Is MarcoFX safe?

Software Index

License

Is MarcoFX A Scam?

Introduction

MarcoFX is a forex broker that positions itself as a global trading platform, offering access to various financial instruments including forex, metals, and indices. As the forex market continues to grow, traders are increasingly faced with a multitude of broker options, making it crucial to conduct thorough evaluations before committing funds. Given the prevalence of scams and unregulated brokers in the industry, understanding the legitimacy and safety of a trading platform like MarcoFX is paramount. This article investigates MarcoFX through a comprehensive assessment framework that includes regulatory status, company background, trading conditions, customer feedback, and risk evaluation.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical factors in determining its safety and reliability. MarcoFX operates without any significant regulatory oversight, which raises concerns about the protection of client funds and the overall integrity of its operations.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of a regulatory license is a significant red flag, as regulated brokers are required to adhere to strict financial standards and provide a level of security for their clients. Regulatory bodies like the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC) enforce rules that protect traders from fraud and malpractice. MarcoFX's unregulated status means that traders may have limited recourse in the event of disputes or issues with fund withdrawals, making it less safe than regulated brokers.

Company Background Investigation

MarcoFX is operated by Market Continental Ltd, which is registered in the Marshall Islands, a jurisdiction known for its lax regulatory environment. The company has been in operation since May 2017, but details regarding its ownership structure and management team are sparse, contributing to concerns about transparency.

The lack of publicly available information about the management team raises questions about their qualifications and experience in the financial services industry. A reputable broker typically provides detailed bios of its leadership, showcasing their backgrounds and expertise. The limited disclosure from MarcoFX could indicate a lack of accountability, making it essential for potential traders to approach this broker with caution.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is crucial for evaluating its overall value proposition. MarcoFX claims to provide competitive trading conditions, including a minimum deposit of $10 and leverage of up to 1:400. However, the absence of clear information regarding fees and spreads can lead to unexpected costs for traders.

| Fee Type | MarcoFX | Industry Average |

|---|---|---|

| Spread on Major Pairs | N/A | 1.0 - 2.0 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of specific details regarding spreads and commissions can be a warning sign. Traders should be wary of brokers that do not transparently disclose their fee structures, as this can lead to hidden costs that diminish profitability. Moreover, the high leverage offered by MarcoFX, while potentially attractive, also increases the risk of significant losses, making it essential for traders to fully understand the implications of trading with such high leverage.

Client Fund Security

The safety of client funds is a critical aspect of any trading platform. MarcoFX does not provide clear information regarding its client fund security measures, which raises concerns about the safety of deposits.

Traders should look for brokers that implement strict fund segregation policies, ensuring that client funds are kept separate from the company's operational funds. Additionally, reputable brokers offer investor protection schemes that safeguard client deposits in case of insolvency. The absence of such measures at MarcoFX indicates a higher risk for traders, as they may have limited protection in the event of financial difficulties faced by the broker.

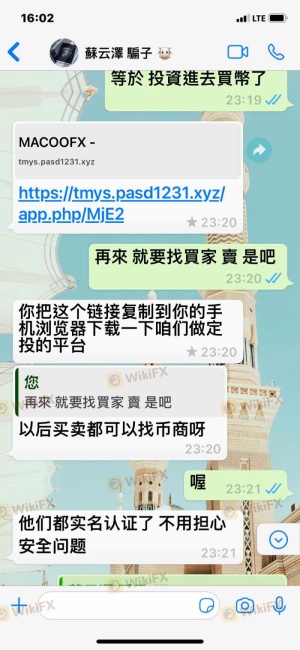

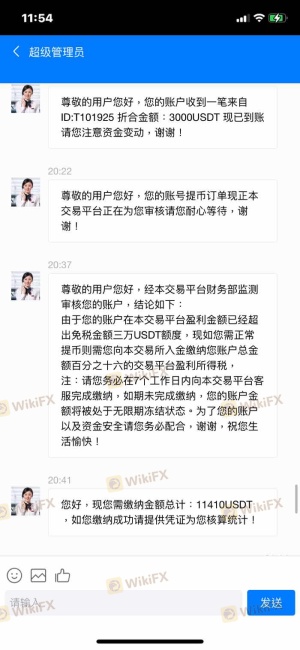

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability and service quality. Reviews of MarcoFX reveal a mix of experiences, with several users reporting difficulties in withdrawing funds and experiencing poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Average |

Common complaints include delayed withdrawals and unresponsive customer support, which are significant concerns for any trader. A broker's ability to process withdrawals efficiently is a fundamental aspect of its credibility. The negative experiences reported by users suggest that MarcoFX may not prioritize client satisfaction or operational transparency.

Platform and Execution

The trading platform offered by MarcoFX is based on the widely used MetaTrader 4 (MT4), which is known for its user-friendly interface and robust features. However, reviews regarding the platform's execution quality indicate potential issues, such as slippage and order rejections.

Traders have reported instances of slippage during volatile market conditions, which can adversely affect trading outcomes. Additionally, any signs of platform manipulation or unfair trading practices should be taken seriously, as they can undermine the integrity of the trading environment.

Risk Assessment

Evaluating the risks associated with trading on MarcoFX is essential for informed decision-making.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status with no oversight. |

| Financial Risk | High | High leverage increases potential losses. |

| Operational Risk | Medium | Customer service issues and withdrawal delays. |

The high regulatory risk associated with MarcoFX, coupled with its lack of transparency and poor customer feedback, suggests that traders should exercise caution. It is advisable to conduct thorough due diligence and consider alternative, regulated brokers that offer better security and customer service.

Conclusion and Recommendations

In conclusion, the analysis of MarcoFX raises significant concerns regarding its safety and reliability. The lack of regulation, transparency issues, and negative customer feedback indicate that this broker may not be a safe choice for traders.

Traders should be wary of the potential risks associated with MarcoFX, particularly regarding fund security and withdrawal issues. For those seeking to engage in forex trading, it is advisable to consider regulated alternatives that provide better protection and customer service. Some reputable brokers include those regulated by the FCA or ASIC, which offer a safer trading environment and more reliable support for their clients.

In summary, while MarcoFX presents itself as a global trading platform, the evidence suggests that it may not be safe for traders. Caution is advised, and potential clients should thoroughly research and consider all available options before making any financial commitments.

Is MarcoFX a scam, or is it legit?

The latest exposure and evaluation content of MarcoFX brokers.

MarcoFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MarcoFX latest industry rating score is 2.18, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.18 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.