OXShare 2025 Review: What You Need to Know

Executive Summary

This comprehensive oxshare review shows a concerning picture of a forex broker struggling with fundamental trust and operational issues. Our extensive analysis of user feedback from multiple platforms including Trustpilot and ForexPeaceArmy reveals that OXShare has significant deficiencies in core areas that matter most to traders. While the broker positions itself as offering loyalty in company features and customer service, the reality painted by user experiences tells a different story entirely.

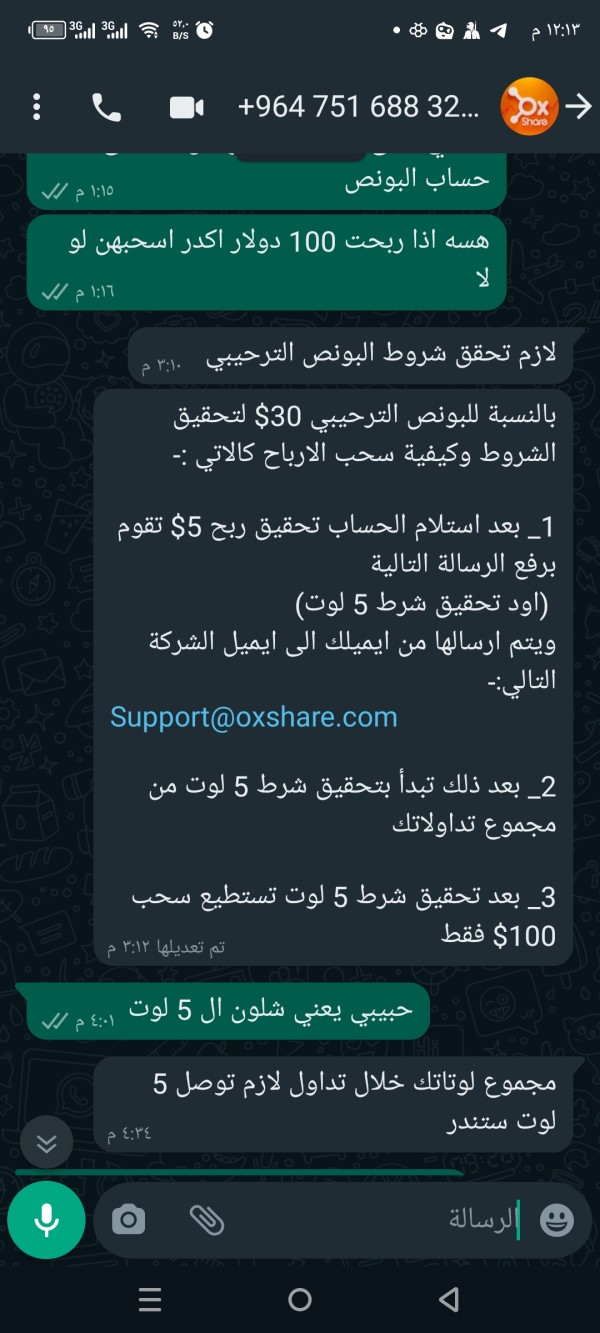

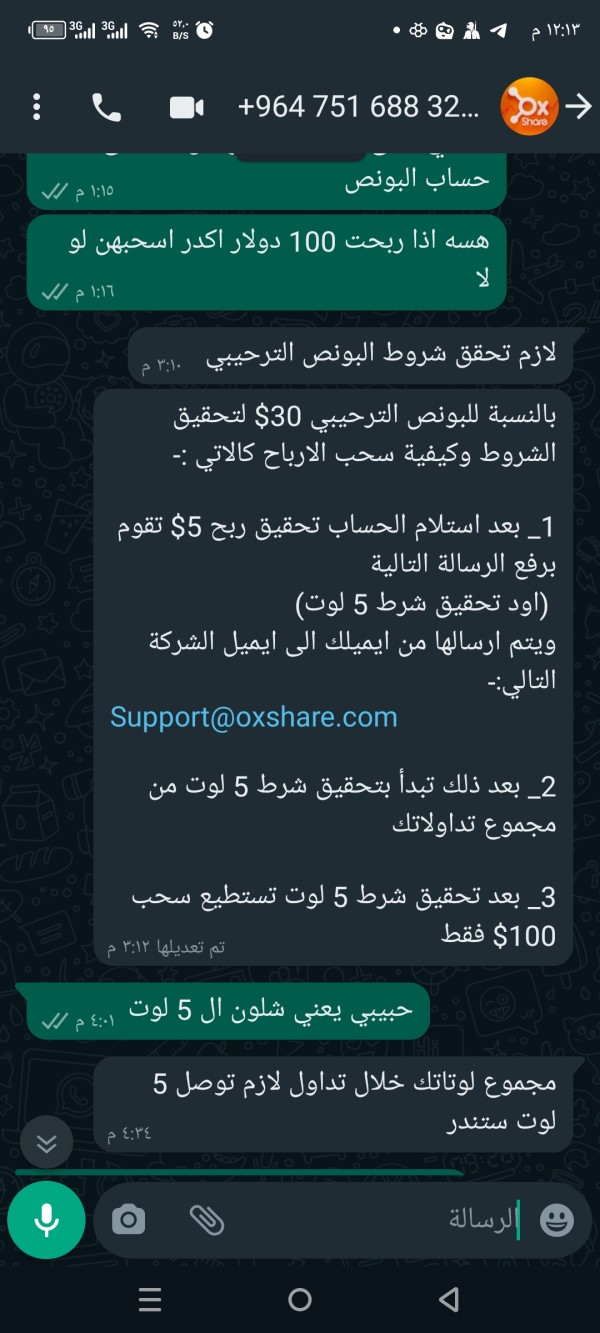

The primary concerns center around withdrawal difficulties and overall trustworthiness. Users frequently question whether OXShare operates as a legitimate broker or follows questionable practices that harm traders. The broker's target demographic appears to be traders who prioritize withdrawal security and reliable customer support – ironically, the very areas where OXShare appears to struggle most significantly. User feedback on Trustpilot reveals persistent trust issues with this broker. Many traders express frustration over fund accessibility and service reliability problems that continue without resolution.

