JP Markets 2025 Review: Everything You Need to Know

JP Markets, a South African forex and CFD broker founded in 2016, has garnered attention for its extensive range of trading instruments and user-friendly platform. However, it has also faced regulatory scrutiny and mixed reviews from users, raising questions about its reliability and service quality. This review synthesizes key findings regarding JP Markets, focusing on user experiences, strengths, weaknesses, and expert opinions.

Note: Its important to be aware that JP Markets operates under different entities across regions, which can affect regulatory compliance and user experiences. This review aims to provide a fair and accurate assessment based on available data.

Rating Summary

We score brokers based on a combination of user feedback, expert analysis, and available data.

Broker Overview

Founded in 2016, JP Markets is based in Johannesburg, South Africa, and is regulated by the Financial Sector Conduct Authority (FSCA). The broker primarily offers the MetaTrader 4 (MT4) platform for trading, which is widely recognized in the industry for its robust features and usability. JP Markets provides a diverse range of trading instruments, including forex pairs, commodities, indices, and cryptocurrencies. However, it has faced challenges with regulatory compliance, particularly in recent years.

Detailed Sections

Regulatory Regions

JP Markets is regulated by the FSCA in South Africa, which provides a level of trust for local traders. However, the broker has faced regulatory issues, including a temporary suspension of its license in 2019 due to client complaints regarding withdrawal issues. While the license has since been restored, these incidents have raised concerns about the broker's reliability.

Deposit/Withdrawal Currencies and Cryptocurrencies

JP Markets accepts deposits in multiple currencies, including USD, ZAR, and GBP. The broker also allows for cryptocurrency deposits through platforms like Skrill, although direct crypto trading is limited to a few major currencies such as Bitcoin, Ethereum, Litecoin, and XRP.

Minimum Deposit

The minimum deposit for opening an account with JP Markets is somewhat flexible. While the broker states there is no strict minimum, it recommends an initial deposit of around R3,000 (approximately $200) for traders who require training or support.

JP Markets offers a 200% deposit bonus, which is one of its standout features. This bonus is available for deposits up to R280,000 (or equivalent in other currencies) and is credited automatically. However, traders should note that the bonus cannot be withdrawn directly, which may limit its appeal.

Tradable Asset Categories

JP Markets provides access to a wide range of assets, including forex pairs, commodities, indices, stocks, and cryptocurrencies. However, the number of forex pairs available is relatively limited compared to other brokers, with around 30 pairs listed.

