GCM Forex 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

GCM Forex, established in 2012 and headquartered in Istanbul, Turkey, operates as a regulated brokerage under the oversight of the Capital Markets Board (CMB). With a significant market presence, it caters primarily to experienced traders by offering a variety of trading instruments, including currency pairs, contracts for difference (CFDs), and Turkish stocks. However, GCM Forex imposes a substantial minimum deposit of 50,000 TRY, which serves as a barrier to entry for many potential clients, particularly novice traders.

For seasoned market participants with a robust capital base and higher risk tolerance, GCM Forex may provide a suitable environment due to its regulated status and access to various financial instruments. Nevertheless, the low leverage of 1:10 and complaints regarding withdrawal processes present considerable concerns—pointing to a trade-off between opportunity and potential pitfalls. All of these factors combine to position GCM Forex as a broker more aligned with affluent, experienced traders seeking exposure to Turkey's financial markets and other international assets.

⚠️ Important Risk Advisory & Verification Steps

Risk Advisory:

Trading in financial markets involves significant risk, and high leverage can amplify losses. Therefore, it is crucial for traders to conduct thorough research and self-verify before entering any trading relationship with a broker like GCM Forex.

Potential Harms:

- Loss of invested capital.

- Withdrawal difficulties based on user experiences.

- Regulatory concerns surrounding the effectiveness of CMB oversight.

Self-Verification Steps:

- Visit the Brokers Website: Check the GCM Forex website for comprehensive information on their regulation, fees, and trading conditions.

- Consult Regulatory Bodies: Refer to the official CMB website at CMB to verify the regulatory status and any disclosures related to GCM Forex.

- Read Independent Reviews: Engage with multiple third-party review sites for a well-rounded understanding of user experiences and broker reputation.

- Monitor Social Media and Forums: Check discussions on trading forums for any complaints regarding customer service, withdrawal processes, or general broker transparency.

Ratings Framework

Broker Overview

Company Background and Positioning

GCM Forex is a prominent Turkish brokerage that commenced operations in 2012. With a regulatory license from the CMB, GCM has positioned itself as a key player in the Turkish trading landscape, appealing primarily to experienced investors. The firm's equity stands at 39 million TRY, and GCM Forex has received awards for its performance, including the “Leverage Volume Leader” award.

Core Business Overview

GCM Forex provides several trading instruments, including:

- Currency Pairs: Comprehensive offering with over 50 pairs.

- CFDs: Traders can access approximately 320 international stocks alongside commodities and indices.

- Options and Futures: Regional focus on Turkish market options and futures linked to the Istanbul Exchange.

The broker operates using platforms such as MetaTrader 4 and its proprietary GCM Trader, both conducive to various trading styles, including scalping and hedging.

