TASS Review 1

Thank you, I learned to use the platform and I started to win money, At the beginning it was difficult for me but with the demo account, the technical and fundamental analysis, the news and the support from TASS it was a great help.

TASS Forex Broker provides real users with 1 positive reviews, * neutral reviews and * exposure review!

Thank you, I learned to use the platform and I started to win money, At the beginning it was difficult for me but with the demo account, the technical and fundamental analysis, the news and the support from TASS it was a great help.

This TASS review shows a troubling picture for people thinking about using this broker. User feedback and available information reveal that TASS performs poorly in multiple areas, earning a negative overall rating. The platform offers high leverage up to 1:500. It also provides access to many trading assets including forex, commodities, cryptocurrencies, and stock indices through MetaTrader 5.

However, these benefits are outweighed by major problems. User reviews give TASS only 2.7 out of 5 stars, with mostly negative feedback about transparency, customer service, and reliability. The broker targets retail investors who want high-leverage trading opportunities. But the lack of clear regulatory information and poor credibility ratings create serious warning signs for potential clients.

Credibility groups label the platform as a "questionable source." Combined with poor user satisfaction scores, this suggests traders should be very careful when considering TASS as their trading partner.

Regional Entity Differences: TASS does not clearly share its regulatory information across different areas. This may result in different service standards and legal protections depending on where the client lives. Potential users should check the specific regulatory status for their region before using this broker.

Review Methodology: This evaluation uses available user feedback, online information, and credibility assessments from various sources. The analysis does not represent official endorsement and should be considered alongside other independent research. Due to limited transparency from TASS about its operations, some information may be incomplete or subject to change.

| Evaluation Criteria | Score | Rating Justification |

|---|---|---|

| Account Conditions | 4/10 | Despite offering high leverage options, user feedback indicates poor overall account management and conditions |

| Tools and Resources | 6/10 | Provides MT5 platform and multiple asset classes, but limited information on additional resources |

| Customer Service | 3/10 | User feedback consistently highlights poor customer support and inadequate service quality |

| Trading Experience | 5/10 | Mixed user feedback regarding platform performance and trading environment consistency |

| Trust and Credibility | 2/10 | Marked as questionable source with transparency concerns and lack of clear regulatory disclosure |

| User Experience | 4/10 | Predominantly negative user reviews indicate widespread dissatisfaction with overall experience |

TASS, LLC operates as a financial services provider that focuses on mutual fund processing services. The company serves brokers and other mutual fund distributors' clients. It positions itself in the competitive online trading space by offering access to various financial instruments, though detailed information about its founding year and corporate background is notably missing from public sources. This lack of transparency about basic company information adds to credibility concerns about the broker.

The business model centers on providing high-leverage trading opportunities to retail investors. This particularly targets those interested in speculative trading across multiple asset classes. However, the limited disclosure of corporate structure, regulatory compliance, and operational history raises questions about the broker's commitment to transparency and regulatory adherence.

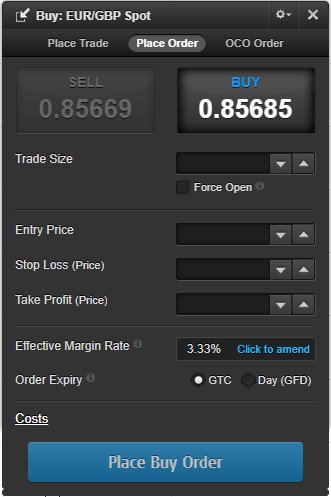

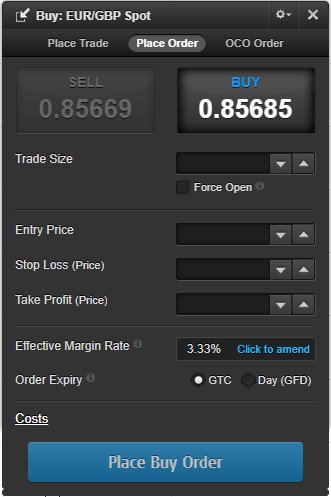

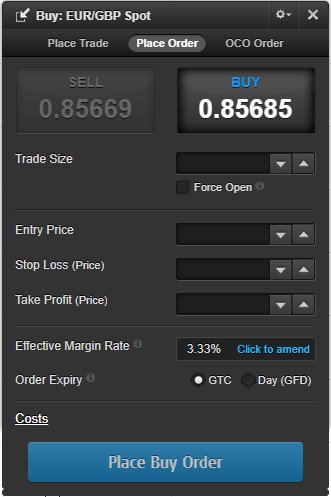

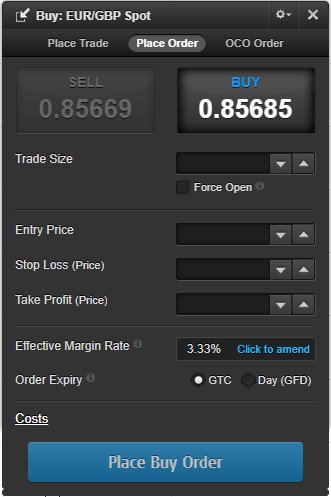

TASS operates primarily through the MetaTrader 5 platform. The platform offers clients access to over 35 foreign exchange currency pairs, commodities including oil, gold, and silver, various stock indices, individual stocks, Bitcoin, and other cryptocurrencies. It supports maximum leverage ratios of up to 1:500, which appeals to traders seeking amplified market exposure. However, specific information about regulatory oversight, licensing jurisdictions, and compliance frameworks remains unclear in available documentation, contributing to overall uncertainty about the broker's legitimacy and operational standards.