Despite claims of focusing on customer service excellence, the evidence suggests OXShare falls short of industry standards. The broker fails to deliver secure, transparent trading services that modern forex traders demand and deserve.

Important Notice

This review is based on comprehensive analysis of user feedback, industry assessments, and available market research data. Our evaluation methodology incorporates direct user testimonials from platforms such as Trustpilot, ForexPeaceArmy, and Reviews.io, combined with technical analysis of the broker's service offerings to provide accurate insights.

Readers should note that forex trading involves significant risk, and broker selection should be based on thorough due diligence. The information presented reflects available data at the time of writing and may be subject to change as broker conditions evolve over time.

Rating Framework

Broker Overview

OXShare presents itself as a forex and CFD trading broker, though specific details about its establishment date and corporate background remain notably absent from readily available public information. The company attempts to position itself in the competitive forex market by emphasizing what it describes as "loyalty of company's features and customer service" as core differentiators for traders seeking reliable trading partnerships with trustworthy brokers.

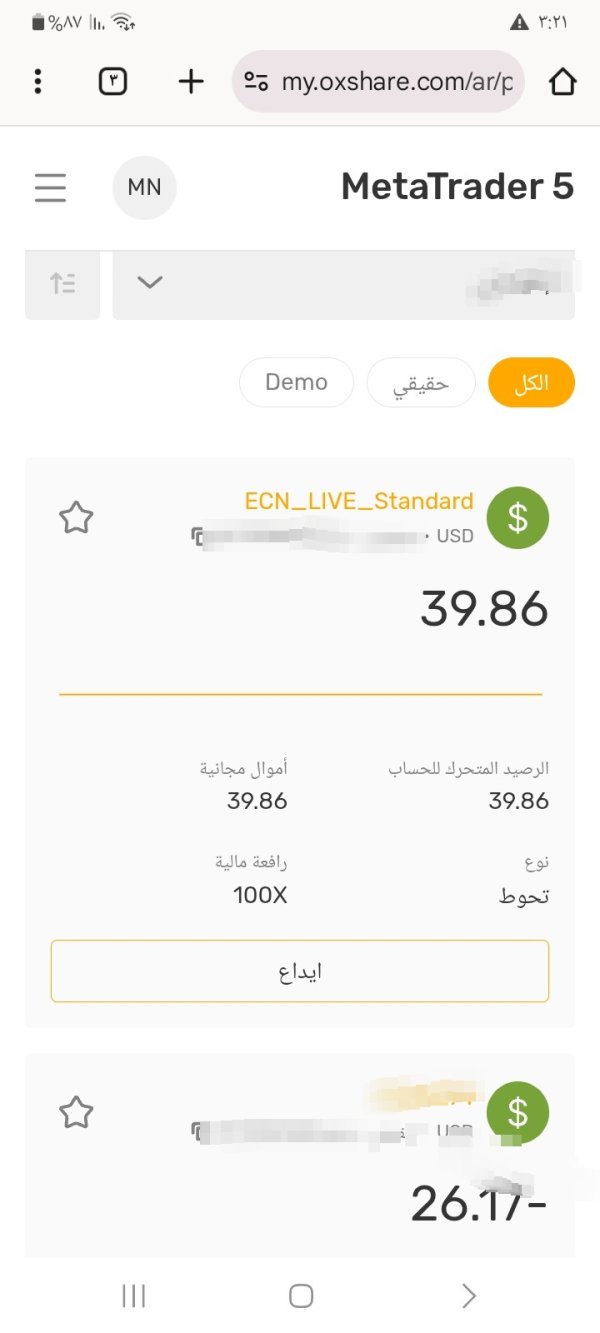

The broker's business model appears to focus on forex and CFD trading services. However, comprehensive details about its operational structure, technological infrastructure, and market-making versus ECN approaches are not clearly documented in available materials that potential clients can access. This lack of transparency regarding fundamental business operations raises immediate concerns for potential clients seeking detailed information before committing funds to any trading platform.

According to available information, OXShare operates in the forex and CFD space, offering trading services across various asset classes to interested traders. However, the specific range of tradeable instruments, platform technologies employed, and regulatory oversight mechanisms remain unclear from public sources that we could locate. The absence of clear regulatory information represents a significant concern, as reputable brokers typically prominently display their licensing details and regulatory compliance status for all potential clients to review. This oxshare review finds that such fundamental transparency gaps significantly impact the broker's credibility in an industry where regulatory oversight and clear operational disclosure are essential for trader confidence and peace of mind.

Regulatory Status and Compliance

Specific regulatory information for OXShare is not clearly documented in available public materials, representing a significant transparency concern for potential clients seeking regulatory assurance.

Deposit and Withdrawal Methods

Available information does not provide specific details about supported payment methods, processing times, or associated fees for fund transfers.

Minimum Deposit Requirements

Specific minimum deposit amounts and account tier structures are not detailed in available public information.

