Regarding the legitimacy of LiteForex forex brokers, it provides CYSEC and WikiBit, (also has a graphic survey regarding security).

Is LiteForex safe?

Pros

Cons

Is LiteForex markets regulated?

The regulatory license is the strongest proof.

CYSEC Forex Execution License (STP) 19

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Forex Execution License (STP)

Licensed Entity:

Liteforex (Europe) Ltd

Effective Date:

2008-08-08Email Address of Licensed Institution:

liteforex@liteforex.euSharing Status:

No SharingWebsite of Licensed Institution:

www.liteforex.eu, www.liteforex.pl, de.liteforex.eu, es.liteforex.eu, fr.liteforex.eu, it.liteforex.eu, pt.liteforex.eu, ru.liteforex.eu, social.liteforex.euExpiration Time:

--Address of Licensed Institution:

124 Gladstonos Street, The Hawk Building, 4th floor, 3032, LimassolPhone Number of Licensed Institution:

+357 25 750 555Licensed Institution Certified Documents:

Is LiteForex A Scam?

Introduction

LiteForex, founded in 2005, has established itself as a notable player in the forex market, primarily recognized for its competitive trading conditions and a wide range of financial instruments. Operating under the brand LiteFinance, the broker offers services to a diverse client base globally, focusing on both novice and experienced traders. However, the forex trading environment is fraught with risks, and traders must exercise caution when selecting a broker. The potential for fraud or mismanagement in the industry necessitates a thorough evaluation of any brokerage firm.

This article aims to provide an objective analysis of LiteForex, examining its regulatory status, company background, trading conditions, customer safety measures, and user experiences. The assessment is based on a comprehensive review of multiple credible sources, including regulatory filings, customer reviews, and expert analyses. By synthesizing these insights, we aim to determine whether LiteForex is a safe and legitimate broker or if it raises any red flags for potential traders.

Regulation and Legitimacy

Regulation is a critical factor in evaluating the safety and legitimacy of a forex broker. LiteForex operates under two primary entities: LiteForex (Europe) Ltd, regulated by the Cyprus Securities and Exchange Commission (CySEC), and LiteForex Investments Limited, registered in the Marshall Islands. The regulatory framework provided by CySEC is significant, as it adheres to the Markets in Financial Instruments Directive (MiFID), which offers a level of protection to traders.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CySEC | 093/08 | Cyprus | Verified |

| Marshall Islands | N/A | Marshall Islands | Registered |

The importance of strong regulatory oversight cannot be overstated. CySEC's regulations include provisions for negative balance protection, ensuring that traders cannot lose more than their deposited funds, and an investor compensation fund that protects clients' funds up to €20,000 in the event of broker insolvency. However, the Marshall Islands entity operates under a less stringent regulatory framework, which could pose risks for clients trading under this jurisdiction. Historically, LiteForex has faced scrutiny regarding its transparency and compliance, but it has made strides to improve its regulatory standing and customer trust.

Company Background Investigation

LiteForex has a rich history that dates back to its inception in 2005. Initially, the broker aimed to democratize forex trading by allowing small investments, with minimum deposits as low as $1. Over the years, it has expanded its services and now offers a variety of account types and trading platforms, including the popular MetaTrader 4 and MetaTrader 5.

The ownership structure of LiteForex includes LiteForex (Europe) Ltd and LiteForex Investments Limited, with the latter being registered in the Marshall Islands. The management team comprises professionals with extensive experience in the financial services industry, contributing to the broker's operational integrity. Transparency is a key focus for LiteForex, as it provides detailed information about its services, fees, and trading conditions on its website.

However, the mixed regulatory environment poses questions about the overall transparency of the broker. While the European entity adheres to strict regulations, the offshore entity's lack of robust oversight may lead to potential issues regarding fund security and customer support.

Trading Conditions Analysis

LiteForex offers competitive trading conditions, which is a significant draw for many traders. The broker provides two main account types: the Classic account and the ECN account, both requiring a minimum deposit of $50. The Classic account features variable spreads starting from 1.8 pips, while the ECN account offers spreads from 0.0 pips, accompanied by a commission of $5 per lot.

| Fee Type | LiteForex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.8 pips (Classic) / 0.0 pips (ECN) | 1.5 pips |

| Commission Model | $5 per lot (ECN) | $3 per lot |

| Overnight Interest Range | Varies | Varies |

While the trading costs appear competitive, it is essential to scrutinize any unusual fee structures. Some users have reported unexpected charges or high spreads during volatile market conditions, which could affect trading profitability. Therefore, potential clients should carefully review the fee schedule and ensure they understand the implications of trading under different account types.

Customer Funds Safety

The safety of customer funds is paramount in the forex trading landscape. LiteForex implements several measures to secure client funds, including segregated accounts, which ensure that customer deposits are kept separate from the broker's operating funds. This practice is crucial in protecting traders' capital in the event of financial difficulties faced by the broker.

Additionally, LiteForex offers negative balance protection for clients trading under the CySEC-regulated entity, safeguarding them from incurring debts beyond their initial investments. The broker's participation in the Investor Compensation Fund further enhances the security of client funds, providing an additional layer of protection.

