Icon FX 2025 Review: Everything You Need to Know

Executive Summary

Icon FX stands out as a key player in online trading and CFD brokerage. The company positions itself to serve traders who want diverse investment opportunities across multiple markets. This icon fx review shows a broker that has earned positive user feedback, especially for its trading execution speed and customer service quality that consistently meets client expectations. The platform offers leverage up to 1:500 and competitive spreads starting from zero, making it attractive for traders who prioritize cost-effective trading conditions.

The broker supports multiple asset classes including forex, commodities, indices, and cryptocurrencies through established platforms like MetaTrader 4 and cTrader. User testimonials indicate significant improvements in trading confidence after switching to Icon FX, with particular praise for the platform's execution speed and liquidity provision that enhances overall trading performance. The target demographic appears to be traders seeking high-leverage opportunities and diversified investment portfolios, though the lack of comprehensive regulatory information may concern some institutional investors who require detailed compliance documentation.

Key performance indicators suggest fast trade execution and superior liquidity, contributing to overall positive user satisfaction across different trading styles. However, potential clients should note that commission structures vary by account type, and minimum deposit requirements are not clearly specified in available documentation that traders can access.

Important Disclaimers

Due to the absence of detailed regulatory information in available materials, investors must independently verify the applicable legal and regulatory frameworks that govern their trading relationship with Icon FX. Different jurisdictions may have varying levels of investor protection, and traders should ensure compliance with their local financial regulations before opening accounts with any broker.

This evaluation is compiled based on user feedback and publicly available information, which may contain time-sensitive data that could become outdated as market conditions change. Market conditions, regulatory changes, and company policy updates may affect the accuracy of this assessment over time. Prospective traders are advised to conduct independent due diligence and verify current terms and conditions directly with the broker before making any investment decisions.

Overall Rating Framework

Broker Overview

Icon FX operates as an online trading and CFD brokerage firm. Specific founding details are not mentioned in available materials that we could access for this review. The company appears to maintain a focus on providing diverse trading opportunities across multiple asset classes, positioning itself as a comprehensive solution for traders seeking variety in their investment approach that spans different markets and instruments.

Based on user feedback patterns, the broker has established a reputation for reliable service delivery and competitive trading conditions. The business model centers on offering various financial instruments including forex pairs, commodities, market indices, and cryptocurrency CFDs to accommodate different trader preferences and risk profiles that vary across the trading community. This icon fx review indicates that the platform emphasizes execution quality and customer satisfaction as core differentiators in a competitive marketplace where brokers compete for trader attention.

User testimonials suggest the broker has successfully attracted traders who value both technological reliability and responsive customer support. Icon FX provides access to trading through MetaTrader 4 and cTrader platforms, both recognized industry standards that offer comprehensive charting tools and automated trading capabilities for professional traders. The asset selection spans major forex pairs, commodity markets, equity indices, and digital currencies, enabling portfolio diversification within a single trading account that simplifies management.

While specific regulatory oversight details are not detailed in available information, the broker's operational framework appears designed to serve international traders across multiple jurisdictions.

Detailed Features Analysis

Regulatory Status: Available materials do not specify particular regulatory authorities or licensing jurisdictions. This represents a significant information gap for potential clients seeking regulatory assurance about their investments.

Deposit and Withdrawal Methods: Specific payment processing options and supported banking methods are not detailed in current documentation. Traders require direct broker consultation for clarification about available payment options.

Minimum Deposit Requirements: Entry-level funding requirements are not explicitly stated in available materials. This makes it difficult to assess accessibility for different trader segments with varying capital levels.

Promotional Offers: Current bonus structures or promotional incentives are not mentioned in accessible information sources that we reviewed.