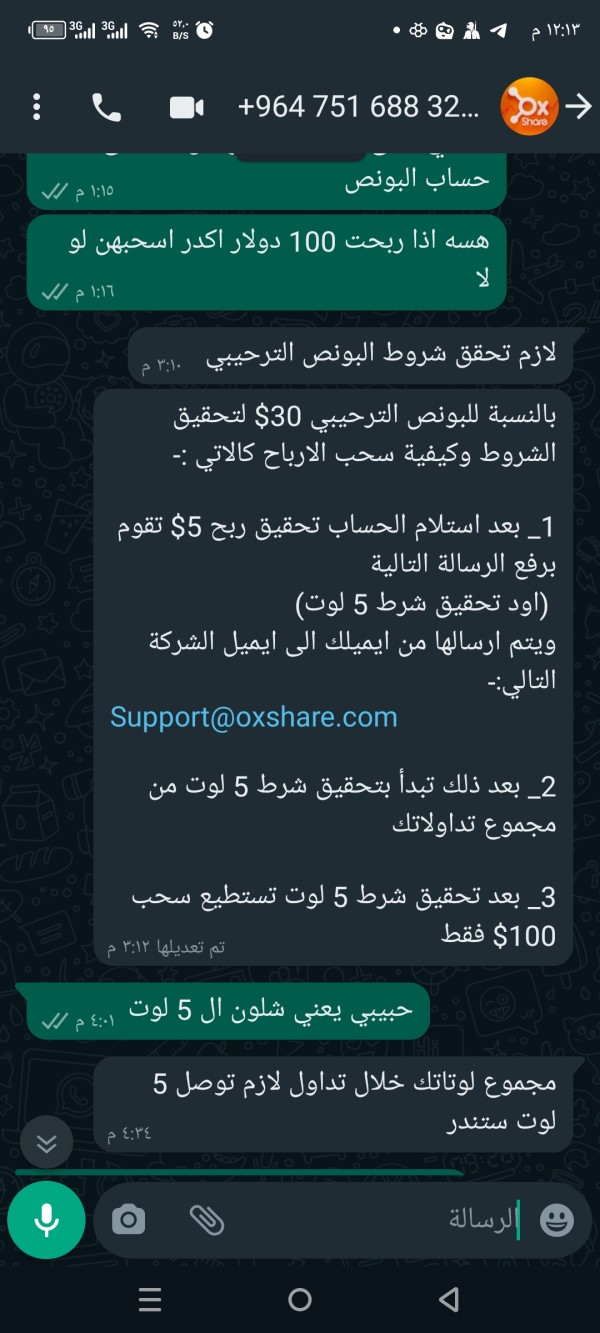

Current bonus structures, promotional campaigns, or incentive programs are not clearly outlined in accessible materials.

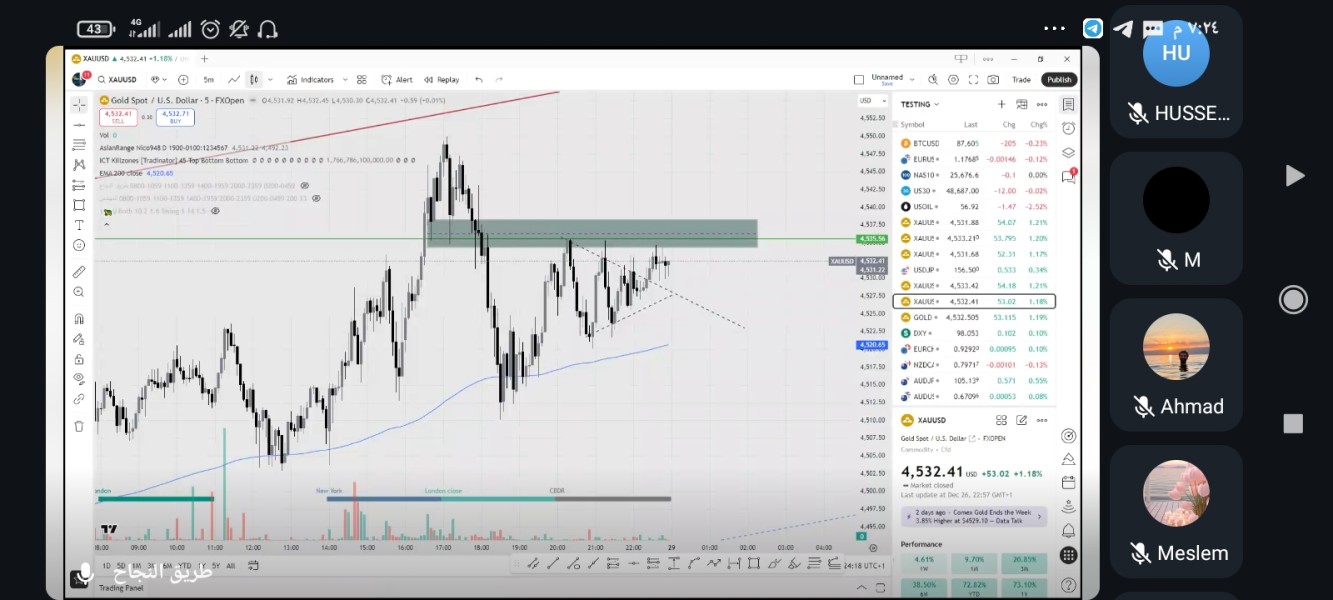

Trading Assets

While the broker operates in forex and CFD markets, specific details about available currency pairs, CFD instruments, and asset coverage remain undocumented.

Cost Structure

Detailed information about spreads, commission structures, overnight financing rates, and other trading costs is not readily available in public materials.

