TREX Trade 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive TREX trade review reveals concerning findings about this offshore broker. Traders should carefully consider these issues before investing their money. TREX Trade operates under the regulation of the Mauritius Financial Services Commission and offers trading across multiple asset classes including forex, cryptocurrencies, commodities, indices, and stocks through CFD instruments. Our analysis reveals significant red flags that overshadow these offerings.

The broker has received mostly negative user feedback. Traders report issues ranging from slow order execution to questionable trading signals that hurt their profits. Multiple warning flags have been raised by industry observers, particularly regarding the broker's offshore status and potential financial risks. TREX Trade positions itself as a multi-asset trading platform suitable for diversified investment strategies. However, the mounting negative reviews and regulatory concerns suggest that traders should exercise extreme caution when considering this broker. The lack of transparency in key areas such as minimum deposits, commission structures, and detailed platform specifications further compounds these concerns.

Important Notice

TREX Trade operates as an offshore broker under Mauritius FSC regulation. This means it may lack certain regulatory protections available in more established financial jurisdictions like the US or UK. Traders should be aware that offshore brokers often operate with different standards compared to brokers regulated in major financial centers. This review is based on available user feedback, industry reports, and publicly accessible information that we could verify. Given the limited transparency from the broker itself, some information gaps exist, and traders are advised to conduct their own research before making any investment decisions.

Rating Framework

Broker Overview

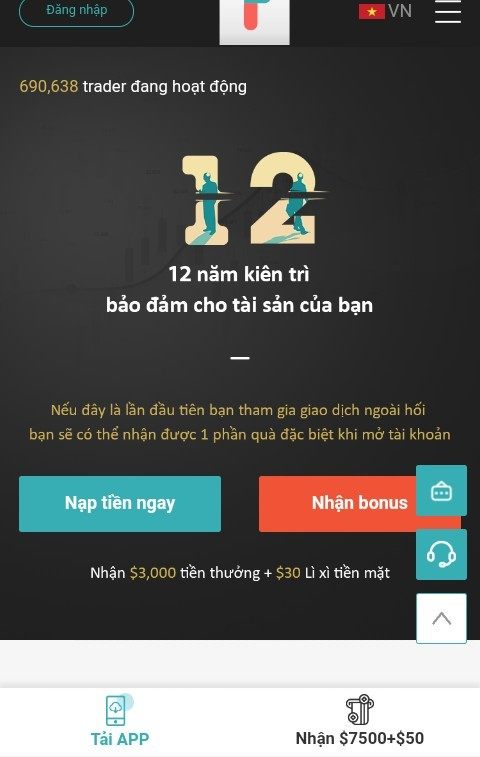

TREX Trade operates as an offshore brokerage firm offering CFD trading services across multiple asset categories. The company presents itself as a multi-asset broker catering to traders seeking diversified investment opportunities across different markets. However, the broker's background information remains notably sparse, with key details about its founding date, headquarters location, and corporate structure not readily available in public sources.

The broker's business model centers around providing CFD trading access to various markets. These include foreign exchange, cryptocurrency, commodities, indices, and stock markets for traders worldwide. Despite offering this range of trading instruments, TREX Trade has faced scrutiny due to its offshore operational structure and the associated risks that come with such arrangements. Industry observers have raised multiple concerns about the broker's credibility and operational practices that potential clients should know about.

TREX Trade operates under the regulatory oversight of the Mauritius Financial Services Commission. This places it in the category of offshore brokers that often attract traders with potentially more flexible trading conditions than onshore alternatives. However, this TREX trade review must emphasize that the FSC regulation, while legitimate, may not provide the same level of investor protection as more stringent regulatory frameworks found in major financial centers. The broker's platform details and technological infrastructure remain unclear from available sources, adding another layer of uncertainty for potential clients who want to understand what they're getting.

Regulatory Jurisdiction: TREX Trade operates under the regulation of the Mauritius Financial Services Commission. While this provides some regulatory oversight, FSC regulation is generally considered less stringent than major financial regulators like the FCA or SEC.

