TPS 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive tps review evaluates a broker that has gained attention in the trading community. However, there is limited publicly available information about its core operations. Based on available data and user feedback, TPS appears to position itself as a service provider in the financial sector. Specific details about its brokerage services remain unclear from current sources.

The evaluation reveals significant information gaps regarding essential brokerage features. These include regulatory compliance, trading platforms, account types, and fee structures. While some sources reference TPS in trading contexts, concrete details about spreads, leverage, customer support quality, and regulatory oversight are not readily available in accessible documentation.

This review is particularly relevant for traders seeking transparency and comprehensive information before selecting a broker. The limited availability of detailed operational information may serve as an important consideration for both novice traders looking for clear guidance and experienced traders requiring specific trading conditions and regulatory assurance.

Important Notice

Due to the limited publicly available information about TPS as a forex broker, this review is based on available sources and general industry standards. Users should independently verify TPS's regulatory status, operational legitimacy, and service availability in their respective regions before engaging with any services.

The evaluation methodology relies on standard brokerage assessment criteria. However, specific data points may be limited. Potential clients are strongly advised to conduct their own due diligence and seek current, official information directly from the service provider before making any financial commitments.

Rating Framework

Broker Overview

TPS presents a challenging case for comprehensive evaluation. This is due to the scarcity of detailed, publicly accessible information about its operations as a forex broker. Unlike established brokers with extensive online presence and regulatory documentation, TPS appears to maintain a relatively low profile in the competitive forex brokerage landscape.

