investizo 2025 Review: Everything You Need to Know

Abstract

The investizo review shows that this broker is a reliable forex provider. It offers competitive trading conditions and gives users a positive experience overall. Established in 2019 and based in Saint Vincent and the Grenadines, investizo has found its place by offering low spreads and high leverage up to 1:1000. Users from beginners to advanced traders like its combined liquidity and low fees. These features help create a smooth trading environment. The platform won recognition as the Best Copy Trading Platform in Southeast Asia for 2025. Good trading conditions and solid technology have made investizo a strong choice in the forex market.

Important Considerations

You should know that investizo is based in Saint Vincent and the Grenadines and lacks clear regulatory oversight in the materials we found. Users should be careful and check the rules that apply to their area before opening an account. This review uses user feedback and available information to give you a complete picture of the broker's strengths and uncertain areas. The analysis shows a balanced view from multiple sources and stresses that potential clients must check details for their local area.

Rating Framework

Broker Overview

Investizo started in 2019 and quickly became a player in online trading. The broker is based in Saint Vincent and the Grenadines and provides many online investment and trading services for both beginners and experienced investors. With a focus on competitive spreads, low fees, and leverage up to 1:1000, investizo has caught the attention of many forex traders. Its business model centers on serving different types of clients by offering easy-to-use trading platforms and combined liquidity. Technology innovation and competitive trading conditions have helped the broker find its place in a tough market.

For trading platforms, investizo offers access through MetaTrader 4. This platform is widely known for its strong features and complete toolset. Traders can use many asset classes including currencies, cryptocurrencies, indices, precious metals, energies, and stocks. Even without clear regulatory oversight in the materials we found, the broker's simple interface and commitment to low spreads and high leverage have pleased many users. The service targets both new traders who want easy entry into financial markets and experienced professionals who need advanced trading capabilities. The platform's design and reliability have built its reputation in the industry, though the lack of clear regulatory information remains a notable concern.

Based on available information, the regulatory region for investizo is not specified. The broker is based in Saint Vincent and the Grenadines, but there is no detailed mention of regulatory licensing or oversight from recognized authorities. Potential clients should check local regulatory requirements based on their country before proceeding.

The deposit and withdrawal methods offered by investizo are not fully detailed in the data we have. Users should expect to find common electronic banking options, but specific methods and processing times are unclear. The minimum deposit requirement is also not clearly stated, so traders should contact the broker directly or check updated information on their website.

Bonus promotions are not explained in the materials. Without clear details, potential traders cannot confirm if investizo offers any trading bonuses or promotional schemes that are common among similar brokers.

For tradable assets, investizo allows trading in a broad range of financial instruments. These include multiple currency pairs, cryptocurrencies, indices, precious metals, energy commodities, and stocks. This variety ensures that both careful and aggressive traders can find instruments that fit their trading strategy.

Looking at cost structures, investizo provides competitive trading conditions with spreads starting at zero and low commission fees. However, the specific fee schedule, such as commission per lot or inactivity fees, is not completely detailed in the existing data. The broker's transparency on fee information could use additional clarity.

The leverage offered by investizo is notably high, with a maximum of up to 1:1000. This gives significant trading power. This feature attracts traders seeking amplified exposure, though it comes with higher risk.

For platform selection, investizo is built exclusively on MetaTrader 4. This ensures a well-established trading environment with strong features and widespread familiarity among traders. Despite its many benefits, relying on a single platform option might limit users who prefer alternative modern platforms with different features.

Regional restrictions for investizo are not clearly detailed in the available information. Users in certain areas may need to confirm whether the broker's services are available in their region. The details about customer service, including available languages, remain limited with no specific indication of multi-language support.

Detailed Rating Analysis

1. Account Conditions Analysis

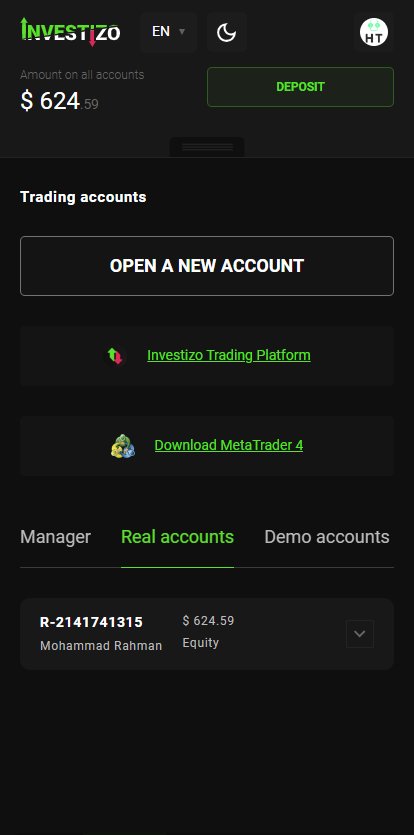

The account conditions offered by investizo are one of the notable strengths of this broker. Specific account types are not clearly detailed, but the available information highlights low spreads starting from 0 and low commission fees as major advantages. The potential to trade with leverage as high as 1:1000 is another attractive feature, particularly for experienced traders aiming to maximize their positions. However, the absence of a clearly stated minimum deposit requirement leaves potential users uncertain, as this important element can significantly affect platform accessibility for beginners. The account opening process, including any potential verification and documentation requirements, also remains unspecified in the data. While users generally express satisfaction with the low-cost trading environment, there is a lack of detailed feedback regarding any specialized account distinctions, such as Islamic accounts or VIP tiers. Compared to other brokers in the market, investizo performs well in terms of spread and leverage offerings; however, further transparency regarding minimum deposit requirements and account types is needed to solidify its competitive position. Overall, this investizo review emphasizes that the account-related conditions, while attractive, could be improved with more comprehensive disclosure of account opening procedures and associated requirements.