Regulatory Jurisdictions: Available information does not specify the regulatory authorities overseeing TASS operations. This creates uncertainty about legal protections and compliance standards for client accounts.

Deposit and Withdrawal Methods: Specific information about accepted payment methods, processing times, and associated fees for deposits and withdrawals is not detailed in available sources.

Minimum Deposit Requirements: The broker has not clearly disclosed minimum deposit amounts required for different account types or trading access levels.

Bonus and Promotions: Current promotional offers, welcome bonuses, or ongoing incentive programs are not specified in available documentation.

Tradeable Assets: The platform provides access to more than 35 forex currency pairs, commodities including precious metals and energy products, major stock indices, individual equity shares, Bitcoin, and various alternative cryptocurrencies. This offers reasonable diversification for different trading strategies.

Cost Structure: Detailed information about spreads, commission rates, overnight financing charges, and other trading costs is not readily available. This makes it difficult for potential clients to assess the true cost of trading.

Leverage Ratios: Maximum leverage of 1:500 is available. This represents a significant amplification factor for both potential profits and losses.

Platform Options: Trading is conducted through the MetaTrader 5 platform. This provides standard charting tools and automated trading capabilities.

Geographic Restrictions: Specific information about jurisdictions where services are restricted or unavailable is not detailed in accessible sources.

Customer Support Languages: Available language support for customer service interactions is not specified in current documentation.

This comprehensive TASS review highlights the significant information gaps that potential clients face when evaluating this broker.

The account conditions offered by TASS present a mixed picture that ultimately disappoints when measured against industry standards and user expectations. While the broker advertises high leverage ratios up to 1:500, which could appeal to traders seeking amplified market exposure, the lack of detailed information about account types creates significant uncertainty for potential clients. Available information does not specify the variety of account types offered, minimum deposit requirements for different tiers, or the specific features that distinguish one account level from another.

This opacity makes it extremely difficult for traders to make informed decisions about which account structure might best suit their trading style and capital requirements. User feedback consistently indicates dissatisfaction with account management processes and overall conditions. The account opening process appears to lack the transparency and efficiency that modern traders expect.

Without clear information about verification requirements, documentation needed, or typical processing times, potential clients face uncertainty about when they can begin trading. Additionally, the absence of information about special account features such as Islamic accounts for Muslim traders, or professional account options for experienced traders, suggests limited accommodation for diverse client needs. This TASS review finding regarding account conditions reflects broader concerns about the broker's commitment to client service and transparency, contributing to the overall negative assessment of their offerings.

TASS provides access to the MetaTrader 5 platform. This represents a solid foundation for trading activities across multiple asset classes. The MT5 platform offers comprehensive charting capabilities, technical analysis tools, and automated trading support through Expert Advisors, providing traders with industry-standard functionality for market analysis and trade execution.

The platform's multi-asset support aligns well with TASS's offering of forex, commodities, cryptocurrencies, and stock indices. However, the evaluation of tools and resources extends beyond just the trading platform itself. Available information does not detail additional research resources, market analysis, educational materials, or proprietary tools that might enhance the trading experience.

Many competitive brokers provide daily market commentary, economic calendars, sentiment indicators, and educational webinars to support client success. Such offerings are not clearly documented for TASS. The absence of information about research departments, analyst reports, or market insights suggests that traders may need to rely on external sources for fundamental analysis and market intelligence.

This limitation could particularly impact new traders who benefit from educational resources and guided analysis to develop their trading skills and market understanding. While the MT5 platform provides adequate technical capabilities, the apparent lack of comprehensive support resources and educational materials limits the overall value proposition, preventing a higher rating in this category despite the solid platform foundation.

Customer service represents one of the most significant weaknesses identified in this evaluation. User feedback consistently highlights poor support quality and inadequate service responsiveness. The lack of detailed information about available support channels, operating hours, and language options compounds these concerns and suggests a limited commitment to client service excellence.

User reviews indicate extended response times for support inquiries. Many clients report frustration about the difficulty in reaching qualified support representatives when issues arise. This is particularly problematic in the trading environment where technical issues, account problems, or urgent inquiries require prompt resolution to prevent potential financial losses or missed trading opportunities.

