Advanced Markets 2025 Review: Everything You Need to Know

Executive Summary

This detailed advanced markets review looks at a forex broker that has built a strong reputation in institutional trading since 2006. Our study of rules, trading conditions, and user feedback shows that Advanced Markets has strong credibility through dual regulation by ASIC and FCA. The broker requires a minimum deposit of $2,500 USD, which targets professional and institutional traders rather than everyday retail clients.

Advanced Markets stands out through its STP and DMA execution models. These systems typically provide clear pricing and direct market connections. The broker's main office is in the Cayman Islands, with additional offices in North Carolina, New York, and London, showing its global institutional focus.

However, the high minimum deposit may limit access for smaller retail traders who want entry-level opportunities. The main users are institutional clients and skilled traders who need professional trading systems and regulatory compliance. This advanced markets review shows that while the broker maintains solid regulatory standing and reliable operations, potential clients should think carefully about whether their trading capital and experience match the broker's institutional focus.

Important Notice

Different regional parts of Advanced Markets may work under different regulatory rules. Traders should check which specific regulatory area applies to their account based on where they live. Rule differences between ASIC and FCA oversight may create different client protections, leverage limits, and available services depending on the applicable regulatory system.

This review uses publicly available information, industry reports, and documented user experiences as of 2025. Trading conditions, regulatory status, and service offerings may change, so potential clients should verify current terms before making trading decisions. The information presented reflects general market analysis and should not be considered as personalized investment advice.

Rating Framework

Broker Overview

Advanced Markets started in 2006 and has built its reputation serving institutional clients globally from its headquarters in the Cayman Islands. The broker works under a professional business model, using STP and DMA execution methods that give clients direct market connectivity. This institutional focus shows in their minimum deposit requirement and service structure, which serves traders with substantial capital and professional trading needs.

The company maintains a global presence with offices in major financial centers including Camana Bay, North Carolina, New York, and London. This international footprint supports their institutional client base and shows operational scale across key trading time zones. The broker's business model focuses on transparent execution through direct market access, which typically results in competitive pricing and minimal conflicts of interest between the broker and clients.

Advanced Markets works primarily in the forex market space, providing currency trading services under strict regulatory oversight. The broker's regulatory compliance with both ASIC and FCA shows commitment to maintaining high operational standards and client protection measures. This dual regulatory framework gives clients enhanced security and ensures adherence to strict financial services regulations across multiple areas.

This advanced markets review shows that the broker's focus on institutional services and professional trading infrastructure sets it apart from retail-oriented competitors. However, this specialization may limit its appeal to entry-level traders seeking lower minimum deposits and more basic service offerings.

Regulatory Oversight: Advanced Markets operates under dual regulation from ASIC and FCA. This provides clients with strong regulatory protection and ensures compliance with strict financial services standards across Australian and UK areas.

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods is not detailed in available documentation. This requires direct inquiry with the broker for complete payment processing options.

Minimum Deposit Requirements: The broker requires a minimum deposit of $2,500 USD. This positions it firmly in the professional trader category and may exclude smaller retail clients seeking lower entry barriers.

Promotional Offerings: Current bonus and promotional structures are not specified in available documentation. This suggests the broker may focus on competitive trading conditions rather than marketing incentives.

Available Trading Assets: The primary focus appears to be on forex trading. However, the complete range of available instruments requires verification through direct broker contact for complete asset listings.

Cost Structure: Commission-based pricing is implemented. However, specific spread information and detailed fee schedules are not fully outlined in available sources, requiring further investigation for complete cost analysis.

Leverage Ratios: Maximum leverage is set at 1:100. This aligns with regulatory requirements while providing moderate leverage for professional trading strategies without excessive risk exposure.

Platform Options: Specific trading platform details are not extensively documented in available information. This requires direct inquiry to understand available technology and interface options.

Geographic Restrictions: Regional limitations and restricted territories are not clearly specified in available documentation. This requires verification based on individual circumstances and regulatory areas.