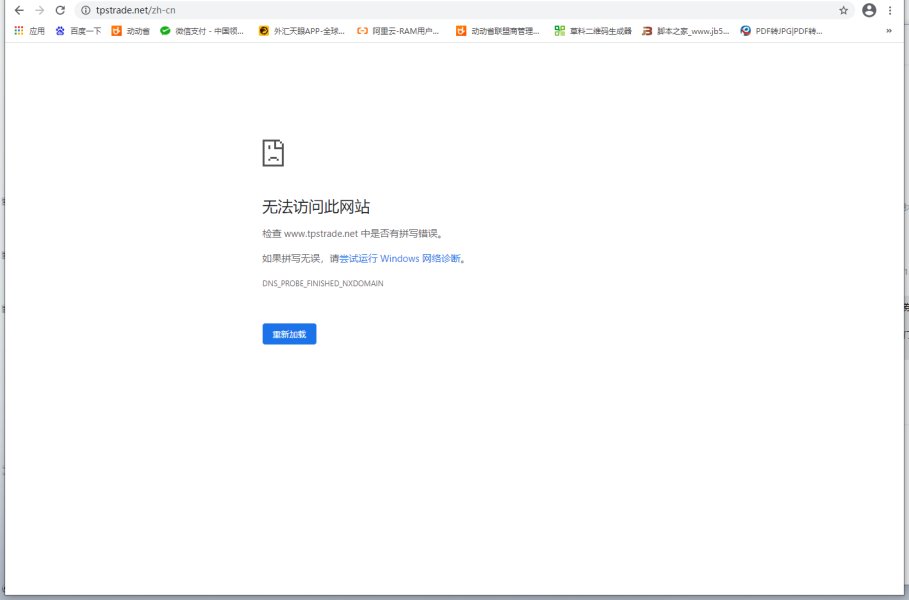

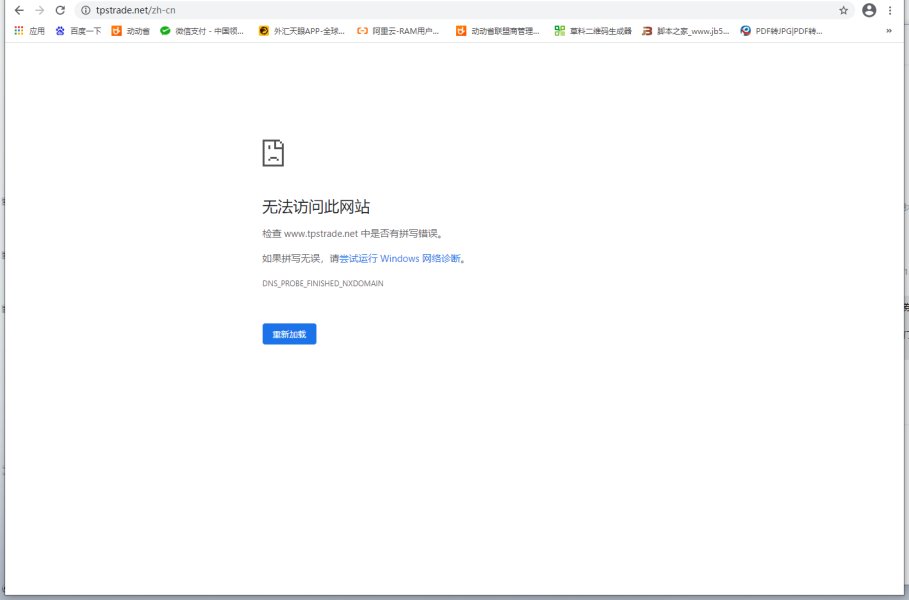

The search results primarily reference TPS in contexts related to government programs and trading strategy discussions. They do not reference it as a standalone brokerage entity. This lack of clear, dedicated information about TPS as a forex broker raises questions about its market presence and operational scope. According to available sources, there are references to trading-related content, but specific details about TPS's brokerage services, platform offerings, or client testimonials are notably absent.

The limited information available suggests that potential clients may need to rely on direct contact with the company. This would be necessary to obtain essential details about trading conditions, regulatory compliance, and service offerings. This tps review acknowledges that the evaluation process is constrained by the availability of verifiable, comprehensive data about the broker's operations and market positioning.

Regulatory Status: Current available information does not provide clear details about TPS's regulatory oversight or licensing status with major financial authorities.

