic calendars, and research reports that may be available through the trading platforms or broker's client portal.

Educational resources and training materials are not mentioned in the reviewed documentation. However, many regulated brokers provide educational content to support trader development. The absence of specific information about educational offerings suggests this may be an area where ActivTrades could enhance its value proposition or where such resources exist but are not prominently featured in public materials.

Automated trading support appears robust through the MetaTrader platforms. These are industry standards for algorithmic trading and expert advisor functionality. The multiple platform options ensure that traders with different automation preferences can find suitable tools for their strategies.

Customer Service and Support Analysis

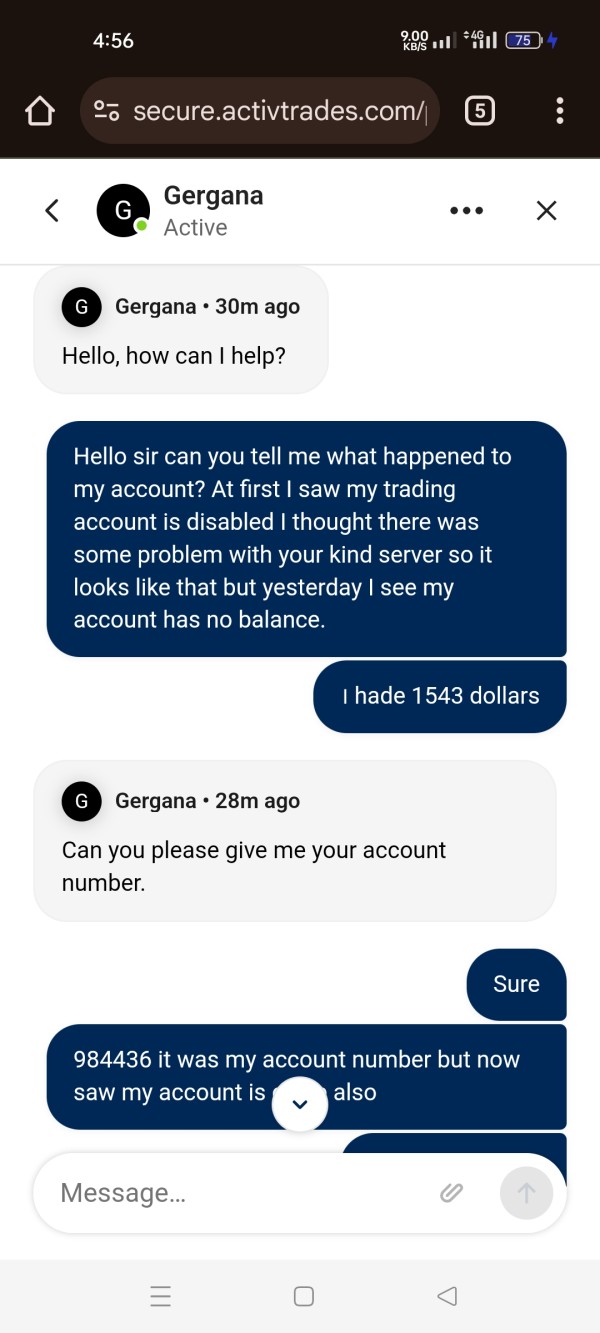

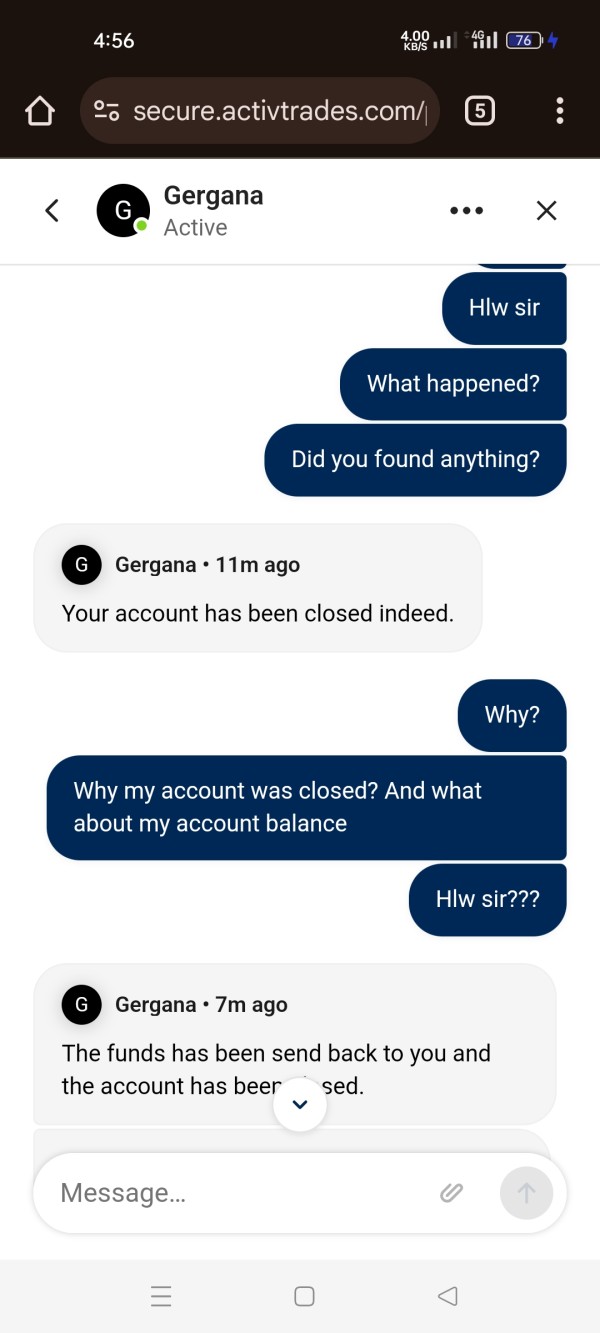

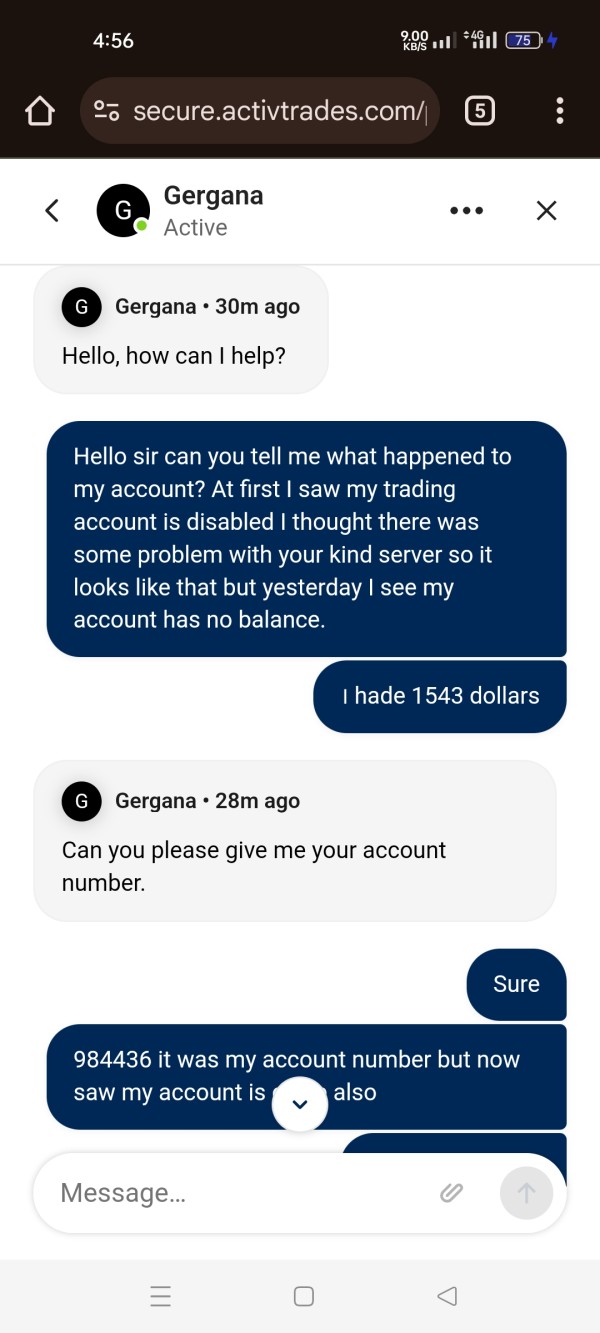

Customer service capabilities and support infrastructure are not comprehensively detailed in the available source materials. This represents a significant information gap for potential clients evaluating ActivTrades. The absence of specific information about support channels, response times, and service quality metrics makes it difficult to assess this critical aspect of the broker's offering.

