Key to Markets 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive key to markets review looks at one of the UK's established independent brokerage firms. Key to Markets has provided traders with access to global financial markets since 2010, positioning itself as a reliable broker that offers competitive spreads and clear operations for both retail and institutional clients.

The broker stands out by offering over 200 trading instruments across multiple asset classes. These include forex, commodities, stocks, indices, and bonds, giving traders many options to choose from. A key security feature keeps client funds separate from operational capital, which means better protection for trader deposits. The firm operates under dual regulatory oversight from the UK's Financial Conduct Authority (FCA) and the Financial Services Commission (FSC). This provides additional layers of regulatory protection that traders can trust.

Key to Markets mainly targets retail and institutional traders who want ECN execution environments with clear pricing structures. The broker offers variable spreads with commission structures starting from $0, making it accessible for many traders. ECN execution carries commission fees beginning at $8 per lot, which is competitive in the market. With a minimum deposit requirement of $100 and maximum leverage up to 1:500, the broker works for traders across different experience levels and capital ranges.

Trading infrastructure centers around MetaTrader 4 and FIX API connectivity. This setup works well for both manual traders and those using algorithmic trading strategies. User feedback consistently highlights the broker's competitive spread offerings and transparent operational approach. However, comprehensive service details require further investigation for complete assessment.

Important Notice

This review acknowledges that Key to Markets operates multiple entities across different jurisdictions. This may result in varying regulatory frameworks and service policies for users in different regions, so traders should verify the specific regulatory entity serving their jurisdiction. They should also understand the applicable terms and conditions that apply to their location.

This evaluation is based on publicly available information, regulatory filings, and aggregated user feedback from various trading community sources. The assessment methodology incorporates regulatory compliance verification, trading condition analysis, and user experience evaluation. This approach provides a comprehensive broker overview that traders can rely on.

Rating Framework

Broker Overview

Key to Markets emerged in the competitive UK brokerage landscape in 2010. The company established itself as an independent financial services provider headquartered in London, developing its operations to serve institutional, corporate, and individual clients seeking access to global financial markets through CFD and forex trading solutions.

The firm's business model centers on providing direct market access through ECN execution. This allows traders to benefit from institutional-grade pricing and execution speeds that many other brokers cannot match. This approach differentiates Key to Markets from many retail-focused brokers by offering more transparent pricing structures and reduced conflicts of interest between the broker and its clients.

The broker's trading infrastructure supports MetaTrader 4 platform integration alongside FIX API connectivity for professional traders requiring direct market access. Asset coverage spans five major categories: foreign exchange pairs, commodity CFDs, stock CFDs, index CFDs, and bond instruments. This provides traders with diversified portfolio construction opportunities across global markets.

Regulatory compliance operates under dual oversight from the Financial Conduct Authority (FCA) in the United Kingdom and the Financial Services Commission (FSC). This ensures adherence to stringent financial services regulations and client protection standards that traders can trust. This regulatory framework provides traders with compensation scheme access and dispute resolution mechanisms when needed.

Regulatory Jurisdictions: Key to Markets maintains regulatory compliance under FCA supervision in the United Kingdom and FSC oversight. This provides comprehensive regulatory coverage for international operations that meets high standards.

