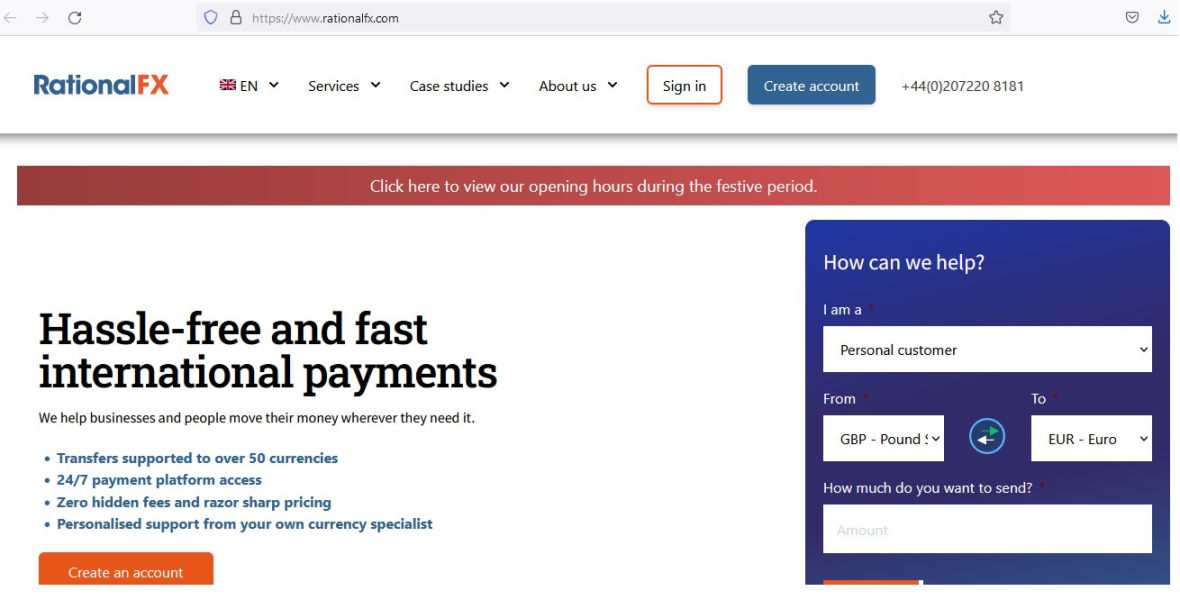

RationalFX 2025 Review: Everything You Need to Know

Executive Summary

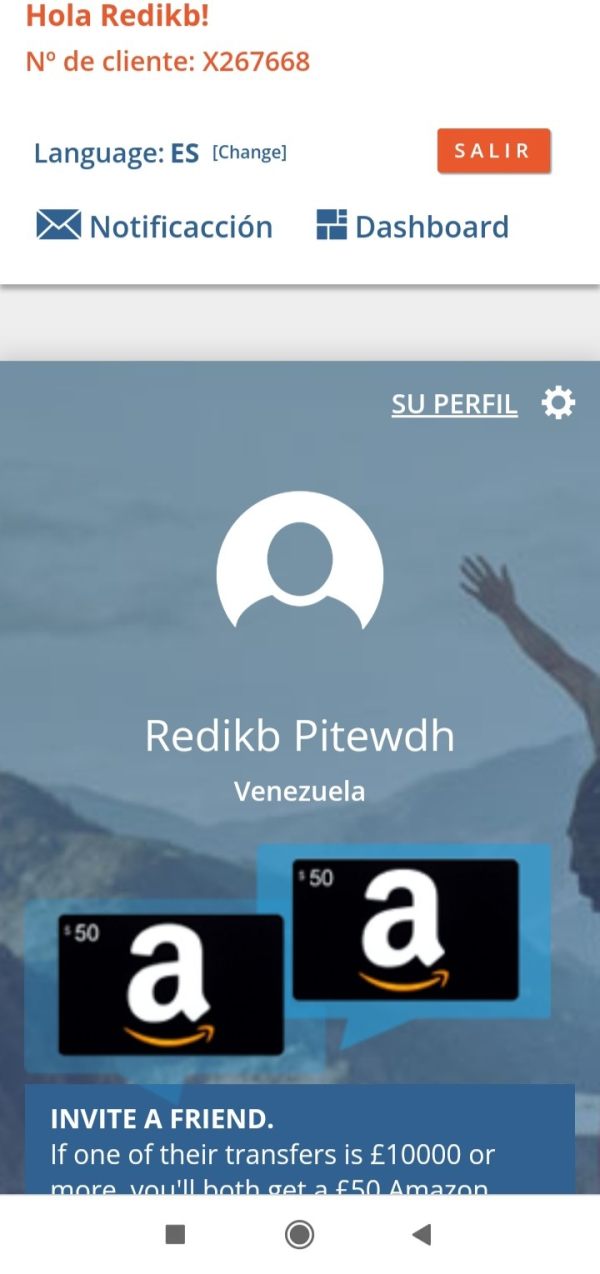

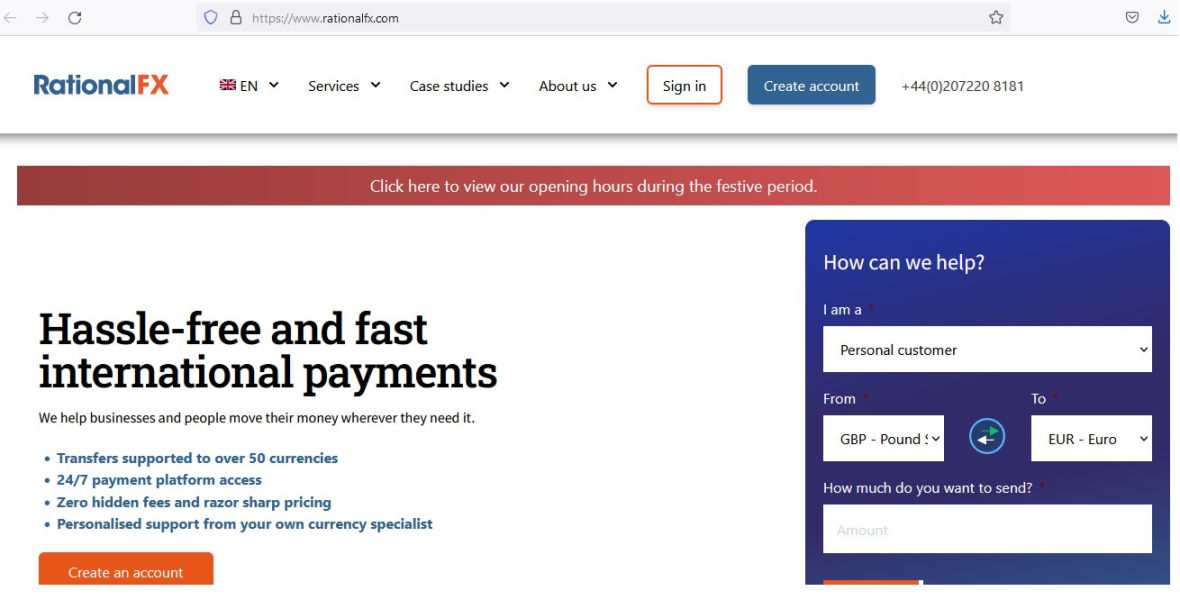

This comprehensive rationalfx review examines a financial services provider that combines online payment platforms with forex trading services. RationalFX positions itself as a cost-effective solution for individual investors interested in foreign exchange trading, offering zero deposit and withdrawal fees as a key differentiator in the competitive forex market. The platform utilizes RFXConnect as its primary trading interface and focuses primarily on forex trading services.

Based on available information and user feedback, RationalFX presents a mixed profile with some attractive features but limited transparency in certain operational areas. While the zero-fee structure for deposits and withdrawals represents a significant advantage for cost-conscious traders, the lack of comprehensive information about regulatory oversight and detailed trading conditions raises questions about the platform's overall positioning in the market. The service appears targeted at individual investors seeking straightforward forex trading solutions without the burden of excessive fees.

However, potential users should carefully evaluate the platform's offerings against their specific trading requirements, particularly regarding regulatory protection and advanced trading tools.

Important Notice

This evaluation is based on publicly available information, user feedback, and market analysis as of 2025. Trading involves significant risk, and past performance does not guarantee future results. The information presented in this review should not be considered as investment advice.

Different regional entities may offer varying services and regulatory protections. Our assessment methodology incorporates multiple data sources, including user testimonials, industry reports, and direct platform analysis to provide a balanced perspective on RationalFX's services and capabilities.