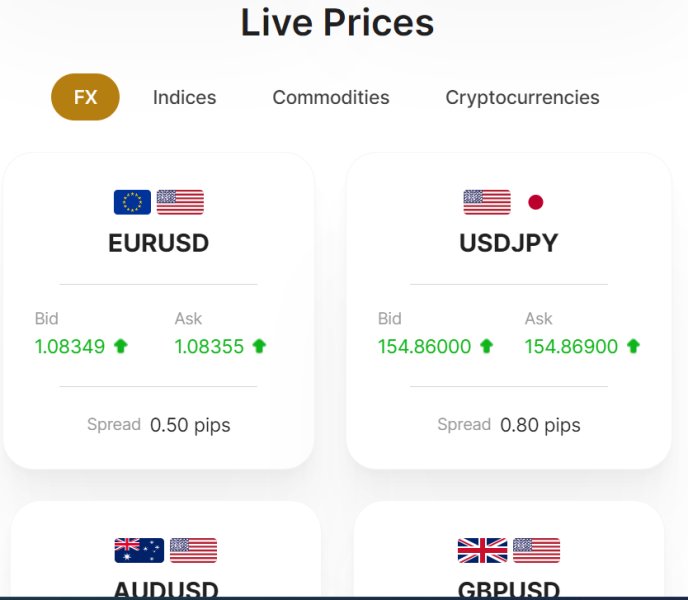

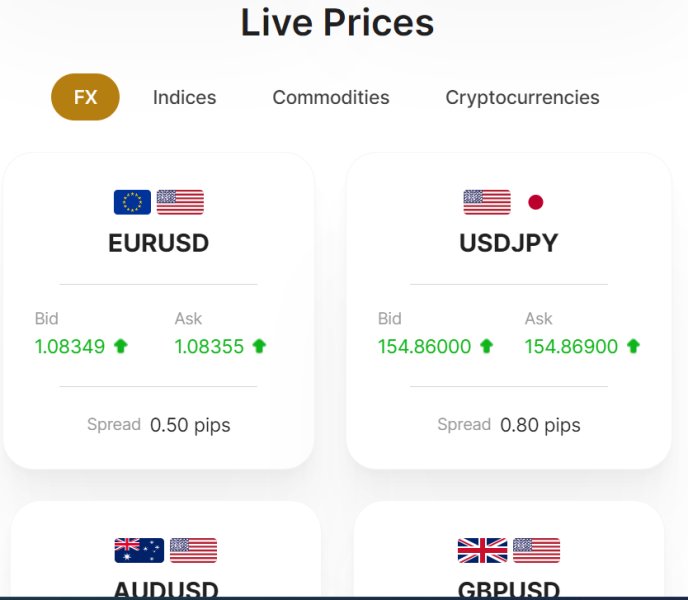

Tradeable Assets: The platform supports foreign exchange pairs, index CFDs, commodity contracts, and cryptocurrency instruments. This provides broad market exposure opportunities for diversified trading strategies across multiple asset classes.

Cost Structure: Spreads begin from zero basis points, with commission charges varying according to specific account type selections. This icon fx review notes that detailed fee schedules require direct verification with the broker for complete transparency about trading costs.

Leverage Options: Maximum leverage ratios reach 1:500. This offers significant capital amplification potential for qualified traders who understand associated risks.

