MarcoFX 2025 Review: Everything You Need to Know

Executive Summary

MarcoFX presents itself as an emerging forex broker in the competitive online trading landscape. This marcofx review reveals several concerning aspects that potential traders should carefully consider before investing their money. Based on available information and user feedback, MarcoFX offers relatively flexible trading conditions with a notably low minimum deposit requirement of just $10 and leverage up to 1:400. This makes it appear attractive to beginner traders seeking entry-level opportunities.

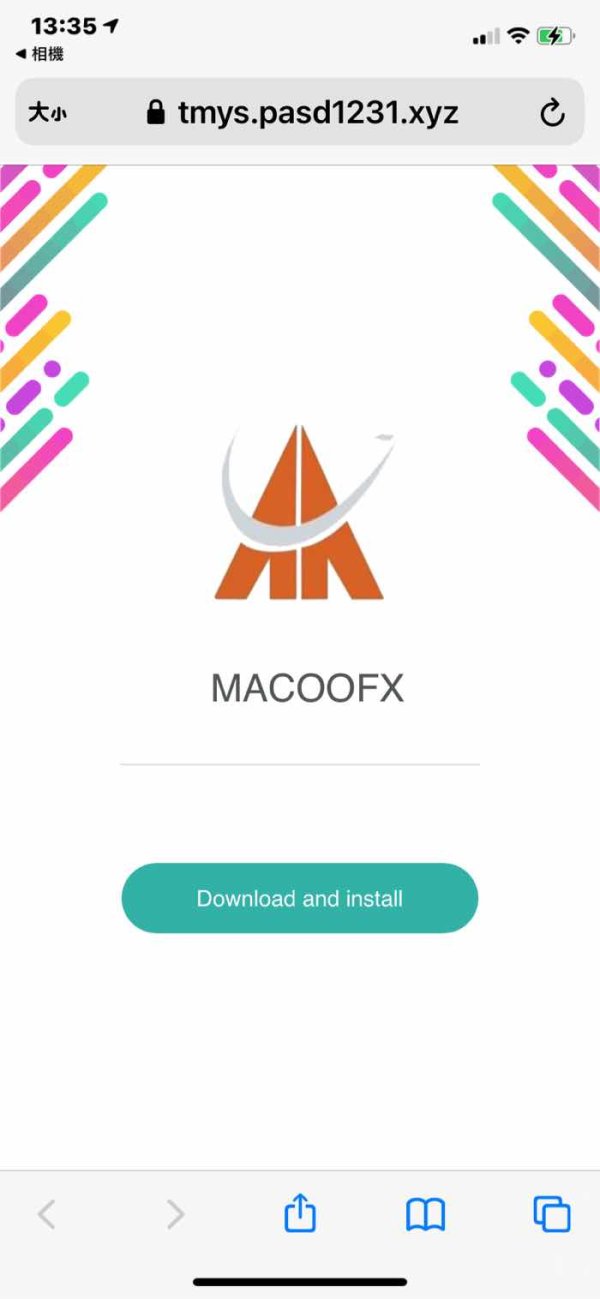

However, user reviews and industry analysis suggest potential red flags regarding the broker's legitimacy and operational practices. Multiple sources have raised concerns about possible fraudulent activities. This significantly impacts the broker's overall credibility in the forex community. The platform operates using the popular MT4 trading platform and provides access to 28 forex pairs, 2 metals, 3 US indices, and oil trading opportunities.

The broker appears to target novice traders and those with limited initial capital. It leverages its low barrier to entry as a primary selling point. However, the absence of comprehensive regulatory information and negative user experiences suggest that traders should exercise extreme caution before committing funds to this platform.

Important Notice

Due to the lack of comprehensive regulatory information available for MarcoFX, users in different regions may face varying levels of legal protection and trading conditions. The regulatory status of this broker remains unclear. This could significantly impact trader security and dispute resolution processes across different jurisdictions.

This review is based on available summary information, user feedback, and publicly accessible data. No direct investigation or testing of the platform's services has been conducted. Traders are strongly advised to conduct their own due diligence and verify all information independently before making any investment decisions with this broker.

Rating Framework

Broker Overview

MarcoFX operates as a forex and CFD trading platform. Specific details about its founding year and corporate background remain unclear in available documentation. The broker positions itself in the retail trading market, offering access to foreign exchange markets and contracts for difference across multiple asset classes. According to available information, the company focuses on providing trading services through digital platforms. It targets individual retail traders rather than institutional clients.

