Regarding the legitimacy of JustMarkets forex brokers, it provides CYSEC, FSCA, FSA, FSC and WikiBit, (also has a graphic survey regarding security).

Is JustMarkets safe?

Pros

Cons

Is JustMarkets markets regulated?

The regulatory license is the strongest proof.

CYSEC Derivatives Trading License (STP) 19

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Derivatives Trading License (STP)

Licensed Entity:

JustMarkets Ltd

Effective Date:

2021-06-08Email Address of Licensed Institution:

support@justmarkets.euSharing Status:

No SharingWebsite of Licensed Institution:

justmarkets.euExpiration Time:

--Address of Licensed Institution:

Grigori Afxentiou, 13&15, Ide Ioannou Court, Office 102, Mesa Geitonia, 4003, Limassol, CyprusPhone Number of Licensed Institution:

+357 25 351514Licensed Institution Certified Documents:

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

JUST GLOBAL MARKETS (PTY) LTD

Effective Date:

2021-11-09Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

12 HEATHER AVENUE KENEVER BELLVILLE CAPE TOWN 7550Phone Number of Licensed Institution:

0824432049Licensed Institution Certified Documents:

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Just Global Markets Ltd.

Effective Date: Change Record

--Email Address of Licensed Institution:

compliance@justmarkets.comSharing Status:

No SharingWebsite of Licensed Institution:

https://www.justmarkets.comExpiration Time:

--Address of Licensed Institution:

Office 10, Floor 2, Vairam Building, Providence Industrial Estate, Providence, Mahe, SeychellesPhone Number of Licensed Institution:

+248 4374322Licensed Institution Certified Documents:

FSC Market Making License (MM)

British Virgin Islands Financial Services Commission

British Virgin Islands Financial Services Commission

Current Status:

Offshore RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Just Global Markets (VG) Limited

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is JustMarkets A Scam?

Introduction

JustMarkets, formerly known as JustForex, is a global online brokerage that has been operational since 2012. The firm primarily focuses on foreign exchange (forex) trading, offering a wide range of financial instruments, including contracts for difference (CFDs) on commodities, indices, stocks, and cryptocurrencies. Given the rapid growth of online trading platforms and the increasing number of brokers entering the market, it is crucial for traders to carefully evaluate the credibility and reliability of their chosen broker. This article aims to provide an objective analysis of JustMarkets, assessing its safety and legitimacy through various criteria, including regulatory compliance, company background, trading conditions, customer feedback, and security measures. The evaluation is based on a comprehensive review of multiple sources and expert opinions, ensuring a well-rounded perspective on the broker's operations.

Regulation and Legitimacy

Regulation is a critical factor in determining the trustworthiness of a forex broker. JustMarkets operates under several regulatory authorities, which is a positive indicator of its legitimacy. The broker is regulated by:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Cyprus Securities and Exchange Commission (CySEC) | 401/21 | Cyprus | Verified |

| Seychelles Financial Services Authority (FSA) | SD 088 | Seychelles | Verified |

| Financial Sector Conduct Authority (FSCA) | 51114 | South Africa | Verified |

| Financial Services Commission (FSC) | GB22200881 | Mauritius | Verified |

The presence of multiple regulatory licenses suggests that JustMarkets adheres to various international standards for financial operations. CySEC, in particular, is known for its stringent regulatory framework, which imposes strict requirements on brokers to ensure client fund protection and operational transparency. JustMarkets also implements measures such as client fund segregation and negative balance protection, which further enhances its credibility. However, it is worth noting that while JustMarkets is regulated, it does not hold a Tier-1 regulatory license, which may be a consideration for more risk-averse traders.

Company Background Investigation

JustMarkets has a relatively short history in the financial services industry but has established a reputation for providing accessible trading options. Founded in 2012, the company has expanded its operations globally, with headquarters in Seychelles and offices in Cyprus, South Africa, and Mauritius. The ownership structure of JustMarkets is comprised of several entities, each regulated by different authorities, which adds layers of oversight to its operations.

The management team behind JustMarkets consists of professionals with extensive experience in finance and trading, contributing to the broker's operational stability and growth. Transparency is a key aspect of JustMarkets' business model; the broker provides detailed information about its regulatory licenses, operational jurisdictions, and contact details on its website. This level of transparency is essential for building trust with potential clients and indicates the broker's commitment to ethical practices.

Trading Conditions Analysis

JustMarkets offers a range of trading conditions that cater to various types of traders. The broker's fee structure is competitive, with spreads starting as low as 0.0 pips on certain accounts. However, the overall cost of trading can vary depending on the account type and instrument being traded. Below is a comparison of core trading costs:

| Fee Type | JustMarkets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.6 pips | 1.2 pips |

| Commission Model | $6 per lot | $8 per lot |

| Overnight Interest Range | Competitive | Varies widely |

JustMarkets employs a transparent pricing model, with no hidden fees associated with deposits or withdrawals. However, traders should be aware of potential overnight financing costs and any fees imposed by payment processors. The broker does charge an inactivity fee of $5 after 150 days of no trading activity, which is a common practice among brokers but may be a concern for less active traders.

Customer Fund Safety

The safety of customer funds is paramount in the forex trading industry. JustMarkets has implemented several measures to protect client assets, including segregated accounts that keep clients' funds separate from the broker's operational funds. This practice is essential for safeguarding traders' capital in case of financial difficulties faced by the broker.

