axia investments 2025 Review: Everything You Need to Know

Abstract

The axia investments review shows a broker with poor ratings and low user scores. Despite offering multiple trading platforms—including the MT5 platform, as well as the AxiaTrader Web and mobile platforms—there are major problems that users face daily. The broker mainly serves customers in the Middle East and North Africa region, targeting both new and experienced traders. Users complain about poor customer support and lack of clear information. Many point out that important details like spreads, commissions, minimum deposit requirements, and leverage are not explained well to customers. The broker also fails to provide clear information about different types of assets you can trade, and the cost structures remain confusing to most users. According to user feedback and market studies, the broker struggles to provide a reliable trading environment that meets basic industry standards. This axia investments review helps investors understand the platform's strengths and weaknesses. Potential clients can make better decisions when they have all the facts before choosing this broker.

Notice

Axia Investments is registered in the Seychelles as an offshore company. This means it follows different rules that you should think about carefully before investing your money. This review looks at user feedback, market data, and company reports to give you a complete picture. Many important details like how you deposit and withdraw money, bonus offers, and account features are not clearly explained in the information we found. While this review uses a careful and data-based approach, potential investors should always check the latest details directly from the company. You should also understand the different rules that apply to offshore companies before making any investment decisions.

Rating Framework

Broker Overview

Axia Investments is a newer online brokerage that serves both new and experienced traders. The company tries to compete in financial markets by offering access to multiple platforms and aims to bridge the gap between high-quality European brokers and the needs of clients in the MENA region. It mainly serves customers in key Middle Eastern markets like the United Arab Emirates, Kuwait, Qatar, Oman, Bahrain, and Saudi Arabia. Despite wanting to provide a good trading environment, many parts of how it operates remain unclear to users. While the range of assets you can trade is not clearly defined, the broker has built its reputation around offering different trading platforms that should make trading easier for both professionals and beginners.

The firm also focuses on using advanced trading platforms for its regional customers. It offers the popular MT5 platform along with its own AxiaTrader Web and mobile apps, giving traders flexibility when they want to trade on the go. However, the details about what types of assets you can trade and what additional tools are available are not well documented in the sources we found. The company operates under the name Smarttool Trading SC Limited in the Seychelles as an offshore company—a fact that raises questions about how well it is regulated and watched over by authorities. This axia investments review shows the two sides of the broker's services: while there are many platform choices available, the lack of clear product details and regulatory clarity remains a major problem for people thinking about investing.

Regulation Region:

Axia Investments is registered in the Seychelles as an offshore company. This means its regulatory framework is limited, and details about licensing are hard to find. Various reports suggest that this lack of strict regulatory oversight should worry any investor.

Deposit and Withdrawal Methods:

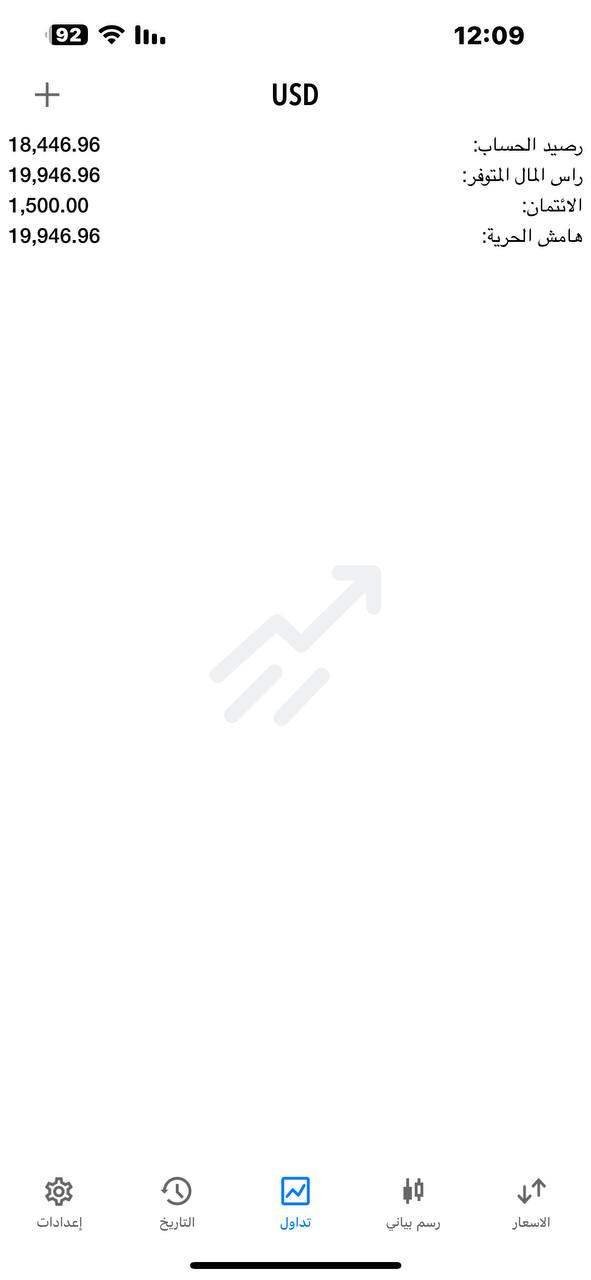

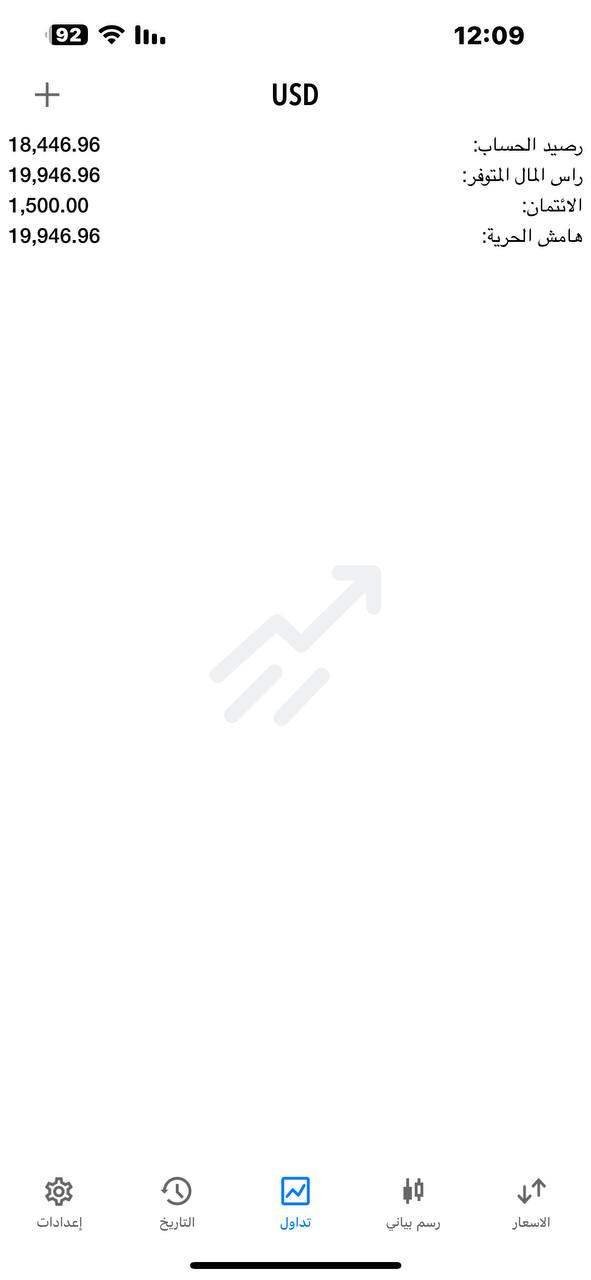

The available summaries do not mention specific deposit and withdrawal methods. This lack of clear information leaves potential investors unsure about how easy it is to manage their funds.

Minimum Deposit Requirement:

The review does not specify any minimum deposit requirements. Traders must ask for more information before they can register for an account because this critical detail is missing.

Bonus Promotions:

There is no mention of any bonus or promotional programs. This suggests that the broker may not focus much on incentives for new or existing clients.