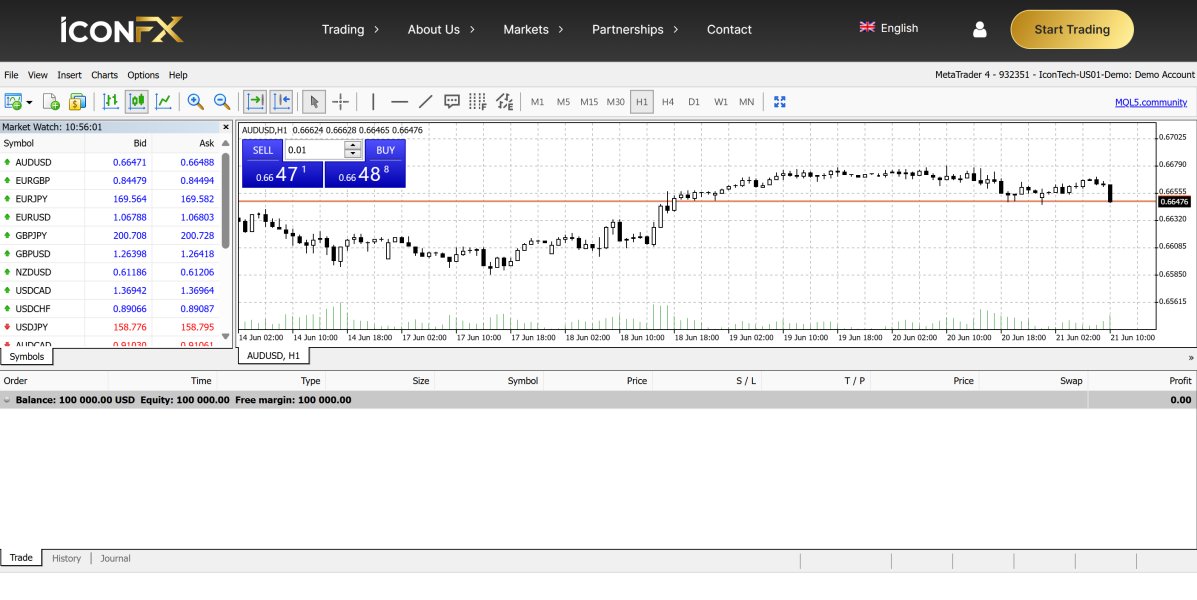

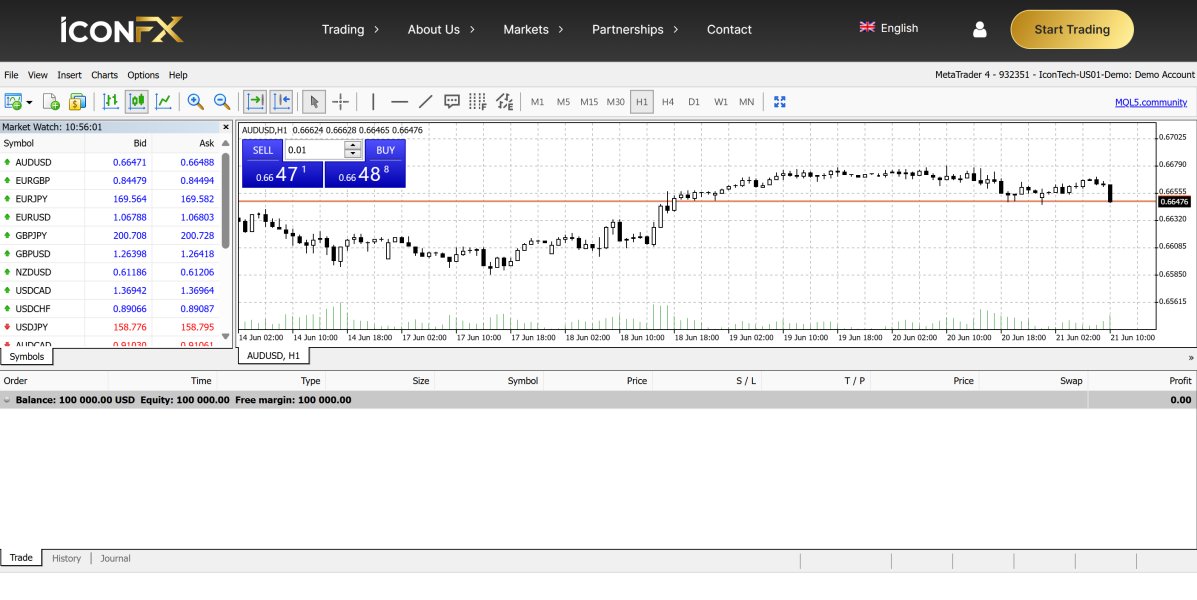

Platform Selection: Trading access is provided through MetaTrader 4 and cTrader platforms. Both offer professional-grade functionality and market analysis tools for serious traders.

Geographic Restrictions: Specific regional limitations or restricted jurisdictions are not outlined in available documentation that traders can review.

Customer Support Languages: The range of supported communication languages for customer service is not specified in current materials.

Comprehensive Rating Analysis

Account Conditions Analysis

The account structure at Icon FX presents a mixed evaluation profile, earning a moderate score due to both attractive features and information limitations. The availability of 1:500 leverage represents a significant advantage for traders seeking capital efficiency, particularly in forex and CFD markets where margin requirements can significantly impact position sizing strategies that determine potential profits. However, this icon fx review must note that the absence of clear minimum deposit information creates uncertainty for potential clients planning their initial investment approach with the broker.

User feedback suggests that the account opening process operates smoothly, with traders reporting relatively straightforward onboarding experiences. The commission structure's variation by account type indicates tiered service levels, which is common industry practice but requires detailed clarification to enable informed decision-making by prospective clients. Without specific information about account types and their respective features, traders cannot adequately assess which option aligns with their trading style and volume expectations.

The lack of information regarding specialized account features, such as Islamic trading accounts or professional trader classifications, limits the comprehensive evaluation of Icon FX's accommodation for diverse trader requirements.

Icon FX's technological infrastructure demonstrates solid foundations through its selection of established trading platforms. This contributes to a favorable assessment in this category for traders who value reliable technology. The provision of both MetaTrader 4 and cTrader addresses different trader preferences, with MT4 offering widespread familiarity and cTrader providing advanced order management capabilities that professional traders often require.

User feedback indicates satisfaction with platform performance and functionality, suggesting adequate technical implementation and maintenance by the broker's technical team. However, this evaluation reveals significant gaps in educational and analytical resource provision that many traders expect from modern brokers. The absence of detailed information about market research, economic analysis, or trader education materials represents a notable limitation for clients seeking comprehensive trading support beyond just platform access.

