Regarding the legitimacy of TPS forex brokers, it provides FSPR and WikiBit, (also has a graphic survey regarding security).

Is TPS safe?

Business

License

Is TPS markets regulated?

The regulatory license is the strongest proof.

FSPR Inst Forex Execution (STP)

Financial Service Providers Register

Financial Service Providers Register

Current Status:

UnverifiedLicense Type:

Inst Forex Execution (STP)

Licensed Entity:

BHP TRADING GROUP LIMITED

Effective Date:

2017-10-06Email Address of Licensed Institution:

solomonpac@yahoo.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Unit B, Level 13, 20 Waterloo Quadrant, Auckland Central, Auckland, 1010, New ZealandPhone Number of Licensed Institution:

+61 405 939 933Licensed Institution Certified Documents:

Is TPS Safe or Scam?

Introduction

TPS, a forex broker established in 2019, has garnered attention in the trading community for its offerings in the foreign exchange market. As with any financial service provider, it is crucial for traders to thoroughly evaluate the legitimacy and safety of TPS before committing their funds. The forex market is rife with scams and unregulated brokers, making it essential for traders to conduct due diligence to safeguard their investments. This article aims to provide a comprehensive analysis of TPS, assessing its regulatory status, company background, trading conditions, client safety measures, customer experiences, and overall risk profile. Our evaluation is based on a thorough review of multiple credible sources, including user feedback, regulatory disclosures, and expert opinions, ensuring a balanced perspective on whether TPS is indeed safe or a potential scam.

Regulation and Legitimacy

The regulatory status of a forex broker is a significant factor in determining its legitimacy and safety. A well-regulated broker is more likely to adhere to industry standards and protect clients' interests. In the case of TPS, concerns have arisen regarding its regulatory compliance. According to various sources, TPS is associated with the Financial Service Providers Register (FSPR), but its status is marked as a "suspicious clone." This raises red flags for potential investors.

Here is a summary of TPS's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Service Providers Register (FSPR) | 572807 | New Zealand | Suspicious Clone |

The low score of 1.53 out of 10 on WikiFX and multiple complaints from users indicate that TPS may not meet the necessary regulatory requirements. The lack of transparency regarding its operations and the absence of a robust regulatory framework further exacerbate concerns about its legitimacy. Traders should be wary of engaging with TPS, as the absence of proper regulation increases the risk of fraudulent activities and potential loss of funds. Overall, the regulatory environment surrounding TPS does not inspire confidence, leading us to question is TPS safe for trading.

Company Background Investigation

TPS was established in 2019 and operates out of China. However, the broker's history is marred by a lack of transparency and information about its ownership structure and management team. The absence of detailed disclosures raises questions about the broker's credibility. A thorough background check reveals that TPS is registered under BHP Trading Group Limited, which adds another layer of complexity to its legitimacy, as the companys regulatory status is also classified as a suspicious clone.

The management team behind TPS has not been adequately disclosed, making it difficult for potential clients to assess their qualifications and experience in the financial industry. A lack of transparency in management can often indicate underlying issues within the organization. Furthermore, the company's official website has been reported as inaccessible, limiting the availability of crucial information for potential traders. This lack of transparency and information disclosure raises significant concerns about is TPS safe for investors looking for a reliable trading platform.

Trading Conditions Analysis

When evaluating a forex broker, the trading conditions they offer play a critical role in determining their overall reliability. TPS's fee structure appears to be less favorable compared to industry standards, raising concerns for potential traders. While specific details on spreads and commissions were not readily available due to the broker's website being inaccessible, feedback from users points to high fees and unclear policies.

To provide a clearer picture, here is a comparison of TPS's trading costs with industry averages:

| Cost Type | TPS | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | High | Low to Medium |

| Commission Structure | Unclear | Clear and Defined |

| Overnight Interest Range | High | Low to Medium |

The lack of transparency regarding fees can lead to unexpected costs for traders, which may deter them from using TPS as their broker. Additionally, complaints about withdrawal difficulties and unexpected charges have surfaced, further questioning the broker's reliability. These factors contribute to the overall perception that is TPS safe for trading, as traders may find themselves facing unforeseen financial hurdles.