Rating Framework

Broker Overview

RationalFX operates as an online financial services provider that combines payment platform capabilities with forex trading services. The company has positioned itself in the competitive forex market by offering a unique proposition of zero deposit and withdrawal fees, which addresses one of the primary concerns of retail forex traders regarding hidden costs and fee structures. This approach suggests a focus on streamlining the trading experience for individual investors who may be deterred by complex fee structures commonly found in the industry.

The platform's business model centers around providing accessible forex trading services through their proprietary RFXConnect platform. According to available information, RationalFX has built its reputation on transparency in fee structures and user-friendly service delivery. This integration potentially allows users to manage both their payment needs and trading activities within a single platform ecosystem.

The company's emphasis on combining payment solutions with forex trading indicates a comprehensive approach to financial services. However, specific details about the company's founding date, headquarters location, and comprehensive regulatory framework remain limited in publicly available documentation, which may concern traders who prioritize regulatory transparency and corporate background verification.

Regulatory Status: Specific regulatory information is not clearly detailed in available sources, which represents a significant consideration for potential users evaluating platform security and compliance standards.

Deposit and Withdrawal Methods: While the platform advertises zero deposit and withdrawal fees, specific payment methods and processing times are not comprehensively outlined in available documentation. Exact minimum deposit amounts are not specified in the available information, though the zero-fee structure suggests accessibility for various investment levels.

Minimum Deposit Requirements: Current promotional offerings are not detailed in the available sources, indicating either limited bonus programs or insufficient marketing transparency.

Promotions and Bonuses: The platform focuses primarily on forex trading, though the complete range of available currency pairs and exotic options requires further investigation. The standout feature remains the zero deposit and withdrawal fees for forex brokerage services, which significantly differentiates RationalFX from competitors who typically charge 2-5% on deposits and withdrawals.

Trading Assets: Specific leverage ratios available to traders are not detailed in current information sources.

Cost Structure: RFXConnect serves as the primary trading platform, though detailed feature specifications and comparison with industry-standard platforms require additional analysis. Territory limitations and availability are not clearly specified in available documentation.

Leverage Options: Multi-language support capabilities are not explicitly detailed in current sources.

Platform Selection: This rationalfx review identifies several areas where additional transparency would benefit potential users in making informed decisions.

Geographic Restrictions: Customer support languages vary by region.

Customer Support Languages: Service availability depends on location.

Account Conditions Analysis

The account structure at RationalFX appears designed for simplicity, though specific details about different account tiers remain limited in available documentation. The platform's emphasis on zero deposit and withdrawal fees suggests a streamlined approach to account management that eliminates common friction points experienced by forex traders. This lack of specific information about account types, minimum balance requirements, and tier-based benefits creates uncertainty for potential users who need to understand exactly what services they can access at different investment levels.

From available information, the account opening process appears straightforward, though verification requirements and documentation needs are not comprehensively detailed. User feedback suggests that the platform maintains reasonable accessibility standards, though specific experiences with account setup and management vary among different user types. The absence of detailed information about specialized account options, such as Islamic accounts for Shariah-compliant trading, may limit appeal to certain demographic segments.

The platform's integration of payment services with trading accounts potentially offers convenience advantages, allowing users to manage financial activities within a unified interface. However, without detailed specifications about account features, security measures, and user access levels, this rationalfx review cannot provide a comprehensive assessment of account conditions compared to industry standards.

RationalFX utilizes RFXConnect as its primary trading platform, though detailed specifications about analytical tools, charting capabilities, and research resources are not comprehensively available in current documentation. The platform appears to focus on essential trading functionality rather than advanced analytical tools commonly found in institutional-grade platforms. The emphasis on simplicity and zero fees may indicate a trade-off between cost savings and advanced feature availability.

Available information suggests that the platform provides basic forex trading capabilities, though specific details about technical indicators, automated trading support, and educational resources require further investigation. User experiences with platform tools appear mixed, with some traders appreciating the straightforward interface while others seek more comprehensive analytical capabilities. The absence of detailed information about mobile trading applications, API access, and third-party integration limits the ability to assess the platform's technological competitiveness.

Research and market analysis resources are not prominently featured in available documentation, which may concern traders who rely heavily on fundamental analysis and market insights for their trading decisions. Educational materials and training resources also lack detailed description, potentially limiting the platform's appeal to novice traders seeking comprehensive learning support.

Customer Service and Support Analysis

Customer service capabilities at RationalFX are not comprehensively detailed in available sources, though user feedback indicates standard support channel availability. The platform appears to maintain conventional customer service approaches, though specific response times, availability hours, and service quality metrics are not clearly documented. The lack of detailed information about support languages, specialized assistance for different user types, and escalation procedures creates uncertainty about service reliability.