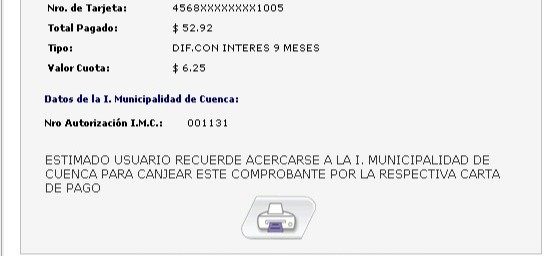

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal options is not detailed in available sources. This raises transparency concerns for potential traders who need to know how they can fund their accounts.

Minimum Deposit Requirements: The minimum deposit requirement is not specified in available documentation. This makes it difficult for traders to plan their initial investment properly.

Bonus and Promotional Offers: No specific information about bonuses or promotional offers is available in current sources.

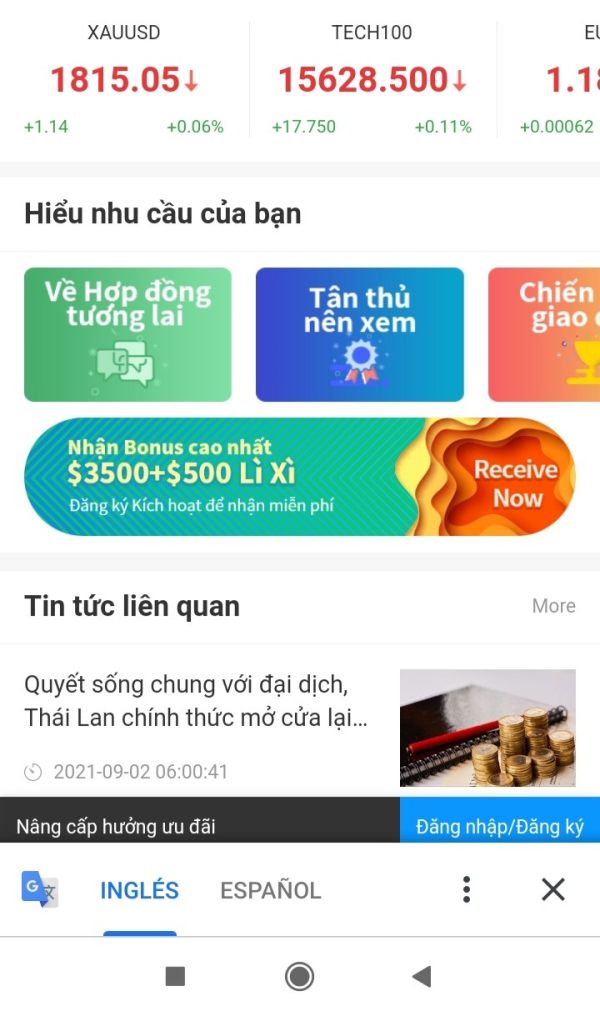

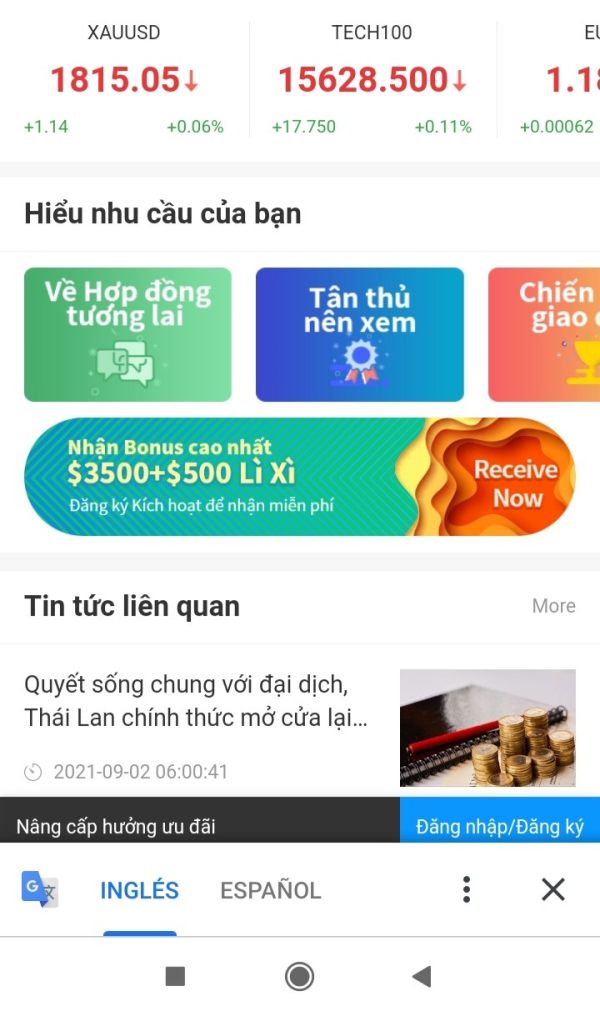

Tradeable Assets: The broker offers CFD trading across forex pairs, cryptocurrencies, commodities, stock indices, and individual stocks. This provides a diverse range of trading opportunities for investors seeking variety.