Moreover, JustMarkets provides negative balance protection, ensuring that clients cannot lose more than their deposited funds, even during extreme market volatility. This feature is particularly beneficial for inexperienced traders who may be more susceptible to significant losses. While JustMarkets has not reported significant security issues in its history, the absence of a Tier-1 regulatory license may raise concerns for some traders regarding the overall safety of their investments.

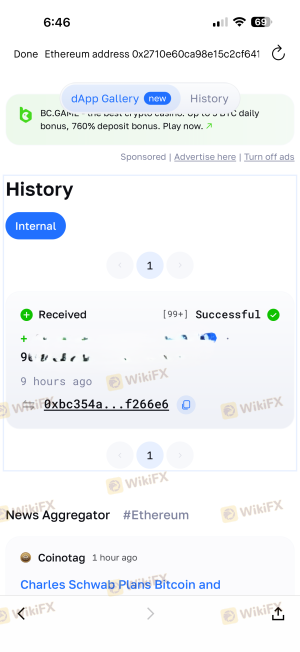

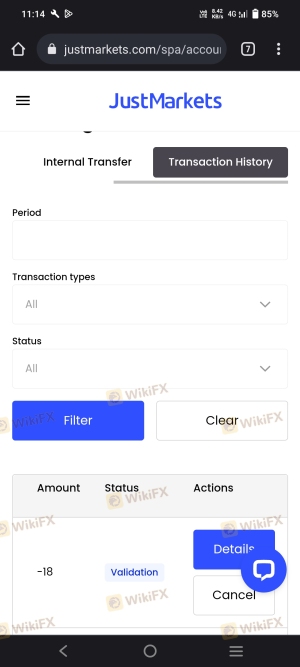

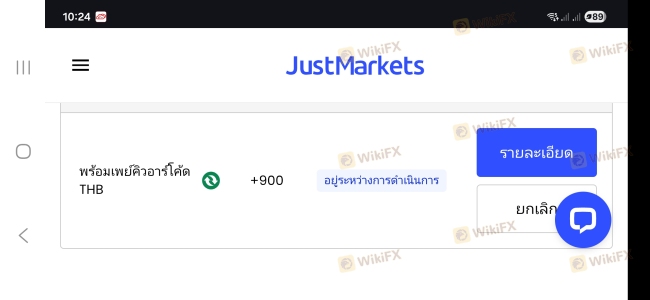

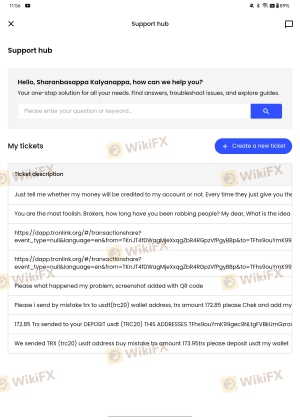

Customer Experience and Complaints

Analyzing customer feedback provides valuable insights into the overall experience of trading with JustMarkets. The broker has garnered a mix of positive and negative reviews, with many users praising its competitive spreads, fast execution times, and responsive customer support. However, common complaints include withdrawal processing times and limited educational resources.

Below is a summary of the main types of complaints received:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | Moderate | Timely response |

| Limited Educational Resources | Low | Ongoing improvements |

| Account Verification Issues | High | Addressed promptly |

A few notable cases highlight the broker's strengths and weaknesses. For instance, some traders reported delays in withdrawal processing, particularly during peak trading times, but noted that the customer support team was responsive and provided timely updates. On the other hand, users expressed a desire for more comprehensive educational materials, indicating that while JustMarkets has made strides in this area, there is still room for improvement.

Platform and Execution

JustMarkets provides access to the widely-used MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, known for their reliability and extensive range of trading tools. The platforms are accessible via desktop, web, and mobile devices, allowing traders to manage their accounts and execute trades conveniently.

The execution quality at JustMarkets is generally regarded as high, with low latency and minimal slippage reported by users. However, some traders have raised concerns about occasional rejections of orders during high volatility, which can impact trading performance. It is essential for traders to remain vigilant and monitor their trades closely, particularly during major economic events.

Risk Assessment

Engaging with any broker carries inherent risks, and JustMarkets is no exception. Below is a risk assessment summarizing key risk areas associated with trading through this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | Medium | Multiple licenses but lacks Tier-1 regulation |

| Fund Safety | Low | Segregated accounts and negative balance protection |

| Trading Conditions | Medium | Competitive spreads, but some complaints regarding execution |

| Customer Support | Low | Generally responsive but may require improvements in educational resources |

To mitigate potential risks, traders should conduct thorough research, utilize demo accounts to practice strategies, and maintain strict risk management protocols while trading.

Conclusion and Recommendations

In conclusion, JustMarkets is a regulated broker that offers a range of competitive trading conditions, making it a viable option for various types of traders. The presence of multiple regulatory licenses, along with strong safety measures for client funds, indicates a commitment to ethical practices and transparency. While there are some areas for improvement, particularly in customer support and educational resources, the overall assessment suggests that JustMarkets is not a scam.

For traders considering JustMarkets, it is advisable to evaluate personal trading needs and risk tolerance. Beginners may benefit from the low minimum deposit and demo accounts, while experienced traders can take advantage of the high leverage and competitive spreads. However, those seeking a broker with a Tier-1 regulatory license or a broader range of trading instruments may want to explore alternative options such as Pepperstone or IG Markets. Overall, JustMarkets presents a solid choice for traders looking for a reliable and accessible trading platform.

Is JustMarkets a scam, or is it legit?

The latest exposure and evaluation content of JustMarkets brokers.

JustMarkets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

JustMarkets latest industry rating score is 3.94, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 3.94 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.