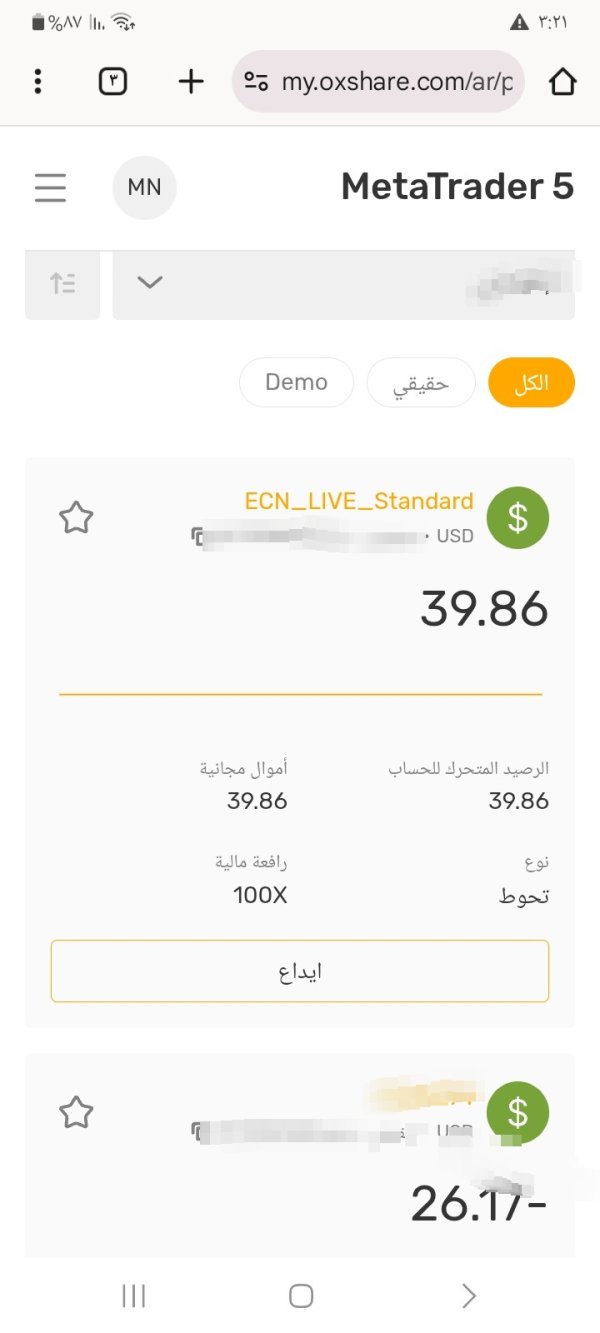

Leverage Options

Specific leverage ratios offered across different account types and asset classes are not clearly documented.

Information about trading platforms, technological infrastructure, and software options is not detailed in available sources.

Geographic Restrictions

Specific information about regional availability and service restrictions is not clearly outlined.

Customer Support Languages

Available language support options for customer service are not specified in accessible materials.

This oxshare review notes that the lack of detailed operational information across these fundamental areas represents a significant transparency deficit that impacts trader confidence.

Detailed Rating Analysis

Account Conditions Analysis (4/10)

OXShare's account conditions receive a below-average rating primarily due to the lack of transparent information about account structures, deposit requirements, and terms of service. Available materials do not provide clear details about different account types, their respective features, or the specific conditions governing each tier of service offered to traders. This opacity makes it difficult for traders to make informed decisions about which account structure best suits their trading needs and capital requirements for successful trading.

The absence of clearly documented minimum deposit requirements across different account levels creates uncertainty for potential clients planning their initial investment with this broker. Most reputable brokers provide detailed breakdowns of account tiers, associated benefits, and qualification criteria, allowing traders to understand exactly what they receive at each level of service. OXShare's lack of such transparency suggests either poor marketing communication or deliberate obfuscation of terms that could be unfavorable to traders.

Furthermore, there is no available information about special account features such as Islamic accounts for Muslim traders, VIP services for high-volume clients, or demo account provisions for practice trading. The account opening process, verification requirements, and timeline for account activation are also not clearly documented, creating additional uncertainty for prospective clients who want to understand the complete onboarding experience. Most established brokers provide clear step-by-step guidance for new account creation and verification procedures.

This oxshare review finds that without clear, accessible information about fundamental account conditions, traders cannot adequately assess whether OXShare's offerings align with their trading requirements and risk tolerance levels.

The tools and resources category receives a poor rating due to the complete absence of detailed information about trading tools, analytical resources, and educational materials. Available sources do not document any specific trading tools, technical analysis capabilities, or research resources that OXShare provides to its clients who need these features for successful trading. This represents a significant deficiency in an industry where comprehensive analytical tools and educational resources are considered standard offerings by most reputable brokers.

Modern forex traders expect access to advanced charting capabilities, technical indicators, economic calendars, market news feeds, and analytical research from their chosen broker. The lack of documented tools suggests either a very basic platform offering or poor communication of available resources to potential clients. Either scenario represents a competitive disadvantage in a market where brokers routinely provide sophisticated analytical capabilities as standard features for all account holders.

Educational resources such as webinars, trading guides, video tutorials, and market analysis are not mentioned in available materials that we could locate during our research. These resources are crucial for trader development and are typically prominently featured by reputable brokers as value-added services that help clients improve their trading skills. The absence of such resources suggests OXShare may not prioritize trader education and development, which could limit client success and satisfaction over time.

Automated trading support, including Expert Advisor compatibility, algorithmic trading capabilities, and API access for advanced traders, is also not documented in any accessible materials. This limits the broker's appeal to sophisticated traders who rely on automated strategies and custom trading solutions for their investment approaches.