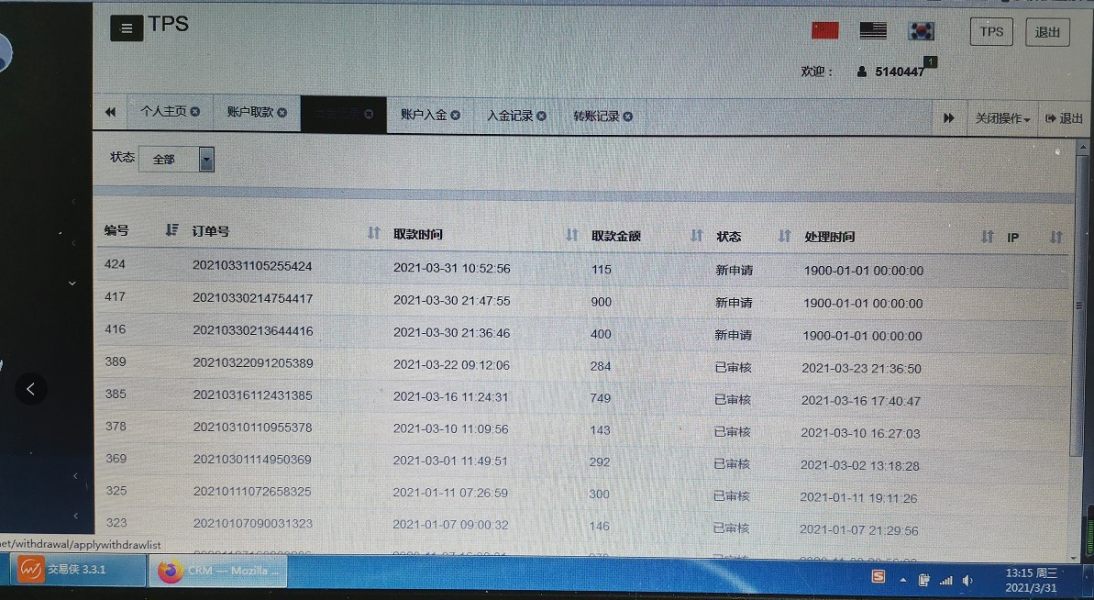

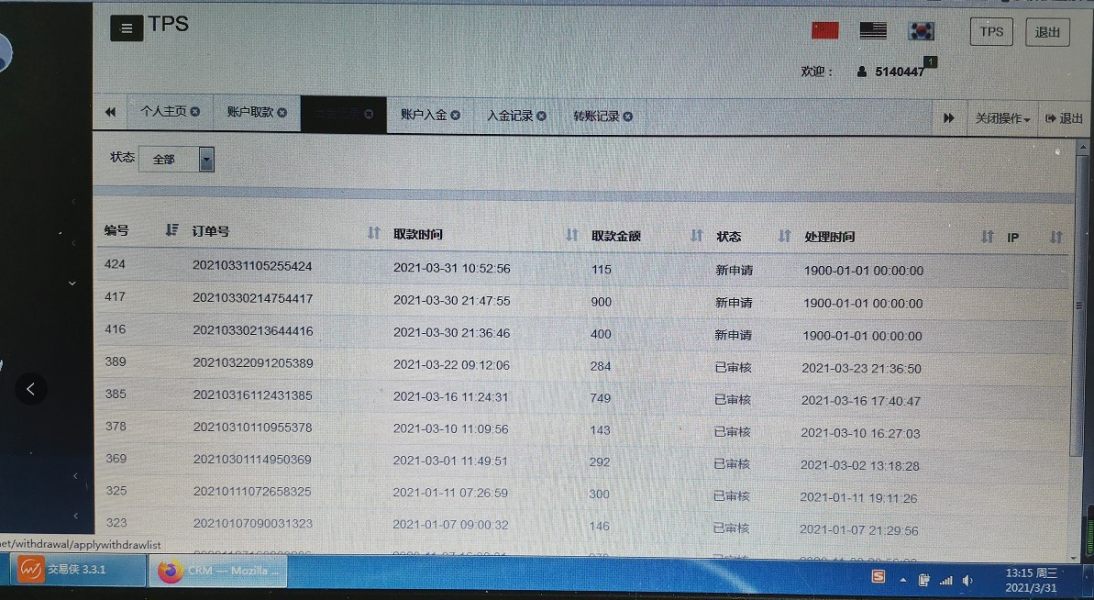

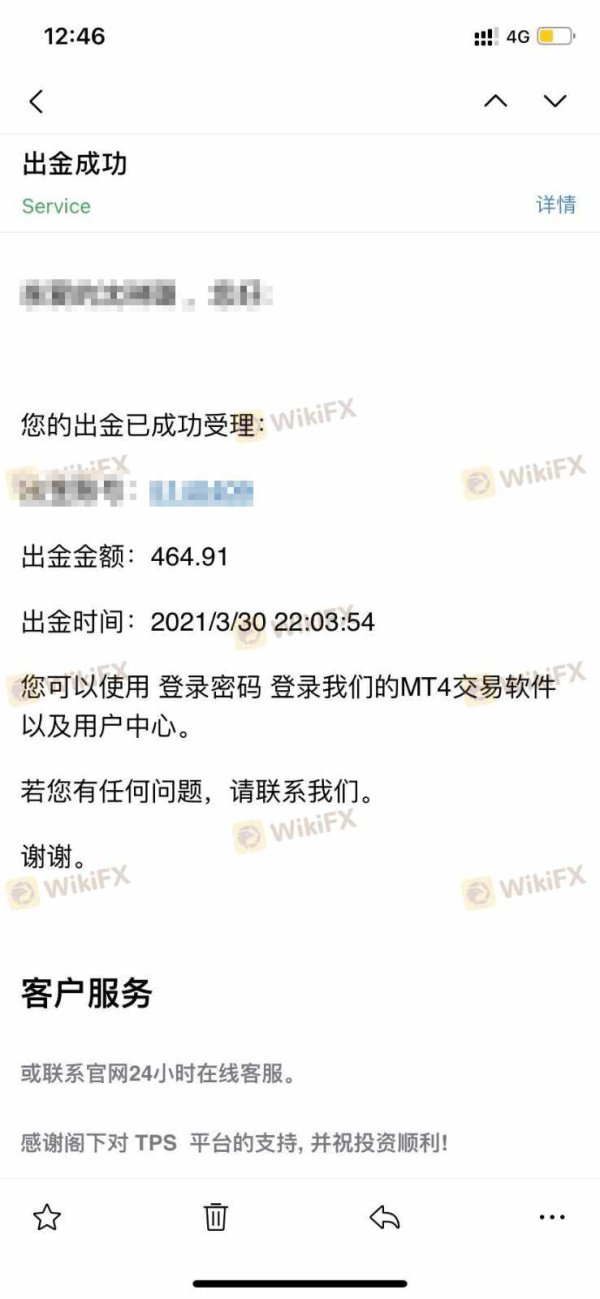

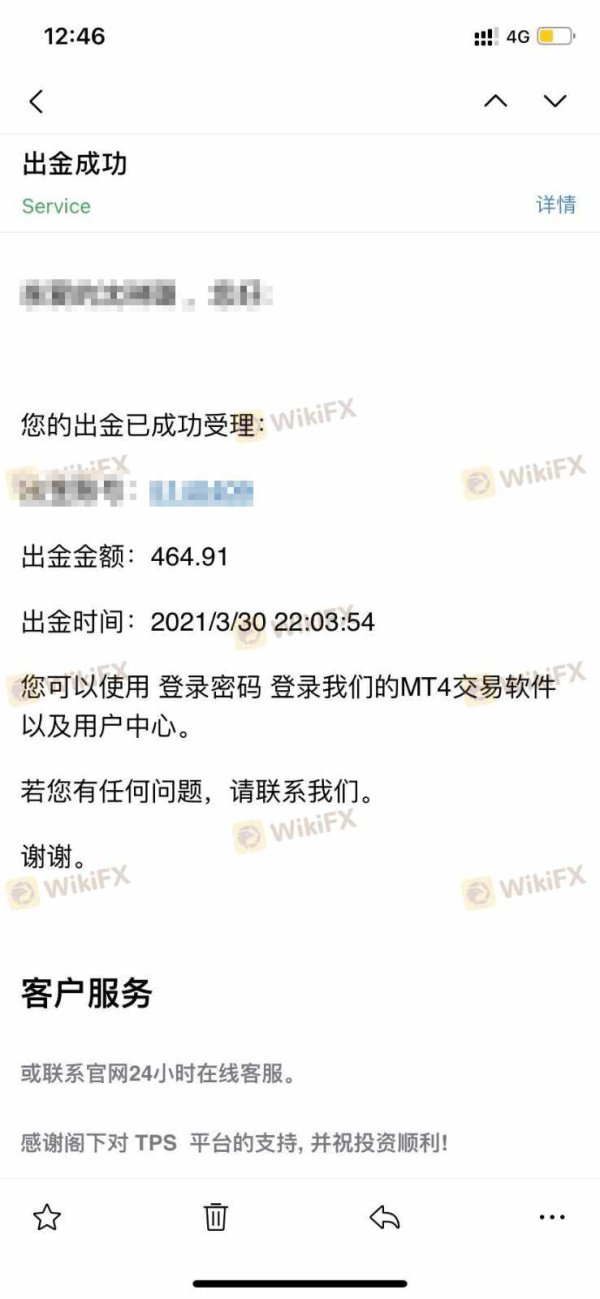

Deposit and Withdrawal Methods: Specific information about supported payment methods, processing times, and associated fees is not readily available in accessible sources.

Minimum Deposit Requirements: The minimum capital requirements for opening trading accounts with TPS are not specified in available documentation.

Bonuses and Promotions: No information about welcome bonuses, trading incentives, or promotional offers is currently available through public sources.