Cost Structure: Reports indicate that spreads can reach 20-30 pips, which is significantly higher than industry standards. Detailed commission information is not readily available, creating uncertainty about total trading costs that traders will face.

Leverage Ratios: Specific leverage information is not detailed in available sources. This is concerning given the importance of this information for risk management.

Platform Options: Trading platform details are not comprehensively covered in available sources. This leaves questions about technological capabilities and user interface quality unanswered.

Geographic Restrictions: Information about geographic trading restrictions is not specified in current documentation.

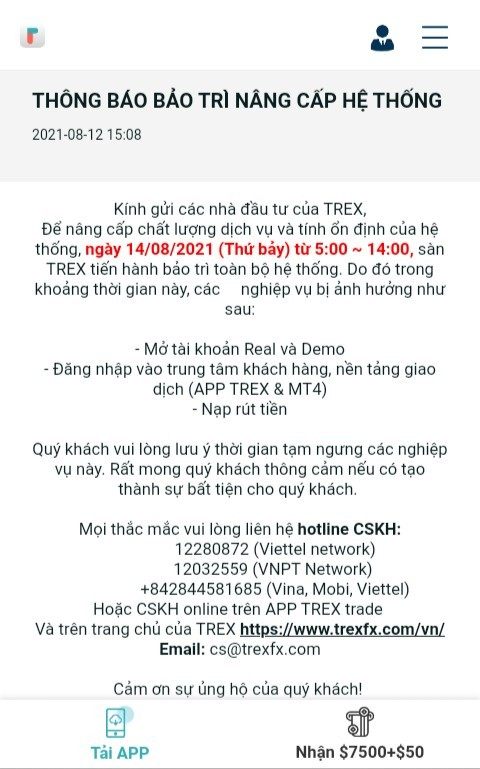

Customer Service Languages: Available customer service languages are not detailed in accessible sources. This potentially limits support for international traders who need help in their native language.

This TREX trade review highlights significant information gaps that potential traders should consider when evaluating this broker.

Detailed Rating Analysis

Account Conditions Analysis

The account conditions offered by TREX Trade present several concerning aspects that contributed to the below-average rating. The lack of transparent information about account types and their specific features creates immediate uncertainty for potential traders who want to understand what they're signing up for. Without clear details about minimum deposit requirements, traders cannot properly assess whether the broker fits their financial capacity or trading strategy.

User feedback suggests that the account opening process may involve delays and complications. This is problematic for traders eager to capitalize on market opportunities that require quick action. The absence of information about special account features, such as Islamic accounts for Muslim traders, indicates either a lack of inclusivity or poor communication about available options.

The reported spread ranges of 20-30 pips are exceptionally high compared to industry standards. Competitive brokers typically offer spreads of 1-3 pips on major currency pairs, making TREX Trade's costs significantly more expensive. This significant cost burden can severely impact trading profitability, particularly for frequent traders or those employing scalping strategies that rely on tight spreads.

The lack of clarity regarding commission structures adds another layer of uncertainty to the overall cost calculation. Furthermore, the absence of detailed information about account tiers, their respective benefits, and upgrade requirements suggests a lack of structured service offering. This TREX trade review finds that the combination of high costs, limited transparency, and user-reported difficulties makes the account conditions particularly unattractive for serious traders.

TREX Trade's tools and resources receive an average rating primarily due to the availability of multiple asset classes for CFD trading. This does provide some value for traders seeking diversification across different markets. The broker offers access to forex, cryptocurrencies, commodities, indices, and stocks, giving traders various market exposure opportunities within a single platform.