Traded Assets:

The summary does not detail the list of assets you can trade. While the broker promotes multiple platforms, there is no clear explanation of asset classes, which might include forex, commodities, indices, or others.

Cost Structure:

No concrete details are provided about spreads, commission rates, or other trading costs. This unclear cost structure is a common complaint from users across multiple reviews, creating uncertainty for traders.

Leverage Ratio:

The available information does not mention any details about leverage options. This leaves potential investors without insight into the risk management options that Axia Investments provides.

Platform Options:

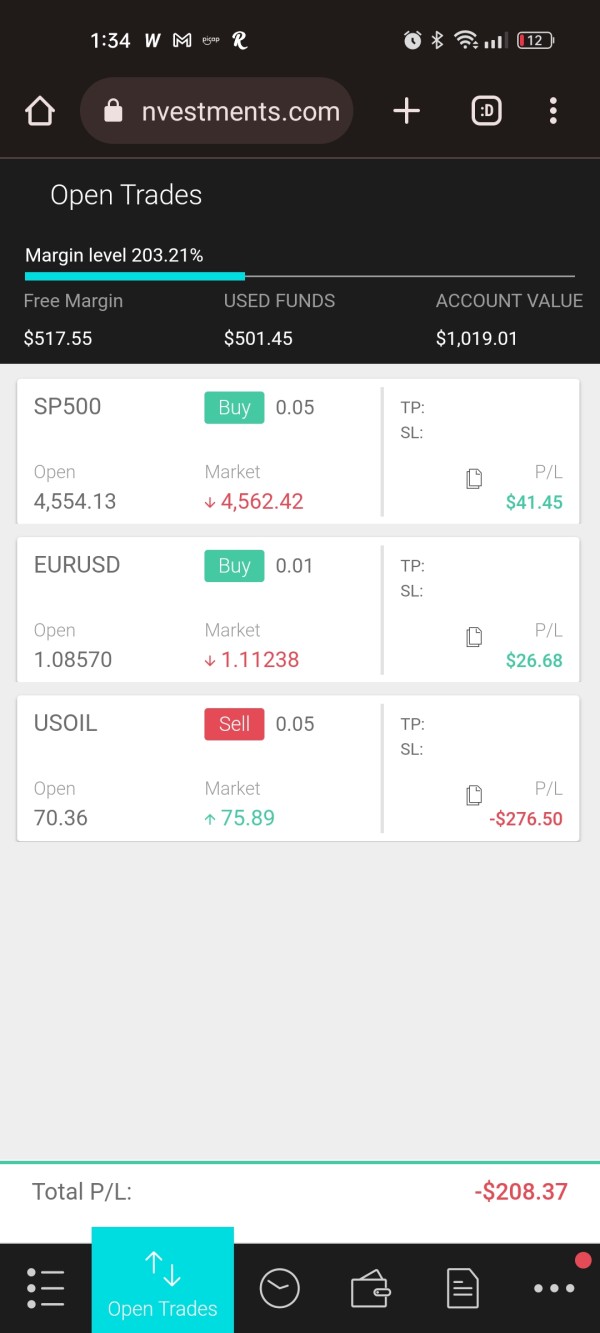

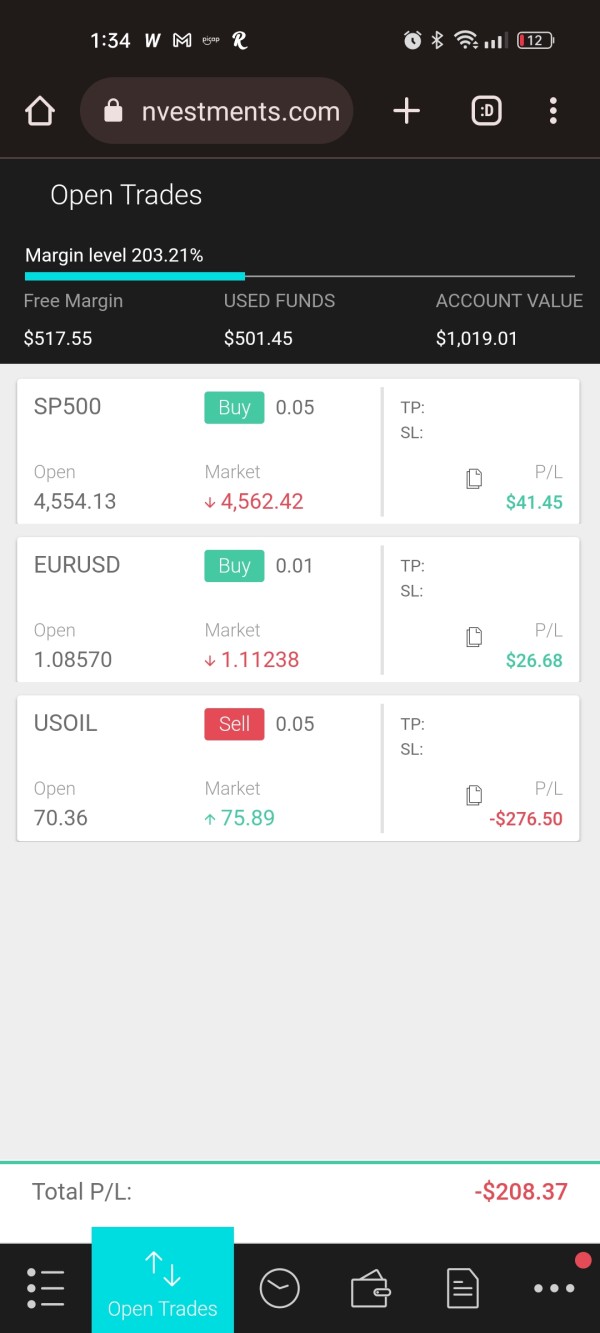

The broker offers the MT5 platform and its own AxiaTrader Web and mobile platforms. These platforms are designed to support various trading strategies, but user experiences show that the platforms may be more complex than expected.

Regional Restrictions:

Axia Investments mainly targets customers in the Middle East and North Africa region. This focused geographical service area may limit access or support for traders in other regions.

Customer Service Language:

There is no detailed information about the languages that the customer service team supports. This may affect non-English speaking users or those who need help in other languages.

This breakdown is based on the information available in the provided summaries. Important details about key trading conditions remain unclear, showing that potential investors need to do more research before working with the broker. The lack of transparency in areas like cost structures and asset offerings is a major element of this axia investments review.

Detailed Rating Analysis

2.6.1 Account Conditions Analysis