Tradeable Assets: The range of financial instruments, currency pairs, and other tradeable assets offered by TPS is not detailed in accessible materials.

Cost Structure: Specific information about spreads, commissions, overnight fees, and other trading costs is not available from current sources. This makes it difficult to assess the competitiveness of TPS's pricing model.

Leverage Ratios: Maximum leverage offerings and margin requirements are not specified in available documentation. This is crucial information for risk management assessment.

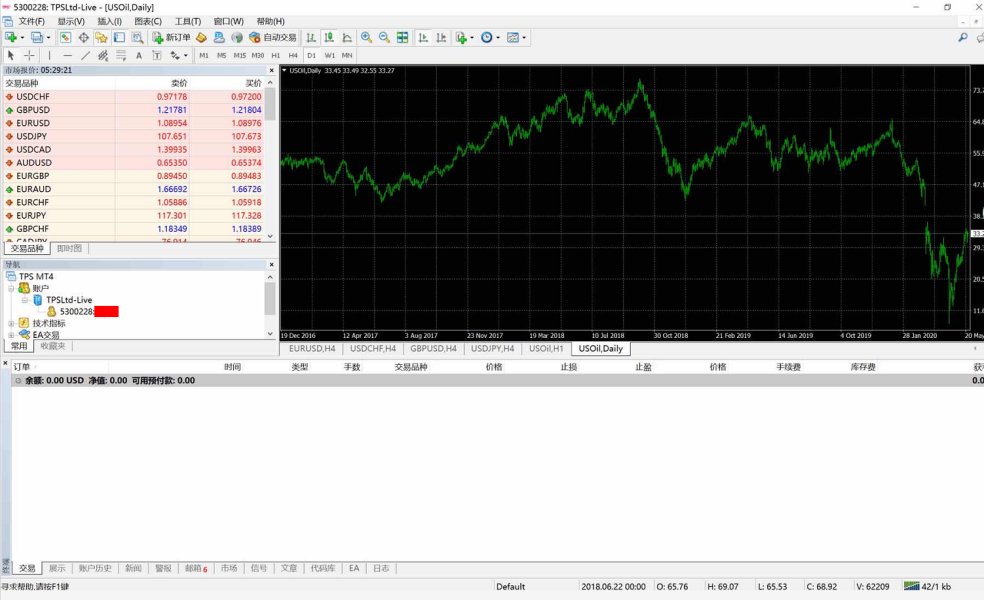

Platform Options: Details about proprietary platforms, MetaTrader availability, or mobile trading solutions are not clearly documented in accessible sources.

This tps review highlights the significant information gaps that potential clients should consider when evaluating TPS as a potential broker choice.

Account Conditions Analysis

The analysis of TPS's account conditions faces substantial limitations. This is due to the lack of comprehensive, publicly available information about their account offerings. Standard brokerage evaluation typically examines multiple account tiers, each designed for different trader profiles and capital levels, but such details are not readily accessible for TPS.

Without clear documentation of account types, minimum deposit requirements, or special features, potential clients cannot effectively compare TPS's offerings against industry standards. Most established brokers provide detailed account specifications including spread types, commission structures, and minimum trade sizes. However, this information appears to be unavailable for TPS through conventional research channels.

The absence of clear account condition information may indicate that TPS operates with a more personalized or direct consultation approach. This would require potential clients to engage directly with representatives to understand available options. However, this approach contrasts with industry trends toward transparency and readily accessible information that allows traders to make informed decisions quickly.

For this tps review, the lack of detailed account information represents a significant limitation in providing comprehensive guidance to potential clients seeking specific trading conditions and account features.

The evaluation of TPS's trading tools and resources encounters similar challenges to other assessment areas. There is limited publicly available information about the technological infrastructure and support materials offered to clients. Modern forex brokers typically provide comprehensive suites of analytical tools, educational resources, and trading aids to support client success.