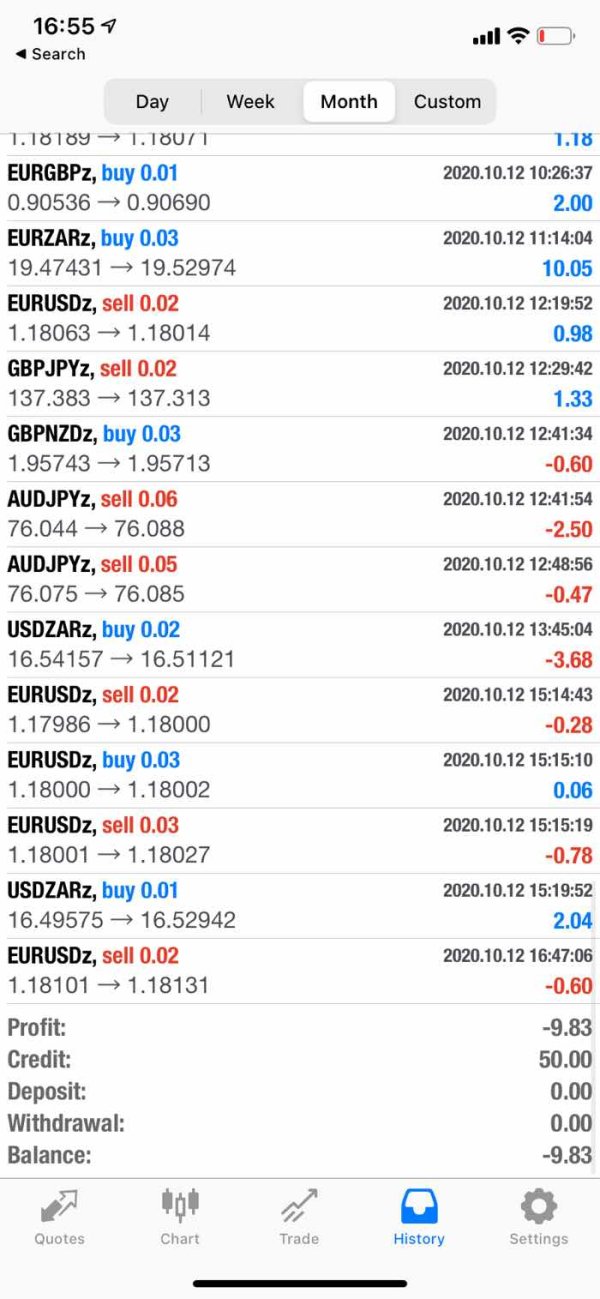

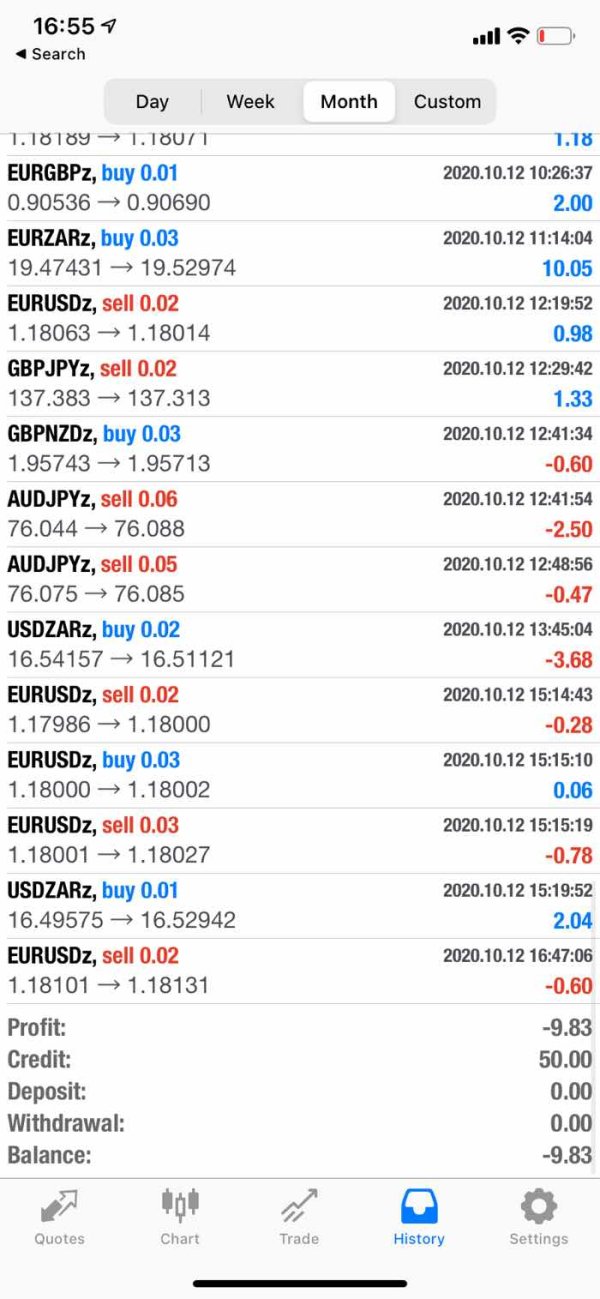

Costs (Spreads, Fees, Commissions)

The broker's spreads are variable, with average spreads on popular pairs like EUR/USD hovering around 2 pips, which is higher than the industry average. Additionally, JP Markets charges a commission of $10 per lot for its ECN accounts, which can add to trading costs. While there are no fees for deposits or withdrawals, traders should be mindful of potential inactivity fees.

Leverage

JP Markets offers leverage up to 1:500, which is attractive for experienced traders looking to maximize their trading potential. However, such high leverage also increases risk, and traders are advised to use it cautiously.

Currently, JP Markets only supports the MT4 platform, which may limit options for traders who prefer other platforms like MT5 or proprietary solutions. The lack of alternative trading platforms could be a drawback for some users.

Restricted Regions

JP Markets primarily caters to traders in South Africa and a few neighboring countries. Unfortunately, it does not accept clients from the United States or other regions, which may limit its user base.

Available Customer Service Languages

JP Markets offers customer support in English, which is suitable for its primary user base in South Africa. However, some users have reported issues with response times and the effectiveness of customer service, highlighting a potential area for improvement.

Repeated Rating Summary

Detailed Breakdown

- Account Conditions: The flexibility in minimum deposits is a plus, but the high average spreads and limited account types detract from the overall experience.

- Tools and Resources: While MT4 is a powerful platform, the lack of additional tools and limited educational resources may hinder less experienced traders.

- Customer Service and Support: Users have reported slow response times and issues with the quality of support, which is a significant concern.

- Trading Setup (Experience): The trading experience is generally smooth, but the high costs associated with trading can be a downside.

- Trustworthiness: Regulatory issues have clouded the broker's reputation, making it a less reliable choice for cautious traders.

- User Experience: The user interface is straightforward, but the lack of comprehensive information on the website can lead to confusion.

In conclusion, JP Markets presents itself as a viable option for traders in South Africa, particularly those who prefer the MT4 platform and are looking for a broker with a strong local presence. However, potential clients should carefully consider the regulatory history and mixed reviews regarding customer service and trading costs before committing.