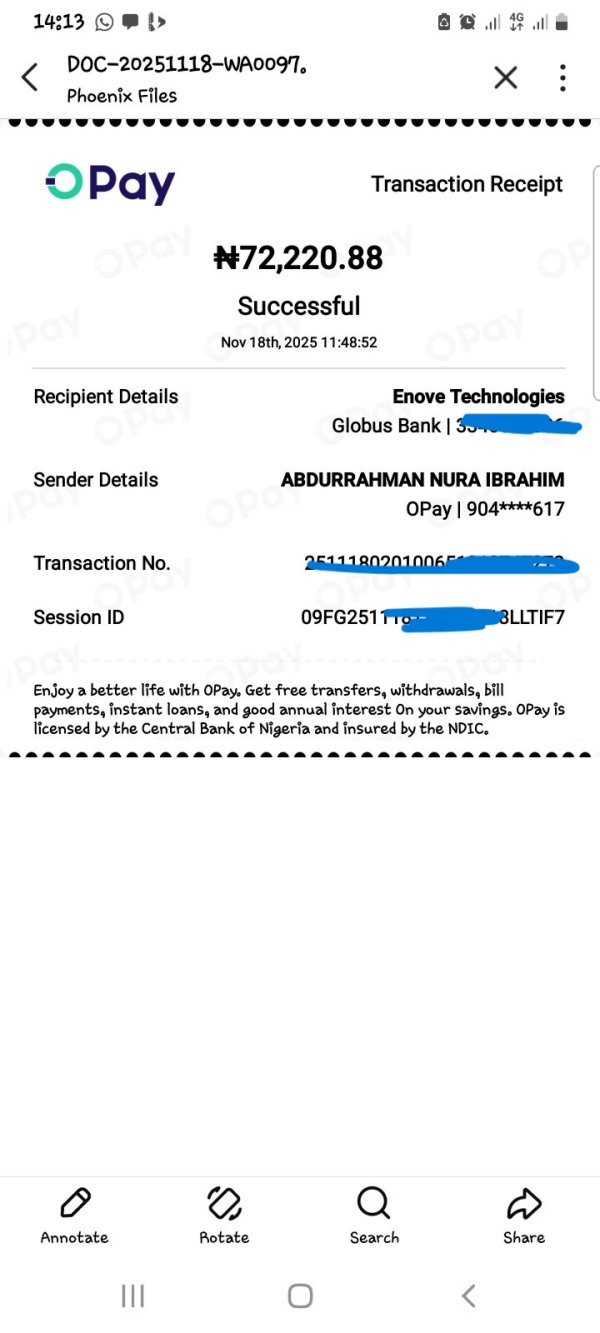

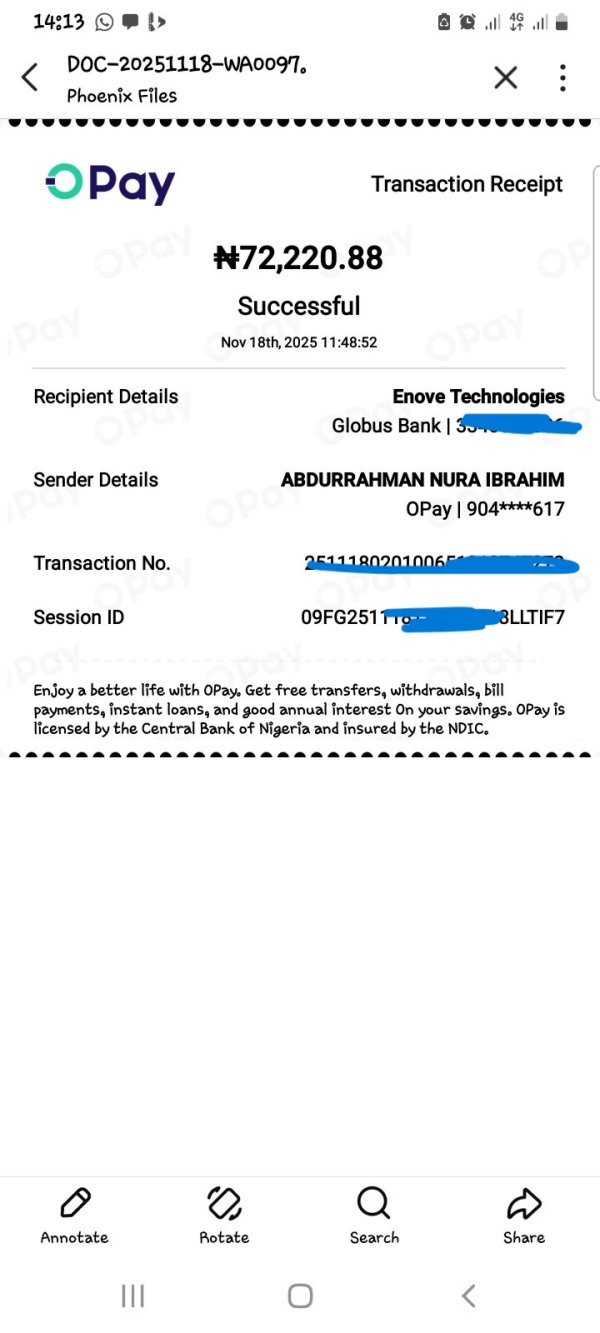

Deposit and Withdrawal Methods: Specific funding method details were not comprehensively detailed in available assessment materials. Traders should verify these details directly with the broker to understand their options.

Minimum Deposit Requirements: The broker maintains an accessible $100 minimum deposit threshold. This accommodates traders across various capital ranges and makes the platform accessible to new traders.

Bonus and Promotional Offers: Current promotional structures and bonus programs were not specified in available assessment documentation. Interested traders should check with the broker directly for current offers.