Industry-standard offerings usually include economic calendars, technical analysis tools, market research, educational webinars, and trading guides. However, specific information about TPS's provision of such resources is not readily available through standard research channels. This makes it difficult to assess the quality and comprehensiveness of their client support ecosystem.

The absence of detailed information about trading platforms, charting capabilities, automated trading support, or mobile applications represents a significant gap in understanding TPS's technological offerings. Most contemporary traders expect robust platform functionality with advanced charting, multiple order types, and reliable execution capabilities.

Without access to platform demonstrations, user manuals, or detailed feature lists, potential clients cannot adequately assess whether TPS's technological infrastructure meets their trading requirements and preferences.

Customer Service Analysis

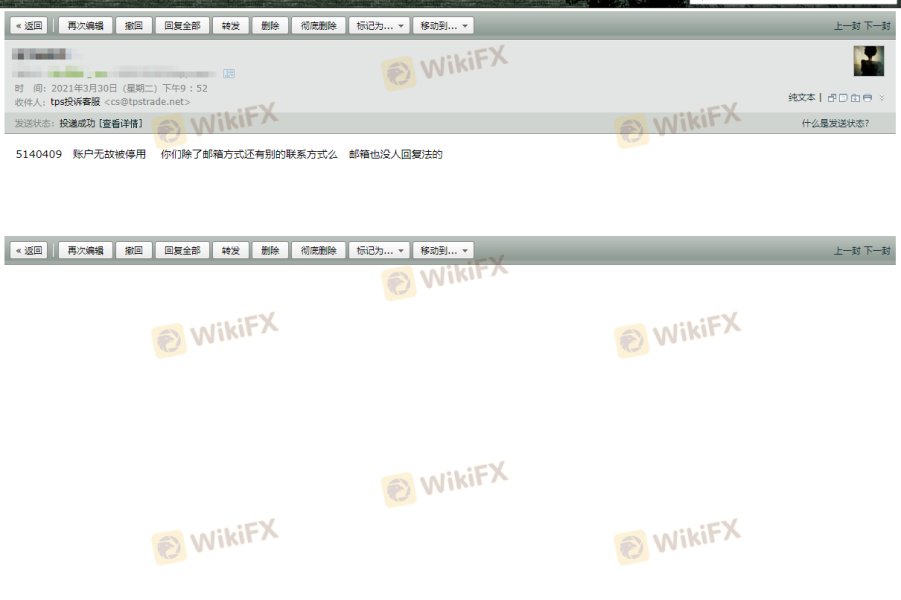

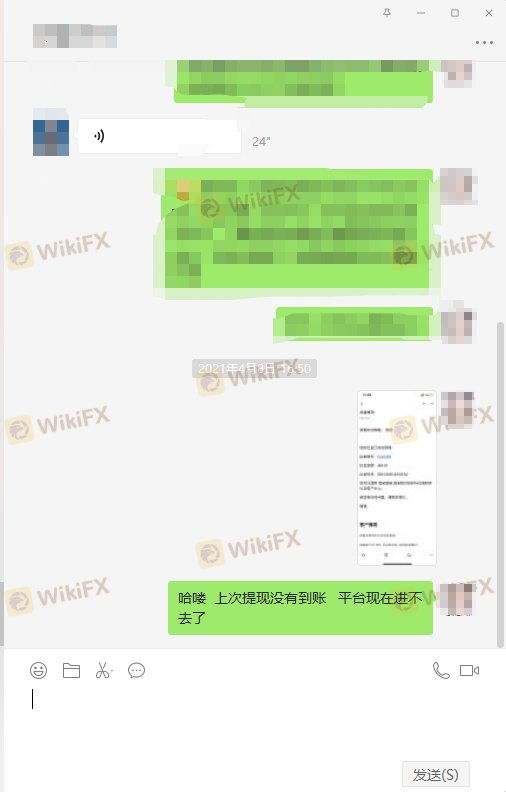

Customer service evaluation for TPS is significantly hampered by the lack of accessible information about support channels, availability hours, and service quality metrics. Professional forex brokers typically maintain multiple customer contact methods including live chat, phone support, email assistance, and comprehensive FAQ sections.