Customer Service and Support Analysis (5/10)

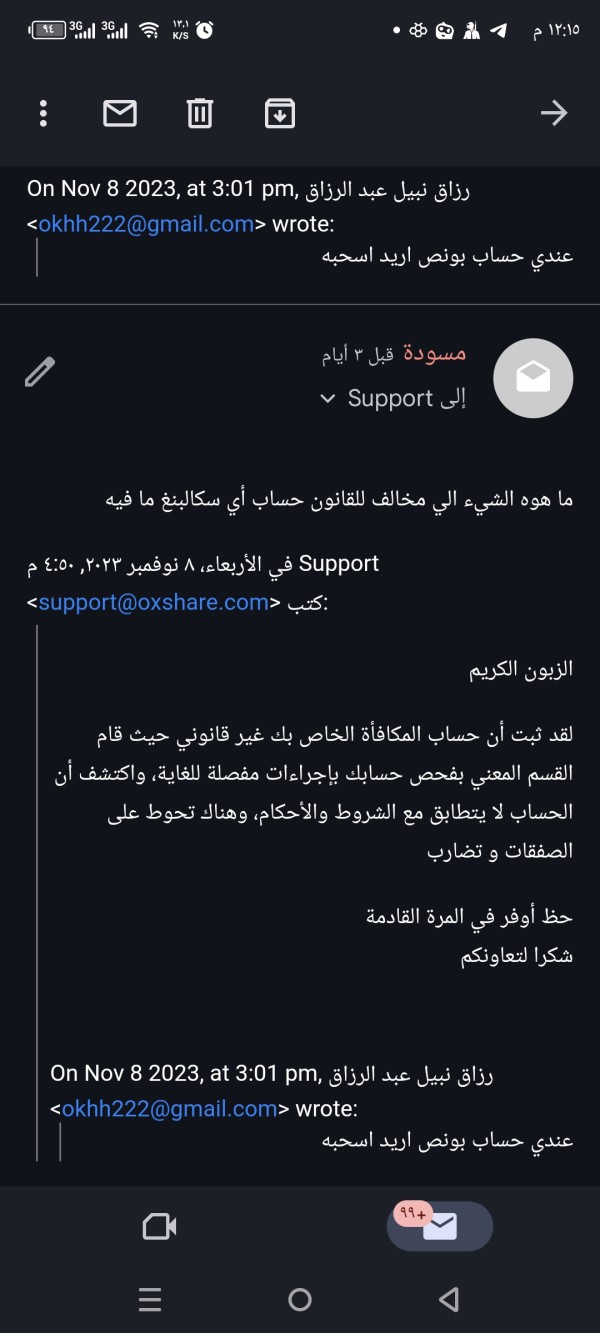

Customer service receives an average rating based on OXShare's stated emphasis on customer service excellence, though user feedback suggests significant gaps between promises and delivery. While the broker positions customer service as one of its core strengths in marketing materials, actual user experiences indicate persistent issues with service quality and responsiveness that contradict these claims. Available user feedback suggests that while customer service channels may exist, the quality and effectiveness of support provided often falls short of trader expectations and industry standards.

