Zrf 2025 Review: Everything You Need to Know

In the ever-evolving landscape of forex trading, Zrf emerges as a notable player. Established in 1995 and regulated by the China Financial Futures Exchange (CFFEX), Zrf has garnered a mixed reputation among traders. While some users praise its trading conditions, others have raised concerns about withdrawal issues and customer service. This Zrf review will delve into the essential features, user experiences, and expert opinions surrounding this broker.

Note: It's important to highlight that Zrf operates under different entities across regions, which may affect user experiences and regulatory compliance. This review synthesizes various sources to provide a fair and accurate assessment.

Ratings Overview

How We Rate Brokers: Our scoring is based on a comprehensive analysis of user feedback, expert reviews, and factual data regarding the broker's offerings.

Broker Overview

Zrf, also known as Zhongrong Futures, is a Chinese brokerage firm that has been in operation since 1995. The company is headquartered in Shanghai and primarily caters to clients in China and Hong Kong. Zrf offers a variety of trading platforms, although it does not support popular platforms like MetaTrader 4 or MetaTrader 5. Instead, it provides proprietary trading software tailored to different trading styles.

Zrf allows trading in various asset classes, including forex, commodities, and financial futures. The broker is regulated by the China Financial Futures Exchange (CFFEX), which oversees its operations and ensures compliance with local laws.

Detailed Analysis

Geographical Regulation: Zrf is primarily regulated in China, with its operations focused on the domestic market. This localized regulation may limit its appeal to international traders seeking broader regulatory oversight.