Tradeable Assets: The platform provides access to over 200 trading instruments encompassing forex pairs, commodity CFDs, stock CFDs, index CFDs, and bond instruments across global markets. This wide selection gives traders many opportunities to diversify their portfolios.

Cost Structure: The broker operates variable spread pricing with commission structures beginning at $0 for standard accounts. ECN execution services carry commission fees starting from $8 per lot, which provides transparent cost disclosure that traders appreciate.

Leverage Ratios: Maximum leverage extends to 1:500, though specific leverage limits may vary based on asset classes and regulatory requirements for different client jurisdictions. Traders should verify the leverage available for their specific situation.

Platform Options: Trading infrastructure centers on MetaTrader 4 integration with additional FIX API connectivity for professional trading requirements. This combination serves both beginner and advanced traders effectively.

Geographic Restrictions: Specific regional limitations were not detailed in current assessment materials. Traders should verify availability in their region before opening an account.

Customer Support Languages: Available language support options were not specified in assessment documentation. Interested traders should contact the broker to confirm language support for their needs.

This key to markets review continues with detailed analysis across all evaluation dimensions to provide comprehensive broker assessment.

Account Conditions Analysis (Rating: 8/10)

Key to Markets demonstrates strong performance in account condition offerings, earning an 8/10 rating based on accessible entry requirements and competitive fee structures. The $100 minimum deposit requirement positions the broker favorably against industry standards. This allows new traders to begin with manageable capital commitments while maintaining access to professional trading infrastructure.

The commission structure flexibility represents a significant advantage, with standard accounts offering zero-commission trading alongside ECN accounts that charge transparent per-lot fees starting at $8. This dual approach accommodates different trading strategies and preferences effectively. It serves everyone from casual retail traders to high-frequency institutional operations requiring direct market access.

Account opening procedures, while not detailed in available materials, appear streamlined based on regulatory compliance requirements under FCA oversight. The broker's regulatory standing suggests standardized verification processes aligned with anti-money laundering protocols and client identification requirements that protect all parties.

However, specific account type variations and their corresponding features require direct verification, as detailed tier structures were not comprehensively outlined in assessment materials. Islamic account availability and swap-free trading options also need confirmation for traders requiring Sharia-compliant trading conditions.

The segregated client fund policy enhances account security significantly, ensuring trader deposits remain protected from operational risks. This key to markets review identifies this as a crucial trust factor that distinguishes the broker from less regulated competitors.

The broker's tools and resources offering receives a 7/10 rating, primarily based on the substantial instrument selection exceeding 200 tradeable assets across multiple asset classes. This extensive range provides traders with adequate diversification opportunities spanning forex, commodities, stocks, indices, and bonds.

MetaTrader 4 platform integration ensures access to comprehensive charting tools, technical indicators, and automated trading capabilities through Expert Advisors. The platform's established ecosystem supports third-party tool integration and custom indicator development. This enhances analytical capabilities for experienced traders who want to customize their trading environment.

FIX API connectivity represents a professional-grade resource for institutional clients and algorithmic traders requiring low-latency market access. This technical infrastructure suggests the broker maintains serious commitment to serving sophisticated trading strategies and high-volume operations.

However, specific research and analysis resources were not detailed in available assessment materials. Market commentary, economic calendars, and fundamental analysis tools require verification to provide complete resource evaluation. Educational content availability and quality also need assessment for comprehensive trader development support.

The absence of detailed information regarding proprietary trading tools, market scanners, or advanced order types limits the complete evaluation of the broker's technological offerings. Additional verification would strengthen understanding of the platform's competitive positioning in the tools and resources category.

Customer Service and Support Analysis

Customer service evaluation remains incomplete due to insufficient information in available assessment materials regarding specific support channels, response times, and service quality metrics. This limitation prevents accurate rating assignment for this crucial evaluation dimension.

Standard industry practices suggest the broker likely provides email, telephone, and potentially live chat support channels, though verification of availability, operating hours, and response quality requires direct assessment. FCA regulatory compliance typically mandates adequate customer support infrastructure. This suggests baseline service standards exist that meet regulatory requirements.

Multilingual support capabilities were not specified in assessment materials, though the broker's international operations suggest potential language accommodation for diverse client bases. Support team expertise levels and problem resolution capabilities also require verification through direct user experience evaluation.

The regulatory framework under FCA oversight provides complaint resolution mechanisms and escalation procedures for unresolved disputes. This offers additional protection layers beyond direct customer service channels that traders can rely on. This regulatory backing enhances overall support framework reliability.

