Executive Summary

This fxtrading.com review gives you a complete look at an online forex broker. The broker works under two different regulators: the Australian Securities and Investments Commission (ASIC) and the Vanuatu Financial Services Commission (VFSC). The platform calls itself a multi-asset trading provider, giving you access to forex, stocks, indices, commodities, and cryptocurrencies through CFD trading.

fxtrading.com has a trust score of 77 points. This shows moderate credibility in the competitive forex brokerage world. The broker follows rules set by established financial authorities, which gives it legitimacy. However, our analysis shows big gaps in transparency about trading conditions and how the company operates.

The platform seems designed for investors who want exposure to multiple asset classes. Still, the lack of detailed information about account structures, pricing models, and platform specs raises questions about overall transparency. Based on what we know, fxtrading.com presents a neutral risk profile suitable for intermediate traders who care more about regulatory oversight and asset diversity than detailed cost transparency.

However, potential clients should do thorough research given the limited public information about specific trading conditions and user experiences.

Important Notice

Regional Entity Differences: fxtrading.com operates under multiple regulatory jurisdictions. ASIC supervises Australian operations, while VFSC oversees international services. Traders should know that regulatory requirements may differ between these jurisdictions.

This could affect trading conditions, client protections, and dispute resolution procedures. The varying regulatory frameworks may result in different leverage limits, negative balance protection policies, and compensation scheme eligibility depending on where you live. Review Methodology: This evaluation uses publicly available information, regulatory filings, and user feedback from various sources.

Our assessment aims to give you an objective analysis of the broker's services. However, some operational details remain unclear due to limited disclosure. Prospective clients should verify all information directly with the broker and consider their individual trading requirements before making any investment decisions.

Rating Framework

Broker Overview

fxtrading.com operates as an Australia-based online brokerage firm. The company specializes in multi-asset trading services across global financial markets. The company has established itself as a provider of Contract for Difference (CFD) trading opportunities.

This lets clients access various financial instruments without directly owning underlying assets. Through its trading infrastructure, the broker helps retail and institutional investors get access to international financial markets. The platform's business model centers on CFD trading provision.

This allows investors to speculate on price movements across forex pairs, individual stocks, market indices, commodity futures, and cryptocurrency markets. This approach enables traders to potentially profit from both rising and falling markets while maintaining relatively smaller capital requirements compared to traditional investment methods. The broker's regulatory compliance framework shows commitment to operational standards, though specific details about trading conditions and platform capabilities remain limited in publicly available materials.

Operating under dual regulatory supervision from ASIC and VFSC, fxtrading.com maintains licensing requirements across multiple jurisdictions. The ASIC regulation provides oversight for Australian operations, while VFSC supervision covers international client services. This fxtrading.com review notes that the broker offers access to forex, CFDs, stocks, indices, commodities, and cryptocurrencies.

However, complete information about trading platforms, execution models, and specific service features requires further clarification from the broker directly.

Regulatory Jurisdictions: fxtrading.com maintains regulatory compliance through ASIC and VFSC supervision. This provides dual-jurisdiction oversight that enhances operational legitimacy. The ASIC regulation offers robust client protection standards for Australian traders, while VFSC oversight helps international market access with established regulatory frameworks.

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal options is not detailed in available materials. This requires direct broker consultation for payment method clarification and processing timeframes. Minimum Deposit Requirements: The broker's minimum deposit thresholds are not specified in accessible documentation.

This represents a significant transparency gap for potential clients evaluating account accessibility. Promotional Offerings: Current bonus structures and promotional campaigns are not detailed in available information sources. This limits assessment of potential incentive programs for new or existing clients.

Tradeable Assets: The platform provides access to multiple asset categories. These include foreign exchange pairs, individual stock CFDs, market index derivatives, commodity contracts, and cryptocurrency instruments, offering diversified trading opportunities across global markets. Cost Structure Analysis: Detailed information about spreads, commissions, overnight financing charges, and other trading costs is not fully available.

This creates uncertainty about the true cost of trading with this broker and limits cost comparison capabilities. Leverage Provisions: Specific leverage ratios and margin requirements are not detailed in accessible materials. However, these would typically vary by asset class and regulatory jurisdiction.

Platform Selection: Trading platform specifications are not fully outlined in available documentation. This includes software types, mobile applications, and advanced trading tools. Geographic Restrictions: Information about countries or regions where services may be restricted is not specified in available materials.

Customer Support Languages: The range of supported languages for customer service communications is not detailed in accessible documentation.