The broker's business model centers around providing access to global financial markets through online trading platforms. MarcoFX offers trading in foreign exchange pairs, precious metals, energy commodities, and stock indices. The platform utilizes the MetaTrader 4 trading software, which is widely recognized in the industry for its reliability and comprehensive trading tools. However, this marcofx review must note that specific information about the company's regulatory status, headquarters location, and operational history remains limited in publicly available sources.

The absence of clear regulatory oversight represents a significant concern for potential clients. Most reputable forex brokers operate under strict regulatory frameworks that provide client protection, segregated fund management, and dispute resolution mechanisms. The lack of transparent regulatory information for MarcoFX raises questions about client fund security and the broker's adherence to industry standards.

Regulatory Status: Available information does not specify any regulatory authorities overseeing MarcoFX operations. This represents a significant red flag for potential traders seeking secure trading environments.

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods has not been detailed in accessible sources. The minimum deposit requirement is confirmed at $10.

Minimum Deposit Requirements: MarcoFX sets its minimum deposit at $10, which is considerably lower than many established brokers and may attract new traders with limited capital.

Bonus and Promotional Offers: No specific information about bonus structures or promotional campaigns is available in the current data set.

Available Trading Assets: The platform provides access to 28 foreign exchange currency pairs, 2 precious metals, 3 US stock indices, and crude oil trading opportunities. This offers a moderate range of trading instruments.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not specified in available sources. This makes it difficult to assess the true cost of trading with this broker.

Leverage Options: Maximum leverage is advertised at 1:400, which is relatively high and may appeal to traders seeking increased market exposure. Such high leverage also significantly increases risk.

Platform Options: Trading is conducted through the MetaTrader 4 platform. This provides standard charting tools, technical indicators, and automated trading capabilities suitable for various trading strategies.

This marcofx review emphasizes that the lack of detailed information about many crucial aspects of the broker's operations should concern potential clients.

Detailed Rating Analysis

Account Conditions Analysis

MarcoFX's account structure appears relatively straightforward. Specific details about different account types and their respective features are not clearly outlined in available documentation. The most notable aspect of the account conditions is the exceptionally low minimum deposit requirement of $10. This significantly lowers the barrier to entry for new traders. This feature could be particularly attractive to individuals who want to test forex trading without substantial financial commitment.

However, the lack of detailed information about account tiers, special features, or premium account options suggests a limited range of choices for traders with different needs and experience levels. Most established brokers offer multiple account types with varying spreads, commissions, and additional services. The absence of such variety may indicate either a simplified business model or insufficient service development.

The account opening process details are not specified in available sources. This makes it difficult to assess the convenience and speed of getting started with MarcoFX. Additionally, there is no mention of Islamic accounts or other specialized account types that cater to specific trader requirements. This marcofx review notes that while the low minimum deposit is appealing, the overall account structure appears basic compared to more established competitors.

User feedback suggests that while the low entry requirement attracts many newcomers, the overall account experience may not meet expectations for more sophisticated trading needs.

MarcoFX offers a moderate selection of trading instruments, including 28 forex currency pairs, 2 precious metals, and 3 US indices, along with oil trading opportunities. This range covers the most popular trading assets and should satisfy basic trading requirements for most retail traders. The forex pairs likely include major, minor, and some exotic currency combinations. The specific list is not detailed in available information.

However, the platform appears to lack comprehensive educational resources, market analysis tools, and research materials that are typically expected from modern forex brokers. Many successful brokers provide daily market analysis, economic calendars, trading tutorials, and webinars to support trader development and decision-making. The absence of such resources in available documentation suggests that MarcoFX may not prioritize trader education and support.

The MetaTrader 4 platform does provide standard technical analysis tools, including various chart types, technical indicators, and automated trading capabilities through Expert Advisors. These built-in MT4 features partially compensate for the apparent lack of proprietary analysis tools. They may not be sufficient for traders seeking comprehensive market insights.

User feedback indicates appreciation for the asset variety but expresses disappointment about the limited educational and analytical resources available to support trading decisions.