Industry best practices include multilingual support, 24/5 availability during market hours, and responsive problem resolution. However, specific details about TPS's customer service infrastructure, response times, and support quality are not available through conventional research methods.

The absence of customer testimonials, service reviews, or detailed contact information makes it challenging to assess the reliability and effectiveness of TPS's client support system. Most established brokers prominently display their customer service capabilities as a competitive advantage. However, such information is not readily apparent for TPS.

Without clear evidence of customer service quality, response times, or available support channels, potential clients cannot adequately evaluate this crucial aspect of the broker-client relationship that often determines overall satisfaction and problem resolution effectiveness.

Trading Experience Analysis

Assessing TPS's trading experience requires examination of platform stability, execution quality, pricing competitiveness, and overall user interface design. However, the limited available information makes comprehensive evaluation challenging for this tps review.

Professional trading experiences depend on factors such as order execution speed, slippage rates, platform uptime, and advanced trading features. Without access to platform demonstrations, user testimonials, or technical specifications, it's difficult to evaluate TPS's performance in these critical areas.

The trading environment's quality significantly impacts client success. This includes factors like spread stability, execution transparency, and platform responsiveness during high-volatility periods. Most established brokers provide detailed information about their execution policies, technology infrastructure, and performance statistics.

The absence of clear information about TPS's trading environment, platform capabilities, and execution quality represents a significant limitation for traders seeking to understand the practical aspects of trading with this broker.

Trust and Regulation Analysis

Trust and regulatory compliance represent perhaps the most critical factors in broker selection. Yet this area presents the greatest information challenges for TPS evaluation. Regulatory oversight by recognized financial authorities provides essential client protections including segregated fund requirements, dispute resolution mechanisms, and operational transparency standards.

Major regulatory bodies such as the FCA, ASIC, CySEC, and others maintain public databases of licensed brokers. However, TPS's regulatory status is not clearly documented in accessible sources. This lack of clear regulatory information raises important questions about client fund protection, operational oversight, and regulatory compliance.

The absence of regulatory transparency contrasts sharply with industry standards where reputable brokers prominently display their licensing information, regulatory compliance details, and client protection measures. Without clear regulatory documentation, potential clients cannot assess the legal protections and oversight mechanisms that would apply to their trading relationship.

This regulatory information gap represents a significant concern for risk-conscious traders who prioritize fund security and regulatory protection in their broker selection process.

User Experience Analysis

User experience evaluation encompasses interface design, account management ease, registration processes, and overall client satisfaction. However, the limited available information about TPS constrains comprehensive user experience assessment.

Contemporary broker evaluation typically includes analysis of website functionality, account opening procedures, platform navigation, and mobile accessibility. Without access to user testimonials, interface demonstrations, or detailed process descriptions, it's challenging to evaluate TPS's user experience quality.

The absence of readily available user feedback, platform reviews, or detailed service descriptions makes it difficult to understand how TPS's services compare to industry standards for user-friendly design and efficient account management processes.

Potential clients seeking information about the practical aspects of working with TPS may need to rely on direct communication with the company to understand the user experience and service delivery approach.

Conclusion

This tps review reveals significant limitations in available information about TPS as a forex broker. This finding itself represents an important discovery for potential clients. The lack of comprehensive, publicly accessible information about regulatory status, trading conditions, platform capabilities, and service offerings contrasts sharply with industry standards for transparency and client communication.

While the absence of detailed information doesn't necessarily indicate poor service quality, it does present challenges for traders who prefer to conduct thorough research before selecting a broker. The limited information availability may be more suitable for clients who prefer direct consultation approaches rather than self-service research methods.

Potential clients should exercise particular caution regarding regulatory verification and fund protection measures. This is especially important given the lack of clear regulatory information. This review emphasizes the importance of direct communication with TPS representatives to obtain essential information about services, conditions, and regulatory compliance before making any trading commitments.