However, the analysis reveals significant gaps in the tools and resources typically expected from a professional trading environment. There is no available information about research and analysis resources, which are crucial for informed trading decisions that can make or break profitability. Professional traders rely heavily on market analysis, economic calendars, trading signals, and research reports, none of which appear to be prominently featured or detailed by TREX Trade.

Educational resources are essential for developing trader skills and understanding market dynamics. These are not mentioned in available sources, which is particularly concerning for novice traders. The lack of information about automated trading support, such as Expert Advisors or copy trading features, limits the platform's appeal to traders who prefer systematic or social trading approaches.

User feedback suggests that the available tools may not meet professional standards. Reports of technical issues and inadequate functionality affect the overall trading experience negatively.

Customer Service and Support Analysis

Customer service and support represent one of TREX Trade's weakest areas, earning a poor rating based on available user feedback. User reports consistently highlight inadequate response times and poor problem-resolution capabilities, which are critical issues for traders. Traders may need immediate assistance during volatile market conditions when every minute counts.

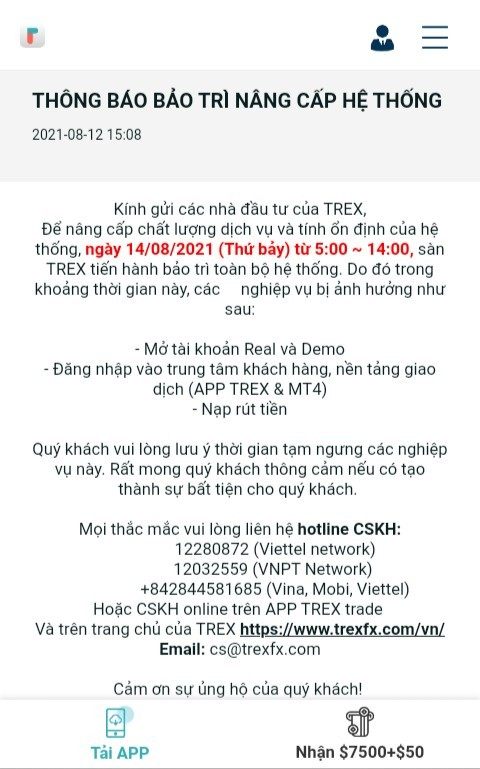

The absence of detailed information about customer service channels raises concerns about accessibility and support quality. Professional brokers typically provide multiple contact methods including live chat, phone support, email, and comprehensive FAQ sections that help users solve problems quickly. The lack of clarity about these basic support features suggests either inadequate service infrastructure or poor communication about available support options.

Response time issues reported by users are particularly problematic in the fast-paced trading environment. Technical problems or account issues can result in significant financial losses if not resolved quickly. Traders expect prompt, knowledgeable support that can quickly resolve issues and provide guidance when needed.

The quality of service when support is available also appears to be substandard based on user experiences. Reports suggest that support representatives may lack the expertise or authority to effectively resolve trader concerns, leading to prolonged issues and user frustration. Additionally, the absence of information about multilingual support may limit accessibility for international traders, further restricting the broker's service quality for global users.

Trading Experience Analysis

The trading experience with TREX Trade receives a below-average rating due to multiple user-reported issues. These problems directly impact trading effectiveness and profitability in ways that matter to real traders. Platform stability and execution speed are fundamental requirements for successful trading, and user feedback indicates significant problems in both areas.

Reports of slow order execution are particularly concerning as they can result in slippage, missed opportunities, and increased trading costs. In fast-moving markets, execution delays can mean the difference between profitable and losing trades that add up over time. Users have also reported issues with requotes and signal errors, which further compound execution problems and create an unreliable trading environment.

The high and unstable spreads mentioned in user feedback contribute to poor trading conditions. When spreads fluctuate unpredictably or remain consistently high, traders face increased costs and reduced profitability that eat into their returns. This is especially problematic for day traders and scalpers who rely on tight spreads for their strategies to remain viable.

Platform functionality concerns appear to be significant based on user experiences. A reliable trading platform should provide real-time data, stable connectivity, and intuitive navigation that traders can depend on. Any deficiencies in these areas directly impact the trader's ability to execute their strategies effectively.

The lack of information about mobile trading capabilities in current sources is also concerning. Mobile trading has become essential for modern traders who need market access regardless of location. This TREX trade review finds that the combination of execution issues, high costs, and platform concerns creates a challenging trading environment.