Customer Service and Support Analysis

Information about MarcoFX's customer service infrastructure is notably absent from available documentation. This raises concerns about the quality and accessibility of client support. Established forex brokers typically provide multiple communication channels including live chat, email support, phone assistance, and comprehensive FAQ sections. The lack of detailed customer service information suggests either poor service infrastructure or insufficient transparency about support capabilities.

Response times, service quality metrics, and customer satisfaction data are not available in current sources. This makes it impossible to assess the effectiveness of the broker's support system. User reviews indicate dissatisfaction with customer service experiences. Specific details about response times and problem resolution capabilities are not provided.

The absence of information about multilingual support, service hours, and specialized support for different account types further compounds concerns about the broker's commitment to customer care. Most reputable brokers offer 24/5 support during market hours and provide assistance in multiple languages to serve their global client base.

User feedback consistently points to customer service as a significant weakness, with reports of inadequate response times and limited problem-solving capabilities. This aspect of the broker's operations appears to be a major source of client dissatisfaction.

Trading Experience Analysis

The trading experience with MarcoFX centers around the MetaTrader 4 platform, which is widely regarded as reliable and functional for forex trading. MT4 provides essential features including real-time quotes, advanced charting capabilities, technical analysis tools, and support for automated trading strategies. Users generally report satisfactory platform stability and functionality when using MT4.

However, specific information about order execution quality, slippage rates, and spread stability is not available in current documentation. These factors are crucial for assessing the true trading experience, as they directly impact trading costs and strategy effectiveness. The absence of such performance data makes it difficult to evaluate whether MarcoFX provides competitive execution conditions.

The platform's mobile trading capabilities, while inherent to MT4, are not specifically detailed in terms of MarcoFX's implementation or any custom features they may have added. Most traders today expect seamless mobile trading experiences. The lack of specific mobile platform information may indicate limited development in this area.

User feedback regarding the trading experience is mixed, with some appreciation for the familiar MT4 interface but concerns about overall platform performance and additional features. This marcofx review notes that while MT4 provides a solid foundation, the overall trading experience may lack the enhancements and optimizations offered by more established brokers.

