Teletrade 2025 Review: Everything You Need to Know

Executive Summary

Teletrade is an established international online retail broker. It has been serving the financial markets since the 1990s, building a strong reputation over decades of operation. This Teletrade review reveals a CySEC-regulated brokerage that caters to both novice traders and experienced investors seeking diversified investment opportunities. The broker stands out with an exceptionally low minimum deposit requirement of just $20. This makes it particularly accessible to newcomers in the forex and CFD trading space who want to start with limited capital.

The platform offers a comprehensive range of trading instruments including forex, stocks, indices, and CFDs, supported by market analysis tools and financial insights. According to available user feedback, Teletrade maintains a respectable 3.94 TrustScore, indicating generally positive customer satisfaction across its user base. The broker's commitment to providing VIP clients with unique conditions and promotional activities further enhances its appeal to serious traders. For beginners and traders looking for diverse investment products with low entry barriers, Teletrade presents a viable option in the competitive brokerage landscape.

Important Notice

Teletrade operates across multiple regions with primary regulatory oversight from the Cyprus Securities and Exchange Commission. Potential clients should be aware that different regional entities may operate under varying legal frameworks and regulatory requirements that could affect their trading experience. This review is compiled based on publicly available information and user feedback to provide prospective customers with a comprehensive understanding of Teletrade's services. Traders should verify the specific regulatory status and terms applicable to their jurisdiction before opening an account to ensure compliance with local regulations.

Rating Framework

Broker Overview

Teletrade emerged in the 1990s as an international online retail broker. The company established itself during the early stages of online trading evolution, positioning itself as a pioneer in digital financial services. Over the decades, Teletrade has built its reputation by focusing on providing accessible forex, stock, and CFD trading services to a global clientele. The broker has successfully positioned itself as a bridge between institutional-grade trading tools and retail accessibility. This approach makes financial markets more approachable for individual traders who might otherwise find entry barriers too high.

The broker operates under a comprehensive business model that encompasses multiple asset classes including foreign exchange, equity markets, major indices, and contracts for difference. This Teletrade review indicates that the company's approach centers on delivering diversified investment opportunities while maintaining competitive entry requirements for new traders. The platform provides market news, financial analytics, and trading insights sourced from industry-leading providers like TradingView. This ensures clients have access to professional-grade market intelligence that can inform their trading decisions.

Teletrade's regulatory framework is anchored by Cyprus Securities and Exchange Commission oversight, providing clients with regulatory protection and operational transparency. The broker's asset offerings span traditional forex pairs, international stock markets, commodity CFDs, and major global indices. This comprehensive range caters to various trading strategies and investment preferences across different market sectors.

Regulatory Jurisdiction: Teletrade operates under the regulatory supervision of the Cyprus Securities and Exchange Commission. This ensures compliance with European financial services regulations and provides client protection measures standard within the European Economic Area for enhanced security.

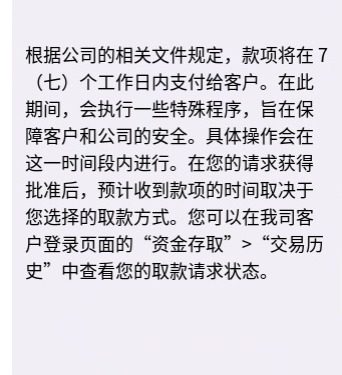

Deposit and Withdrawal Methods: While specific payment method details are not extensively detailed in available materials, the broker's operational framework suggests support for standard banking and electronic payment solutions. These methods are commonly used in international brokerage services to facilitate client transactions.

Minimum Deposit Requirements: The broker sets an exceptionally accessible minimum deposit threshold of $20 for verified clients. This positions it among the most entry-friendly brokers in the market and makes forex trading accessible to newcomers with limited capital.

Bonus and Promotional Programs: Teletrade offers several promotional initiatives including "Invest Start" for risk-free beginnings and "TeleTrade Accruals" providing 4.5% annual returns plus additional trading bonuses. The "VIPTrade" program delivers unique conditions for qualified clients who meet specific trading volume requirements.

Available Trading Assets: The platform provides access to forex markets, international stock exchanges, major global indices, and CFD instruments across various asset classes. This comprehensive offering enables diversified trading strategies for different market conditions and investment goals.