Many competitive brokers enhance their value proposition through extensive educational content, market commentary, and analytical tools that support trader development and decision-making processes.

Customer Service and Support Analysis

Customer service emerges as a particular strength in this icon fx review, with user feedback consistently highlighting positive experiences with support team interactions. Traders report timely responses to inquiries and effective problem resolution, suggesting well-trained support staff and efficient internal processes that prioritize client satisfaction. The quality of customer service often significantly impacts trader satisfaction and retention, making this a valuable competitive advantage for Icon FX in the crowded brokerage marketplace.

User testimonials indicate that support representatives demonstrate professional competence and genuine commitment to resolving client concerns effectively. The responsiveness factor receives particular praise, with traders noting that their questions and issues receive prompt attention rather than extended waiting periods common with some industry providers that lack adequate staffing. This level of service quality suggests adequate staffing levels and possibly effective training programs for customer-facing personnel who interact with traders daily.

However, the evaluation is limited by the absence of information about specific customer service channels, operating hours, or multilingual support capabilities that international traders often require.

Trading Experience Analysis

The trading experience evaluation yields highly positive results, with user feedback emphasizing fast execution speeds and superior liquidity provision. These factors are fundamental to successful trading outcomes, particularly for strategies that depend on precise entry and exit timing in volatile markets. Traders consistently report satisfaction with order fulfillment quality, suggesting robust technological infrastructure and effective liquidity partnerships that minimize slippage and execution delays that can impact profitability.

The stability of spreads and quality of liquidity provision receive particular commendation from users, indicating that Icon FX maintains competitive pricing even during volatile market conditions. This consistency is crucial for traders who rely on predictable cost structures for their strategy implementation across different market environments. The platform's ability to maintain execution quality across different market conditions suggests adequate technological investment and operational expertise by the broker's management team.

However, this icon fx review notes the absence of specific technical performance data, such as average execution speeds, slippage statistics, or uptime measurements that would provide quantitative validation of user experiences.

Trust and Security Analysis

The trust and security evaluation presents the most significant concern in this comprehensive assessment. This primarily stems from the absence of detailed regulatory information in available materials that traders can review. Regulatory oversight provides essential investor protections including segregated fund storage, dispute resolution mechanisms, and operational transparency requirements that many traders consider fundamental prerequisites for broker selection in today's market environment.

Without clear information about licensing authorities, regulatory compliance standards, or fund safety measures, potential clients cannot adequately assess the security of their capital or the legal protections available in case of disputes. This information gap is particularly concerning for larger traders or institutional clients who require comprehensive due diligence documentation for their compliance and risk management processes that govern their investment decisions.

The absence of transparency regarding company financial reporting, management team backgrounds, or operational history further compounds trust assessment challenges for potential clients.

User Experience Analysis

Overall user satisfaction appears strongly positive based on available feedback, with traders reporting significant improvements in their trading confidence after transitioning to Icon FX. This psychological factor often correlates with improved trading performance and suggests that the platform successfully meets user expectations across multiple dimensions including reliability, functionality, and support quality that traders value most. The feedback indicates that the registration and account verification processes operate smoothly, reducing friction for new users and enabling faster account activation than many competitors offer.

This operational efficiency contributes to positive first impressions and may influence long-term client retention rates that determine broker success. Users appreciate the straightforward approach to account management and the absence of unnecessary complications in routine procedures that can frustrate traders trying to focus on market opportunities.

However, the evaluation is constrained by the lack of specific interface design information, detailed usability assessments, or comprehensive user satisfaction metrics that would provide deeper insights into the platform experience.

Conclusion

Icon FX presents itself as a competent online trading and CFD brokerage that delivers solid performance in execution quality and customer service. However, significant information gaps limit comprehensive evaluation of all aspects that traders typically consider when selecting a broker. This icon fx review identifies the broker as particularly suitable for traders prioritizing fast execution, competitive spreads, and responsive customer support over extensive educational resources or detailed regulatory transparency that some institutional clients require.

The platform appears most appropriate for experienced traders who value high leverage opportunities and multi-asset portfolio diversification. This is particularly true for those comfortable navigating limited regulatory disclosure in their broker selection process. However, institutional traders or those requiring comprehensive compliance documentation may find the available information insufficient for their due diligence requirements that govern their investment decisions.

Primary advantages include the 1:500 leverage availability, zero-spread starting points, superior execution speed, and quality customer service delivery that consistently meets client expectations. Conversely, the main limitations involve unclear regulatory oversight, undefined minimum deposit requirements, and limited transparency regarding fund safety measures and corporate governance standards that some traders consider essential for their peace of mind.