Customer Support Languages: Available customer service languages are not detailed in current documentation. However, the international office presence suggests multilingual support capabilities.

This advanced markets review reveals that while core operational information is available, many specific service details require direct broker contact for complete understanding.

Account Conditions Analysis

Advanced Markets offers multiple account types designed to meet varying client needs. However, specific details about each account tier's features and benefits require further clarification from available documentation. The $2,500 minimum deposit requirement represents a significant barrier for entry-level traders but ensures a professional client base with adequate trading capital.

This threshold suggests the broker's focus on serious traders who can maintain meaningful position sizes and generate sufficient trading volume to justify the operational costs of professional-grade services. The account opening process details are not extensively documented in available sources, though the regulatory oversight by ASIC and FCA typically requires thorough KYC and AML procedures. These regulatory requirements generally ensure thorough client verification but may result in longer account approval timeframes compared to less regulated alternatives.

Professional traders typically appreciate this thorough approach as it indicates serious regulatory compliance and operational integrity. Account management features and special functionalities, such as Islamic account options or specific trading condition modifications, are not clearly outlined in available documentation. The institutional focus suggests that account customization may be available for larger clients, though specific details would require direct consultation with the broker's account management team.

User feedback regarding account conditions indicates general satisfaction with the professional service level. However, the higher minimum deposit requirement naturally limits the broker's accessibility to a smaller segment of the trading community. This advanced markets review suggests that while account conditions meet professional standards, the entry requirements clearly target experienced traders with substantial capital rather than retail clients seeking accessible entry points.

Advanced Markets provides multiple account types to meet different trading requirements. However, detailed information about specific tools and analytical resources is not extensively documented in available sources. The broker's institutional focus suggests access to professional-grade trading infrastructure, though specific platform capabilities, charting tools, and analytical resources require direct verification with the broker for complete understanding of available technology offerings.

Research and analysis resources are not clearly detailed in current documentation, which is somewhat surprising given the broker's professional positioning. Institutional clients typically require detailed market analysis, economic calendars, and research reports to support their trading decisions. The absence of detailed information about these resources in available documentation suggests that such services may be provided through direct client relationships rather than publicly marketed features.

Educational resources and training materials are not prominently featured in available information. This aligns with the broker's institutional focus where clients are generally assumed to possess advanced trading knowledge and experience. Professional traders typically require technical support and advanced platform features rather than educational content, though detailed training resources can benefit even experienced traders adapting to new platforms or market conditions.

Automated trading support and algorithmic trading capabilities are not specifically detailed in available documentation. However, the STP and DMA execution models typically support automated strategies effectively. Professional traders often require strong API access and low-latency execution for algorithmic strategies, though specific technical capabilities would require direct technical consultation with the broker's support team.

Customer Service and Support Analysis

Customer service quality receives positive mentions in user feedback, with reliability being highlighted as a key strength of Advanced Markets' support operations. However, specific information about available support channels, such as live chat, phone support, or email ticketing systems, is not fully detailed in available documentation. Professional brokers typically offer multiple contact methods, though the specific availability and accessibility of these channels require verification through direct contact.

Response time performance metrics are not specifically documented in available sources. However, user feedback suggesting reliable service indicates generally satisfactory support responsiveness. Institutional clients typically expect prompt support resolution, particularly for technical issues or account-related inquiries that may impact trading operations.

The absence of specific response time commitments in available documentation suggests that service levels may vary based on account size or client tier. Service quality standards appear to meet professional expectations based on available user feedback, though detailed service level agreements or detailed support policies are not publicly documented. The broker's regulatory compliance with ASIC and FCA typically requires adequate customer service standards, providing some assurance of minimum service quality expectations.

Multilingual support capabilities are not clearly specified in available documentation. However, the international office presence across North Carolina, New York, and London suggests potential for multiple language support. Professional traders operating across different time zones typically require support availability during their active trading hours, though specific support schedules and language options would require direct verification.