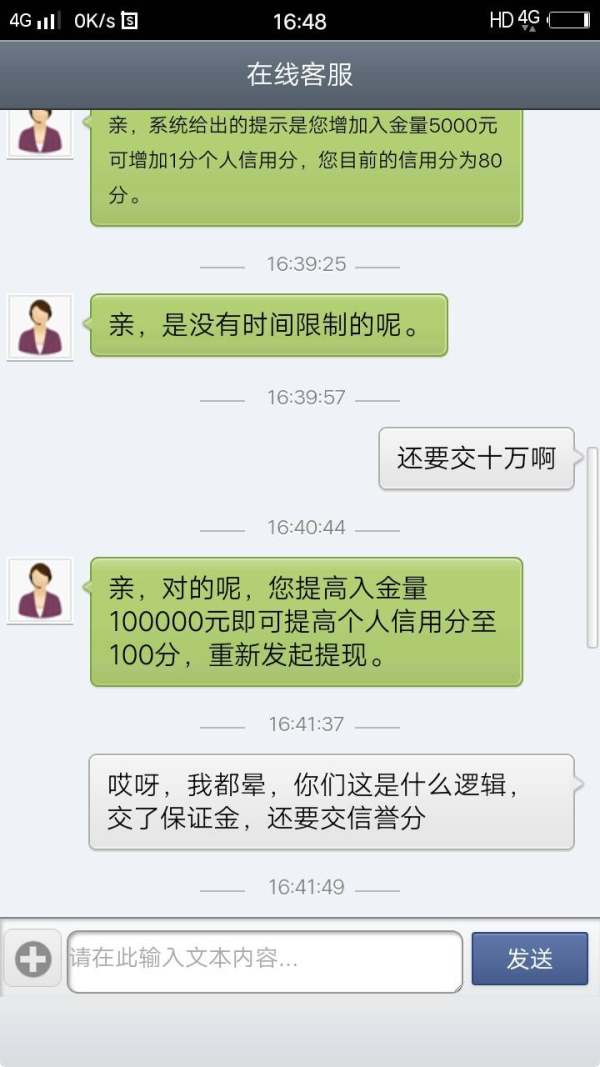

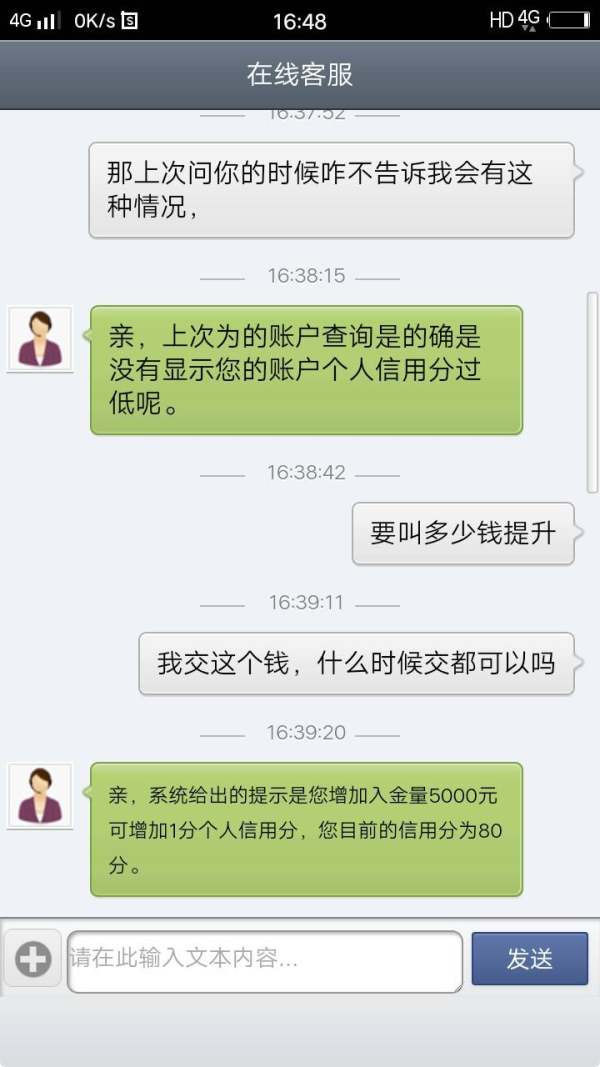

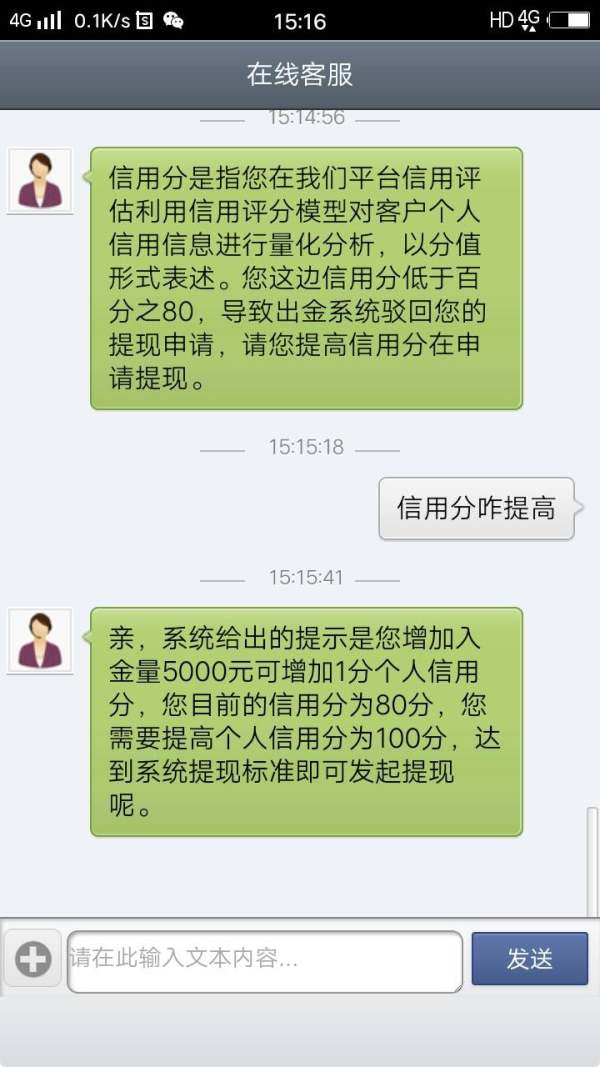

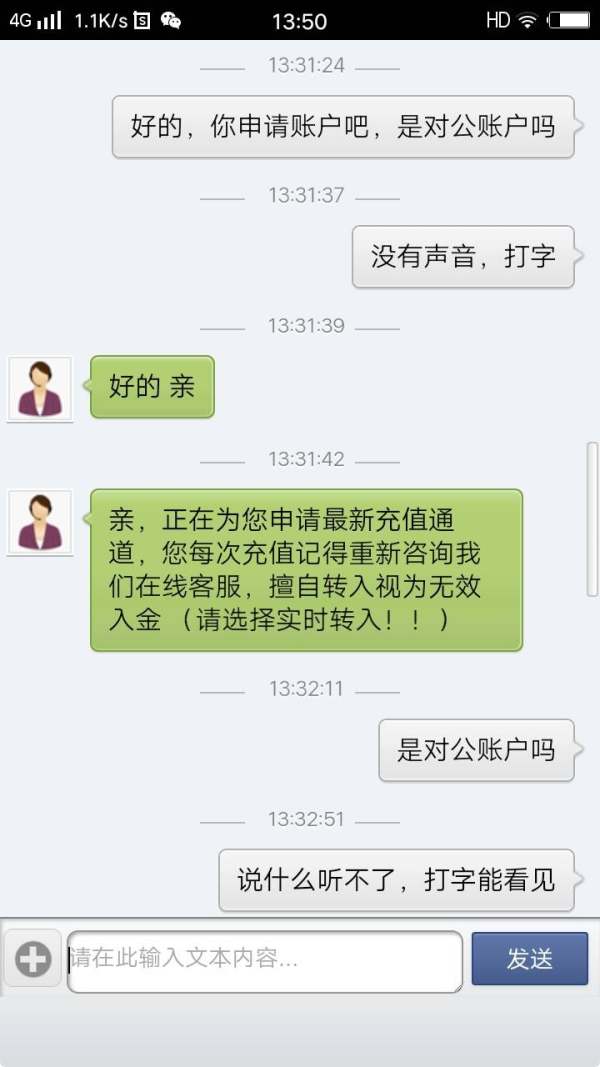

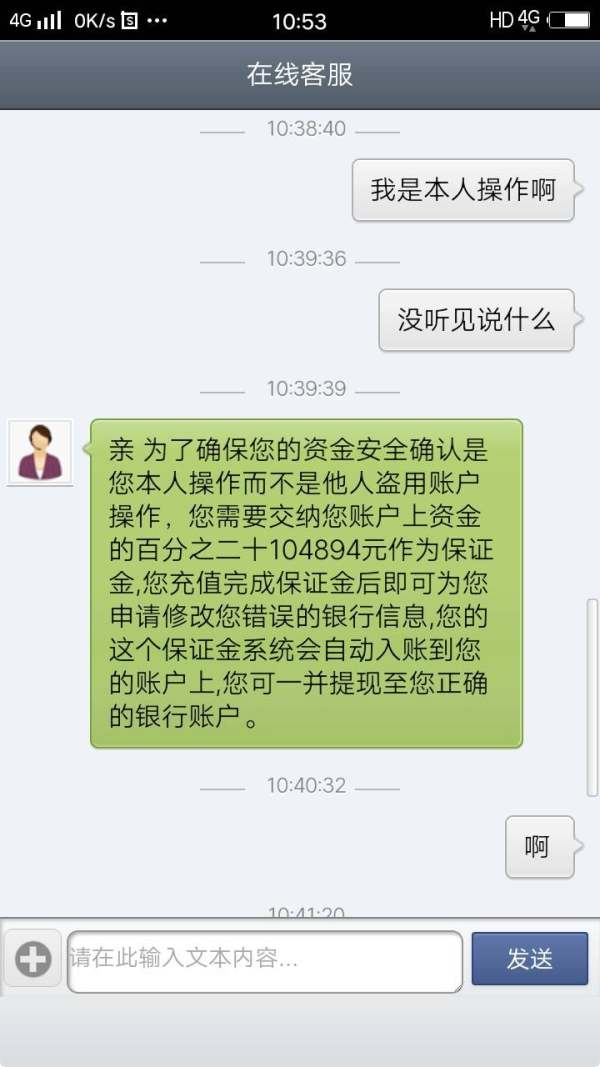

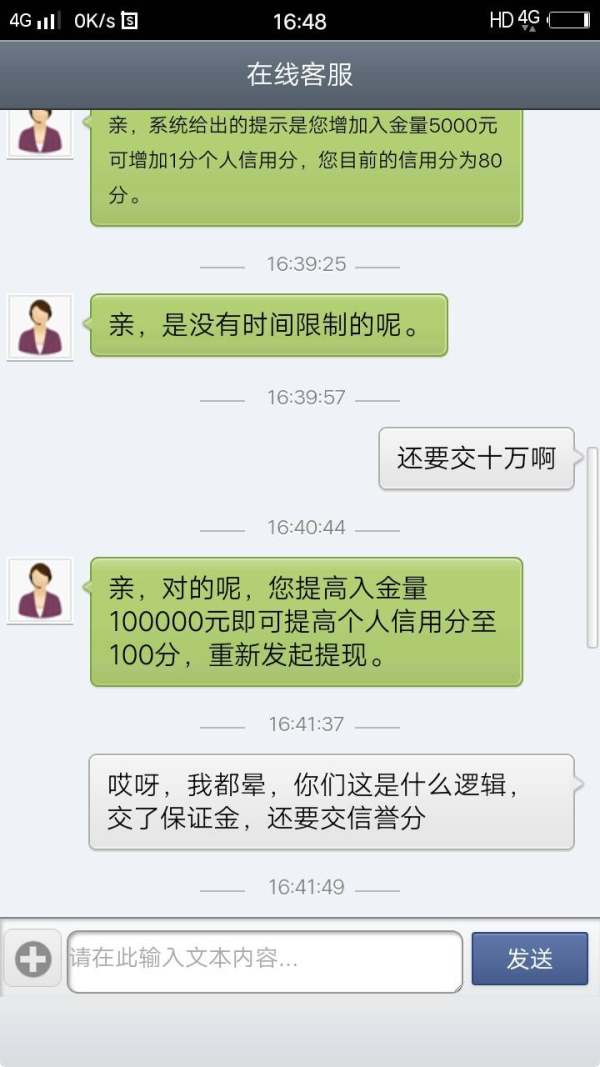

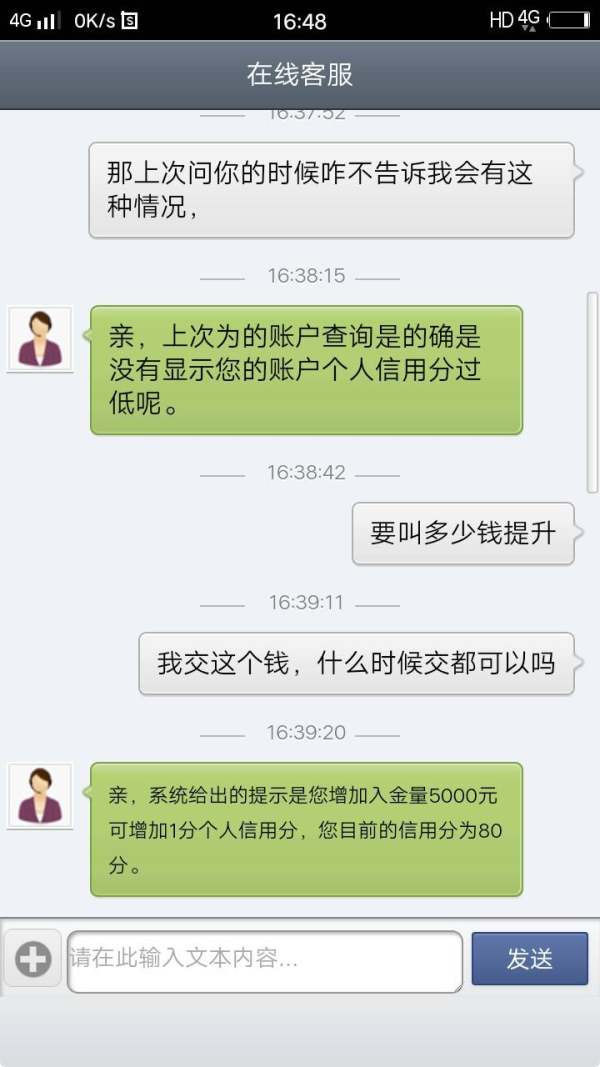

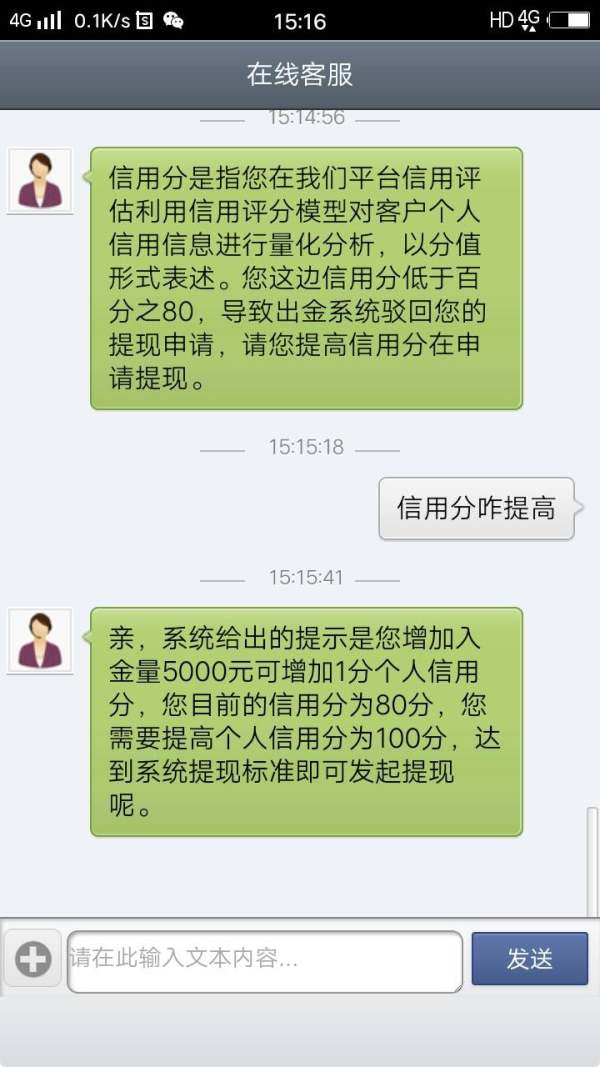

Deposit/Withdrawal Currencies: Zrf supports transactions in Chinese Yuan (CNY). However, users have reported difficulties with withdrawals, leading to negative experiences that are highlighted in this Zrf review.

Minimum Deposit: The minimum deposit requirements vary based on account types, but specific figures were not consistently reported across sources. Users should verify this information directly with Zrf.

