Weltrade 2025 Review: Everything You Need to Know

Executive Summary

This weltrade review looks at one online forex trading platform that has gotten mixed attention in the trading community. Weltrade says it offers competitive trading solutions with a focus on low-cost trading environments. The company claims to provide zero trading commissions and maintains a team of 65 professionals offering round-the-clock service support.

The broker mainly targets traders seeking cost-effective forex trading solutions. However, our analysis reveals big concerns about transparency and user trust. Weltrade promotes advanced trading platforms and educational resources including webinars and research materials, but user feedback presents a complex picture with 1,622 reviews on Trustpilot showing varied experiences.

Key features that make Weltrade different include its zero commission structure and claimed 24/7 professional support. However, potential traders should note that specific regulatory information, minimum deposit requirements, and detailed platform specifications are not clearly disclosed in available materials, which raises questions about how transparent their operations really are.

Important Disclaimers

Regional Entity Differences: Specific regulatory authorities and license numbers for Weltrade are not mentioned in available information. This may indicate potential regional restrictions or regulatory limitations. Traders should verify regulatory status in their jurisdiction before engaging with the platform.

Review Methodology: This evaluation is based on available user reviews, market information, and publicly accessible data. Due to limited official documentation, some assessments rely on user feedback and third-party sources rather than verified company statements.

Rating Framework

Broker Overview

Weltrade operates as an online forex trading service provider. The company claims to maintain a team of 65 professionals dedicated to providing continuous customer support. Weltrade positions itself in the competitive forex market by emphasizing low-cost trading solutions, particularly highlighting its zero commission structure.

According to available information, Weltrade focuses primarily on forex trading services and aims to provide traders with favorable trading conditions while maintaining competitive fee structures. The broker's business model centers around providing accessible forex trading solutions with an emphasis on cost efficiency. However, specific details about the company's establishment date, corporate structure, and founding background are not clearly disclosed in available materials.

This lack of transparency regarding basic corporate information represents a significant concern for potential clients seeking comprehensive broker evaluation. Regarding trading infrastructure, Weltrade claims to offer advanced trading platforms, though specific platform names and detailed technical specifications are not mentioned in available sources. The company's primary focus appears to be forex trading, with limited information available about additional asset classes or diversified trading options.

The absence of detailed regulatory information, including specific regulatory authorities and license numbers, presents challenges for traders seeking to verify the broker's compliance status and operational legitimacy.

Regulatory Status: Available information does not specify particular regulatory authorities or provide license numbers for Weltrade operations. This lack of regulatory transparency may indicate potential compliance concerns or regional operational limitations.

