Regarding the legitimacy of ZHONG RONG HUI XIN FUTURES forex brokers, it provides CFFEX and WikiBit, .

Is ZHONG RONG HUI XIN FUTURES safe?

Pros

Cons

Is ZHONG RONG HUI XIN FUTURES markets regulated?

The regulatory license is the strongest proof.

CFFEX Derivatives Trading License (AGN)

China Financial Futures Exchange

China Financial Futures Exchange

Current Status:

RegulatedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

中融汇信期货有限公司

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is ZRF Safe or Scam?

Introduction

ZRF, a forex brokerage firm established in 2018, has positioned itself within the competitive landscape of the foreign exchange market, primarily serving clients in China and Hong Kong. As the forex market continues to grow, traders must exercise caution when selecting a broker, as the risk of encountering fraudulent entities remains high. Evaluating a brokers legitimacy involves scrutinizing various aspects such as regulatory compliance, customer experiences, and the overall safety of funds. This article investigates whether ZRF is safe or potentially a scam, using a comprehensive assessment framework that includes regulatory status, company background, trading conditions, customer fund safety, and user feedback.

Regulation and Legitimacy

The regulatory status of a brokerage is paramount in determining its safety and credibility. ZRF is regulated by the China Financial Futures Exchange (CFFEX), which plays a crucial role in overseeing the trading of financial derivative products linked to the Chinese renminbi. Here is a summary of ZRFs regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| China Financial Futures Exchange (CFFEX) | 0179 | China | Verified |

The importance of regulation cannot be overstated, as it ensures that brokers adhere to strict operational guidelines designed to protect traders. CFFEX is known for its rigorous oversight, which adds a layer of security for investors. However, it is essential to recognize that not all regulatory bodies enforce the same standards. While ZRF's regulatory framework appears solid, the lack of international oversight raises questions regarding its global operational practices. Furthermore, during our research, we found no significant negative regulatory disclosures related to ZRF, which suggests a relatively clean compliance history. This information supports the argument that ZRF is, to some extent, a safe trading option.

Company Background Investigation

ZRF, officially known as Zhongrong Futures, has a rich history dating back to its founding in 1995. The company has evolved to become a prominent player in the financial services sector, focusing on futures brokerage, investment advisory, and asset management. Its ownership structure is backed by the China National Agricultural Development Group, a notable entity that provides financial stability and resources.

The management team at ZRF comprises professionals with extensive experience in finance and trading. This expertise is crucial for maintaining operational integrity and delivering quality service to clients. Transparency is another critical factor in evaluating ZRF's credibility. The company provides access to its regulatory information and operational details, which is a positive indicator of its commitment to openness. However, the limited international presence may hinder its ability to serve a broader client base effectively.

Trading Conditions Analysis

When assessing whether ZRF is safe, it is vital to analyze its trading conditions and fee structures. ZRF offers a variety of financial instruments, including forex and CFDs, but its fee structure has raised some eyebrows among users. The following table summarizes ZRF's core trading costs:

| Fee Type | ZRF | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | 1.5 pips | 1.2 pips |

| Commission Model | Variable | Fixed |

| Overnight Interest Range | 0.5% - 2% | 0.3% - 1.5% |

While ZRF's spreads are slightly higher than the industry average, the variable commission model could lead to unexpected costs for traders. Moreover, the overnight interest rates appear to be on the higher end, which may deter long-term traders. These fees could potentially impact trading profitability and should be carefully considered by prospective clients. Overall, while the trading conditions at ZRF do not immediately suggest a scam, the fee structure warrants a cautious approach.

Customer Fund Safety

The safety of customer funds is a crucial aspect of any brokerage. ZRF claims to implement several measures to protect client funds, including segregating client accounts from operational funds. This practice is essential for ensuring that client assets are safeguarded in the event of company insolvency. Additionally, ZRF does not appear to have a history of significant financial security issues, which further supports its credibility.