Quick-Look Details Table

In-Depth Analysis of Each Dimension

Trustworthiness Analysis

Regulatory Information Conflicts

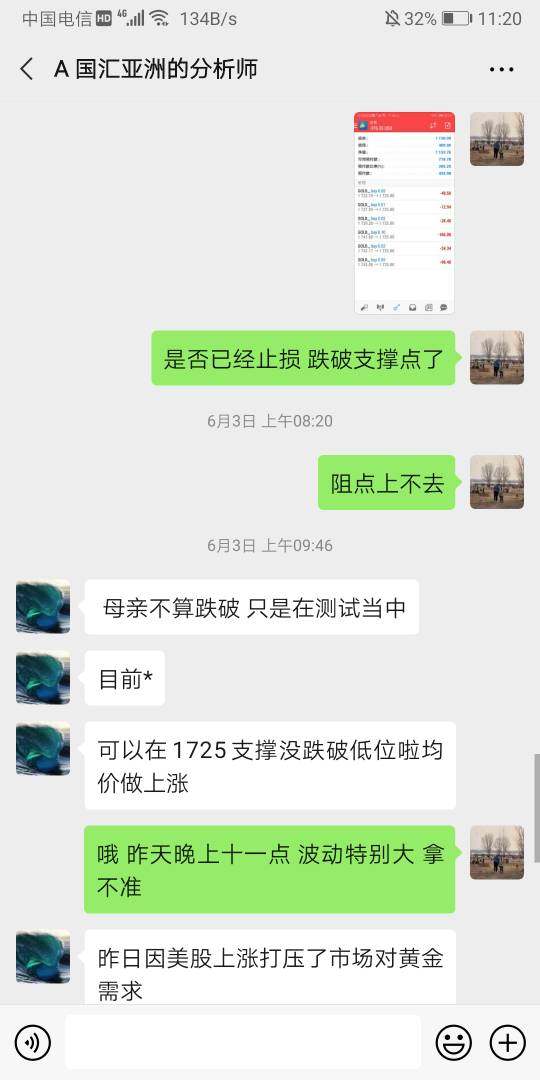

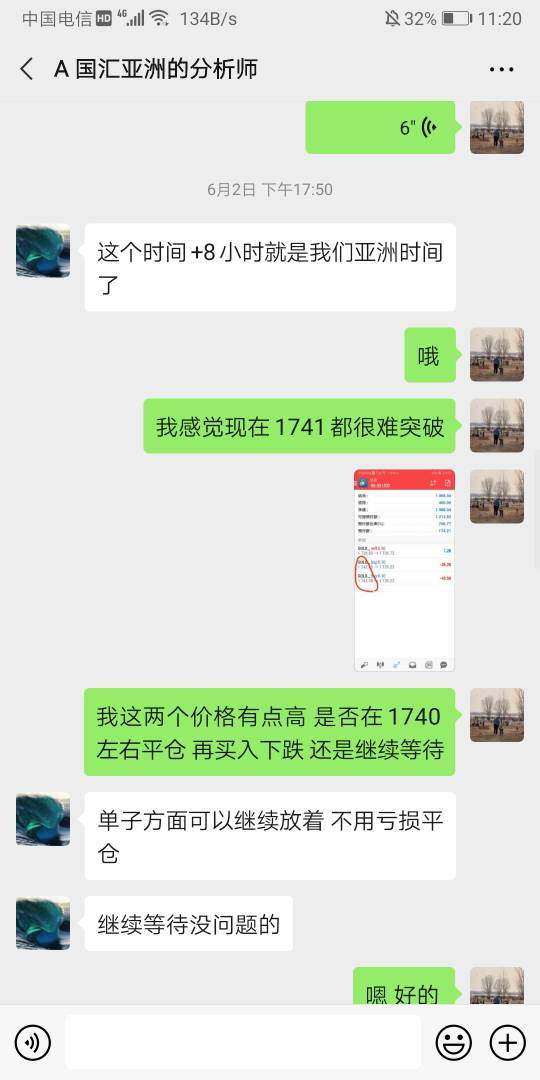

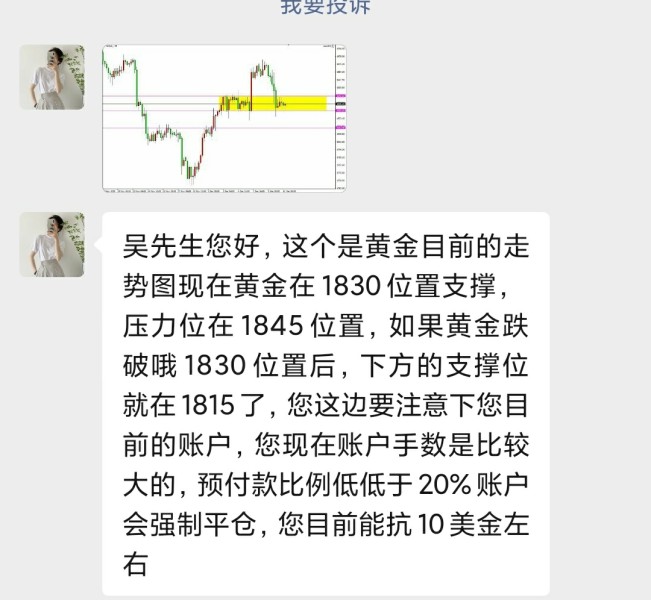

While GCM Forex operates under the CMB, some reviews highlight concerns regarding its regulatory effectiveness. Complaints about withdrawal processes raise flags over client trust.