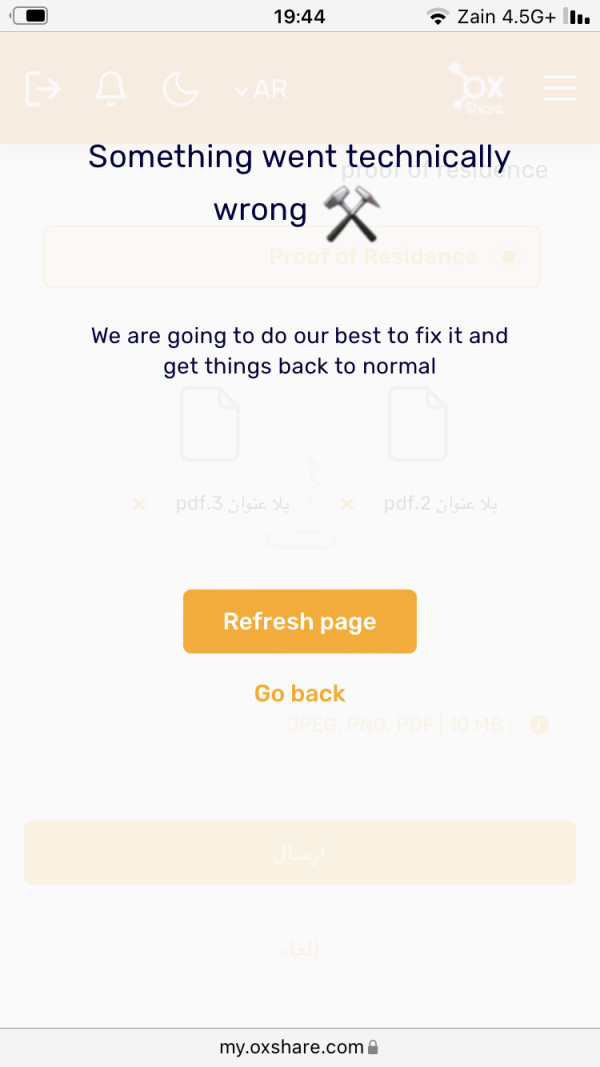

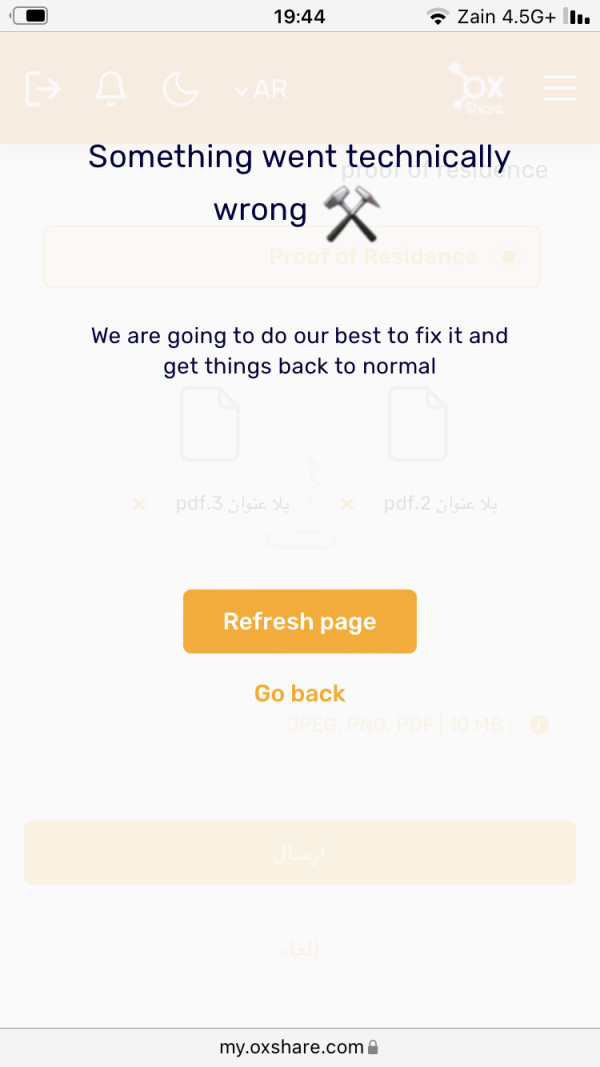

Response times, problem resolution capabilities, and the overall helpfulness of support staff appear to be areas where OXShare struggles to meet industry standards consistently. The lack of detailed information about available support channels, operating hours, and multilingual capabilities creates additional uncertainty about service accessibility for traders who need assistance. Most reputable brokers clearly outline their support infrastructure, including live chat availability, phone support hours, email response times, and language options to help clients understand what support they can expect.

User testimonials indicate that while traders recognize the importance of quality customer service – which OXShare claims to prioritize – the actual delivery of such service remains inconsistent and problematic. This contributes to overall dissatisfaction with the broker's offerings and creates frustration among clients who expect reliable support when they encounter issues or have questions about their accounts.

Trading Experience Analysis (4/10)