Client Fund Safety

Client fund safety is paramount when assessing the legitimacy of any forex broker. TPS's approach to safeguarding client funds raises several concerns. Reports indicate that TPS does not adequately separate client funds from its operational funds, which is a critical practice among reputable brokers. This lack of fund segregation poses a significant risk to clients, as their investments could be at risk if the broker faces financial difficulties.

Furthermore, TPS has not provided sufficient information regarding investor protection schemes or negative balance protection policies, which are essential safeguards for traders. The absence of such measures means that traders could potentially lose more than their initial investment, adding to the overall risk of engaging with TPS. Historical complaints alleging difficulties in withdrawing funds further highlight the risks associated with this broker. Given these factors, it is reasonable to question is TPS safe for traders who prioritize the security of their investments.

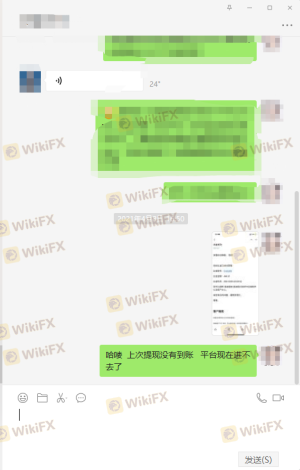

Customer Experience and Complaints

Customer feedback is a critical component in evaluating the reliability of a forex broker. In the case of TPS, reviews from users are overwhelmingly negative. Common complaints include withdrawal difficulties, lack of customer support, and issues with fund accessibility. Many users have reported being unable to withdraw their funds, which is a significant red flag when assessing a broker's trustworthiness.

Here is an overview of the primary complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Customer Support | Medium | Poor |

| Fund Accessibility Problems | High | Poor |

One notable case involved a user who reported being unable to withdraw their funds after multiple attempts, leading to frustration and financial loss. Another user claimed that their account was closed without explanation, further emphasizing the lack of responsiveness from TPS's customer support. Such patterns of complaints raise significant concerns about the broker's operational integrity and customer service quality, leading many to question is TPS safe for trading.

Platform and Execution

The trading platform offered by a broker significantly impacts the user experience and trading outcomes. TPS's platform has received mixed reviews, with users reporting issues related to stability and execution quality. Complaints about slippage and order rejections have been common, which can severely affect trading performance and profitability.

The lack of transparency regarding the platform's functionality and execution metrics also raises concerns. Traders have expressed dissatisfaction with the platform's performance, often citing delays in order execution and poor customer support when issues arise. These factors contribute to the overall perception of TPS as a less-than-reliable broker, prompting further investigation into whether is TPS safe for traders seeking a stable and efficient trading environment.

Risk Assessment

Engaging with TPS carries several inherent risks that potential traders should consider. The combination of regulatory concerns, customer complaints, and issues regarding fund safety creates a comprehensive risk profile that is unfavorable for investors. Heres a summary of the key risk areas associated with TPS:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status and clone issues |

| Financial Risk | High | Difficulties in fund withdrawals |

| Operational Risk | Medium | Complaints about platform stability |

| Customer Service Risk | High | Poor response to user complaints |

To mitigate these risks, traders should consider opening accounts with well-regulated brokers that offer clear fee structures, robust customer support, and strong fund protection measures. Seeking out brokers with positive user reviews and transparent operations can help ensure a safer trading experience.

Conclusion and Recommendations

In conclusion, the evidence suggests that TPS may not be a safe choice for forex trading. The broker's dubious regulatory status, coupled with numerous user complaints regarding fund withdrawals and customer support, raises significant concerns about its legitimacy. As traders evaluate their options, it is crucial to prioritize safety and reliability.

For those considering engaging with TPS, it is advisable to proceed with caution. Traders should explore alternative brokers with solid regulatory frameworks, transparent fee structures, and positive user experiences. Options such as brokers regulated by top-tier authorities like the FCA or ASIC may provide a more secure trading environment.

Ultimately, the question remains: is TPS safe? Based on the available evidence, potential investors should be wary and consider other reputable alternatives to safeguard their investments.

Is TPS a scam, or is it legit?

The latest exposure and evaluation content of TPS brokers.

TPS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TPS latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.