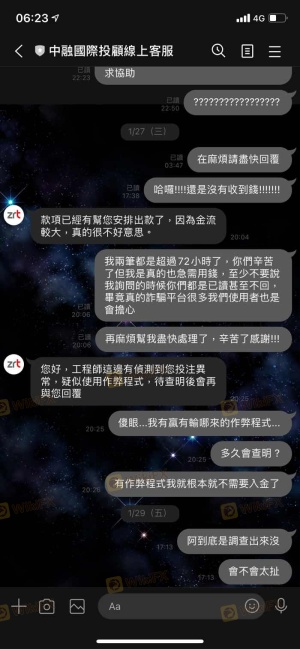

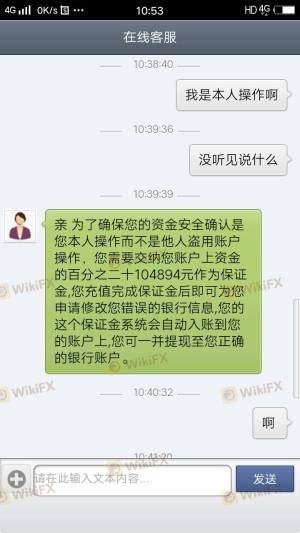

However, some users have reported difficulties in withdrawing funds, raising concerns about the effectiveness of ZRF's customer fund safety measures. This highlights the importance of investigating any historical disputes or controversies surrounding the broker. Overall, while ZRF implements some safety measures, potential clients should remain vigilant regarding fund withdrawal processes.

Customer Experience and Complaints

Customer feedback is a vital indicator of a brokerage's reliability. Reviews of ZRF reveal a mixed bag of experiences, with some users praising the platform's functionality while others express frustration over withdrawal issues. The following table summarizes the main types of complaints received about ZRF:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Difficulties | High | Slow response |

| High Fees | Medium | Acknowledged but unchanged |

| Poor Customer Service | High | Inconsistent |

Common complaints revolve around withdrawal difficulties, with several users reporting that they were unable to access their funds after making deposits. This pattern raises red flags about ZRF's operational integrity and customer service quality. For instance, one user reported being unable to withdraw $1,000 despite having a profitable trading account, leading to suspicions of potential scams. Such experiences suggest that while ZRF may not be an outright scam, it has significant areas that require improvement.

Platform and Trade Execution

Evaluating the performance and reliability of ZRF's trading platform is essential for determining its overall safety. Users have reported that the platform offers a range of features and tools, but execution quality has been a point of contention. Issues such as slippage and order rejections have been noted, which can significantly affect trading outcomes.

The platform's stability is crucial for maintaining a seamless trading experience. However, reports of technical glitches during high-volatility periods have led some traders to question ZRF's reliability. While these issues may not constitute outright manipulation, they do raise concerns about the broker's operational capabilities.

Risk Assessment

Engaging with ZRF involves several risks that potential clients should consider. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Limited international regulation may pose risks. |

| Financial Risk | High | Reports of withdrawal issues could indicate financial instability. |

| Operational Risk | Medium | Technical issues and slippage may affect trading performance. |

To mitigate these risks, potential clients should conduct thorough due diligence before committing significant funds. Starting with a smaller investment and testing the platform's functionality may be prudent. Additionally, staying informed about user experiences and regulatory updates can help traders make more informed decisions.

Conclusion and Recommendations

In conclusion, while ZRF is regulated by the China Financial Futures Exchange, which adds a layer of credibility, several factors suggest that traders should approach this broker with caution. Reports of withdrawal difficulties and inconsistent customer service raise significant concerns about its operational integrity. While ZRF may not be a scam in the traditional sense, the potential risks and complaints indicate that it may not be the safest choice for all traders.

For those considering ZRF, it is advisable to start with a small investment and monitor the platform's performance closely. Additionally, traders may want to explore alternative brokers with a stronger international presence and more favorable customer feedback. Some recommended alternatives include brokers with top-tier regulation and a proven track record of reliable service. Always prioritize safety and conduct thorough research before engaging with any trading platform.

Is ZHONG RONG HUI XIN FUTURES a scam, or is it legit?

The latest exposure and evaluation content of ZHONG RONG HUI XIN FUTURES brokers.

ZHONG RONG HUI XIN FUTURES Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ZHONG RONG HUI XIN FUTURES latest industry rating score is 7.90, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.90 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.