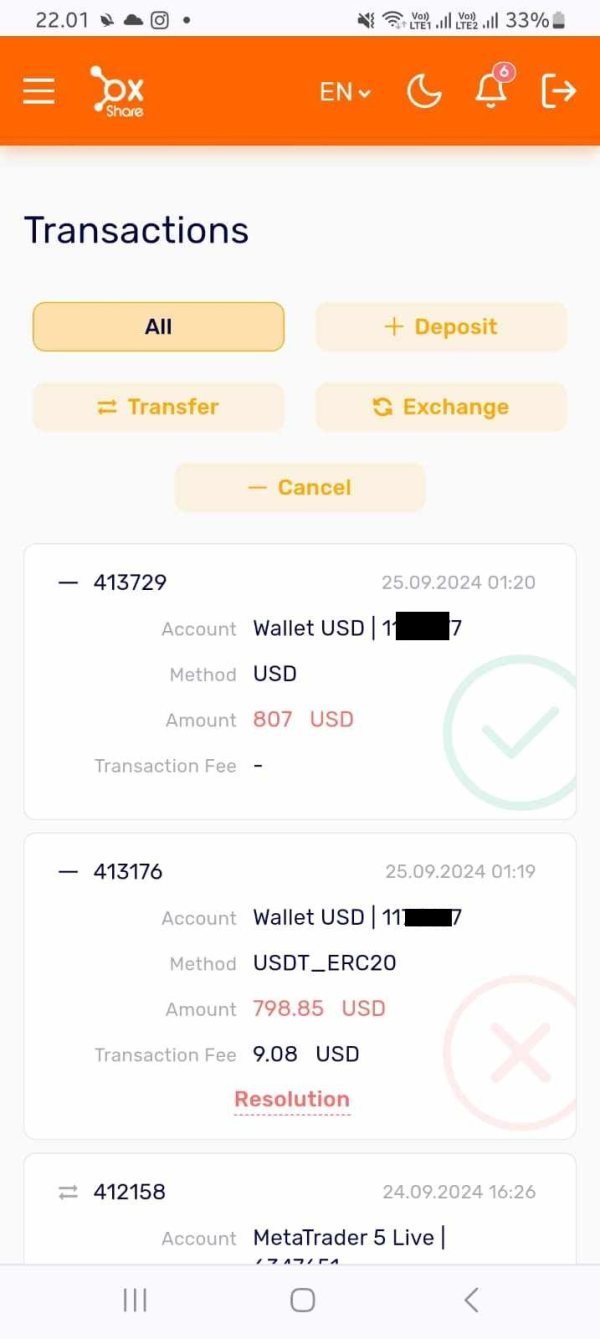

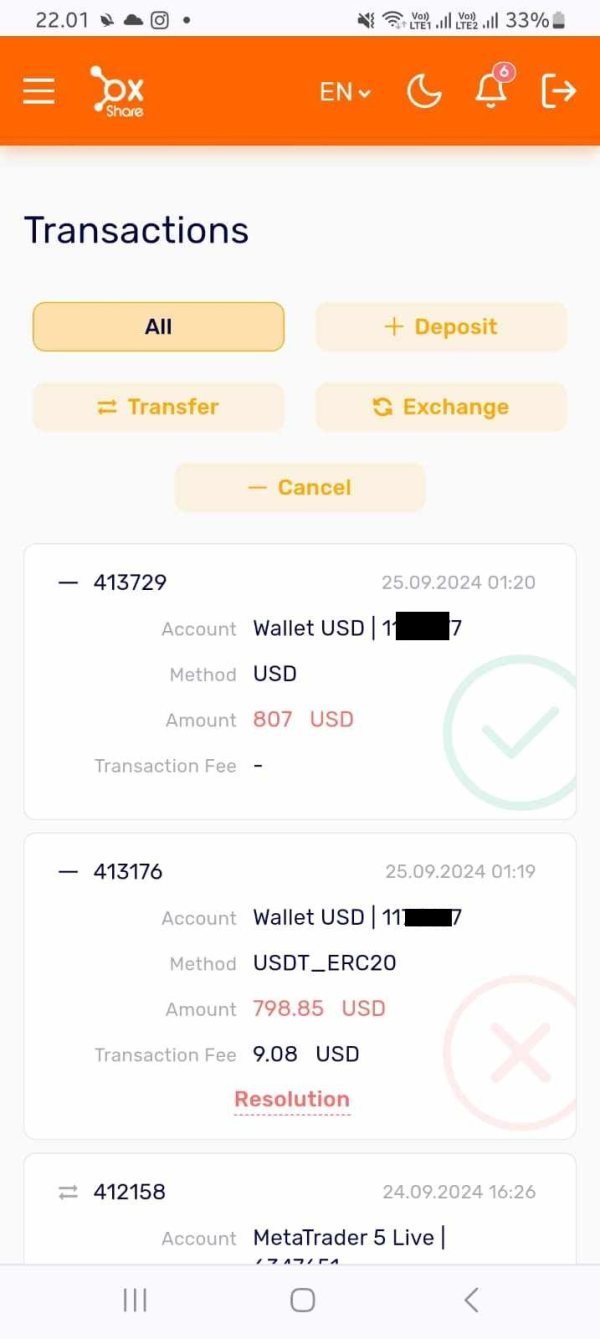

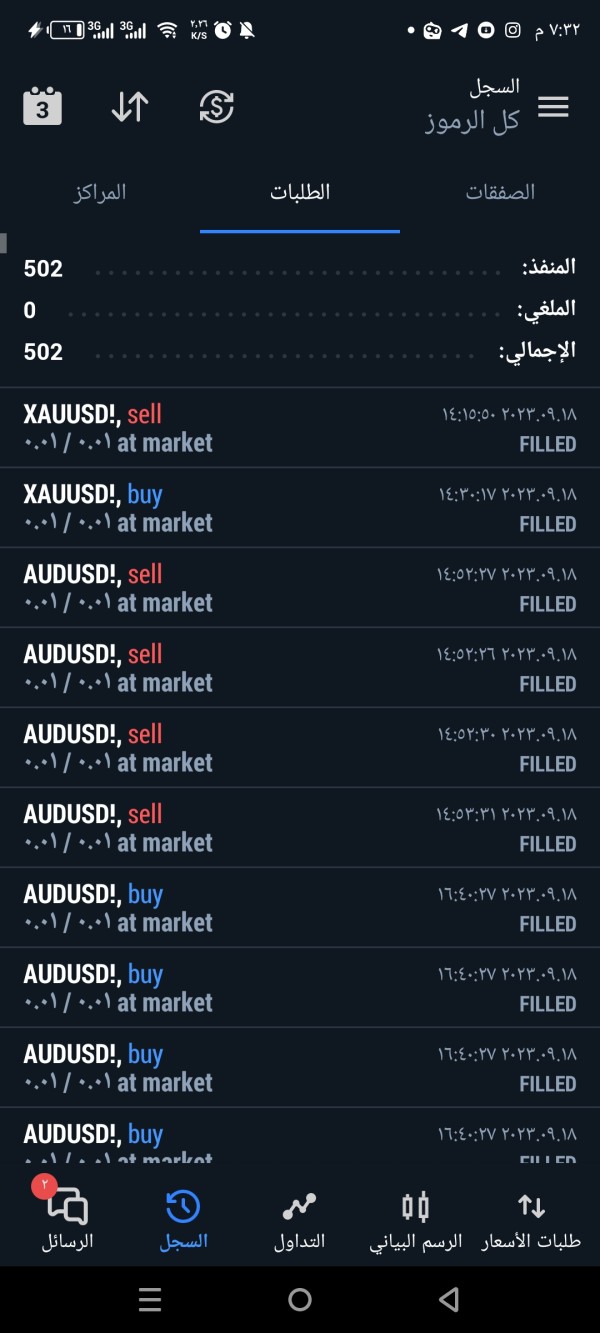

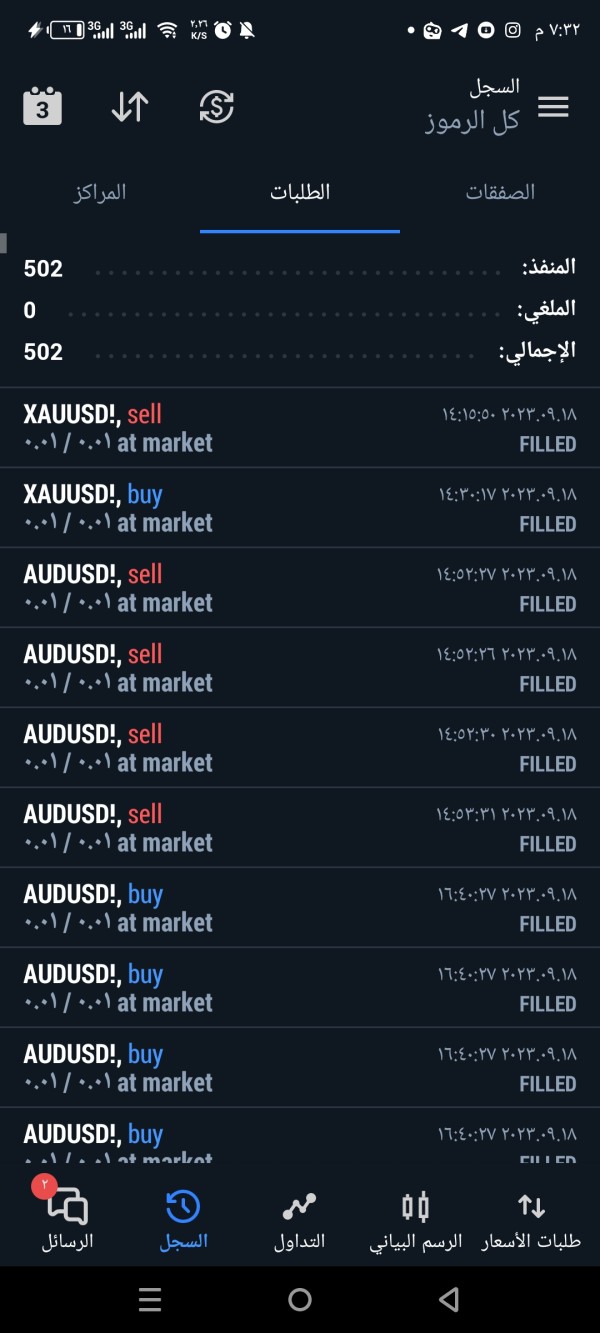

The trading experience receives a below-average rating primarily due to user feedback highlighting withdrawal difficulties and operational concerns that directly impact the core trading experience. While specific platform performance metrics are not detailed in available sources, user reports suggest significant issues with fund accessibility that fundamentally undermine trader confidence in the broker's reliability. Withdrawal problems represent perhaps the most critical aspect of trading experience, as traders must be confident they can access their funds when needed without unnecessary delays or complications.

User feedback indicates persistent issues with withdrawal processing, which creates an environment of uncertainty that negatively impacts the overall trading experience regardless of platform functionality. Platform stability, execution speed, and order processing quality are not specifically documented in available materials, making it difficult to assess the technical aspects of the trading experience objectively. However, the absence of positive user feedback about platform performance suggests that technical execution may also be problematic and could contribute to trader dissatisfaction.

The mobile trading experience, including app functionality and mobile platform capabilities, is not documented in available sources that we could access during our research. In today's trading environment, robust mobile capabilities are essential for traders who need to monitor and manage positions while away from desktop platforms for work or travel. The lack of information about mobile trading options suggests this may be another area where OXShare falls behind industry standards.

This oxshare review finds that fundamental operational issues, particularly around fund management and withdrawal processing, significantly compromise the overall trading experience regardless of platform technical capabilities.

Trust and Security Analysis (2/10)

Trust and security receive the lowest rating due to fundamental concerns about regulatory transparency, operational legitimacy, and user confidence levels. The absence of clear regulatory information represents the most significant trust deficit, as reputable brokers typically prominently display their licensing details, regulatory compliance status, and oversight mechanisms for all potential clients to review and verify. User feedback consistently raises questions about OXShare's legitimacy, with many traders expressing concerns about whether the broker operates as a legitimate entity or follows questionable practices that could harm client interests.

This type of user sentiment represents a critical trust deficit that impacts every aspect of the broker-trader relationship and creates uncertainty about fund safety. Fund security measures, including segregated account policies, client fund protection schemes, and insurance coverage, are not documented in available materials that potential clients can access. These protections are fundamental to trader confidence and are typically clearly outlined by reputable brokers as key safety features that protect client investments from company financial difficulties.

Company transparency regarding management structure, financial reporting, corporate governance, and operational oversight is notably absent from public sources. Legitimate brokers usually provide detailed corporate information, including management team details, company registration information, and financial stability indicators that help clients assess the company's credibility and long-term viability. The handling of negative user feedback and complaint resolution processes also appears problematic, with persistent user concerns about fund accessibility and service reliability remaining unaddressed in public forums where potential clients can see ongoing issues.