Trust and Reliability Analysis

Trust and reliability represent the most concerning aspect of TREX Trade, earning the lowest rating in our analysis. The broker operates under FSC regulation from Mauritius, which, while legitimate, provides less comprehensive investor protection. Major financial regulators such as the FCA, SEC, or CySEC offer stronger safeguards for traders.

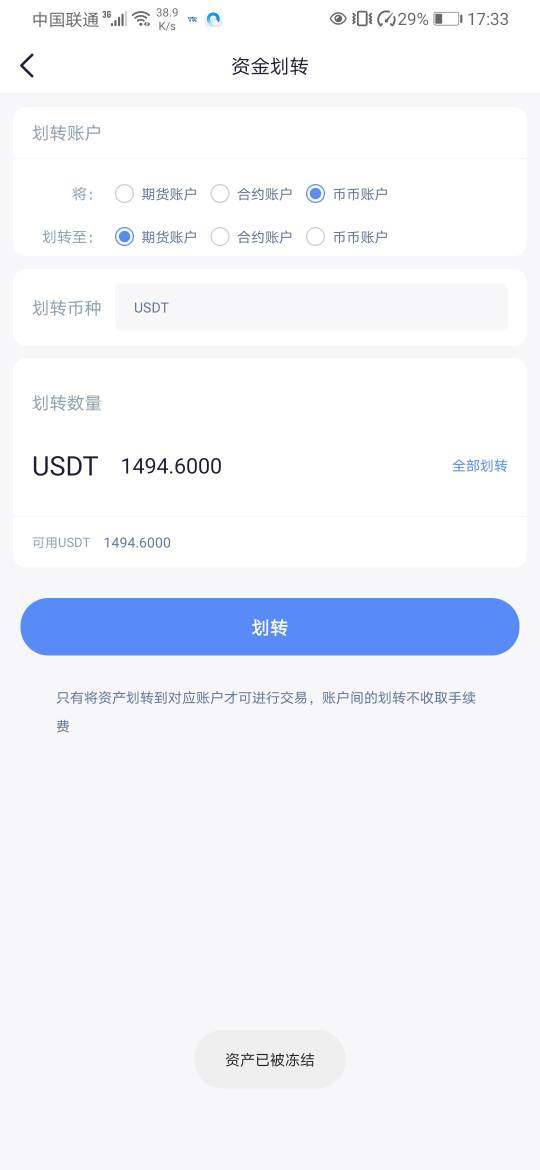

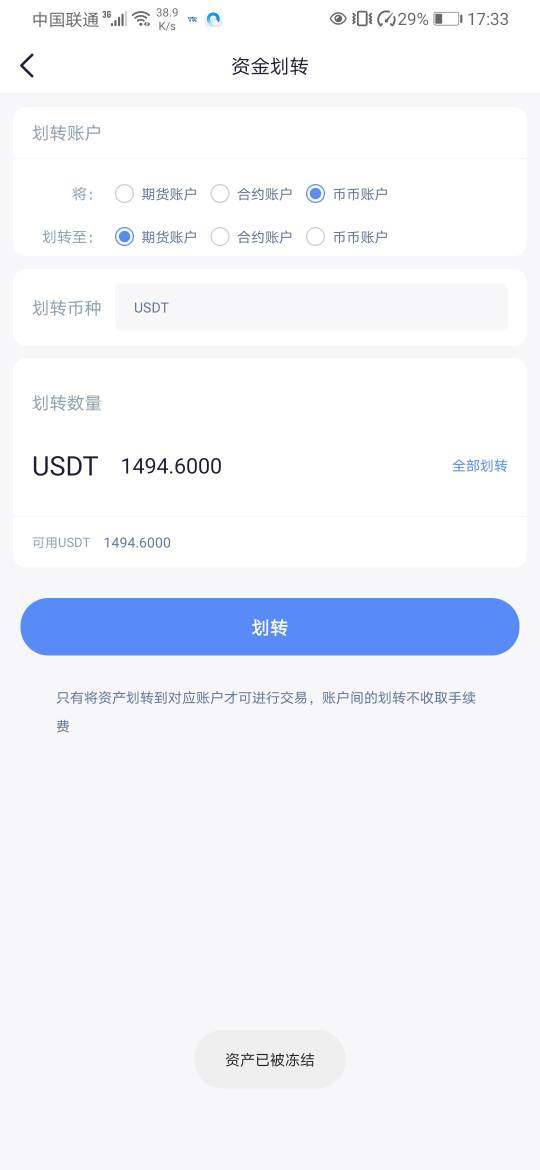

Multiple negative warnings have been raised about TREX Trade by industry observers. These warnings create significant concerns about the broker's credibility and operational practices that potential clients should take seriously. The warnings, combined with the lack of transparent information about the company's background, ownership structure, and financial stability, severely undermine confidence in the broker's reliability.