The account conditions that Axia Investments offers are one of the biggest concerns for users. As noted, important details like spread levels, commission fees, minimum deposit requirements, and leverage ratios are not clearly explained to customers. This lack of clarity has led to user dissatisfaction and uncertainty when people try to figure out if the broker offers good value for money. The absence of clear guidelines on account types, including whether there are options like Islamic accounts or special accounts for different trading styles, makes the broker less attractive to potential clients. Compared to well-established brokers that clearly show detailed account structures, Axia Investments' vague presentation leaves many traders questioning the overall value they will receive. Many users have reported bad experiences during account setup, citing difficult verification processes and unexpected details about trading fees that were not explained upfront. The lack of transparency and the negative user feedback have resulted in a low score for this category. This detailed account conditions analysis shows how important it is for potential users to have clear, detailed information—something that is unfortunately missing here.

Axia Investments does give users access to popular trading platforms, including MT5 and its own AxiaTrader Web and mobile apps. However, while these platforms are well-known in the trading community, the detailed tools available for research, analysis, and education are not fully explained to users. The absence of a strong set of analytical and educational tools puts the broker at a disadvantage compared to competitors who offer better trading resources. Users have expressed concerns about the limited range of automated trading options and the lack of connection with comprehensive market analysis tools that could help them make better trading decisions. While the MT5 platform is known for being versatile and useful, the overall system provided by Axia Investments appears to fall short of user expectations. Traders need clear guidance on the available asset classes and whether additional support, such as advanced charting tools or algorithmic trading options, is accessible through the platform. This problem contributed to a middle-range score, reflecting user experiences where the potential benefits of a top-tier platform are reduced by insufficient additional resources.