Bonuses/Promotions: There is limited information regarding ongoing promotions or bonuses, which could be a drawback for traders looking for additional incentives.

Tradeable Asset Classes: Zrf offers access to forex, commodities, and financial futures. This range allows traders to diversify their portfolios but may not be as extensive as offerings from other international brokers.

Costs (Spreads, Fees, Commissions): The cost structure at Zrf includes variable spreads and commissions, but specific rates were not detailed in the sources reviewed. Traders should be aware of potential hidden fees, especially concerning withdrawal processes.

Leverage: Zrf provides leverage options, but specific ratios were not consistently mentioned. Traders should inquire directly for precise details.

Allowed Trading Platforms: Zrf does not support widely used platforms like MT4 or MT5, opting instead for its proprietary systems. This could be a significant limitation for traders accustomed to popular trading software.

Restricted Regions: Zrf primarily serves clients in China and Hong Kong, which may restrict access for international traders. This limitation could impact the broker's overall reach and reputation.

Available Customer Service Languages: Customer support at Zrf is primarily offered in Chinese, which may pose challenges for non-Chinese speaking clients. Reports indicate that response times can be slow, contributing to user dissatisfaction.

Repeated Ratings Overview

Detailed Breakdown

-

Account Conditions (6.5): Zrf offers a range of account types, but specific details regarding minimum deposits and features were not consistently provided. This lack of clarity may deter potential clients.

Tools and Resources (5.5): The proprietary trading platforms may lack some advanced features found in popular software like MT4 or MT5, which could limit traders' analytical capabilities.