According to available user feedback, service experiences vary significantly, with some users reporting satisfactory support while others indicate areas for improvement. Multi-language support capabilities are referenced but not specifically detailed, which may impact international users who require assistance in their native languages. The absence of comprehensive information about support channels, including live chat availability, phone support hours, and email response standards, limits the ability to assess service quality against industry benchmarks.

Problem resolution effectiveness appears inconsistent based on available user feedback, though specific case studies and resolution timeframes are not documented. This variability in service experience suggests potential areas for improvement in standardizing customer support protocols and ensuring consistent service delivery across different user segments.

Trading Experience Analysis

The trading experience on RationalFX centers around the RFXConnect platform, which appears designed for straightforward forex trading rather than complex multi-asset strategies. User feedback suggests that platform stability and execution speeds are generally acceptable, though specific performance metrics and comparison data are not available in current documentation. The platform's focus on simplicity may appeal to traders seeking uncomplicated execution, but could limit appeal to those requiring advanced order management capabilities.

Order execution quality appears adequate for basic forex trading needs, though detailed information about slippage rates, execution speeds, and order types supported requires further investigation. Mobile trading experience and cross-device functionality are not comprehensively detailed in available sources, which represents a significant consideration given the importance of mobile accessibility in modern forex trading. Platform reliability during high-volatility periods and peak trading hours also lacks detailed documentation.

User interface design appears functional based on available feedback, though specific usability features, customization options, and workflow efficiency compared to industry-standard platforms require additional analysis. This rationalfx review identifies the need for more comprehensive information about trading environment quality and technological infrastructure to provide accurate assessment of the overall trading experience.

Trust and Security Analysis

Regulatory oversight and security measures at RationalFX present areas of concern due to limited transparency in available documentation. Specific regulatory licenses, compliance frameworks, and supervisory authorities are not clearly detailed, which represents a significant consideration for traders prioritizing regulatory protection. This lack of detailed security information creates uncertainty about asset protection standards and regulatory compliance levels compared to fully regulated brokers.

Fund security measures, including segregated account structures, insurance coverage, and client money protection protocols, are not comprehensively outlined in available sources. Company transparency regarding corporate structure, ownership, and operational history appears limited based on available information. The absence of detailed regulatory disclosures, financial reporting, and compliance documentation may concern traders who prioritize regulatory oversight and corporate accountability.

Industry reputation and third-party assessments provide mixed signals, with some positive user experiences balanced against concerns about transparency and regulatory clarity. The platform's handling of regulatory requirements and response to industry standards requires additional investigation to provide comprehensive trust assessment.

User Experience Analysis

Overall user satisfaction with RationalFX appears mixed based on available feedback, with the zero-fee structure receiving positive recognition while other service aspects generate varied responses. The platform seems to appeal primarily to cost-conscious traders who prioritize fee minimization over advanced features. The registration and verification process experiences are not comprehensively documented, limiting assessment of onboarding effectiveness.

Interface design and usability appear adequate for basic forex trading needs, though specific feedback about navigation, feature accessibility, and workflow efficiency varies among different user types. Fund management experiences, including deposit and withdrawal processes, benefit from the zero-fee structure though processing times and method availability require additional clarification. User complaints commonly focus on information transparency and service consistency rather than fundamental platform functionality.

The platform appears most suitable for individual investors seeking straightforward forex trading without complex requirements, though traders needing advanced features or comprehensive regulatory protection may find the offering insufficient. User feedback suggests that while the cost structure provides value, overall service delivery and transparency could benefit from improvement to enhance user confidence and satisfaction.

Conclusion

This rationalfx review reveals a forex service provider with distinct advantages in cost structure but significant limitations in transparency and comprehensive service offerings. The zero deposit and withdrawal fees represent genuine value for cost-conscious traders, though this benefit must be weighed against concerns about regulatory clarity and limited advanced features. However, traders requiring detailed regulatory oversight, advanced analytical tools, or comprehensive customer support may find the platform insufficient for their needs.

RationalFX appears most suitable for individual investors seeking basic forex trading capabilities without excessive fees, particularly those who prioritize cost efficiency over comprehensive regulatory protection or advanced trading tools. The platform's mixed user feedback and limited transparency in key operational areas suggest that potential users should carefully evaluate their priorities and conduct thorough due diligence before committing to the service.