The absence of detailed information about client fund protection measures is particularly alarming. Reputable brokers typically provide clear information about segregated client accounts, insurance coverage, and compensation schemes that protect trader money. The lack of such transparency raises questions about how client funds are protected and what recourse traders have in case of broker insolvency.

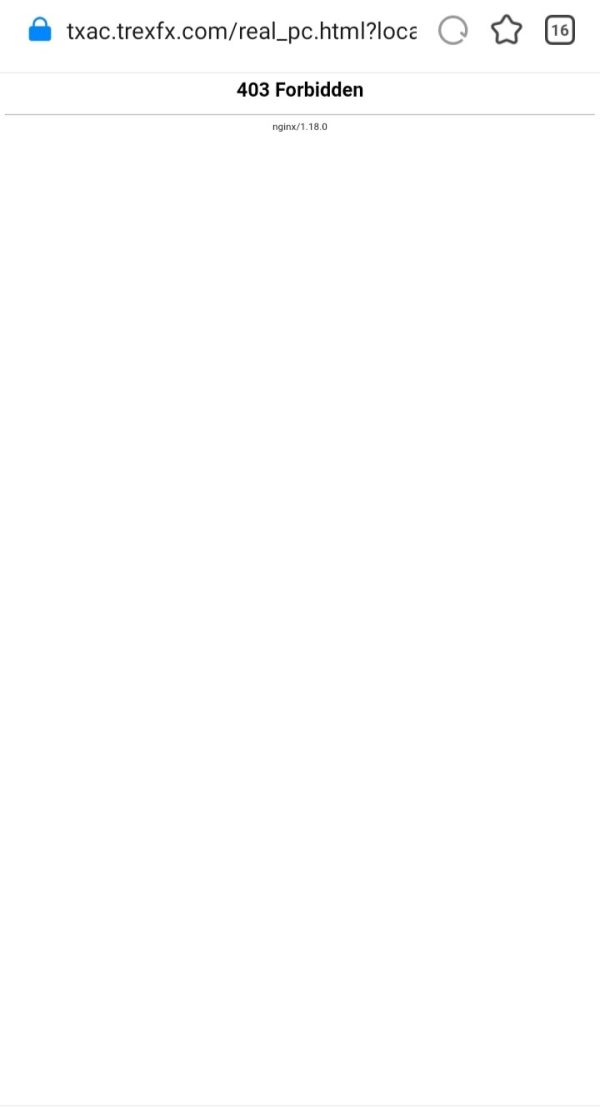

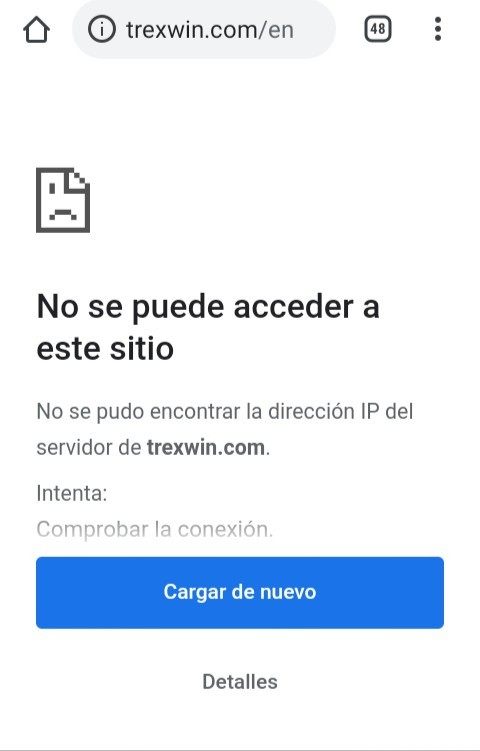

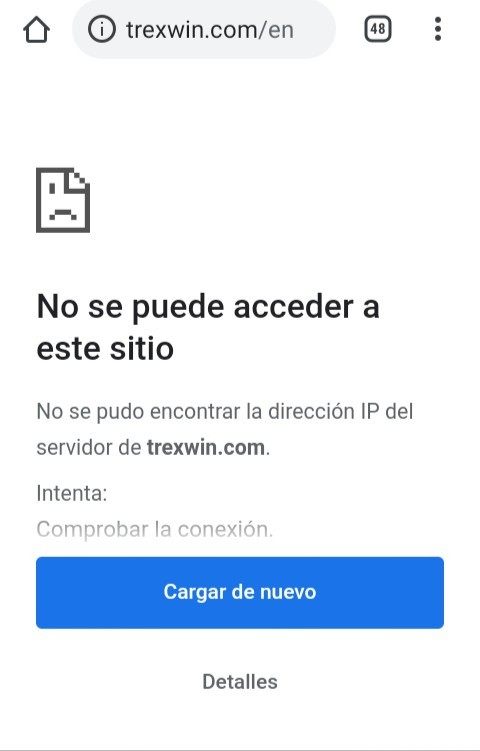

Company transparency issues extend beyond fund protection to basic corporate information. The unavailability of clear details about the company's founding date, headquarters location, key personnel, and corporate history makes it difficult for traders to assess the broker's legitimacy and track record. Industry reputation appears to be significantly damaged by multiple negative reports and user experiences that paint a concerning picture.

The potential financial risks mentioned in various sources, combined with the offshore operational structure, create an environment where traders face elevated risks. These risks go beyond normal market exposure and include counterparty risk from the broker itself.

User Experience Analysis

User experience with TREX Trade is predominantly negative, reflecting poor overall satisfaction among traders. The consistent pattern of negative feedback across multiple aspects of the service indicates systemic issues rather than isolated problems that could be easily fixed. Overall user satisfaction appears to be low, with complaints focusing on fundamental aspects of the trading experience including execution quality, customer support, and platform reliability.

The absence of positive user testimonials or reviews in available sources suggests that the broker struggles to meet even basic trader expectations. Registration and verification processes appear to be problematic based on user feedback, with reports suggesting delays and complications. A smooth onboarding experience is crucial for user satisfaction, and deficiencies in this area create immediate negative impressions that set the tone for the entire relationship.