Investizo supports the widely known MetaTrader 4 platform. This ensures that traders have access to an efficient and reliable trading environment. The platform itself comes with a suite of strong trading tools that cater to technical analysis, automated trading strategies, and comprehensive charting capabilities. Users have reported that the stability of MetaTrader 4 contributes to a positive trading experience, with smooth order execution and a familiar interface that minimizes the learning curve. Despite the positive aspects pertaining to platform reliability, the data does not provide detailed insights into additional research or analytical resources. Educational materials, such as webinars, tutorials, or market analysis reports, appear to be limited or are not referenced in the available materials. The absence of clearly documented educational resources suggests that while the platform is technologically proficient, there might be missed opportunities to assist beginner traders in their learning curve. Automated trading options are inherently available on MetaTrader 4, yet the broker's specific support for setting up such strategies has not been thoroughly outlined. Overall, this investizo review indicates that while the technical tools and platform resources are strong, there remains room for improvement in offering supplementary educational content and advanced research materials to enhance the overall user experience.

3. Customer Service and Support Analysis

Customer service is a core component of any trading platform. Yet with investizo, detailed information on support channels and multilingual services is sparse. From the available materials, it is evident that specific elements such as response times, customer service channels , and operating hours have not been elaborated upon. This lack of transparency may pose challenges for users who require prompt and reliable support during critical trading periods. Additionally, while there is a general indication that customer service exists, there is no strong evidence of exceptional support in terms of problem resolution or dedicated account management. The absence of specific user testimonials regarding support interactions means that prospective users must rely on limited data when assessing the quality of customer service. Compared to competitors that clearly outline and emphasize strong customer support, investizo could benefit from greater transparency and an expanded range of customer service options. This investizo review highlights that while the broker appears to offer standard support services, traders should exercise caution and seek further details regarding language options and comprehensive support practices before committing substantial investments. Enhanced support documentation and clear communication of service channels would likely improve the overall perception and satisfaction regarding customer service.

4. Trading Experience Analysis

The overall trading experience with investizo is characterized by a stable, strong, and user-friendly environment. This is predominantly supported by the industry-standard MetaTrader 4 platform. Users have noted favorable characteristics such as steady execution of market orders and optimal liquidity, which contribute to maintaining consistent spreads. The platform's design is intuitive, allowing both novice traders and experienced investors to navigate efficiently and execute complex trading strategies with relative ease. Despite these strengths, some specific details like mobile trading performance and the availability of advanced charting or analytical tools beyond the standard offerings remain underreported. Order execution quality appears to be met with satisfaction according to several user comments, although quantitative performance data is not explicitly mentioned in the available materials. Furthermore, while the platform's stability is routinely praised, the absence of information regarding potential downtimes during peak trading sessions leaves a minor gap in the overall picture. This investizo review reiterates that the trading experience is largely positive, with users enjoying rapid execution and a well-regarded interface, yet also emphasizes that additional insights and third-party performance validations would further bolster confidence in the platform's operational reliability.

5. Trust Analysis

Trust is a critical factor when evaluating any financial broker. In the case of investizo, the overall picture is somewhat mixed. While user feedback generally suggests that the broker is reliable in its trading execution and operational transparency, there are significant concerns stemming from the absence of clearly defined regulatory information. Without explicit licensing or oversight from reputable financial regulatory bodies, potential clients might view investizo as carrying higher risks compared to its fully regulated competitors. The broker's headquarters in Saint Vincent and the Grenadines does little to counterbalance these concerns since many traders look for strong regulatory environments as a safety net for their investments. Although investizo has been recognized as the Best Copy Trading Platform in Southeast Asia for 2025, which lends some credibility in terms of innovation and service delivery, the lack of detailed funding protection measures and risk disclosures remains a notable drawback. Various industry reports hint at positive operational practices, yet the absence of comprehensive regulatory validation means that trust must be continually earned through consistent performance. In this investizo review, it is clear that while the broker has strengths in service delivery, its trust score is penalized by the regulatory uncertainty and the need for enhanced transparency in how client funds are safeguarded.

6. User Experience Analysis

User experience on investizo's platform appears to be generally positive. Most traders appreciate the clean interface and the ease of navigation provided by MetaTrader 4. The design of the platform allows for easy access to various trading instruments, and the combined liquidity has been highlighted as a beneficial feature for ensuring competitive pricing in volatile markets. Although the registration and account verification processes have not been detailed extensively, the available user testimonials tend to focus on the overall satisfaction with the platform's simplicity in execution. Feedback suggests that the trading environment is stable and well-suited to both novice beginners and seasoned traders. However, the limited availability of information regarding potential technical issues, such as downtime or glitches, means that there are still areas requiring further confirmation from user experiences over time. Additionally, while most reports are positive regarding intuitive design, the absence of personal accounts detailing registration challenges or fund transfer experiences leaves a slight gap in the user experience narrative. This investizo review encapsulates that while the overall sentiment is favorable, improvements in clarity regarding the onboarding and troubleshooting processes would elevate user satisfaction even further.

Conclusion

In summary, investizo emerges as a broker offering competitive trading conditions with low spreads and high leverage. This caters to both novice and experienced traders. The available evidence confirms a stable trading platform powered by MetaTrader 4 and a diverse range of tradable assets. However, the lack of detailed regulatory information, specific account requirements, and comprehensive customer support documentation pose potential concerns. Overall, this investizo review suggests that while there are many positive aspects to the broker's offerings, prospective traders should exercise due diligence, particularly in understanding regulatory risks and account details before committing substantial funds.