Support channel availability, including whether the broker offers live chat, telephone support, email assistance, or dedicated account managers, is not specified in the reviewed documentation. Given the broker's international presence across 170 jurisdictions, multiple communication channels would typically be expected to serve diverse client needs and time zones.

Response time commitments and service level agreements are not mentioned in the available materials. However, regulated brokers generally maintain professional standards for client communication and issue resolution. The FCA and other regulatory bodies typically require brokers to maintain adequate customer service standards.

Service quality indicators such as customer satisfaction ratings, support team expertise levels, or problem resolution procedures are not detailed in the source materials. This represents an area where prospective clients would need to rely on direct experience or seek additional user feedback beyond the reviewed sources.

Multilingual support capabilities are not specified. However, the broker's international regulatory presence across multiple countries suggests that language support may be available for major client markets. The specific languages supported and the quality of non-English support would require direct inquiry.

Customer service hours and availability across different time zones are not mentioned in the reviewed materials. However, the global nature of forex markets typically necessitates extended support coverage for active trading periods.

Trading Experience Analysis

ActivTrades receives positive feedback for execution quality and platform performance. Users report satisfaction with trade execution speeds according to the reviewed sources. The broker's emphasis on "lightning-fast execution" suggests a focus on technical infrastructure that can handle rapid order processing, which is crucial for active traders and scalping strategies.

Platform stability appears strong based on the available information. The broker offers multiple established platforms including MetaTrader 4 and MetaTrader 5, both known for reliability and widespread industry acceptance. The addition of TradingView integration provides access to advanced charting capabilities and social trading features that enhance the analytical experience.

Order execution quality benefits from the broker's tight spread structure starting from 0 pips. However, specific information about slippage rates, requotes, or execution statistics is not detailed in the available materials. The competitive spread structure suggests a focus on cost-effective trading that can benefit traders across different strategies and market conditions.

Platform functionality appears comprehensive through the multiple platform options. This allows traders to choose tools that best match their analytical needs and trading styles. The proprietary ActivTrader platform adds broker-specific functionality, while the MetaTrader options ensure compatibility with popular third-party tools and expert advisors.

Mobile trading experience is not specifically addressed in the reviewed materials. However, most modern brokers provide mobile applications or mobile-optimized platforms. The availability and quality of mobile trading tools would require direct verification with the broker.

Trading environment stability is supported by the broker's regulatory compliance and established market presence since 2001. This suggests operational maturity and technical infrastructure capable of supporting consistent trading conditions across different market scenarios.

This activtrades review indicates that while execution quality receives positive user feedback, comprehensive performance metrics and detailed platform comparisons would benefit from direct testing. Additional user experience research would also be valuable.

Trust and Safety Analysis

ActivTrades demonstrates strong regulatory credentials through its multiple licenses from respected financial authorities. This significantly enhances its trustworthiness profile. The FCA license in the UK represents one of the most stringent regulatory frameworks in the financial industry, requiring comprehensive compliance with capital adequacy, client money protection, and operational standards.

The multi-jurisdictional regulatory approach, including licenses from CMVM (Portugal), FCB (Bahamas), and FSC (Seychelles), enables the broker to serve international clients while maintaining appropriate regulatory oversight in different regions. This diversified regulatory structure provides clients with multiple layers of protection and demonstrates the broker's commitment to compliance across various jurisdictions.

Client fund protection measures are not specifically detailed in the available source materials. However, FCA regulation typically requires segregation of client funds and participation in compensation schemes. The specific protections available, such as Financial Services Compensation Scheme (FSCS) coverage for UK clients, would require verification based on individual account jurisdiction and regulatory classification.