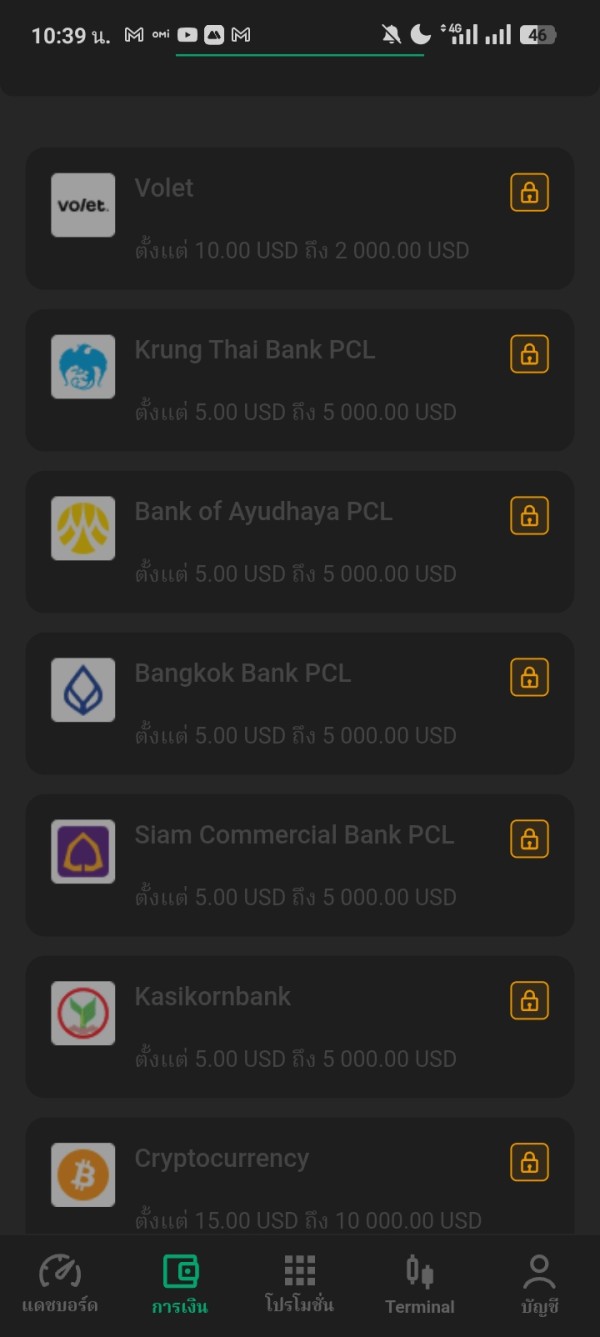

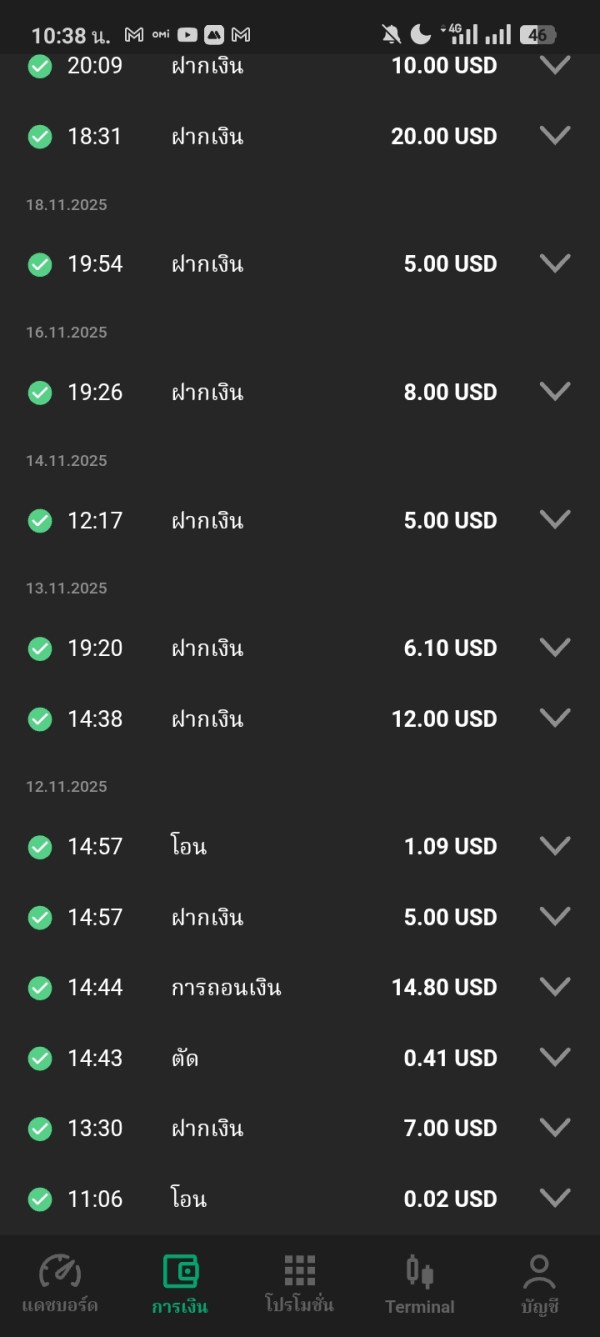

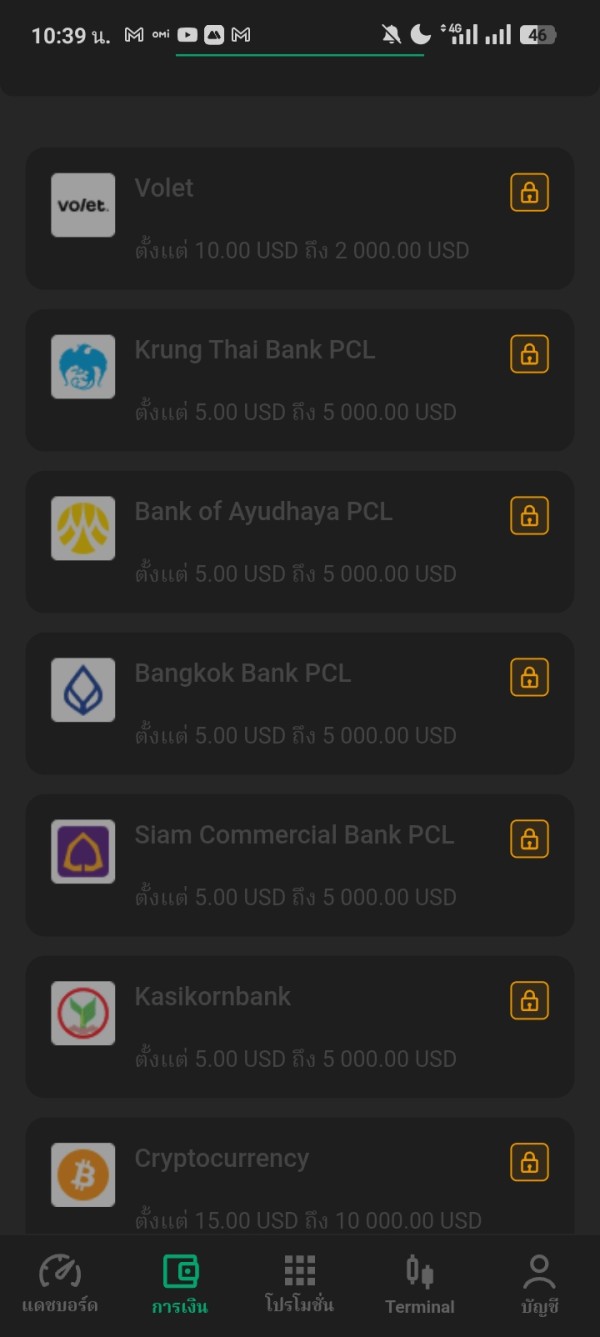

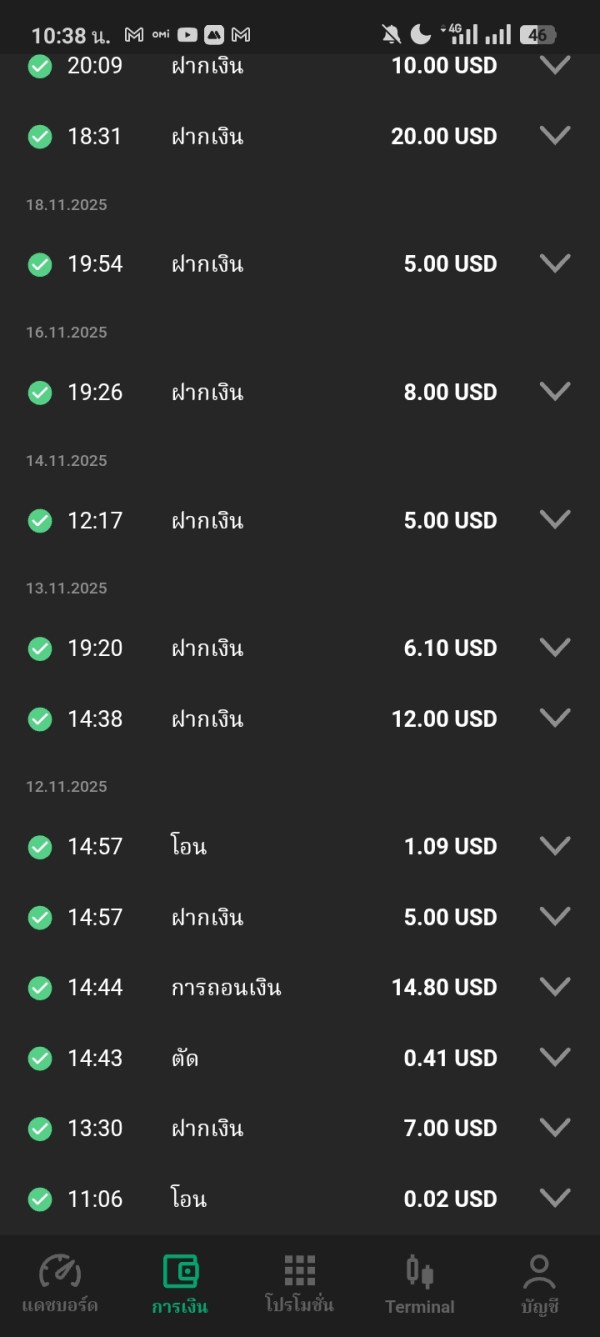

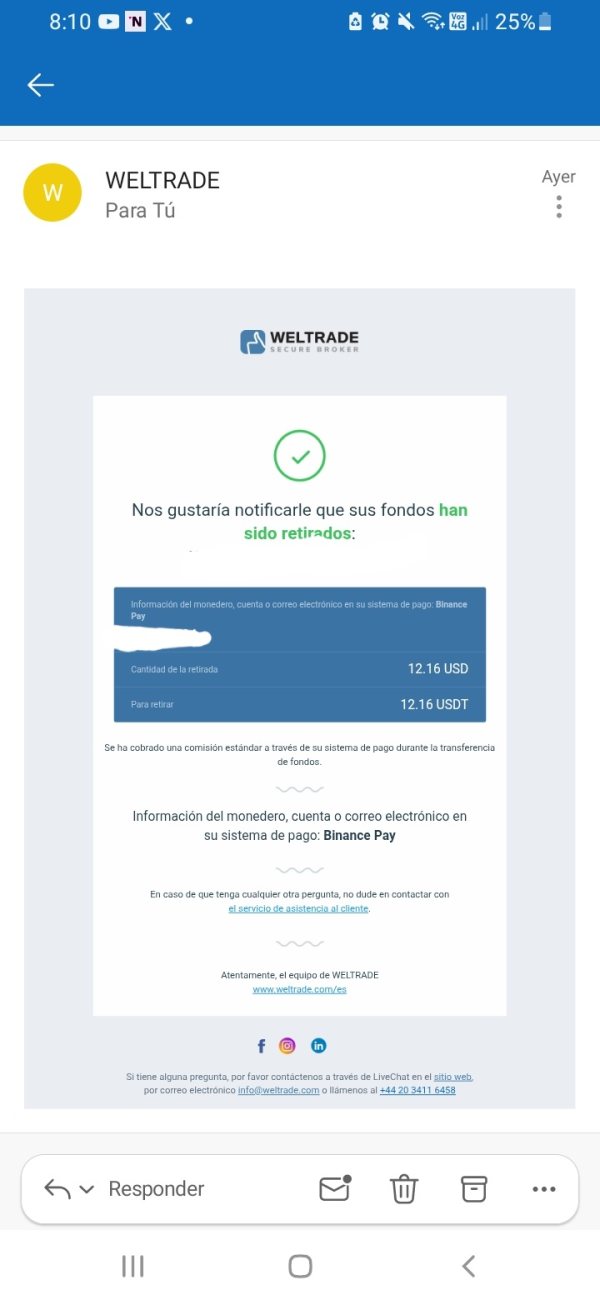

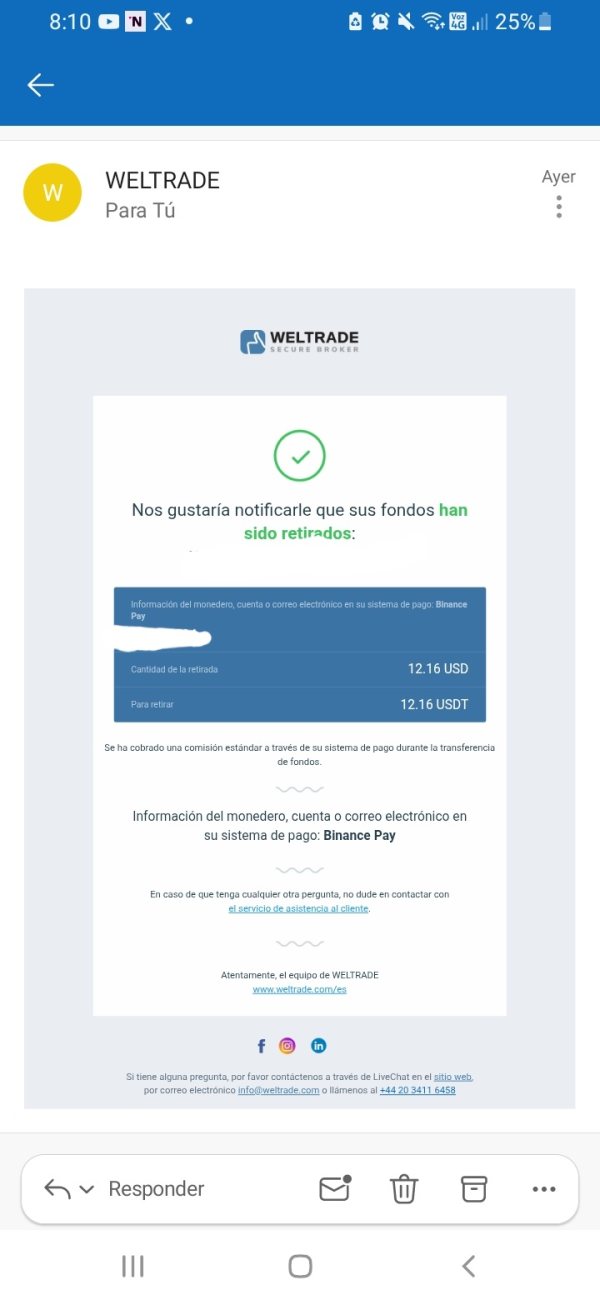

Deposit and Withdrawal Methods: Specific deposit and withdrawal options are not detailed in available sources. This creates uncertainty about funding convenience and processing procedures.

Minimum Deposit Requirements: Information regarding minimum deposit requirements is not disclosed in available materials. This makes it difficult for potential traders to assess account accessibility.

Bonuses and Promotions: No specific information about bonus programs or promotional offers is mentioned in available sources.

Tradeable Assets: The primary focus appears to be forex trading. However, detailed information about specific currency pairs, exotic options, or additional asset classes is not provided in available materials.

Cost Structure: Weltrade advertises zero trading commissions, which represents a potentially attractive feature for cost-conscious traders. However, specific information about spreads, overnight fees, and other potential charges is not detailed in available sources.

Leverage Options: Leverage ratios and margin requirements are not specified in available information. This creates uncertainty about trading flexibility and risk management options.

Platform Selection: The company claims to provide advanced trading platforms. However, specific platform names, features, or technical capabilities are not detailed in available materials.

