Finsai Trade 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive finsai trade review examines a relatively new forex brokerage that has generated mixed reactions in the trading community. Finsai Trade was established in 2023 and is based in Dubai, UAE, where it operates as a market maker offering trading services across forex, indices, commodities, and cryptocurrencies. However, the broker faces significant scrutiny due to its unregulated status. No recognized financial authority provides oversight for this company.

The platform's primary attractions include advertised low commissions and swap-free trading options, which may appeal to specific trader segments seeking cost-effective solutions. Finsai Trade positions itself as a premier online trading platform. The company claims to offer cutting-edge tools and raw spreads, targeting small to medium-sized investors who want to participate in various asset markets.

Despite these advertised benefits, multiple review sources have raised red flags about the broker's operations. They cite discrepancies between advertised and actually available services, unclear trading costs, and the inherent risks associated with unregulated offshore brokers. The company's YouTube presence includes 372 subscribers and 19 videos. This suggests limited market penetration and brand recognition compared to established industry players.

Important Notice

Finsai Trade is registered in the United Arab Emirates but operates without regulation from any recognized financial institution. This unregulated status presents significant risks for traders. There are no investor protection schemes or regulatory oversight to safeguard client funds.

The information presented in this review is based on publicly available sources and user feedback, which may be incomplete or subject to change. Potential traders should exercise extreme caution when considering this broker. Multiple independent review sources have identified concerning practices and operational discrepancies.

The evaluation presented here reflects information available at the time of writing and should not be considered as investment advice.

Rating Framework

Broker Overview

Finsai Trade emerged in the forex brokerage landscape in 2023. The company established its headquarters in Dubai, United Arab Emirates, where it positions itself as a comprehensive trading solution provider operating as a market maker across multiple asset classes.

The broker aims to serve traders interested in forex, indices, commodities, and cryptocurrency markets, though specific details about its operational scale and client base remain limited. The brokerage's business model centers around providing what it describes as "cutting-edge tools and services" for online trading. Finsai Trade emphasizes features such as raw spreads, zero commission trades, and swap-free accounts as key differentiators in its service offering.

However, independent reviews have noted discrepancies between these advertised features and the actual services available to clients. This raises questions about the accuracy of the company's marketing claims. The platform operates through what is described as a user-friendly trading interface.

Specific technical details about the trading platform, its capabilities, or performance metrics are not readily available in public sources. The broker's asset coverage includes the four major categories mentioned, but the depth of instruments within each category and the quality of execution remain unclear from available documentation. Most significantly, Finsai Trade operates without regulation from any recognized financial authority.

This places it in the category of offshore unregulated brokers that typically carry higher risks for traders.

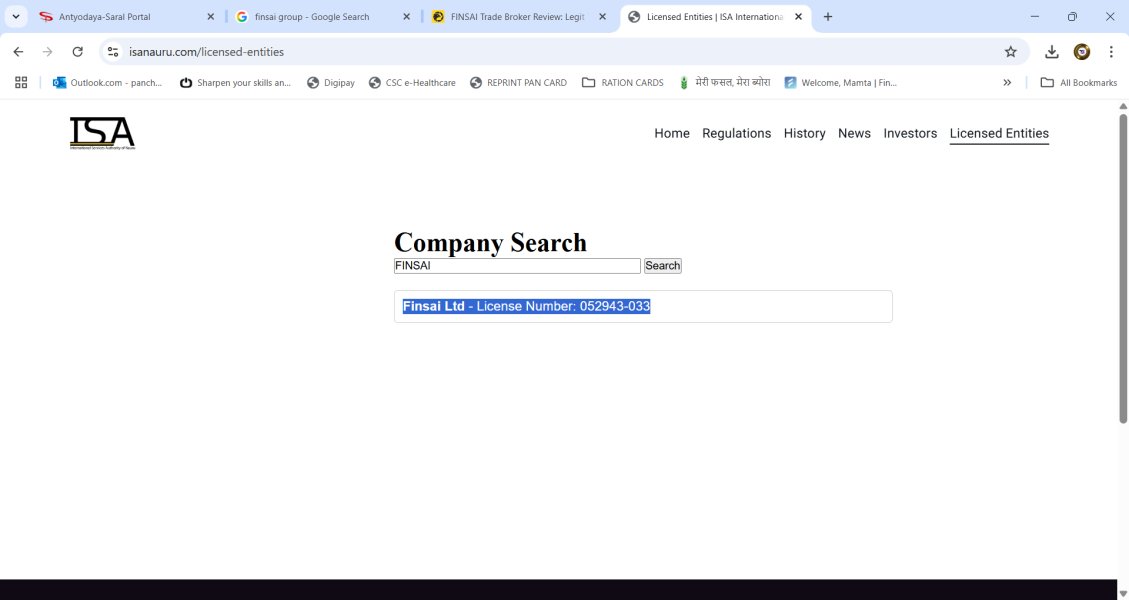

Regulatory Status and Geographic Coverage

Finsai Trade is registered in the United Arab Emirates but operates without oversight from any recognized financial regulatory body. This unregulated status is particularly concerning given the UAE's own regulatory framework through the Securities and Commodities Authority.