Cost Structure: While specific spread and commission details are not extensively outlined in available information, user feedback suggests that the overall cost structure remains competitive within industry standards. Detailed fee schedules would require direct broker consultation for precise information.

Leverage Options: Specific leverage ratios are not detailed in the available information. As a CySEC-regulated entity, the broker likely adheres to European leverage restrictions for retail clients to ensure responsible trading practices.

Trading Platform Selection: Available information does not specify the exact trading platforms offered by the broker. The integration with TradingView suggests professional charting and analysis capabilities are available to clients for enhanced market analysis.

This comprehensive Teletrade review highlights the broker's focus on accessibility and diverse market offerings. Some operational details would benefit from direct verification with the broker for complete accuracy.

Detailed Rating Analysis

Account Conditions Analysis (7/10)

Teletrade's account structure demonstrates a clear commitment to accessibility. The $20 minimum deposit requirement stands as one of the most competitive entry points in the international brokerage space, removing significant barriers for newcomers. This low threshold allows individuals to begin their trading journey without substantial capital commitments, making forex and CFD trading accessible to a broader audience.

The broker's account opening process, according to user feedback, appears streamlined and user-friendly for new clients. Specific account tier details and their respective features are not extensively documented in available materials, which could be improved for transparency. The verification process for new clients appears standard, requiring typical documentation for regulatory compliance purposes as mandated by financial authorities.

While the promotional programs like "Invest Start" and "VIPTrade" suggest multiple account categories with varying benefits, more detailed information would be helpful. The specific features, trading conditions, and exclusive services for different account levels would require direct consultation with the broker for complete understanding. The 30% spread sharing mentioned in promotional materials indicates potential rebate programs for active traders who meet volume requirements.

User experiences suggest satisfaction with the account setup process and initial trading conditions. This Teletrade review notes that more detailed information about account types, their specific features, and any associated maintenance requirements would enhance transparency for potential clients considering the platform.

Teletrade provides a solid foundation of analytical tools and market resources. The broker shows particular strength in its integration of professional market analysis that can support various trading strategies. The platform offers comprehensive market news coverage, ensuring clients stay informed about global economic developments that impact trading opportunities across different markets.

The inclusion of TradingView integration represents a significant value addition for traders. This provides access to professional-grade charting tools and technical analysis capabilities that are typically found on more expensive platforms. The platform's financial market analytics appear robust, offering expert market reviews and detailed forex trend mapping that can support both fundamental and technical analysis approaches.

However, the available information does not extensively detail educational resources. These could be valuable for the broker's target demographic of beginning traders who need guidance on market fundamentals. Additionally, specific information about automated trading support, expert advisors, or algorithmic trading capabilities is not readily apparent in the current materials available for review.

Users have expressed appreciation for the quality of market analysis provided by the platform. This review notes that expanding educational content and providing more detailed tool documentation could further enhance the platform's value proposition for developing traders who are still learning market dynamics.

Customer Service and Support Analysis (6/10)

Based on available user feedback, Teletrade maintains generally satisfactory customer service standards. Users report positive experiences regarding response times and service quality when dealing with account issues or general inquiries. The support team appears to demonstrate professional competence in addressing client inquiries and resolving account-related issues in a timely manner.

However, specific details about customer service channels, availability hours, and language support options are not extensively documented in available materials. This lack of detailed information about support infrastructure represents a transparency gap that could be improved to better inform potential clients. More comprehensive information about available assistance options would help clients understand what support they can expect.