Trading Experience Analysis

Platform stability and execution speed are critical factors for professional trading. The STP and DMA models typically provide superior execution quality compared to dealing desk operations. These execution methods generally result in faster order processing and reduced conflicts of interest, though specific performance metrics such as average execution speed or slippage statistics are not detailed in available documentation.

Order execution quality benefits from the broker's STP and DMA infrastructure, which typically provides direct market connectivity and transparent pricing. Professional traders generally prefer these execution models as they reduce the potential for price manipulation and ensure that orders are processed at genuine market prices. However, specific execution statistics or third-party performance audits are not referenced in available documentation to provide quantitative validation of execution quality.

Platform functionality and feature completeness require direct verification, as specific trading platform details are not extensively documented in available sources. Professional traders typically require advanced charting capabilities, multiple order types, risk management tools, and potentially algorithmic trading support. The institutional focus suggests that sophisticated platform features are likely available, though detailed platform specifications would require direct demonstration or trial access.

Mobile trading experience and cross-platform synchronization capabilities are not specifically addressed in available documentation. However, modern professional trading typically requires seamless access across desktop and mobile devices. The absence of detailed mobile platform information suggests this may be an area requiring direct inquiry to understand the full scope of available trading technology.

This advanced markets review indicates that while the underlying execution infrastructure appears solid through STP and DMA models, detailed platform performance data would enhance confidence in the overall trading experience quality.

Trust and Reliability Analysis

Regulatory credentials represent Advanced Markets' strongest trust factor, with dual oversight from ASIC and FCA providing strong client protection frameworks. These regulatory bodies maintain strict operational standards, capital adequacy requirements, and client fund protection measures that significantly enhance the broker's credibility. ASIC and FCA regulation typically includes segregated client funds, professional indemnity insurance, and regular compliance audits that protect client interests.

Fund security measures and client money protection protocols are implicitly covered under ASIC and FCA regulatory frameworks. However, specific details about segregated account arrangements, deposit insurance coverage, or additional security measures are not explicitly outlined in available documentation. Professional regulatory oversight generally ensures adequate client fund protection, though detailed security policy details would provide additional confidence for potential clients.

Corporate transparency and public disclosure practices are not extensively detailed in available sources. However, regulatory compliance typically requires certain levels of operational transparency and financial reporting. The broker's establishment in 2006 shows operational longevity, which generally indicates stable business operations and successful navigation of various market conditions over nearly two decades.

Industry reputation and recognition through awards or professional acknowledgments are not specifically mentioned in available documentation. However, the broker's institutional focus and regulatory compliance suggest solid standing within the professional trading community. Negative incidents or regulatory actions are not referenced in available sources, which generally supports the broker's reputation for compliance and operational integrity.

User Experience Analysis

Overall user satisfaction appears positive based on available feedback, with reliability being consistently highlighted as a key strength. Professional traders typically prioritize operational consistency and execution quality over flashy features, and the positive reliability feedback suggests that Advanced Markets meets these fundamental requirements. However, detailed user satisfaction surveys or detailed testimonials are not extensively available to provide quantitative satisfaction metrics.

Interface design and platform usability details are not specifically documented in available sources. This requires direct platform evaluation to assess the quality of user interface design and navigation efficiency. Professional trading platforms typically prioritize functionality over aesthetics, though intuitive design can significantly impact trading efficiency and user satisfaction.

Registration and account verification processes are not detailed in available documentation. However, ASIC and FCA regulatory compliance typically requires thorough KYC procedures that may extend account opening timeframes. Professional traders generally accept longer verification processes in exchange for enhanced regulatory protection and operational credibility.