Corporate transparency appears adequate through the regulatory disclosures required by multiple authorities. However, specific information about company financials, ownership structure, or operational transparency initiatives is not detailed in the reviewed materials.

Industry recognition as an "award-winning CFD broker" according to brokerchooser.com suggests positive peer and industry assessment. However, the specific awards, recognition criteria, and awarding organizations are not detailed in the available documentation.

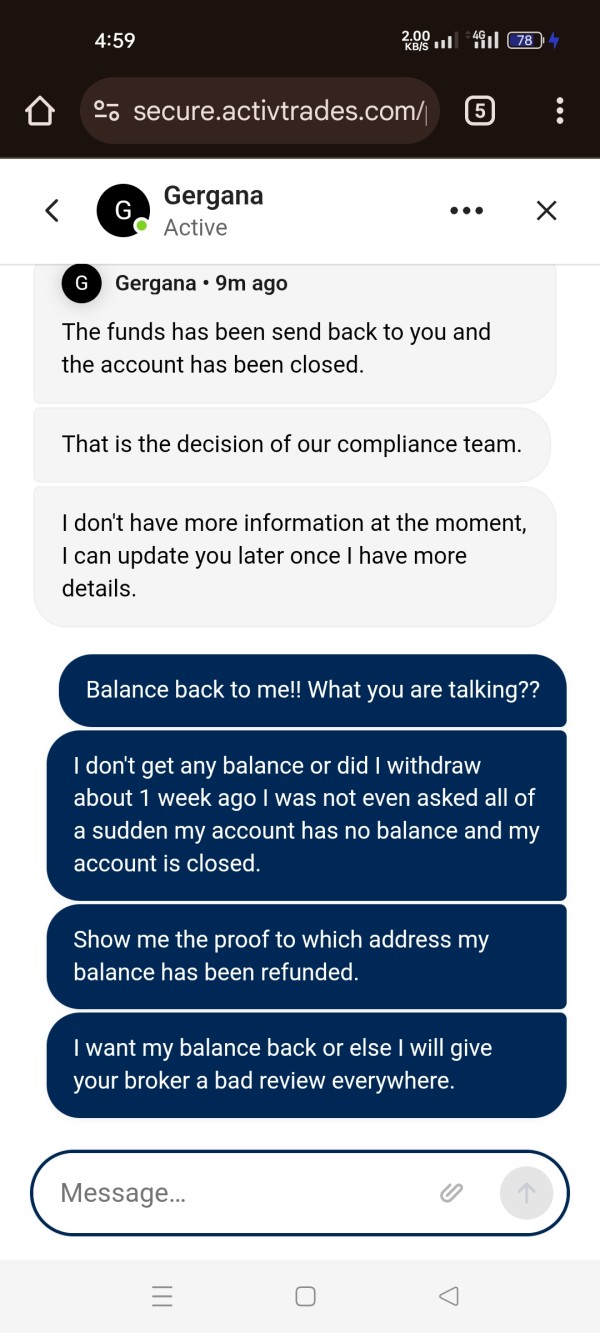

Negative incident handling and dispute resolution procedures are not specifically outlined in the reviewed materials. However, regulatory oversight typically requires formal complaint handling processes and access to financial ombudsman services for eligible clients.

The broker's operational longevity since 2001 provides additional confidence in its stability and market presence. This demonstrates the ability to maintain operations through various market cycles and regulatory changes over more than two decades.

User Experience Analysis

Overall user satisfaction appears positive based on the limited feedback available in the reviewed sources. Particular strength is noted in execution speeds and trading conditions. Users reportedly appreciate the competitive spreads and fast order processing, which are fundamental elements of the trading experience for active traders.

Interface design and platform usability benefit from the broker's multi-platform approach. This allows traders to choose between established platforms like MetaTrader 4/5 and more modern options like TradingView. This flexibility accommodates different user preferences and technical requirements, from basic chart analysis to advanced automated trading strategies.

Registration and account verification processes are not specifically detailed in the available materials. However, regulatory compliance requirements typically involve standard identity verification and suitability assessments. The experience quality of these onboarding processes would require direct user feedback or testing.