Without comprehensive user feedback data or specific service level commitments, this key to markets review cannot provide definitive customer service assessment. This highlights the need for additional verification before making service quality conclusions.

Trading Experience Analysis (Rating: 7/10)

Trading experience evaluation yields a 7/10 rating based on available information regarding competitive spreads and ECN execution capabilities. User feedback indicates satisfaction with pricing competitiveness. This suggests effective execution quality and reasonable transaction costs across major trading instruments.

The MetaTrader 4 platform foundation provides familiar trading environment for most retail traders, ensuring smooth transition and reduced learning curves for platform adoption. Established platform stability and feature completeness support consistent trading experiences across different market conditions.

ECN execution availability enhances trading quality for users requiring direct market access and institutional-grade execution speeds. This execution model typically reduces slippage and provides more transparent pricing compared to market maker arrangements. However, specific performance metrics require verification to confirm these benefits.

However, detailed platform performance data, including execution speeds, slippage statistics, and platform uptime metrics, were not available in assessment materials. Mobile trading capabilities and cross-device synchronization also need verification for comprehensive experience evaluation.

Order type availability, advanced trading features, and platform customization options require additional assessment to provide complete trading experience analysis. The absence of specific user experience testimonials limits comprehensive evaluation of day-to-day trading satisfaction levels.

Trust and Reliability Analysis (Rating: 9/10)

Trust and reliability assessment achieves the highest rating at 9/10, reflecting strong regulatory compliance and security measures implemented by Key to Markets. Dual regulatory oversight from the FCA and FSC provides comprehensive regulatory coverage. This ensures adherence to stringent financial services standards that protect traders.

Client fund segregation represents a crucial security measure, ensuring trader deposits remain protected from operational risks and potential company financial difficulties. This policy aligns with best industry practices and regulatory requirements. It provides enhanced security for client capital that traders can depend on.

The broker's operational history since 2010 demonstrates market longevity and stability through various market cycles, including significant economic events and regulatory changes. This operational track record suggests sustainable business practices and reliable service continuity.

FCA regulation specifically provides access to the Financial Services Compensation Scheme (FSCS), offering up to £85,000 protection per client in the unlikely event of broker default. This regulatory protection significantly enhances overall trust metrics compared to unregulated alternatives.

However, specific transparency measures, such as execution statistics publication or third-party auditing results, were not detailed in available materials. Additional verification of company financial health and operational transparency would further strengthen trust assessment. Current regulatory standing provides strong foundation for reliability confidence.

User Experience Analysis

User experience evaluation remains incomplete due to limited comprehensive feedback data in available assessment materials. This prevents accurate rating assignment and detailed analysis of overall user satisfaction levels across different trader segments.

Available information suggests the broker attracts traders seeking ECN execution environments and transparent pricing structures. This indicates appeal to more sophisticated trading audiences who value execution quality over flashy features. The $100 minimum deposit accessibility suggests accommodation for entry-level traders alongside institutional clients.

Interface design and platform usability assessment requires direct evaluation, though MetaTrader 4 integration provides familiar environment for most traders. Registration and verification processes likely align with FCA regulatory requirements. However, specific user experience feedback on these procedures needs verification.

Funding operation experiences, including deposit and withdrawal processing times and procedures, require comprehensive user feedback analysis for complete assessment. Common user complaints or satisfaction highlights also need evaluation through community feedback aggregation.

The broker's positioning toward ECN execution suggests target audience appreciation for transparent trading conditions over simplified retail-focused features. However, this assumption requires validation through comprehensive user survey data and community feedback analysis.

Conclusion

This key to markets review concludes that Key to Markets represents a reliable brokerage option for traders prioritizing regulatory compliance, transparent execution, and competitive trading conditions. The broker's strengths lie in its dual regulatory oversight, segregated client funds, and ECN execution capabilities. These features appeal to both retail and institutional trading audiences.

The broker particularly suits traders seeking transparent pricing structures and direct market access through ECN execution models. The combination of accessible $100 minimum deposits with professional-grade trading infrastructure creates appeal across different trader experience levels and capital ranges.

Key advantages include strong regulatory protection under FCA and FSC oversight, competitive commission structures starting from $0, and extensive asset selection exceeding 200 instruments. However, limitations exist in the comprehensive disclosure of customer service capabilities, detailed user experience feedback, and specific platform performance metrics. These gaps would strengthen overall assessment confidence if addressed.

Overall, Key to Markets demonstrates solid fundamentals for traders prioritizing regulatory security and execution transparency over extensive educational resources or comprehensive customer service verification.