This fxtrading.com review highlights significant information gaps that potential clients should address through direct broker communication before account opening.

Detailed Rating Analysis

Account Conditions Analysis (Score: 5/10)

The account conditions evaluation for fxtrading.com reveals big transparency challenges. These impact potential client decision-making processes. Available information does not specify the range of account types offered.

We don't know whether the broker provides standard, premium, or professional account categories, or how these might differ in terms of features and requirements. This lack of clarity extends to minimum deposit requirements, which remain unspecified across all potential account categories. The absence of detailed information about account opening procedures, required documentation, verification timeframes, and approval processes creates uncertainty for prospective clients.

Without clear guidance on initial funding requirements, traders cannot properly assess whether the broker's services align with their available capital and investment objectives. Additionally, information about special account features such as Islamic accounts for Shariah-compliant trading, demo account availability, or managed account services is not readily available. The scoring reflects these transparency limitations, as complete account condition assessment requires clear disclosure of terms, requirements, and features.

Potential clients should directly contact the broker to obtain detailed account specifications, understand minimum deposit thresholds, and clarify any special requirements or restrictions that may apply to different account categories.

This fxtrading.com review emphasizes the importance of obtaining complete account information before proceeding with any registration or funding decisions, given the limited publicly available details about account structures and requirements.

fxtrading.com shows strength in asset diversity. The broker offers access to multiple financial instrument categories including forex, stocks, indices, commodities, and cryptocurrencies through CFD trading mechanisms. This multi-asset approach provides traders with opportunities to diversify their portfolios and explore various market sectors from a single platform.

The availability of cryptocurrency trading alongside traditional financial instruments reflects the broker's adaptation to evolving market demands. However, specific details about trading tools, analytical resources, and educational materials are not fully outlined in available information. The absence of detailed information about charting capabilities, technical indicators, automated trading support, or research provision limits the complete assessment of the broker's tool ecosystem.

Additionally, information about market analysis, economic calendars, trading signals, or educational webinars is not readily accessible. The moderate scoring acknowledges the positive aspect of multi-asset trading availability while recognizing the significant information gaps regarding specific tools and resources. Professional traders typically require detailed information about platform capabilities, analytical tools, and research resources to make informed broker selection decisions.

Potential clients should inquire directly about available trading tools, research resources, educational materials, and analytical capabilities to determine whether the broker's offerings align with their trading strategies and analytical requirements.

Customer Service and Support Analysis (Score: 6/10)

The customer service evaluation for fxtrading.com faces big limitations due to insufficient information about support channels, availability, and service quality. Available materials do not specify whether the broker offers phone support, live chat, email assistance, or other communication methods. Response time expectations, support hours, and availability across different time zones are not detailed.

This creates uncertainty about accessibility when assistance is needed. Information about multilingual support capabilities, staff expertise levels, and problem resolution procedures is not readily available. The absence of user feedback about customer service experiences limits the assessment of actual service quality and effectiveness.

Additionally, details about account management services, educational support, or technical assistance are not fully outlined. Without specific user testimonials or detailed service descriptions, evaluating the broker's commitment to customer satisfaction becomes challenging. The moderate scoring reflects the uncertainty created by limited information availability rather than confirmed service deficiencies.

However, reliable customer support represents a crucial element of broker selection, particularly for traders who may require assistance with platform navigation, account issues, or trading-related questions.

Prospective clients should test customer service responsiveness and quality through direct contact before committing to account opening, ensuring that support standards meet their expectations and requirements.

Trading Experience Analysis (Score: 6/10)

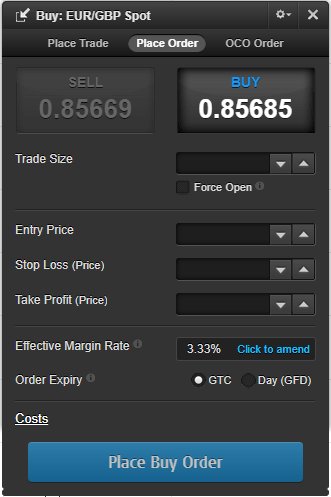

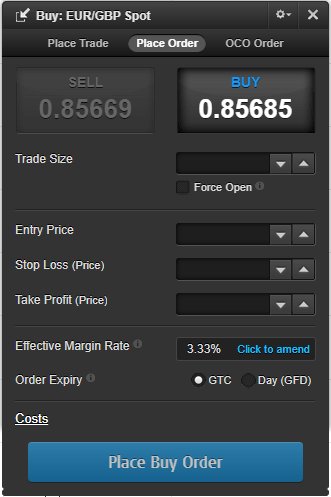

The trading experience assessment for fxtrading.com encounters big limitations due to insufficient information about platform specifications, execution quality, and user interface design. Available materials do not detail the trading platforms offered. We don't know whether the broker provides MetaTrader 4, MetaTrader 5, proprietary platforms, or web-based trading solutions.