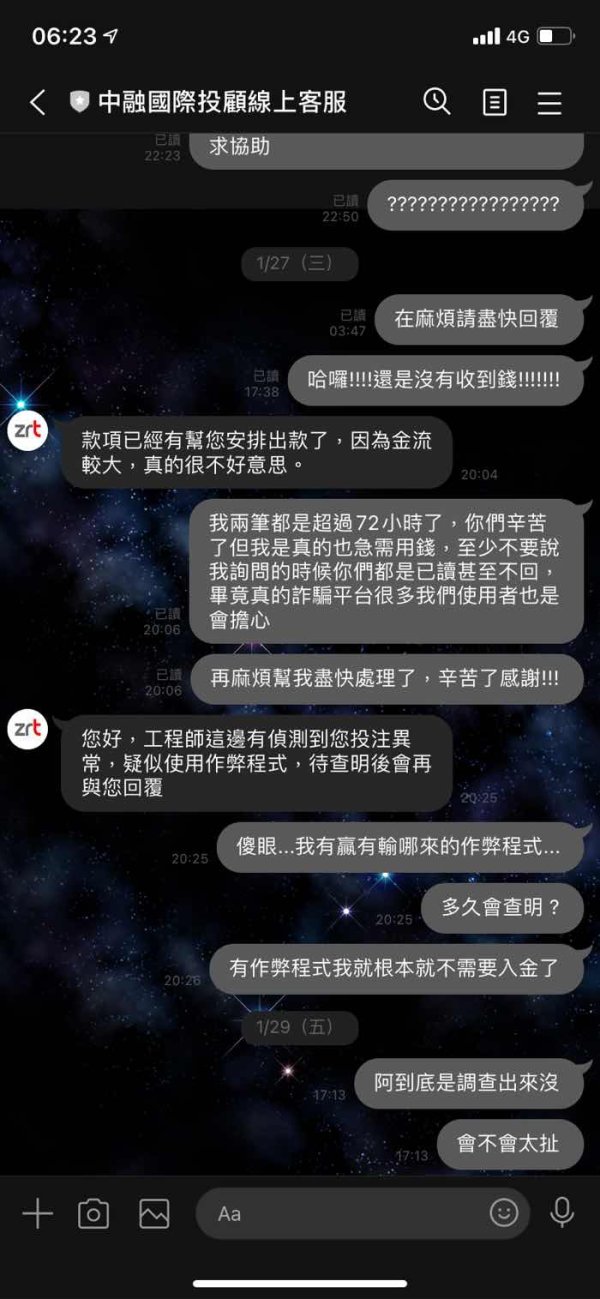

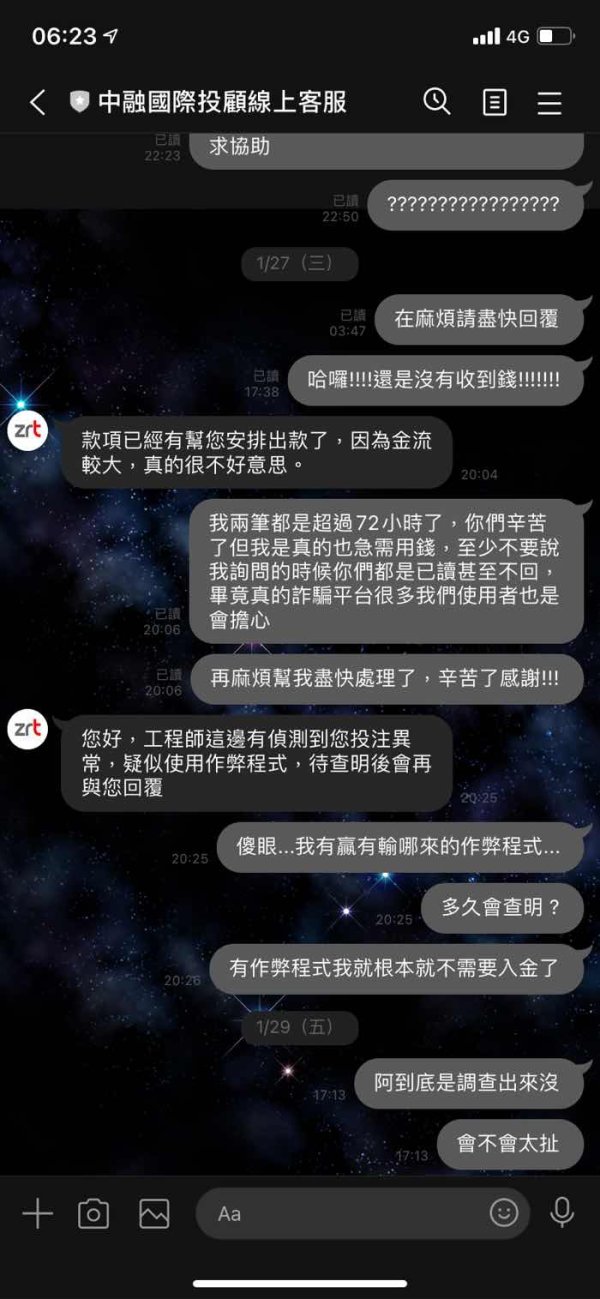

Customer Service and Support (4.0): User reviews highlight significant issues with customer service, including slow response times and difficulties in resolving withdrawal requests. This aspect is a critical concern in this Zrf review.

Trading Setup (Experience) (6.0): While some users report satisfactory trading experiences, the withdrawal issues and lack of robust customer support detract from the overall trading environment.

Trustworthiness (5.0): Zrf's regulatory status with CFFEX offers some level of assurance, but the negative user experiences regarding withdrawals raise red flags about its reliability.

User Experience (5.5): Overall user experiences are mixed, with some traders expressing satisfaction while others report significant issues, particularly around withdrawals.

Conclusion

In summary, Zrf presents a mixed bag for potential traders. While it offers a range of trading instruments and is regulated by a local authority, significant concerns regarding customer service and withdrawal processes cannot be overlooked. This Zrf review highlights the importance of conducting thorough research and considering personal trading needs before committing to this broker. For those seeking a more established international broker with robust support, exploring alternatives may be advisable.