The absence of clear information about support channels such as live chat availability, phone support hours, or email response time commitments creates additional uncertainty for potential clients. Modern traders expect multiple communication options and reasonable response times, especially when dealing with account funding, withdrawal requests, or technical difficulties that could impact their trading activities. Furthermore, the lack of specified language support options may limit accessibility for international clients who require assistance in their native languages.

Quality customer support should provide clear communication and effective problem resolution. Available evidence suggests TASS falls significantly short of these expectations, warranting the low rating in this critical service area.

The trading experience evaluation reveals mixed results that reflect both the capabilities of the MT5 platform and the limitations imposed by unclear operational standards and inconsistent user feedback. While MetaTrader 5 provides a robust trading environment with advanced charting capabilities, multiple order types, and automated trading support, the overall trading experience depends heavily on execution quality, platform stability, and the broker's operational reliability. User feedback regarding platform performance shows inconsistent experiences, with some traders reporting acceptable functionality while others highlight concerns about execution speeds, platform stability during volatile market conditions, and order processing reliability.

These mixed reports suggest potential issues with server infrastructure or order management systems that could impact trading outcomes. The lack of detailed information about execution models, whether the broker operates as a market maker or uses straight-through processing, creates uncertainty about potential conflicts of interest and execution quality. Additionally, without transparent information about average execution speeds, slippage statistics, or rejection rates, traders cannot adequately assess the quality of the trading environment.

The absence of specific data about spreads, commission structures, and trading costs makes it difficult for traders to calculate the true cost of their trading activities and compare TASS with alternative brokers. This TASS review finds that while the basic trading infrastructure appears functional, the lack of transparency and mixed user experiences prevent a more favorable assessment of the overall trading experience.

Trust and credibility represent the most concerning aspects of TASS's operations. Multiple factors contribute to significant doubts about the broker's reliability and legitimacy. The classification of TASS as a "questionable source" by credibility assessment organizations raises immediate red flags about the broker's operational standards and commitment to transparency.

The absence of clear regulatory information represents a fundamental concern for any financial services provider. Legitimate brokers typically prominently display their regulatory licenses, oversight authorities, and compliance frameworks to assure clients of proper supervision and legal protections. TASS's failure to provide this basic information suggests either a lack of proper regulatory oversight or an unwillingness to submit to transparent regulatory scrutiny.

The lack of detailed information about fund segregation, client money protection, insurance coverage, or dispute resolution mechanisms further undermines confidence in the broker's commitment to client protection. These safeguards are standard in regulated environments and their absence raises questions about what protections, if any, are available to client funds and trading accounts. Additionally, the limited corporate transparency regarding company history, management team, financial statements, or operational track record makes it impossible for potential clients to conduct proper due diligence.

The combination of questionable credibility ratings, regulatory opacity, and limited corporate disclosure creates a risk profile that is unacceptable for most prudent traders seeking reliable trading partners.

The overall user experience with TASS reflects the cumulative impact of the various operational shortcomings identified throughout this evaluation. User satisfaction ratings of 2.7 out of 5 indicate widespread dissatisfaction among clients who have engaged with the broker's services, suggesting systemic issues that affect multiple aspects of the client relationship. Feedback patterns suggest that users encounter difficulties across various touchpoints, from initial account setup through ongoing trading activities and customer support interactions.

The lack of clear information about registration processes, verification requirements, and account activation timelines creates frustration for new clients seeking to begin trading activities promptly. The absence of detailed information about user interface design, platform customization options, and mobile trading capabilities suggests limited attention to user experience optimization. Modern traders expect intuitive interfaces, responsive design, and seamless functionality across different devices and operating systems.

User complaints appear to center around communication difficulties, unclear fee structures, problematic withdrawal processes, and inadequate support for resolving account issues. These fundamental service failures significantly impact user satisfaction and suggest operational deficiencies that extend beyond simple platform functionality to encompass broader service delivery problems. The concentration of negative feedback and low satisfaction ratings indicates that TASS struggles to meet basic user expectations for reliability, transparency, and service quality, resulting in an overall user experience that falls well short of industry standards and client requirements.

This comprehensive evaluation reveals that TASS performs poorly across virtually all assessment criteria. It earns a strongly negative overall rating that should serve as a clear warning for potential clients. While the broker offers high leverage ratios up to 1:500 and access to diverse trading assets through the MT5 platform, these limited advantages are overwhelmed by significant deficiencies in transparency, customer service, and operational credibility.

The broker appears most suited to high-risk tolerance speculators who prioritize leverage access over regulatory protection and service quality. Even this narrow user segment should carefully consider the substantial risks involved. The primary advantages include the high leverage offering and reasonable asset diversity, but these are overshadowed by critical disadvantages including poor transparency, questionable credibility ratings, inadequate customer support, and widespread user dissatisfaction.

Potential clients should exercise extreme caution and consider alternative brokers that demonstrate proper regulatory oversight, transparent operations, and commitment to client service excellence before engaging with TASS for their trading activities.

FX Broker Capital Trading Markets Review