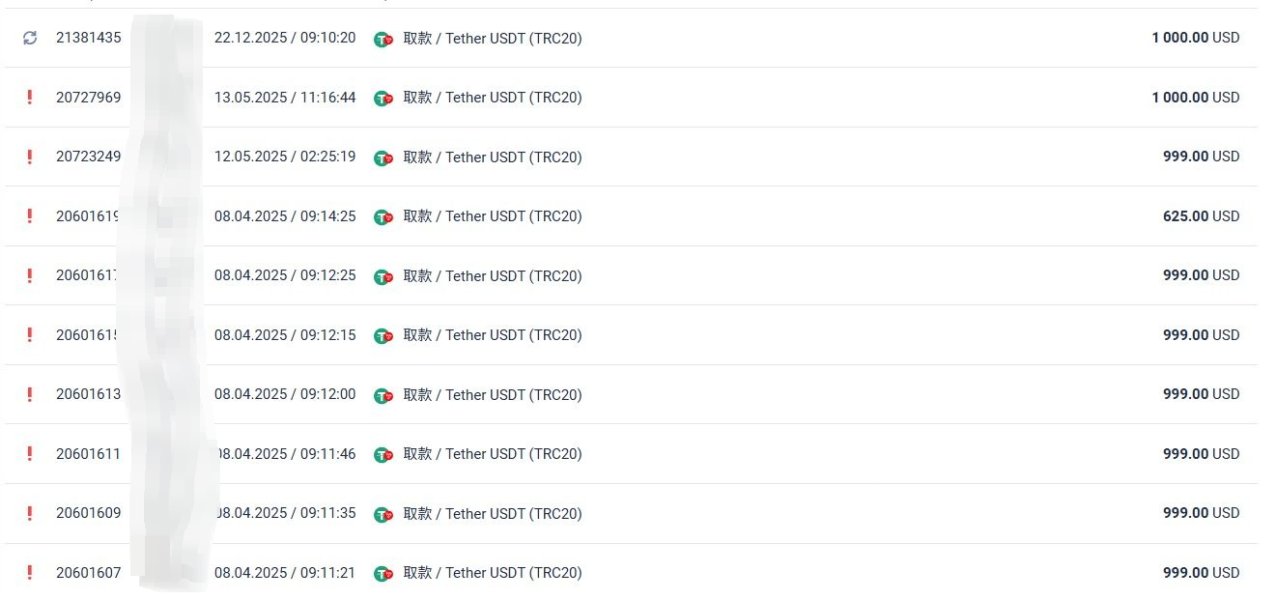

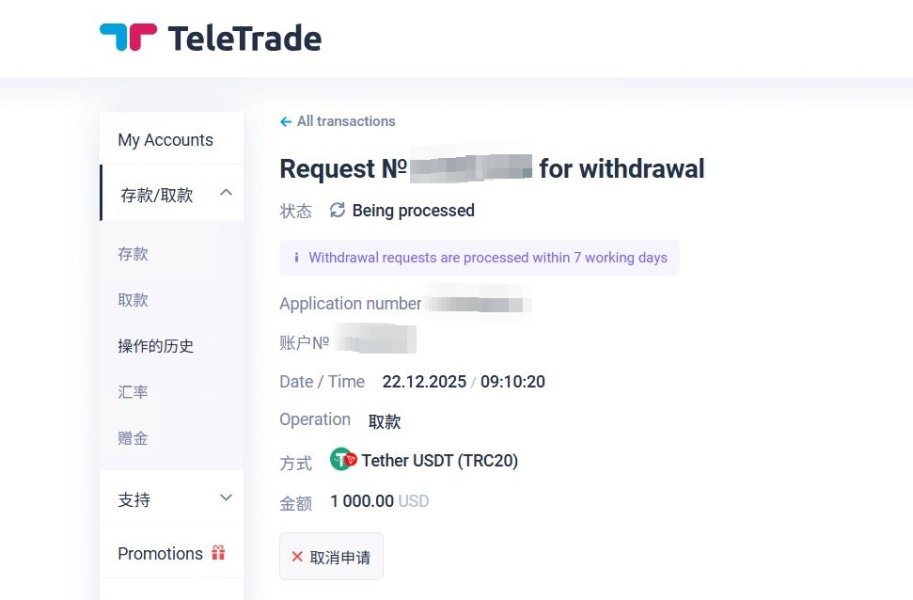

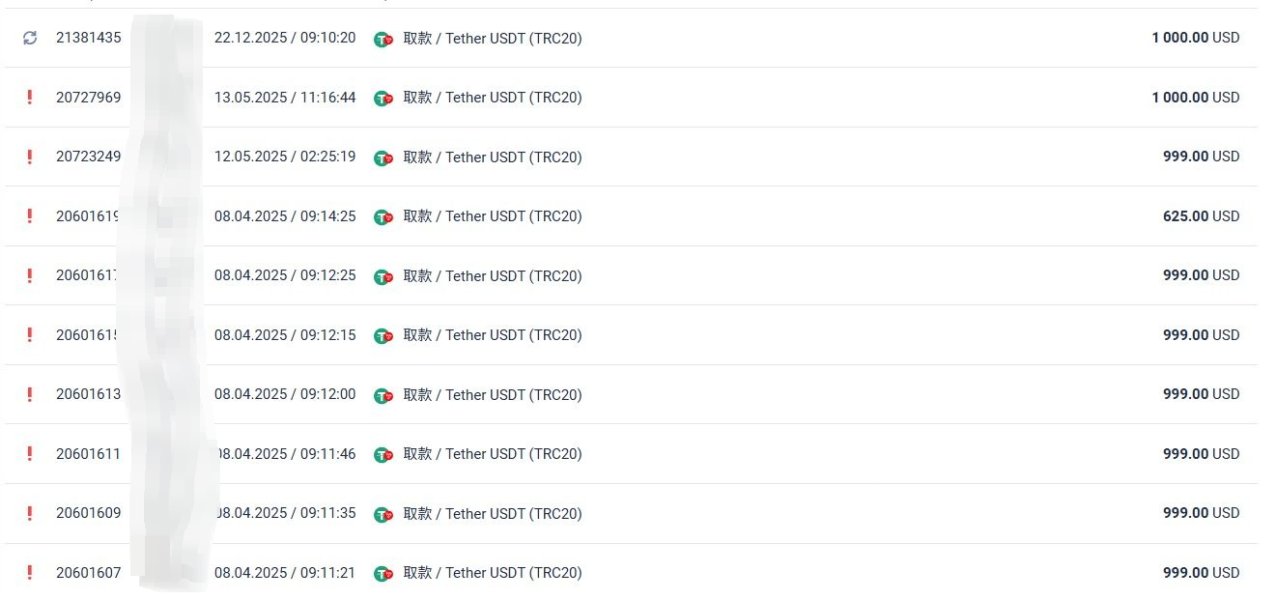

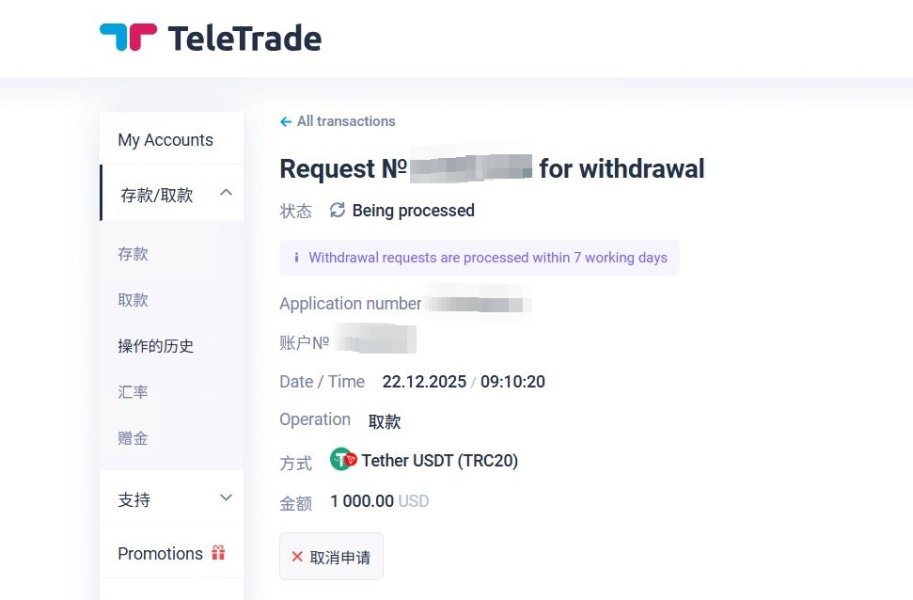

User testimonials suggest that the support team handles withdrawal requests and account management efficiently. At least one user specifically mentioned successful withdrawal processing, which indicates reliable backend operations and customer service follow-through. This positive feedback demonstrates the broker's commitment to maintaining smooth operational processes for client fund management.

The absence of detailed information about multi-language support capabilities, live chat availability, phone support options, and regional customer service centers limits the assessment scope. Enhanced transparency in this area would benefit potential clients in understanding available assistance options and setting appropriate expectations for support quality.

Trading Experience Analysis (6/10)

User feedback indicates general satisfaction with Teletrade's trading environment. The platform appears to provide a stable and functional trading experience that meets basic user expectations for reliability and performance. Clients appear satisfied with the overall platform functionality and the completeness of available trading features, though more detailed performance metrics would provide better insight.