Despite these measures, there have been historical concerns regarding the safety of funds, particularly for clients trading under the offshore entity. Traders should remain vigilant and consider the regulatory environment of the entity under which they are trading.

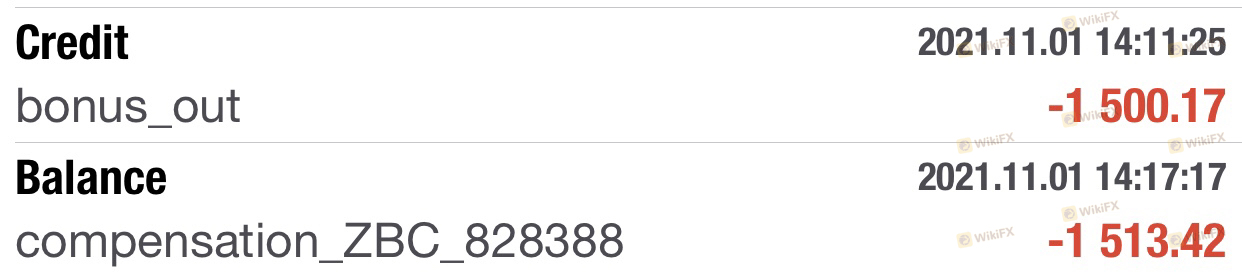

Customer Experience and Complaints

Customer feedback is a vital aspect of evaluating a broker's reliability. LiteForex has received a mix of positive and negative reviews from users. Many traders appreciate the broker's low minimum deposit requirements, user-friendly platforms, and extensive educational resources. However, common complaints include issues with withdrawal delays, poor customer support responsiveness, and occasional technical glitches during trading.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Mixed responses |

| Customer Support Issues | Medium | Slow to respond |

| Technical Glitches | Medium | Addressed but inconsistent |

A few notable cases highlight these issues. One trader reported a delay in a withdrawal request that took over ten days to process, raising concerns about the broker's operational efficiency. In another instance, a client faced difficulties accessing customer support during a critical trading period, leading to frustration and dissatisfaction.

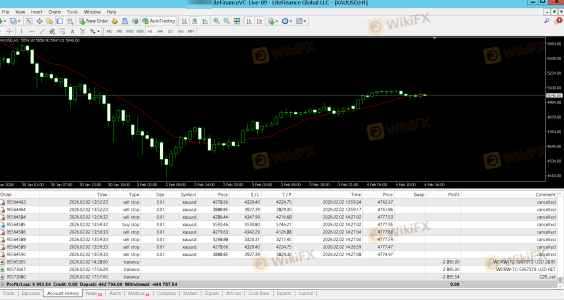

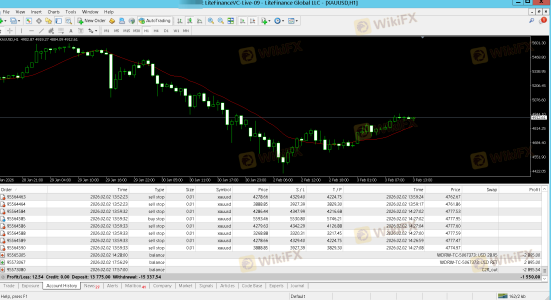

Platforms and Trade Execution

LiteForex provides access to the widely used MetaTrader 4 and MetaTrader 5 platforms, known for their robust features and reliability. The platforms offer a range of tools for technical analysis, automated trading, and social trading capabilities, allowing users to copy successful traders' strategies.

However, some users have reported experiencing slippage and requotes, particularly during high volatility periods, which can impact trading outcomes. While these occurrences are not uncommon in the forex industry, they warrant attention, especially for traders employing high-frequency or scalping strategies.

Risk Assessment

Using LiteForex comes with inherent risks, as is the case with any forex broker. The regulatory environment, while offering some protections, varies significantly between the European and offshore entities. Traders should be aware of the potential for fund security issues, particularly if trading under the less regulated entity.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Varies by entity |

| Operational Risk | Medium | Potential withdrawal delays |

| Market Risk | High | Volatility impacts trading |

To mitigate these risks, traders are advised to conduct thorough research, understand the broker's fee structures, and consider using risk management tools such as stop-loss orders.

Conclusion and Recommendations

In conclusion, LiteForex is not a scam, as it operates under regulatory oversight from CySEC, which provides a level of safety for traders. However, the mixed regulatory environment, particularly for clients trading under the offshore entity, raises concerns that potential clients should consider.

Traders should weigh the pros and cons before choosing LiteForex as their broker. For those who prioritize strong regulatory protections and are comfortable navigating the complexities of trading, LiteForex can be a viable option. However, it may not be the best choice for those seeking a fully regulated environment with comprehensive investor protections.

For traders looking for alternative options, brokers such as XTB and IG offer robust regulatory frameworks and extensive trading resources, making them worthy considerations. Ultimately, thorough research and personal risk assessment are crucial when selecting a forex broker.

Is LiteForex a scam, or is it legit?

The latest exposure and evaluation content of LiteForex brokers.

LiteForex Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

LiteForex latest industry rating score is 4.89, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 4.89 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.