The absence of proper licensing raises questions about the broker's compliance with international financial standards and investor protection protocols.

Deposit and Withdrawal Methods

Specific information about available deposit and withdrawal methods is not detailed in available sources. This lack of transparency regarding payment processing is another red flag. Reputable brokers typically provide comprehensive information about funding options, processing times, and associated fees.

Minimum Deposit Requirements

The minimum deposit requirements for opening accounts with Finsai Trade are not specified in available documentation. This makes it difficult for potential clients to assess the accessibility of the broker's services.

No specific information about bonus structures, promotional campaigns, or incentive programs is available in the reviewed sources. This suggests either limited marketing initiatives or poor transparency in promotional terms.

Available Trading Instruments

Finsai Trade offers trading across four main asset categories: forex pairs, stock indices, commodities, and cryptocurrencies. However, the specific number of instruments within each category, the quality of pricing, and execution standards remain unspecified in available documentation.

Cost Structure and Fee Analysis

The broker advertises low commissions and raw spreads as key features. However, independent reviews have noted unclear trading costs and discrepancies between advertised and actual pricing structures.

The lack of transparent fee disclosure is a significant concern for potential traders seeking to understand their total trading costs.

Leverage Options

Information about maximum leverage ratios, margin requirements, and risk management tools is not available in the reviewed sources. This represents a significant information gap for this finsai trade review.

The platform is described as offering a "user-friendly" trading experience. However, specific technical details about the platform's features, stability, mobile compatibility, or advanced trading tools are not provided in available sources.

Detailed Rating Analysis

Account Conditions Analysis (4/10)

The account conditions offered by Finsai Trade receive a below-average rating due to significant information gaps and transparency issues. Available sources do not provide clear details about the different account types available, minimum deposit requirements, or specific account features that would help traders make informed decisions.

The absence of information about Islamic accounts, professional trading accounts, or tiered account structures suggests either limited account variety or poor communication of available options. According to forex review sources, the broker's failure to clearly outline account conditions is a common characteristic among less established or potentially problematic brokers.

The lack of transparency regarding account opening procedures, verification requirements, and account maintenance fees further undermines the attractiveness of the broker's account offerings. Established brokers typically provide comprehensive account information to help traders understand exactly what services and conditions they can expect.

Without clear information about leverage options, margin requirements, or account-specific benefits, potential traders cannot adequately assess whether Finsai Trade's account conditions align with their trading strategies and risk tolerance. This finsai trade review identifies this information deficit as a significant weakness in the broker's service transparency.

Finsai Trade's tools and resources receive a middle-ground rating based on limited available information about the actual quality and comprehensiveness of offered tools. The broker claims to provide "cutting-edge tools and services," but specific details about trading indicators, charting capabilities, automated trading support, or analytical resources are not well-documented.

The platform is described as user-friendly, but without detailed specifications about technical analysis tools, fundamental analysis resources, or educational materials, it's difficult to assess the true value proposition for traders. Most reputable brokers provide extensive information about their research capabilities, market analysis tools, and educational resources.

The absence of information about third-party integrations, API access for algorithmic trading, or advanced order types suggests either limited platform capabilities or inadequate communication of available features. Independent broker reviews typically highlight these technical capabilities as important differentiators in the competitive forex market.

Without clear documentation of available tools, their functionality, or user guides, traders cannot determine whether the platform will meet their analytical and execution needs. This lack of transparency in tool specification represents a significant weakness in the broker's service offering.

Customer Service and Support Analysis (3/10)

Customer service capabilities receive a poor rating due to the complete absence of detailed information about support channels, availability, response times, or service quality standards. This lack of transparency about customer support is particularly concerning given the broker's unregulated status. Quality customer service becomes even more critical for trader confidence when regulatory oversight is absent.