User Self-Verification Guide

- Check the CMB Website: Confirm CMB oversight for GCM Forex.

- Cross-reference Reviews: Look at details on independent broker review sites.

- Verify Cost Structures: Examine commissions and fees associated with trading products.

- Investigate User Experiences: Search for prevalent complaints about service and withdrawals.

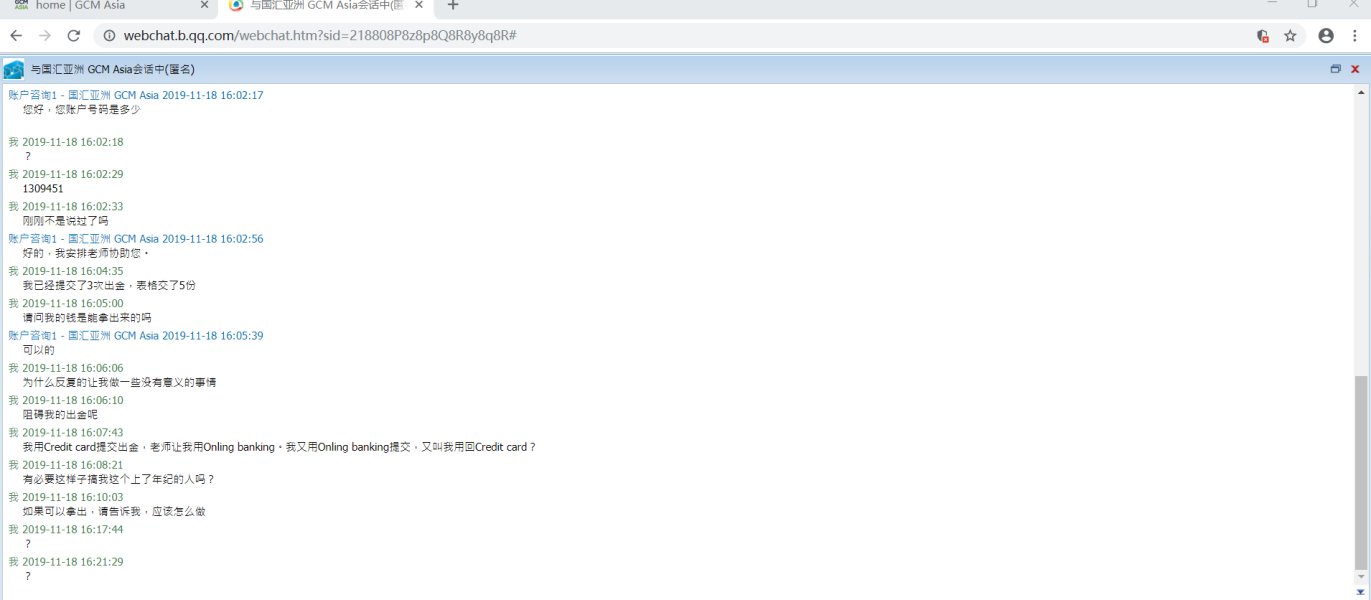

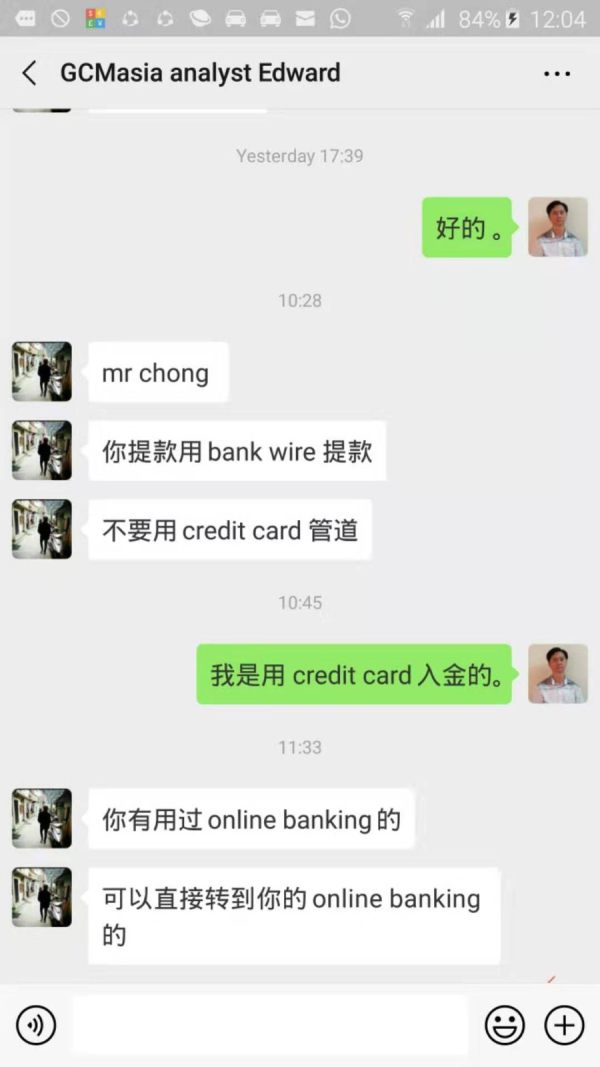

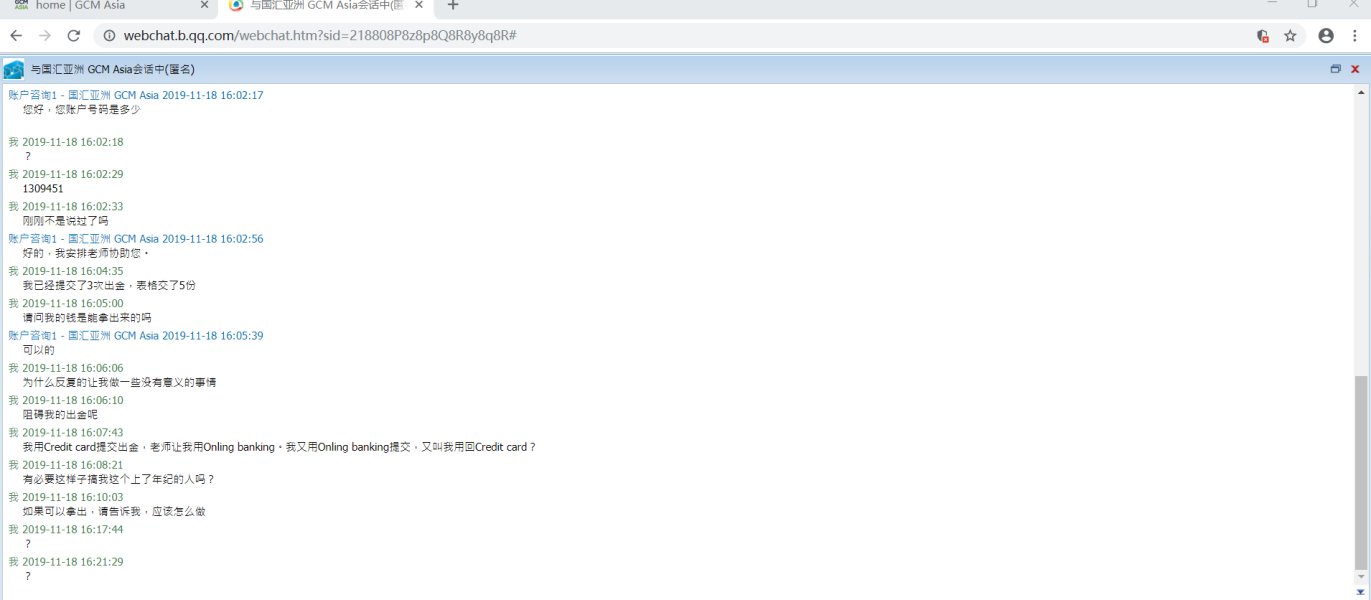

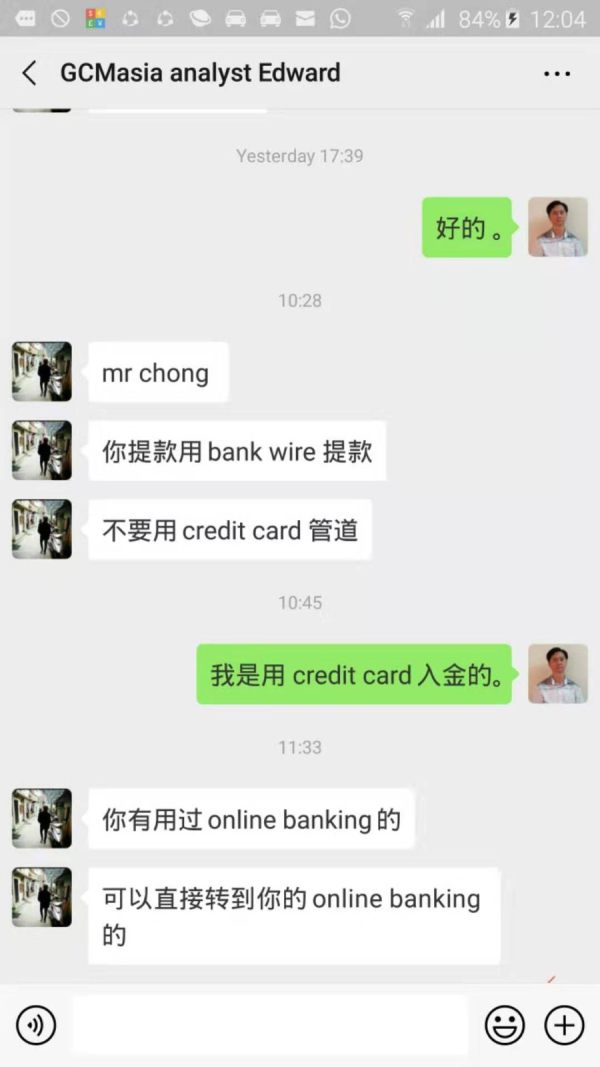

"Many users reported difficulties with the withdrawal process, suggesting a concerning level of trust."

Industry Reputation and Summary

Despite its reputable regulatory standing, numerous trader experiences indicate that concerns about withdrawal issues and transparency remain prevalent. Therefore, self-verification is vital.