Geographic Restrictions: Specific regional limitations or restricted territories are not mentioned in available information.

Customer Support Languages: Information about supported languages for customer service is not provided in available sources.

This weltrade review reveals significant information gaps that potential traders should consider when evaluating the broker's suitability for their trading needs.

Detailed Rating Analysis

Account Conditions Analysis (Score: 5/10)

Weltrade's account conditions present a mixed picture due to limited transparency in available information. The broker does not clearly disclose specific account types, their respective features, or the requirements for each tier. This lack of detailed account information makes it challenging for potential traders to understand what options are available and which might best suit their trading style and capital requirements.

The absence of minimum deposit information in available sources represents a significant concern for trader evaluation. Without clear deposit requirements, traders cannot adequately plan their initial investment or compare Weltrade's accessibility against industry standards. Additionally, the account opening process and required documentation are not detailed in available materials.

User feedback regarding account conditions varies significantly, with some traders expressing satisfaction while others report difficulties. The lack of specific account features, such as negative balance protection, account insurance, or premium account benefits, further complicates the evaluation process. Based on available information, Weltrade appears to offer basic account functionality, but the absence of comprehensive details about account types and their specific advantages limits the overall assessment of account conditions quality.

This weltrade review finds that while the broker may offer competitive account terms, the lack of transparency significantly impacts the evaluation of account conditions.

Weltrade demonstrates a reasonable commitment to trader education and support through its provision of webinars, seminars, and research resources. These educational offerings represent valuable tools for both novice and experienced traders seeking to improve their market knowledge and trading skills. The availability of research materials suggests that the broker recognizes the importance of informed trading decisions and provides analytical support to its client base.

The claimed advanced trading platforms, while not specifically detailed, indicate that Weltrade invests in technological infrastructure to support trader activities. However, the lack of specific information about trading tools, technical analysis features, charting capabilities, or automated trading support limits a comprehensive evaluation of the platform's technological offerings.

User feedback suggests generally positive experiences with available tools and resources, though specific details about tool effectiveness, research quality, or educational content depth are not extensively documented. The broker's focus on providing educational support through webinars and seminars demonstrates awareness of trader development needs, which positively impacts this category's evaluation.

The absence of detailed information about mobile trading capabilities, API access, or advanced analytical tools represents missed opportunities for comprehensive tool assessment. Nevertheless, the confirmed availability of educational resources and research support provides a solid foundation for this rating category.

Customer Service and Support Analysis (Score: 6/10)

Weltrade claims to provide 24/7 customer support through a team of 65 professionals. This suggests a significant investment in customer service infrastructure. This round-the-clock availability represents a positive aspect for traders who may need assistance outside traditional business hours or across different time zones.

However, user feedback presents concerning patterns regarding service quality and responsiveness. Some users have reported negative experiences with customer support, including difficulties in resolving issues and concerns about service professionalism. The mixed nature of user reviews suggests inconsistency in support quality, which impacts the overall evaluation of customer service effectiveness.

Specific information about support channels, such as live chat, email, phone support, or ticket systems, is not detailed in available sources. The absence of clear response time commitments or service level agreements makes it difficult to assess support efficiency standards. Additionally, information about multilingual support capabilities is not provided, which could limit accessibility for international traders.

The contrast between claimed professional support infrastructure and actual user experiences creates uncertainty about service reliability. While the stated commitment to comprehensive support is positive, the reported user concerns about service quality significantly impact this category's assessment.

Trading Experience Analysis (Score: 7/10)

User feedback regarding Weltrade's trading experience tends toward the positive side. This suggests that the broker provides a generally functional trading environment. The claimed advanced trading platforms appear to deliver adequate performance for most user needs, though specific technical details about platform stability, execution speed, or advanced features are not comprehensively documented.

The zero commission structure represents a significant advantage for trading experience, potentially allowing traders to execute strategies without worrying about per-trade commission costs. This cost structure can particularly benefit high-frequency traders or those implementing scalping strategies where commission costs can significantly impact profitability.