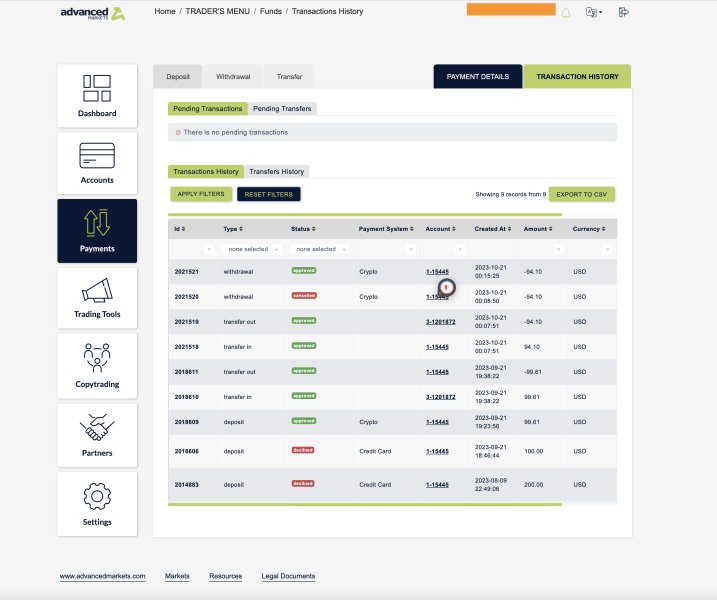

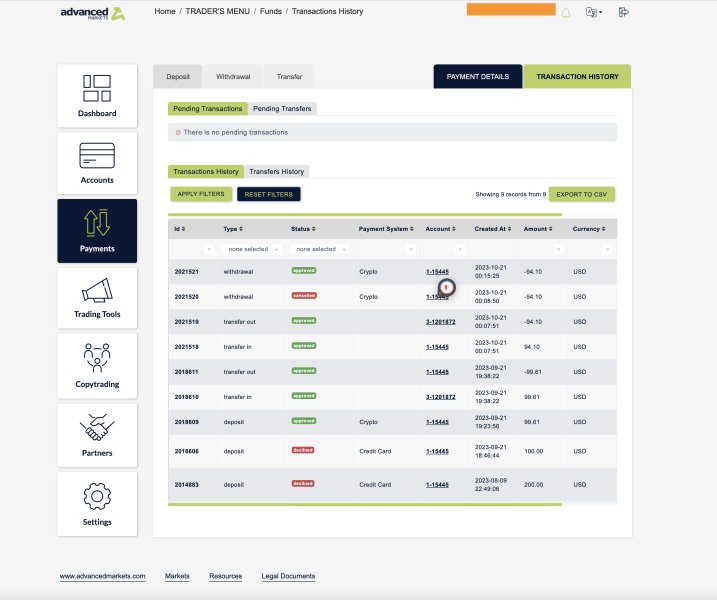

Funding operations and withdrawal experiences are not fully detailed in available sources. However, the absence of negative feedback regarding payment processing suggests generally satisfactory fund management procedures. Professional traders typically require efficient and reliable payment processing, particularly for larger transaction amounts common in institutional trading.

Common user complaints or recurring issues are not specifically documented in available sources. This may indicate either limited negative feedback or insufficient detailed user review coverage. The institutional client focus may result in fewer public reviews compared to retail-oriented brokers, as professional traders often maintain discretion about their service providers.

Conclusion

This advanced markets review reveals a forex broker that maintains solid regulatory credentials and operational reliability. This makes it suitable for professional and institutional traders seeking regulated market access. The dual oversight from ASIC and FCA provides substantial credibility and client protection, while the STP and DMA execution models offer transparent trading conditions typical of professional-grade services.

The broker is primarily suited for institutional clients and experienced traders with substantial trading capital. This is evidenced by the $2,500 minimum deposit requirement and professional service orientation. Smaller retail traders seeking accessible entry points may find the minimum deposit threshold prohibitive, while professional traders will likely appreciate the serious client base and institutional-grade infrastructure.

The main advantages include strong regulatory oversight, reliable service delivery, and professional execution models that minimize conflicts of interest. However, the higher minimum deposit requirement and limited publicly available information about specific service features represent potential drawbacks for some prospective clients. Overall, Advanced Markets appears well-positioned for traders prioritizing regulatory compliance and operational reliability over promotional offerings or low entry barriers.