User Experience Analysis (3/10)

User experience receives a poor rating based on predominantly negative feedback across multiple review platforms, indicating systemic issues with overall service delivery and customer satisfaction. Available user testimonials consistently highlight problems with fund accessibility, service reliability, and operational transparency that collectively create a frustrating user experience for traders who choose this broker. The overall user satisfaction level appears significantly below industry standards, with many traders expressing regret about choosing OXShare as their broker for forex and CFD trading.

This negative sentiment spans multiple aspects of the user experience, from initial account setup through ongoing trading operations and fund management processes. Interface design and platform usability information is not available in accessible sources, making it difficult to assess the technical aspects of user experience objectively. However, the absence of positive feedback about platform functionality suggests that technical user experience may also be problematic and contribute to overall client dissatisfaction.

The registration and account verification process is not clearly documented, creating uncertainty about onboarding procedures and timeline expectations for new clients. User feedback suggests that operational processes may be cumbersome or unclear, contributing to overall dissatisfaction and confusion among traders who expect straightforward account management procedures. Common user complaints center on withdrawal difficulties and trust concerns, indicating that the most fundamental aspects of the broker-trader relationship are problematic and create ongoing stress for clients.

These core operational issues overshadow any potential positive aspects of the user experience and create an environment where traders feel uncertain about their fund security and service reliability.

Conclusion

This comprehensive oxshare review reveals a broker struggling with fundamental operational and trust issues that significantly impact its viability as a reliable trading partner. The overall assessment is predominantly negative, driven by persistent user concerns about withdrawal processing, regulatory transparency, and service reliability that affect daily trading operations. While OXShare positions itself as prioritizing customer service excellence, the evidence suggests a significant gap between marketing claims and operational delivery that disappoints many clients.

The broker appears most suitable for traders who prioritize customer service and withdrawal security – ironically, the very areas where user feedback indicates the most significant problems. The lack of regulatory transparency, combined with persistent user complaints about fund accessibility, creates a risk profile that most prudent traders would find unacceptable for their investment capital. The primary advantages appear limited to the broker's stated commitment to customer service, though user experiences suggest this commitment is not effectively translated into actual service delivery that meets client expectations.

The disadvantages are substantial and include withdrawal difficulties, trust concerns, lack of regulatory transparency, and poor overall user experience ratings across multiple evaluation criteria that matter to traders.