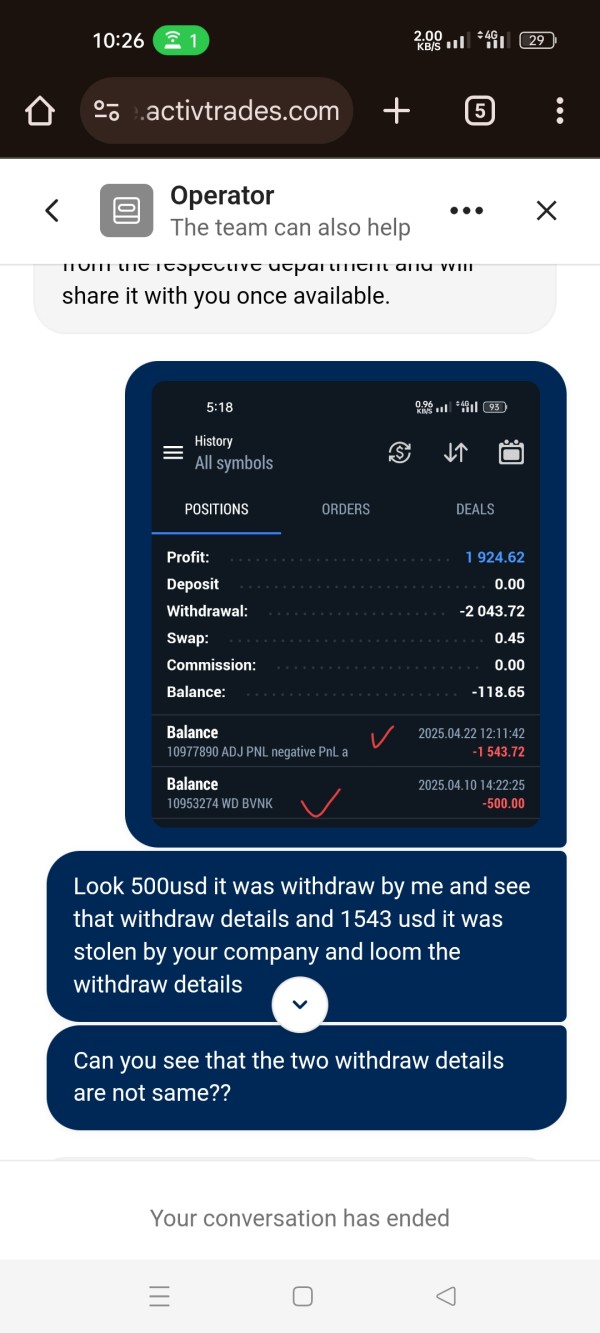

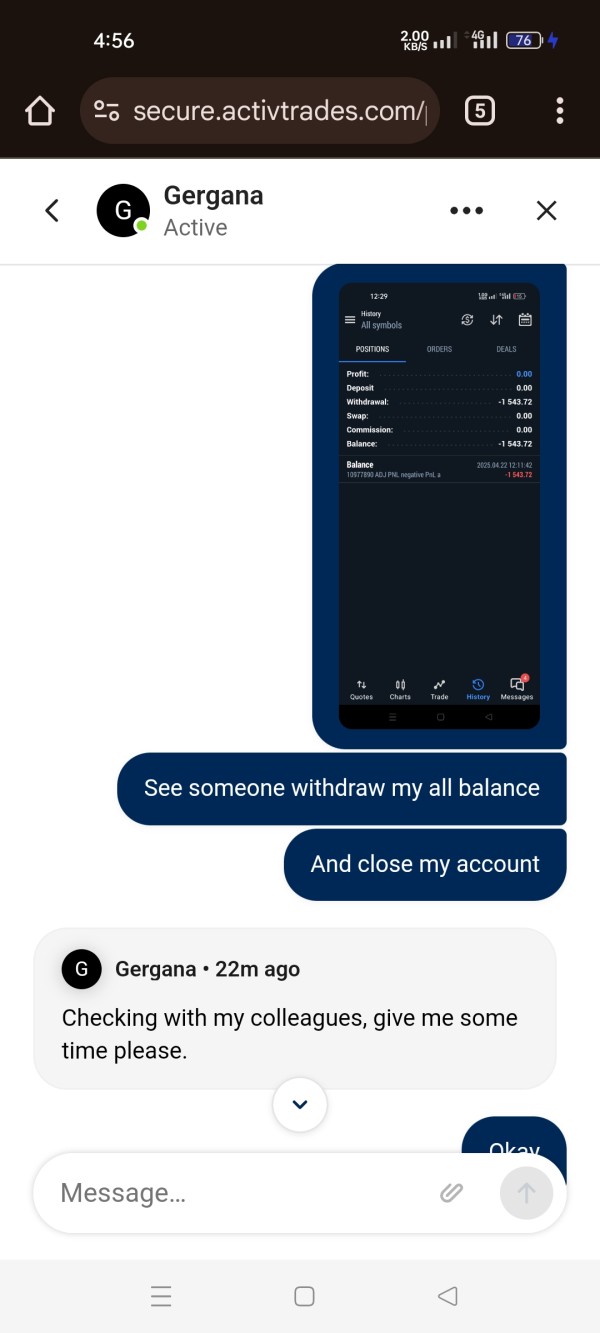

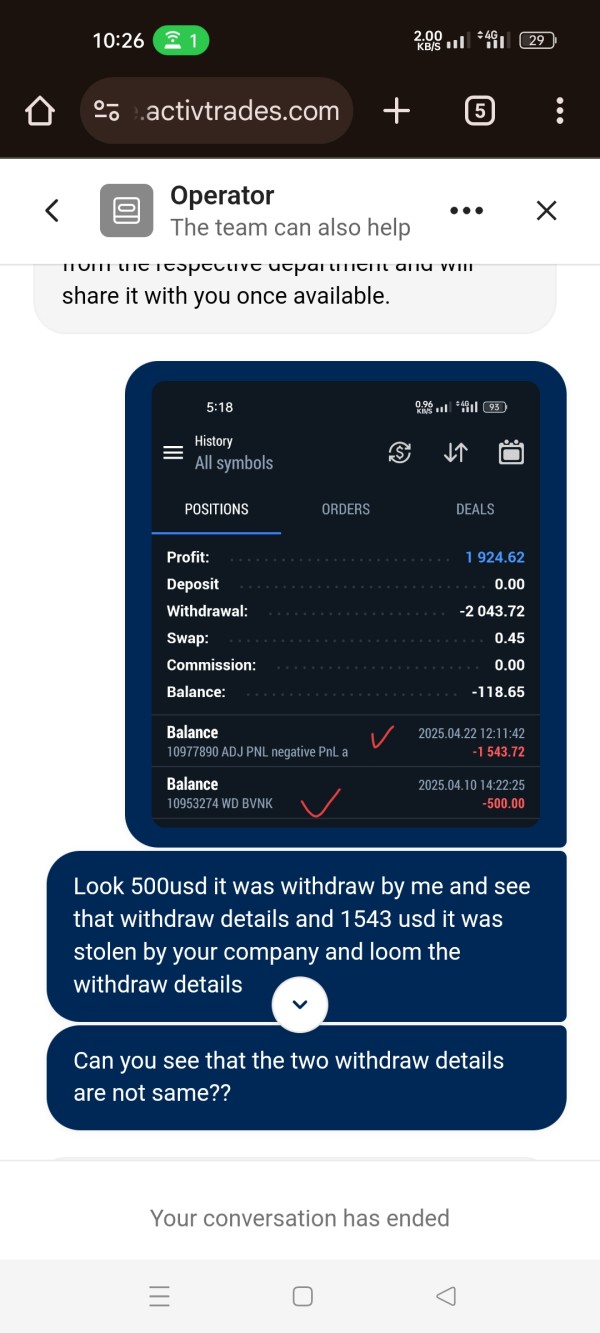

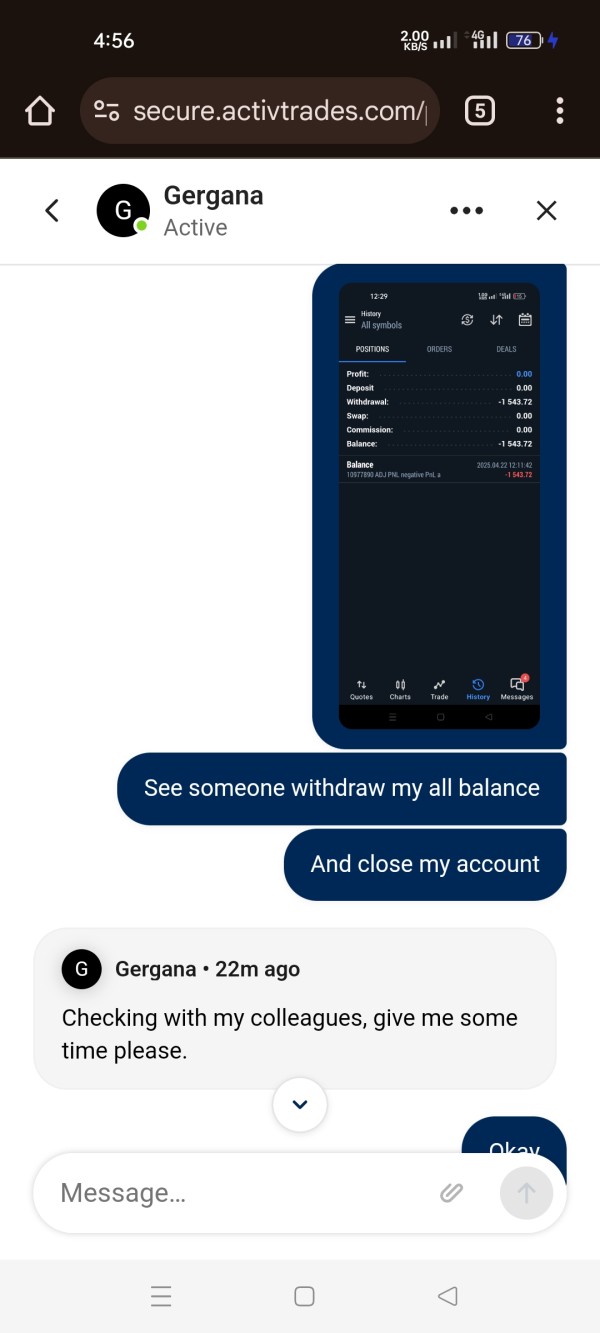

Fund management experience, including deposit and withdrawal processes, timeframes, and associated costs, is not comprehensively covered in the reviewed documentation. This represents a significant information gap for evaluating the complete user experience, as funding operations are critical to trader satisfaction.

Common user complaints or areas of dissatisfaction are not specifically identified in the available materials. This limits the ability to assess potential pain points or areas where the broker might need improvement. Independent user reviews and feedback platforms would provide additional insight into user experience challenges.

User demographic analysis suggests the broker serves both retail and institutional clients across 170 jurisdictions. This indicates a broad appeal and scalable service model. However, specific user profiles, satisfaction metrics by trader type, or detailed user journey analysis are not available in the reviewed sources.