The integration with professional analysis tools like TradingView suggests that the trading environment supports sophisticated market analysis. This can enhance the overall trading experience for both technical and fundamental analysts who rely on detailed market data. Users report that spread conditions and liquidity appear generally stable, contributing to a consistent trading environment across different market sessions.

However, this Teletrade review notes the absence of specific information about mobile trading capabilities. This represents an important component of modern trading experiences that many traders now consider essential for market access. Additionally, detailed performance metrics regarding order execution speed, slippage rates, and platform uptime would provide valuable insights into the technical quality of the trading environment.

The feedback suggests that while the basic trading experience meets user expectations, there may be opportunities for enhancement. Areas such as platform features, mobile accessibility, and advanced trading tools could elevate the overall trading experience for more sophisticated users who require additional functionality.

Trust and Reliability Analysis (8/10)

Teletrade's regulatory status under CySEC supervision provides a strong foundation for client trust and operational reliability. The Cyprus Securities and Exchange Commission maintains rigorous oversight standards that ensure broker compliance with European financial services regulations. This provides clients with established legal protections and recourse mechanisms in case of disputes or operational issues.

User feedback consistently indicates high levels of trust in the broker's financial reliability. Specific mentions of successful withdrawal processing demonstrate the broker's commitment to honoring client fund requests promptly and efficiently. This practical evidence of reliable financial operations supports the broker's trustworthiness claims and regulatory compliance standards that clients expect from regulated brokers.

The broker's longevity in the market, operating since the 1990s, provides additional credibility through demonstrated market survival and adaptation. This operational history spans multiple market cycles and economic conditions, suggesting institutional stability and management competence. The ability to navigate various market conditions over decades indicates strong business fundamentals and risk management practices.

While specific details about fund segregation, insurance coverage, and additional safety measures are not extensively documented in available materials, the CySEC regulatory framework provides standard European client protection measures. The consistent positive user feedback regarding fund security and withdrawal reliability further supports the broker's trustworthiness rating in this comprehensive review of their services.

User Experience Analysis (7/10)

The 3.94 TrustScore rating reflects generally positive user satisfaction with Teletrade's services. This indicates that the majority of clients find the platform meets their trading needs and expectations across various service areas. This rating suggests a solid foundation of user satisfaction while acknowledging room for improvement in certain operational areas that could enhance the overall experience.

User feedback indicates that the registration and account verification process proceeds smoothly. Clients report straightforward onboarding experiences that don't create unnecessary barriers to account activation and trading access. The low minimum deposit requirement particularly appeals to users seeking accessible entry into forex and CFD trading markets, making the platform attractive to newcomers and those with limited initial capital for investment.

The broker appears to successfully serve its target demographic of beginning traders and those seeking diversified investment opportunities. Users appreciate the range of available instruments and the quality of market analysis provided by the platform's research team. However, some users have indicated areas where improvements could enhance the overall experience and platform functionality for more advanced trading needs.

While the overall user experience receives positive feedback, this Teletrade review suggests that enhancements could further improve user satisfaction. Areas such as educational resources, platform documentation, and expanded tool offerings could better serve more advanced trading requirements and learning objectives. The current experience appears solid for basic trading needs, but additional features could attract more sophisticated traders seeking comprehensive platform capabilities.

Conclusion

This comprehensive Teletrade review reveals a CySEC-regulated brokerage that successfully serves traders seeking accessible entry into international financial markets. With its exceptionally low $20 minimum deposit requirement and diverse range of trading instruments spanning forex, stocks, indices, and CFDs, Teletrade positions itself as an attractive option for newcomers. The broker also appeals to experienced traders pursuing portfolio diversification across multiple asset classes and market sectors.

The broker's strengths lie in its regulatory credibility, accessible account conditions, quality market analysis resources, and demonstrated reliability in fund management and withdrawals. The integration with professional tools like TradingView and comprehensive promotional programs for VIP clients add significant value to the overall offering for serious traders. These features combine to create a platform that serves both entry-level and more experienced market participants effectively.

However, potential areas for improvement include enhanced transparency regarding fee structures, expanded educational resources, and more detailed documentation of trading platform features and customer service options. Despite these considerations, Teletrade represents a solid choice for traders prioritizing low entry barriers, regulatory protection, and diverse market access in their brokerage selection process. The broker's long-standing market presence and positive user feedback support its position as a reliable option in the competitive online trading landscape.