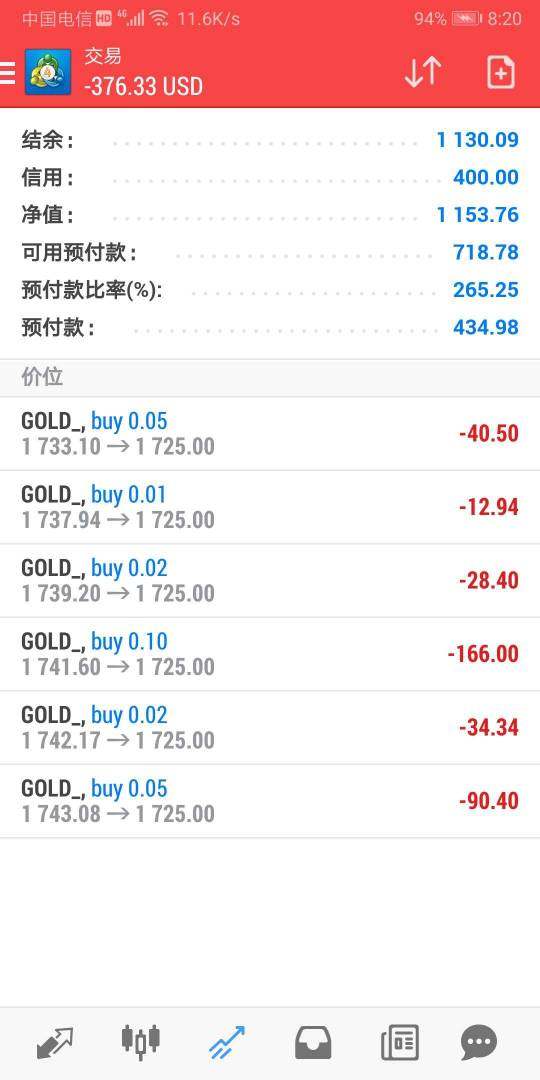

Trading Costs Analysis

Advantages in Commissions

GCM Forex has a competitive commission structure, with no charges assessed for forex trades and a market spread that starts from 2 pips for major currency pairs.

The "Traps" of Non-Trading Fees

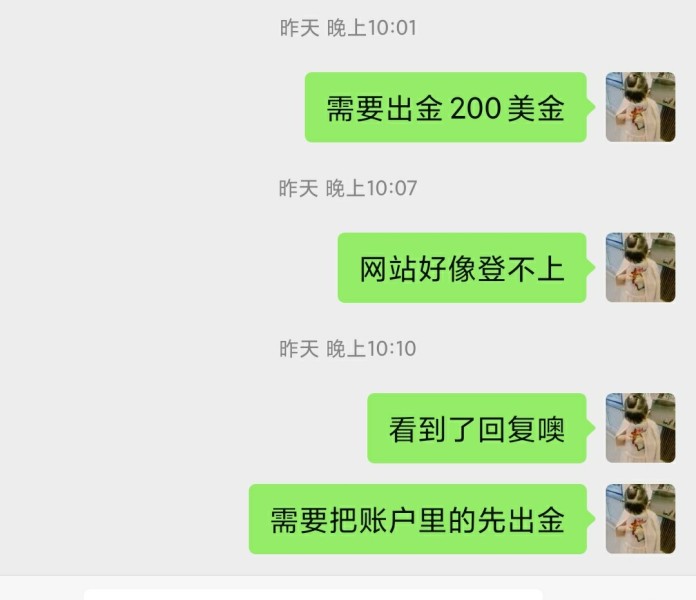

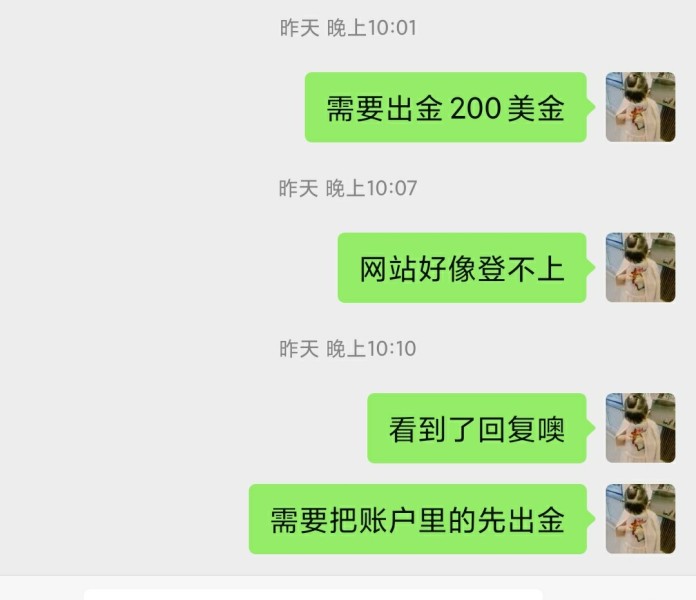

Complaints have surfaced regarding withdrawal fees that can reach 0.5%, which may erode profits, especially for lower-volume traders.

"There is a $30 charge for processing withdrawals, which has drawn criticism from users."

Cost Structure Summary

GCM Forex presents a mixed-cost profile: attractive trading commissions contrasted with unwelcome withdrawal fees. This discrepancy requires potential clients to assess their trading style carefully.