Platform accessibility features, mobile optimization quality, and user interface modernization are not specifically addressed. However, the multiple platform options suggest attention to diverse user needs and technological preferences.

Conclusion

ActivTrades presents itself as a well-established and comprehensively regulated broker that delivers competitive trading conditions through multiple respected platforms. This activtrades review reveals a broker with particular strengths in regulatory compliance, trading instrument diversity, and execution quality. These qualities make it suitable for both retail and institutional traders seeking reliable market access.

The broker's primary advantages include extremely competitive spreads starting from 0 pips, access to over 1,000 trading instruments across multiple asset classes, strong regulatory oversight from authorities including the FCA, and positive user feedback regarding execution speeds. The multiple platform options and international regulatory presence provide flexibility and confidence for traders across different experience levels and geographic locations.

However, this evaluation also identifies areas where additional information would benefit prospective clients. These include specific details about account requirements, customer service capabilities, educational resources, and comprehensive cost structures beyond the advertised spreads. These information gaps suggest that direct broker consultation remains essential for making fully informed decisions about account opening and service expectations.

ActivTrades appears most suitable for traders who prioritize regulatory security, competitive trading costs, and access to diverse markets through established trading platforms. However, those seeking comprehensive educational resources or detailed service transparency may need to evaluate these aspects through direct broker engagement.