However, the absence of specific information about order execution quality, slippage rates, or platform uptime statistics limits a comprehensive assessment of trading experience quality. Details about mobile trading capabilities, offline functionality, or platform customization options are not provided in available sources.

User reviews suggest that while the basic trading functionality meets expectations, there may be room for improvement in platform sophistication and feature depth. The lack of detailed information about liquidity providers, execution models, or trading environment specifics creates some uncertainty about the overall trading experience quality.

This weltrade review indicates that while basic trading needs appear to be met, the limited transparency about technical specifications affects the comprehensive evaluation of trading experience quality.

Trust and Reliability Analysis (Score: 4/10)

Trust and reliability represent significant concerns in this Weltrade evaluation. The absence of specific regulatory authority information and license numbers in available sources raises fundamental questions about the broker's compliance status and operational legitimacy. Regulatory oversight provides crucial protection for traders, and the lack of clear regulatory disclosure represents a major red flag.

User feedback includes serious concerns about company trustworthiness, with some users characterizing Weltrade as potentially fraudulent. These allegations, while requiring careful consideration, significantly impact the trust assessment and suggest that potential clients should exercise extreme caution when considering this broker.

The lack of transparency regarding company ownership, management structure, financial reporting, or operational history further complicates trust evaluation. Legitimate brokers typically provide comprehensive information about their corporate structure, regulatory compliance, and financial stability, none of which is clearly available for Weltrade.

Additionally, the absence of information about client fund segregation, deposit insurance, or investor protection measures raises concerns about financial security. Without clear regulatory oversight and transparent operational practices, traders face elevated risks regarding fund safety and dispute resolution.

The combination of regulatory uncertainty, negative user allegations, and limited transparency creates a concerning picture for trust and reliability assessment.

User Experience Analysis (Score: 5/10)

The 1,622 reviews on Trustpilot indicate significant user engagement with Weltrade. However, the mixed nature of feedback suggests varied user experiences. This substantial review volume provides valuable insight into real user experiences, though the diversity of opinions complicates overall user satisfaction assessment.

User experience appears to vary significantly depending on individual circumstances and expectations. While some users report satisfactory experiences with basic trading functionality, others express serious concerns about service quality, transparency, and trustworthiness. This polarization in user feedback suggests inconsistent service delivery or potentially different user experiences based on account types or engagement levels.

The absence of detailed information about platform interface design, registration processes, or account verification procedures limits assessment of user experience quality. Additionally, information about deposit and withdrawal convenience, processing times, or user interface intuitiveness is not comprehensively available.

Common user complaints include concerns about company legitimacy and service quality, which significantly impact overall user experience evaluation. The contrast between claimed professional service and reported user difficulties suggests potential gaps between marketing promises and actual service delivery.

User experience assessment is further complicated by the lack of detailed information about platform usability, mobile experience quality, or customer onboarding processes. The mixed review patterns suggest that while some users find adequate value, others encounter significant difficulties that impact their overall experience.

Conclusion

This comprehensive weltrade review reveals a complex picture of a forex broker that presents both potential opportunities and significant concerns. While Weltrade offers attractive features such as zero trading commissions and claimed 24/7 professional support, substantial transparency issues and user trust concerns significantly impact its overall assessment.

The broker appears most suitable for experienced traders who prioritize low-cost trading environments and can conduct thorough due diligence regarding regulatory status and operational legitimacy. However, the lack of clear regulatory information, mixed user feedback, and transparency concerns make Weltrade a questionable choice for novice traders or those prioritizing security and regulatory protection.

Key advantages include: Zero commission trading structure, claimed round-the-clock support, and educational resources availability. Primary disadvantages encompass: Unclear regulatory status, mixed user trust feedback, limited operational transparency, and absence of detailed account information. Potential traders should exercise significant caution and conduct comprehensive independent research before considering Weltrade for their trading activities.