Platform Diversity

GCM Forex offers access to robust trading platforms, primarily the widely-accepted MetaTrader 4. Users benefit from various features, including technical analysis tools, indicators, and user-friendly interfaces.

Quality of Tools and Resources

The platforms provide solid educational resources, including introductory videos and expert insights which help to enrich the trading experience.

Platform Experience Summary

According to user feedback, experiences on the GCM Forex platform vary. Some users praise its usability, while others cite issues with execution speed and reliability.

"The trading platform sometimes freezes, leading to execution failures during critical moments."

User Experience Analysis

User Journey from Account Setup to Trading

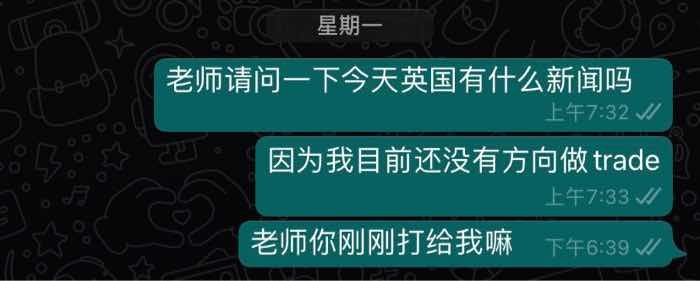

Drawing users to GCM Forex is its straightforward account registration process, yet the high minimum deposit acts as a barrier. Users report varying experiences regarding the responsiveness of the customer support team.

Community Interaction and Trading Education

GCM Forex promotes active user engagement via webinars and video tutorials, though the effectiveness of the support team can leave users divided.

Conclusion on User Experience

GCM Forex appeals to serious traders but might overlook the beginner market due to deposit requirements and accessibility issues.

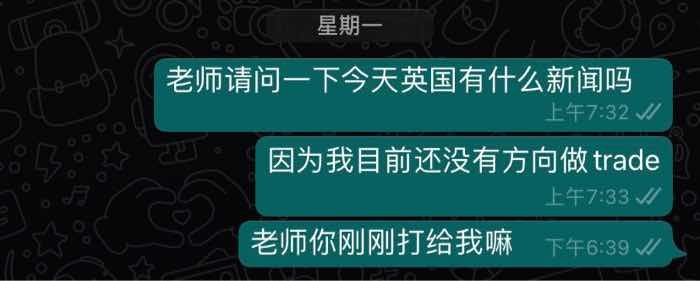

Customer Support Analysis

Service Accessibility

GCM Forex provides customer support primarily in Turkish and English, operating during limited hours that do not encompass weekends.

Challenges in Resolution

Users have expressed dissatisfaction with the efficiency of support, citing slow response times and unresolved queries.

"Customer support can be delayed, often taking time to resolve straightforward issues."

Final Evaluation

While GCM Forex has made strides in developing robust support channels, issues with accessibility and efficiency remain.

Account Conditions Analysis

Account Types and Flexibility

The brokerage offers only two account types—standard and ECN. The mandated 50,000 TRY minimum deposit restricts access for casual traders.

Withdrawal and Deposit Processes

Users have mentioned cumbersome withdrawal methods that only include bank transfers with steep waiting times.

Overall Account Structure Summary

The limitations on account types and high minimum deposits, combined with regulatory flexibility, may deter potential clients seeking to explore forex trading.

Quality Control

As a newcomer to GCM Forex, I plan to undertake a thorough review of its offerings. A potential investment requires caution, especially regarding high minimum deposits and the high leverage limits prevalent within the brokerage. The current user sentiment needs careful analysis regarding operational efficiency and reliability—essential for maintaining financial health while trading.

In conclusion, GCM Forex stands as a brokerage positioned to serve experienced traders able to navigate its high capital requirements and regulatory landscape.

Your investment decisions should always align with your financial situation and risk tolerance. Conduct thorough research and make informed choices to ensure successful trading.