Trust and Safety Analysis

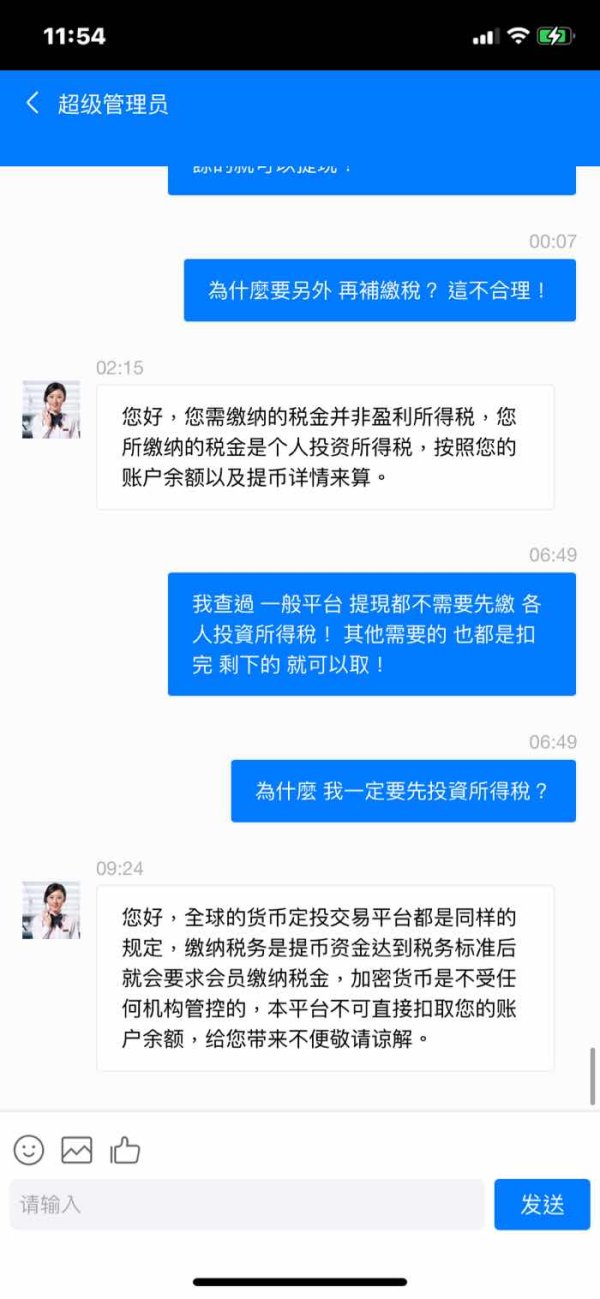

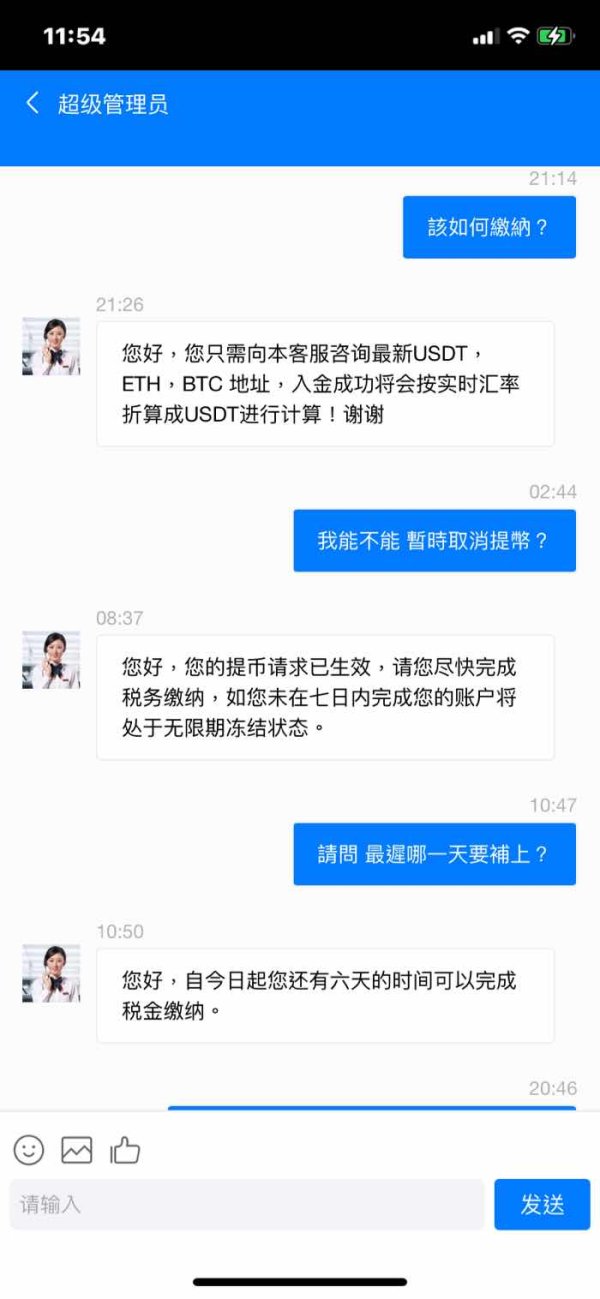

Trust and safety represent the most concerning aspects of MarcoFX's operations, with multiple red flags appearing in user feedback and available information. The absence of clear regulatory oversight is perhaps the most significant concern. Reputable forex brokers typically operate under strict regulatory frameworks that provide client protection, fund segregation, and dispute resolution mechanisms.