The most common user complaints center around slow trading execution and signal errors. These technical issues directly impact trading results and profitability in ways that matter to real traders. The problems, combined with poor customer support experiences, create a compounding effect where issues persist and user frustration increases over time.

User demographics that might find TREX Trade suitable appear to be limited to those with high risk tolerance. Even these traders would need to prioritize asset variety over service quality and reliability. However, even for risk-tolerant traders, the combination of high costs, execution issues, and reliability concerns makes the broker difficult to recommend.

The lack of positive user experiences and the prevalence of warnings suggest that most trader types would be better served by alternative brokers. These alternatives have stronger reputations and more transparent operations that provide better value and security.

Conclusion

This comprehensive TREX trade review reveals a broker with significant shortcomings that outweigh its limited advantages. While TREX Trade offers access to multiple asset classes including forex, cryptocurrencies, commodities, indices, and stocks, the numerous red flags and poor user experiences make it difficult to recommend. The broker fails to meet basic standards that traders should expect from a professional trading environment.

The broker may theoretically appeal to traders seeking diversified investment opportunities across various markets. However, the high costs, poor execution quality, and reliability concerns make it unsuitable even for high-risk tolerance traders who might otherwise overlook some issues. The lack of transparency in crucial areas such as costs, platform features, and corporate information further compounds these concerns and raises additional red flags.

The main advantages include the variety of tradeable assets and FSC regulation, but these are significantly overshadowed by serious disadvantages. These include exceptionally high spreads that eat into profits, poor customer service that leaves traders without help when they need it, execution problems that can cost money, multiple industry warnings that suggest deeper issues, and lack of transparency that makes it impossible to fully evaluate the risks. The overall poor rating of 3.5/10 reflects the substantial risks and limitations that traders would face when choosing TREX Trade as their broker, making it difficult to recommend for any serious trading activity.