Reputable brokers typically provide comprehensive information about their support infrastructure, including available contact methods, support hours, multilingual capabilities, and average response times. The absence of such information suggests either inadequate support infrastructure or poor communication practices.

Review sources have noted that unregulated brokers often provide substandard customer service, and the lack of available information about Finsai Trade's support capabilities does nothing to counter this concern. Without clear escalation procedures, complaint handling processes, or service level commitments, traders have no assurance about the quality of support they might receive.

The absence of educational support, account management services, or technical assistance information further undermines confidence in the broker's commitment to client service. This represents a significant weakness for any broker, but particularly for one operating without regulatory oversight.

Trading Experience Analysis (6/10)

The trading experience dimension receives a slightly above-average rating primarily based on the broker's advertised low commissions and raw spreads. These features could potentially enhance the trading environment for cost-conscious traders, though this positive aspect is significantly tempered by concerns about the accuracy of advertised features and actual service delivery.

Independent reviews have highlighted discrepancies between advertised services and what is actually available to clients, which raises serious questions about execution quality and pricing transparency. While low costs can improve trading profitability, they are meaningless if not delivered as promised or if hidden fees offset the apparent savings.

The lack of specific information about order execution speeds, slippage rates, requote frequency, or platform stability makes it difficult to assess the actual quality of the trading experience. These technical performance metrics are crucial for evaluating whether a broker can provide reliable execution, especially during volatile market conditions.

Without detailed information about mobile trading capabilities, platform uptime statistics, or user experience feedback, this finsai trade review cannot provide a comprehensive assessment of the actual trading experience quality. The moderate rating reflects the potential benefits of low costs balanced against significant concerns about service delivery reliability.

Trust and Safety Analysis (2/10)

Trust and safety receive the lowest rating in this evaluation due to multiple serious concerns about the broker's regulatory status and operational transparency. The complete absence of regulation from any recognized financial authority represents a fundamental safety risk for potential traders. There are no investor protection schemes or regulatory oversight mechanisms in place.

Multiple review sources have identified Finsai Trade as potentially problematic, with some specifically labeling it as a scam alert situation. The broker's unregulated offshore status, combined with reported discrepancies between advertised and delivered services, creates a high-risk environment for traders considering this platform.

The lack of information about client fund segregation, deposit insurance, compensation schemes, or dispute resolution mechanisms further undermines trust. Regulated brokers are required to maintain client funds in segregated accounts and provide various forms of investor protection. None of these protections appear to be available with this broker.

The absence of transparent company information, detailed terms and conditions, or clear regulatory disclosures represents additional trust concerns. Without proper regulatory oversight and transparent operational practices, traders have no assurance about the safety of their funds or the integrity of their trading environment.

User Experience Analysis (5/10)

User experience receives a middle-ground rating based on limited available feedback and the mixed nature of information about the broker's service delivery. The platform is described as user-friendly, but the lack of comprehensive user reviews or detailed experience reports makes it difficult to assess actual user satisfaction levels.

The discrepancies noted between advertised features and actual service availability suggest that users may experience disappointment when their expectations are not met in practice. Marketing materials set certain expectations that may not align with actual service delivery, and this type of service delivery gap typically leads to negative user experiences and satisfaction issues.

The absence of detailed information about account registration processes, platform navigation, customer onboarding, or ongoing account management suggests either limited attention to user experience design or inadequate communication of available support. Review sources indicate that the overall user experience may be compromised by operational and transparency issues.

Without comprehensive user feedback, platform usability assessments, or detailed service delivery reports, this evaluation cannot provide a definitive assessment of user experience quality. The moderate rating reflects the uncertainty about actual user satisfaction balanced against concerning reports about service delivery reliability.

Conclusion

This comprehensive analysis reveals that Finsai Trade presents significant risks that outweigh its potential benefits for most traders. The broker advertises attractive features such as low commissions and swap-free trading, but the fundamental concerns about regulatory oversight, operational transparency, and service delivery reliability make it unsuitable for serious traders seeking a trustworthy trading environment.

The broker might only be considered by highly speculative traders who prioritize low costs over safety and regulatory protection. Even this limited recommendation comes with substantial caveats about the inherent risks involved, and the multiple red flags identified by independent review sources, combined with the broker's unregulated status, create an environment where traders face significant risks to their capital and trading success.

For the vast majority of traders, particularly those seeking reliable, transparent, and properly regulated trading services, numerous better alternatives exist in the competitive forex brokerage market. The lack of regulatory oversight, limited transparency, and concerning operational practices make Finsai Trade a broker to approach with extreme caution, if at all.