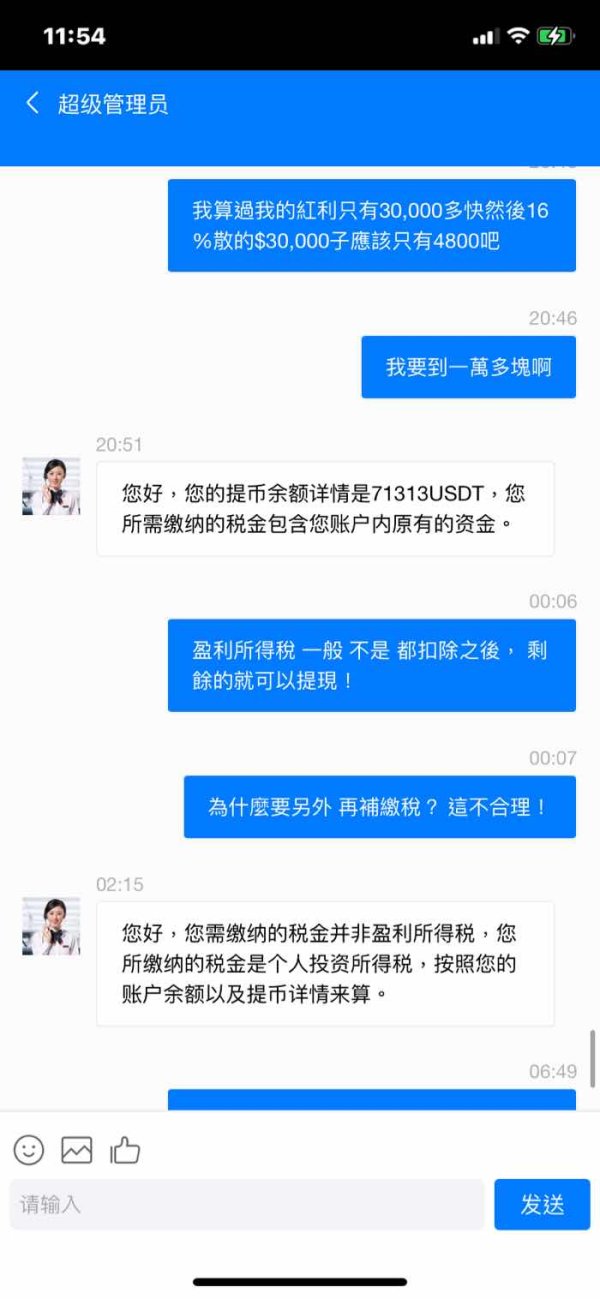

User reviews specifically mention concerns about potential fraudulent activities, which significantly undermines confidence in the broker's legitimacy. Such allegations, whether substantiated or not, create a climate of uncertainty that makes it difficult for traders to feel secure about their investments. The lack of transparent regulatory information compounds these concerns by removing standard protection mechanisms.

Fund security measures, including client money segregation, negative balance protection, and investor compensation schemes, are not detailed in available documentation. These protections are standard among regulated brokers. Their absence raises serious questions about client fund safety.

The broker's transparency regarding company ownership, financial statements, and operational procedures appears limited based on available information. Most legitimate brokers provide detailed company information, regulatory compliance reports, and clear terms of service to build client confidence.

Industry reputation and third-party verification of the broker's legitimacy are not evident in available sources, further contributing to trust concerns.

User Experience Analysis

Overall user satisfaction with MarcoFX appears to be below industry standards based on available feedback and reviews. Users consistently report concerns about various aspects of the platform's operations, from customer service quality to questions about the broker's legitimacy. The combination of these factors creates a generally negative user experience that may deter potential clients.

Interface design and platform usability are not specifically detailed in available information, though the use of MT4 provides a familiar and generally user-friendly trading environment. However, any custom implementations or modifications by MarcoFX are not documented. This makes it difficult to assess the complete user interface experience.

The account registration and verification process details are not available, which may indicate either a streamlined process or lack of proper due diligence procedures. Most regulated brokers have comprehensive KYC and verification procedures that, while sometimes lengthy, provide important security benefits.

User feedback consistently highlights concerns about trustworthiness and customer support as primary sources of dissatisfaction. The accumulation of negative experiences appears to significantly impact overall user satisfaction and platform reputation. Common complaints focus on communication difficulties, lack of transparency, and concerns about fund security.

Based on available feedback, the typical user profile for MarcoFX appears to be beginners attracted by the low minimum deposit, though many seem to encounter difficulties that lead to negative experiences.

Conclusion

This comprehensive marcofx review reveals a broker that, while offering some attractive entry-level features such as low minimum deposits and high leverage, presents significant concerns that potential traders must carefully consider. The combination of unclear regulatory status, user reports of potential fraudulent activities, and limited customer service information creates a risk profile that may be unsuitable for most traders.

MarcoFX may appeal to absolute beginners seeking to test forex trading with minimal initial investment, but the potential risks appear to outweigh the benefits for most trading scenarios. The lack of regulatory protection, combined with negative user feedback, suggests that traders would be better served by choosing more established and transparently regulated alternatives.

The primary advantages of low minimum deposits and flexible leverage are overshadowed by fundamental concerns about safety, legitimacy, and customer support quality that are essential for successful long-term trading relationships.