This information gap extends to mobile trading capabilities, platform stability, and advanced trading features. Order execution quality, including execution speeds, slippage rates, and requote frequency, is not documented in accessible materials. Without this information, traders cannot assess whether the broker's execution standards align with their trading strategies, particularly for scalping or high-frequency trading approaches.

Additionally, details about order types, risk management tools, and automated trading support are not fully available. The lack of specific user feedback about trading experiences, platform performance, and execution quality further limits assessment accuracy. Information about server locations, latency optimization, and platform uptime statistics would be valuable for serious traders but is not readily available.

This fxtrading.com review acknowledges that trading experience represents a fundamental aspect of broker evaluation, requiring detailed platform information and user feedback for complete assessment. The moderate scoring reflects information limitations rather than confirmed platform deficiencies, emphasizing the need for direct platform testing and broker consultation.

Trust and Security Analysis (Score: 7/10)

fxtrading.com shows reasonable credibility through regulatory oversight from both ASIC and VFSC. This provides dual-jurisdiction compliance that enhances operational legitimacy. The ASIC regulation offers robust client protection standards, including segregated client funds, negative balance protection, and participation in compensation schemes for Australian clients.

VFSC oversight provides additional regulatory framework compliance for international operations. The broker's trust score of 77 points indicates moderate industry standing. However, specific details about fund segregation policies, client money protection measures, and insurance coverage are not fully detailed in available materials.

Information about the broker's financial stability, company ownership structure, and operational history would strengthen trust assessment but remains limited in accessible documentation. While regulatory compliance provides a foundation of legitimacy, the absence of detailed information about security measures, data protection protocols, and risk management procedures creates some uncertainty. Additionally, information about any regulatory actions, compliance issues, or industry recognition is not readily available for complete reputation assessment.

The scoring acknowledges the positive aspects of regulatory oversight while recognizing information gaps about specific security measures and operational transparency. Prospective clients should verify regulatory status directly with relevant authorities and seek detailed information about client protection measures before proceeding with account opening.

User Experience Analysis (Score: 5/10)

The user experience evaluation for fxtrading.com faces big challenges due to limited information about platform usability, interface design, and actual user satisfaction levels. Available materials do not provide specific user ratings, detailed reviews, or complete feedback about the overall client experience. This information gap extends to registration processes, account verification procedures, and initial platform navigation experiences.

Without detailed user testimonials or complete platform demonstrations, assessing the broker's commitment to user-friendly design and intuitive operation becomes difficult. Information about platform customization options, educational resources for new users, and onboarding support is not readily available. Additionally, details about mobile application functionality, cross-device synchronization, and platform accessibility features are not fully outlined.

The absence of specific feedback about common user challenges, platform learning curves, or satisfaction with overall service delivery limits complete experience assessment. Information about deposit and withdrawal experiences, customer service interactions, and problem resolution effectiveness would be valuable but is not detailed in accessible materials. The moderate scoring reflects the uncertainty created by limited user feedback and detailed platform information rather than confirmed usability issues.

Prospective clients should consider requesting platform demonstrations, testing demo accounts, and seeking user community feedback before committing to live trading accounts.

Conclusion

This complete fxtrading.com review reveals a broker operating under legitimate regulatory oversight with dual ASIC and VFSC supervision. The broker offers multi-asset trading opportunities across forex, stocks, indices, commodities, and cryptocurrencies. While the regulatory compliance and trust score of 77 points indicate reasonable credibility, significant transparency gaps regarding trading conditions, platform specifications, and user experiences create challenges for thorough evaluation.

The broker appears most suitable for intermediate traders who prioritize regulatory oversight and asset diversification over detailed cost transparency. The multi-asset trading capability provides portfolio diversification opportunities. However, the lack of specific information about trading costs, platform features, and user experiences requires careful consideration.

Primary advantages include regulatory compliance with established authorities and diverse asset class availability. Key limitations center on insufficient transparency regarding trading conditions, platform capabilities, and user feedback. Prospective clients should conduct direct broker consultation to obtain detailed information about account conditions, trading costs, and platform features before making investment decisions.