2.6.3 Customer Service and Support Analysis

Customer service remains one of the weakest parts of Axia Investments. Users consistently report long waiting times and poorly resolved questions, which significantly hurts the overall trading experience for people who need help. The support channels available do not appear to be strong enough or proactive in helping users, and complaints about unhelpful responses happen again and again. There is also little evidence to suggest that the broker offers support in multiple languages, further limiting its ability to serve clients from different countries effectively. According to user reports, serious issues, especially those related to account problems or technical difficulties with the trading platforms, often go unresolved for long periods of time. Compared to other brokers that prioritize quick customer service and provide extensive support resources, the feedback for Axia Investments remains mostly negative from users who have tried to get help. The overall low score in this area reflects both the slow response times and the general dissatisfaction with the quality of assistance offered to customers. This analysis strongly emphasizes that improving customer support should be a key priority for the broker if it wants to keep and attract clients.

2.6.4 Trading Experience Analysis

The trading experience that Axia Investments provides is marked by complications and a lack of user-friendly design. Many users have described the trading platform as too complex, which directly impacts how efficiently they can execute trades. Platform stability and the speed of order execution are critical elements for any active trader, yet users have raised concerns about delays and occasional technical problems that interrupt their trading. Although the broker offers both a desktop and mobile version of its trading platform, the overall ease of use remains below what users expect from a modern broker. The absence of clear guidance within the platform further takes away from its functionality, making it less appealing for both new and experienced traders looking for a smooth trading environment. The feedback suggests that despite having access to well-known platforms such as MT5, the user interface and execution processes do not meet industry standards that traders have come to expect. These issues together contribute to a lower trading experience score, emphasizing the need for simplification and improved technical performance to meet user needs.

2.6.5 Trustworthiness Analysis

Trust is a crucial factor in the decision-making process for any investor. In the case of Axia Investments, there are significant concerns that potential clients should consider carefully. The fact that the company is registered as an offshore entity in the Seychelles inherently limits the level of regulatory oversight compared to brokers licensed in more strict jurisdictions that have stronger rules. The lack of detailed information about the measures taken to protect client funds further reduces investor confidence in the broker's ability to keep their money safe. Users have consistently pointed out the lack of transparency in how the company operates and the absence of verifiable regulatory credentials that would prove the broker follows proper rules. Industry experts also point out that transparency in both operational processes and fee structures is essential to building trust; unfortunately, Axia Investments falls short on these important counts. Given these factors, the overall trustworthiness score remains low and reflects the concerns that many users have expressed. This analysis shows the importance of strong regulatory compliance and transparent operational practices, elements that are noticeably lacking in this broker's approach to doing business.

2.6.6 User Experience Analysis

The overall user experience with Axia Investments is characterized by dissatisfaction and unnecessary complexity. Users consistently report that the platform's design does not make things easy to use, with registration and verification processes that are more complicated than they need to be. The interface also lacks easy navigation, resulting in a steep learning curve for new traders while frustrating experienced ones who expect better functionality. Another area of concern is the consistency of the trading environment; while the broker offers multiple platforms, the integration and uniformity across these devices appear to be lacking in quality. Many users have also pointed out ongoing issues with the usability of the customer support function and the general inefficiency in resolving user concerns when problems arise. These combined factors contribute to the relatively low overall user experience score that reflects what actual users have reported. The feedback indicates that while the broker targets both new and experienced traders, the disconnect between the intended service quality and the actual user experience is significant and requires considerable improvements to meet basic expectations.

Conclusion

In summary, Axia Investments earns an overall negative evaluation mainly due to its unclear account conditions, poor customer support, and lack of detailed operational transparency. Although it provides multiple trading platforms for the MENA region, the problems with regulatory clarity and user experience cannot be ignored by potential investors. This axia investments review makes it clear that while the broker might work for certain traders who are willing to deal with these complications, potential clients should be very careful before choosing this broker. Future improvements, particularly in customer service and operational transparency, are essential for building overall trust and satisfaction among users who want a reliable trading experience.